Myanmar’s Moment, Your Opportunity – Doing Business in the Myanmar – The Frontier Market of Asia

Article by: Mr. Jonathan Rao, Counsellor (Trade) Trade Section / MATRADE Yangon

Myanmar has undergone significant changes to become one of the fastest-growing economies in the world today. Under the leadership of President U Thein Sein, the government has embarked on a series of reforms to liberalise the economy and trade while gradually shifting towards a market-driven business environment. Through its continuous engagement with the international community, the country has rebranded itself from a once-isolated nation into a bright spot in the region.

In a report compiled by The Business Insider on the ‘Top 13 Fastest-Growing Economies in the World’, Myanmar was ranked fourth fastest, driven mainly by a young labour force and abundance of natural resources. The list was compiled based on the World Bank’s Global Economic Prospects report released in June 2015, which forecasted Myanmar’s GDP to grow at the rate of 8.5 per cent this year; 8.2 per cent in 2016; and 8.0 per cent in 2017.

The positive outlook is echoed by the Asian Development Bank (ADB), which predicted that Myanmar’s GDP growth will accelerate to 8.3 per cent in the 2015-2016 fiscal year after moderating 7.7 per cent in the 2014-2015 fiscal year. Growth is expected to rise on the back of continued investments, ongoing structural reform, improved business environment, and gradual integration into the Southeast Asian sub-region.

Mr Jonathan Rao (right) receives President U Thein Sein after returning from a State Visit to Malaysia in March 2015

According to the McKinsey Global Institute (MGI), Myanmar has the potential to quadruple its current GDP to USD200 billion in 2030. At the same time, the consuming class is expected to grow from 2.5 million in 2010 to 19 million in 2030, which could potentially triple spending from USD35 billion to USD100 billion.

The opportunities are immense. A growing consumer class; largely unreached population of more than 50 million people; and access to the greater neighbouring markets of about 2.8 billion people – these are some of pull factors, which has drawn many foreign companies to establish their presence in Myanmar. From food and beverages to power stations, oil and gas, construction, consumer electronics, franchises and automobiles, companies from almost all sectors are wasting little time in securing a foothold in this market.

The changes in this country have also enticed many Myanmar professionals to return and be part of the transformation process. Realising the prospects in Myanmar, many have opted to leave their comfort zones to become returning expats or ‘repats’ to set-up businesses or contribute their skills as well as knowledge for the betterment of the country. Certainly, these are the future movers and shakers who will play an important role in developing Myanmar to its full potential.

LIBERALISATION & TRANSPARENCY, A BOOST FOR MYANMAR’S GROWTH

The liberalisation process in Myanmar has brought many positive changes and boosting economic growth. Some of the notable changes are:

Opening of the banking sector – In October 2014, Myanmar awarded the much-awaited banking license to nine foreign banks including Malaysia’s Maybank. The big winners are Japanese banks with three licences. Singapore came in second with two banking licences. China, Thailand, Malaysia and Australia won one banking licence each. The opening of Maybank’s office in Myanmar this year is expected to provide more financing options for Malaysian investors keen to venture into this market. In the bigger picture, the entry of foreign bankers will be an opportunity for the country to modernise its domestic financial sector by fostering cooperation, technical transfer and learning in a competitive environment.

Health Insurance – A health insurance plan set out by the government has started in July 2015 for the first time in Myanmar under a test period of one year. The insurance industry is regulated by Myanmar Insurance, which is a state-owned enterprise that also issues licenses. It has been the sole insurer in the country since 1952 and enjoyed a monopoly until the government decided to open up the insurance sector to local companies in June 2013. Currently, there are 12 local companies that have been authorized to sell insurance. There are 15 foreign insurance companies that have been permitted to operate as representative offices but are not allowed direct underwriting. The industry is still in its infancy whereby only a few people in Myanmar or less than 10 per cent of the population can afford insurance. For more than 50 years, private insurance did not exist in Myanmar, and many do not have much idea of the benefits for policy holders. Despite these challenges, many in the Myanmar insurance sector are positive as the economy grows with more people beginning to feel the need to protect themselves as well as their assets.

Yangon Stock Exchange – Myanmar’s first stock exchange is targeted to be launched in October 2015 and will be known as the Yangon Stock Exchange (YSE). It will be operated by the Myanmar Economic Bank in partnership with the Japan Exchange Group and Daiwa Institute of Research. Myanmar is the last country in ASEAN without a stock exchange. The Myanmar government aims to ensure that the YSE is a success with at least five companies ready for the launch. Several companies have submitted their proposals and signings with two companies – Asia Green Development (AGD) Bank and Myanmar Agribusiness Public Corporation (MAPCO) have been completed to date. The stock exchange presents an opportunity for companies to raise funds, capital and project financing to expand their business instead of relying on their own resources or contribution from international organisations as well as donor countries.

Mr Jonathan Rao leads H.E. U Myint Swe, Chief Minister of the Yangon Regional Government (fifth from left) with Madam Susila Devi, Deputy CEO of MATRADE (foreground) at the opening ceremony tour of Showcase Malaysia & Malaysia Services Exhibition (MSE) Yangon 2014, which was held on 1 October 2014

Extractive Industries Transparency Initiative (EITI) – Myanmar was accepted as a candidate country for the Extractive Industries Transparency Initiative (EITI) in 2014. This marks a significant step towards becoming a member of a global initiative, which has the aim to bring greater transparency to the oil and gas as well as mining sector. The EITI Standard requires extensive disclosure and measures to improve accountability in how oil, gas and minerals are governed. Myanmar must meet all of the requirements within three years to become EITI compliant and publish its first EITI Report by January 2016. By implementing these standards, the country is required to publish accounts and payments received by the government. They are also required to provide public information on the licence holders; production data; information on state-owned enterprises as well as the allocation of the revenues collected from its natural resources.

Open Government Partnership (OGP) – In another major step towards greater transparency and public sector governance, President U Thein Sein in November 2012 has announced Myanmar’s intention to join the OGP by 2016. The OGP is an international standard that seeks to promote transparency, fight corruption, increase civic participation, and cultivate the use of new technologies to make governments more open, effective, and accountable. The commitment is a major step towards reforming the public sector and bringing it in-line with international best practices, which would influence Myanmar’s future planning, policies and development strategies. For Myanmar to join the OGP would be a big achievement in public sector reform. The principles and working practices outlined in the OGP such as fiscal transparency; access to information; income and asset disclosures; and citizen engagement will help to reinforce Myanmar’s positive political and economic reform process.

OPPORTUNITIES IN MYANMAR

The opening of Myanmar following the economic reforms has resulted in rapid economic development that offers opportunities for companies to increase trading activities and investments in the country. Among the sectors that offer opportunities are:

Products

1. Fast Moving Consumer Goods (FMCG) – The FMCG market in Myanmar has changed as a result of efforts to liberalise trade and ease restrictions on import procedures that has brought the influx of foreign brands as well as products into the country. Market demand is growing at a steady pace and competition between local and foreign brands is becoming fiercer. As purchasing power grows, there is an increasing number of consumers demanding more choices and niche products such as health drinks; or products of higher quality. Indeed, consumer behaviour is changing as more foreign brands appear on retail shelves nationwide. Today’s consumers are spoiled for choice and tend to spend based on their wants or occasions. Studies have estimated that the average spending per basket by shoppers in CityMart, one of the most established supermarkets in Myanmar, is between USD20 to USD80. This is expected to increase or even double within the next three or four years. To stand out among the competition, suppliers must undertake aggressive promotions not only at the point of sales but collaborate and work closely with local distributors in order to capture the hearts and minds of consumers in this burgeoning market.

2. Building Materials – Myanmar’s size of the construction market is estimated at USD3.5 billion with capital expenditure in Myanmar increasing mainly due to heavy investments in residential, commercial, hotel, retail and office space. Yangon has been the centre of construction activity and is likely to undergo more development in the near future. Furthermore, the increasing number of expats and locals moving to Yangon for job opportunities will contribute to higher demand for housing. According to the Myanmar Construction Entrepreneurs Association (MCEA), overall demand for building materials have increased about 40 per cent due to increasing demand for apartments, condominiums and high-rise buildings. The Association estimates that 25,000 new rooms are needed each year to meet growing demand. Meanwhile, the construction sector is expected to expand at an annual rate of at least 8 per cent over the next five years as investment looks likely to gain momentum in the medium term, buoyed by growing international investor interest and rising business confidence. In addition, the government is increasing its focus on utility and transport, while pushing forward with its affordable housing programmes. Myanmar is also planning several major projects to support its economic development, including the construction of hydroelectric plants; road and railway networks; new aviation hubs; which will require foreign investment.

3. Automotive – The Myanmar automotive aftermarket sector is undergoing tremendous growth following the ease of restrictions on car import regulations after decades of tight control. Demand for spare parts and after-sales services are also on the rise as the car circulation is dominated by second-hand units. Since 2012, all Myanmar citizens were allowed to import cars and this has led to a rapid increase in the number of cars in the country. As of May 2014, there were a total of 4.4 million registered vehicles in Myanmar, of which 85 per cent comprise motorcycles. In addition to the constant need to maintain the imported second-hand cars, Myanmar’s climate and poor road conditions tend to wear out parts faster and this accelerates the need for replacements. Furthermore, it is estimated that 79 percent of Myanmar’s roads remain unpaved, which adds to the vehicle wear and tear. Several market studies have found that battery, oil filters and tyre products register the strongest growth rate in the Myanmar market. Overall, the automotive sector is expected to grow at about 7.8 percent through 2019, driven by a growing economy, expanding infrastructure, less stringent regulations, and rising income in Myanmar. Given the low car penetration rate as well as the country’s accelerating development, the future for automotive spare parts looks positive with a projected market size of USD80 million by the year 2017.

4. Healthcare – Consumer spending on over-the-counter healthcare products is anticipated to grow three to four times in size, from about USD140 million in 2013 to USD480 million by 2020. In addition, the medical devices market in Myanmar is anticipated to grow threefold by 2020. It is estimated that eight out of ten of consumers in Myanmar are willing to fork out more money on better healthcare products and services. At the same time, Myanmar’s pharmaceutical sector is expected to grow 10 – 15 per cent a year as the government spends more on the healthcare sector. According to the Myanmar Pharmaceutical and Medical Equipment Entrepreneurs Association (MPMEEA), the market is now estimated to be worth about USD100 million to USD120 million. The industry imports more than 90 per cent of its products, whereby suppliers from India enjoy the largest share of 35.4 per cent, followed by Thailand, China, Pakistan, Bangladesh, South Korea and Indonesia. About 60 per cent of all products are sold in Yangon and Mandalay. There are only 10 domestic manufacturers.

Services

1. Power sector – Myanmar plans to increase the country’s electricity reserves by 30 per cent to address the problem of nationwide power shortages. Myanmar’s annual electricity consumption rate is about 4,362 MW and this is expected to increase by 13 per cent every year. Though the country is blessed with abundant natural gas and hydropower potential, only about 30 per cent of Myanmar’s population has access to electricity, among the lowest rates in Asia. While this rate is higher for the major cities, many in the outskirts of Myanmar have almost no access to electricity. Lack of power is a threat to Myanmar’s economic transition, particularly to the manufacturing sector, which relies heavily on a constant supply of electricity. Furthermore, this restricts the expansion of infrastructure projects and slows down job growth. The World Bank Group has committed USD1 billion in financial support for Myanmar’s energy development through projects to expand electricity generation, transmission and distribution in the country. The World Bank is working closely with Myanmar’s government including the Ministry of Electric Power (MOEP) to develop the National Electrification Plan (NEP) with the goal of achieving universal electricity access by 2030.

Mr Jonathan Rao (second from left) received H.E. U Nyan Tun Oo, Yangon Regional Minister for Electrical Power and Industry (centre) at the Malaysian Pavilion during the Opening Ceremony of BuildTech Yangon 2015 exhibition in May 2015

2. Oil and Gas – The energy sector is poised to grow further given the energy shortage problem in many parts of the country. Traditionally, almost 85 per cent of Myanmar’s oil and gas resources are exported to neighbouring Thailand and China, leaving some 15 per cent for domestic use. The Myanmar government plans to renegotiate current agreements to meet energy needs in the country. According to data by BP Plc, Myanmar has 7.8 trillion cubic feet of proven natural gas resources or worth about USD75 billion waiting to be discovered. However, experts believe that the potential gas reserves could be much bigger that what is known. Furthermore, Myanmar’s oil and gas reserves have not been sufficiently explored using modern seismic technology, making it an exciting prospective exploration target. This is a good opportunity for Malaysian oil and gas companies in the upstream (exploration and production), midstream (transportation, pipeline) and in the future downstream (refinery) services providers. Among the major oil and gas companies currently operating in Myanmar include Petronas, Daewoo E&P, PTTEP and Total E&P.

In Myanmar, the first onshore bidding round for 18 blocks was launched in 2011 and nine blocks were subsequently awarded to international companies. Later in 2013, Myanmar launched its second onshore bidding round for 18 blocks and the first offshore round for 30 blocks. Of these, a total of 16 onshore and 20 offshore blocks have been awarded. This is also an opportunity for Malaysian oil and gas companies to participate in potential projects by the operators and provide services to enhance their operations. In the future, there could also be potential for foreign companies to develop an oil and gas supply base within Myanmar as the government has plans to further enhance the distribution and network in the country.

3. Human Resource Development – Myanmar is facing a shortage of trained and capable labour in a range of industrial sectors that could undermine the nation’s development prospects. The country’s demand for skilled workers is expected to reach a level equal to almost half the population by 2015. By 2015, Myanmar will require 32 million workers to meet the needs of various sectors such as agriculture, forestry, energy, mining, industry, electrical, construction, social management and trading. In 2010, the demand for skilled workers stood at 29.7 million people, and the number is expected to reach over 34.6 million by 2020. There is good prospect for foreign companies to establish vocational training institutes that provide training and education for Myanmar citizens to improve their employability.

CHALLENGES

Though much has changed to improve transparency and the business environment in Myanmar, it is not a market that is free from challenges, which foreign companies should take this into consideration when strategizing their mode of entry. Firstly, the legal framework is constantly being revised with enhancement and notifications added from time to time. Case in point, the Myanmar Companies Act is more than 100-years old (enacted in 1914), which has been proposed to be updated to bring it into compliance with international standards. Secondly, trading activities (distributing and selling products), are still restricted to Myanmar citizens. It is for this reason that foreign exporters must conduct due diligence to identify the right local partner and build long term relationship. For this, companies should work closely with the Union of Myanmar Federation of Chambers of Commerce and Industry (UMFCCI), the apex non-governmental business association that represents and safeguards the interests of the private sector in Myanmar.

Legal framework is continually being updated

Investors must be aware that the legal framework in Myanmar is continually being updated. In recent years, Myanmar has passed about 75 new laws, of which many are related to the business environment including the Foreign Investment Law; Myanmar Citizens Investment Law; Foreign Exchange Management Law; and the Central Bank of Myanmar Law. These laws have been updated with the intention of facilitating business and investment in Myanmar. While Myanmar’s efforts to continually update these laws are commendable, other areas such as the legal institutions, governance and regulatory enforcement still has to be improved further. Until then, this makes Myanmar a challenging place to do business.

Restriction from owning properties

Foreigners are not allowed to own property in Myanmar and are only allowed to lease the properties for up to 50 years with the option of renewing another 10-years for two consecutive times. This is a major hindrance for investors as financial institutions are reluctant to provide long-term financing due to the limited lease period. This is a major hindrance for investors in projects requiring long-term commitment such as the Build-Operate-Transfer (BOT) package, which is common in Myanmar. In terms of pricing, the cost of land lease is considerably high compared to regional standards. Currently, prices can be up to USD1,500 per square feet (psf). in prime areas in Yangon which, to most Malaysian investors, is comparatively high (as compared to +/- RM2,000.00 psf. around KLCC).

Foreigners barred from trading

Foreigners are restricted from setting up a trading company or register as an importer or exporter with the Ministry of Commerce. Whether it is wholesale or retail purposes – the sector is off limits to foreigners. In Myanmar, the definition of “foreigner” includes companies incorporated in Myanmar with as little as one share held by foreign investors. This would mean that most foreign goods in Myanmar must be traded through domestic importers and local distributors.

Border trade

Border trade is an important channel for importers as well as exporters in Myanmar to trade goods across borders such as China, Thailand and India. Border trade thrives as it is a faster and more cost-effective method of transporting goods as well as clearing customs, compared to overseas shipment, which might take up to two weeks to ship goods from say Malaysia to Myanmar. Land transport also enables exporters from border countries such as China and Thailand to fulfil small orders without the hassle of filling a container with goods. In contrast, Malaysian exports via overseas shipment are subject to various costs such as customs duty, insurance, stricter inspection, longer clearing time, freight charges and commercial tax. Businesses must take note that despite the availability of legal cross-border trade channels, smuggling activities will continue to persist, which creates an unlevel playing field of competition. Smugglers often try to evade custom checks by using lesser-known routes or by concealing the cargos.

High cost and challenge of doing business

Myanmar remains as one of the most challenging places to do business in the world. The country was ranked 177th out of 189 countries in the Doing Business Report 2015 released by the World Bank, up from 182nd position in 2014. According to the report, Myanmar has weaknesses in the “starting a business” category but did well for “paying taxes” and “trading across borders”. Despite this setback, the government is continually finding ways to improve the business environment and facilitate trading activities.

CONCLUSION

Notwithstanding the challenges, Myanmar continues to receive interest from the international business community due to its strategic location; access among the largest markets in the world; and ready market of more than 50 million people. Malaysian companies must be willing come in and take the risk to reap benefits in this nascent market. Building solid long-term relationship with local partners and joint ventures takes perseverance, time, money and understanding of norms and business culture. Though the market has potential, companies must be patient with the pace of change and cannot expect things to improve overnight.

It is also an opportune time for various trade chambers and business associations in Malaysia to organise activities such as trade fairs and missions to forge business links and realise the full potential for business in Myanmar. We have observed that business organisations from countries such as Singapore, Japan and Taiwan have been successful by taking their own initiative to solidify business links with their local counterparts. By complementing trade promotion efforts by government agencies, these business organisations have achieved greater impact in penetrating the market.

The pace of change and reforms makes Myanmar one of the most exciting yet challenging places to do business. Since 2011, the country has started opening up after many decades and much has to be done for the country to leapfrog in terms of development. This presents an opportunity for foreign companies to share technology, best practices and knowledge through effective and mutually beneficial partnerships. To gain a position in this market, companies must be prepared to make long-term commitments and play their part in developing the country’s business environment; human resource capacity development; and corporate social responsibility. Furthermore, companies must be agile, responsive and swift in seizing opportunities in this fragmented market. With more than 135 ethnic groups, Myanmar requires unique solutions to meet demands and gaps in the market.

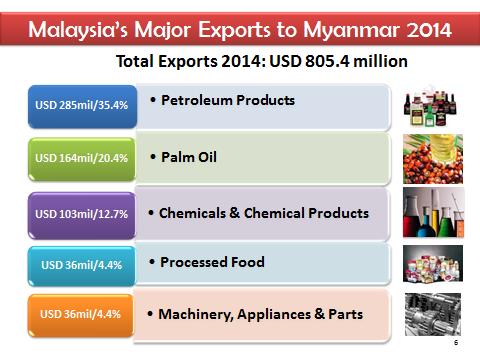

Table 1: Malaysia’s Major Exports to Myanmar

Source: Department of Statistics, Malaysia

Table 2: Malaysia’s Major Imports from Myanmar

Source: Department of Statistics, Malaysia

Source: Department of Statistics, Malaysia

Table 3: Malaysia’s Investments In Myanmar

(as at 30 April 2015)

| NO. | COUNTRY | AMOUNT (US$MIL) | PERCENTAGE (%) |

| Total | 56,466.083 | 100.00 | |

| 1 | China | 14,754.494 | 26.13 |

| 2 | Thailand | 10,264.711 | 18.18 |

| 3 | Singapore | 10,230.402 | 18.12 |

| 4 | Hong Kong | 7,137.725 | 12.64 |

| 5 | United Kingdom | 4,044.258 | 7.16 |

| 6 | Republic of Korea | 3,366.521 | 5.96 |

| 7 | Malaysia | 1,657.688 | 2.94 |

| 8 | The Netherlands | 981.991 | 1.74 |

| 9 | India | 716.326 | 1.27 |

| 10 | Vietnam | 688.586 | 1.22 |

Source: Directorate of Investment and Company Administration (DICA)

Table 4: MATRADE Trade Promotion Activities in Myanmar

for 2015

| NO. |

EVENT |

DATE |

| 1 | Special Projects Business Visit to Yangon and Nay Pyi Taw |

23 – 27 February |

| 2 | Specialised Marketing Mission on Construction and Related Services to Yangon and Nay Pyi Taw |

16 – 20 March |

| 3 | Specialised Marketing Mission on Construction and Building Materials to Yangon in conjunction with BuildTech Yangon 2015 exhibition |

26 – 29 May |

| 4 | Specialised Marketing Mission on Tourism, Hospitality and Related Services to Yangon |

2 – 5 June |

| 5 | Mid-Tier Company Development Programme (MTCDP) to Yangon, Myanmar |

2 – 6 August |

| 6 | Specialised Marketing Mission on Oil & Gas Sector to Yangon and Nay Pyi Taw |

25 – 28 August |

| 7 | Specialised Marketing Mission on Information & Communication Technology (ICT) to Yangon |

8 – 11 September |

| 8 | Showcase Malaysia & Malaysia Services Exhibition (MSE) 2015 |

30 September – 3 October |

| 9 | Incoming buying missions to Malaysia in conjunction with trade exhibitions in Kuala Lumpur: |

| i. Langkawi International Maritime & AerospaceExhibition (LIMA) | March | |

| ii. Malaysia International Halal Showcase (MIHAS) | April | |

| iii. Oil and Gas Asia (OGA) | June | |

| iv. APHM International Healthcare Conference andExhibition | June | |

| v. International Greentech & Eco Products Exhibition& Conference Malaysia (IGEM) | September | |

| vi. International Construction Week (ICW) | September | |

| vii. International Trade Malaysia (INTRADE) | November |

Mr Jonathan Rao is Counsellor (Trade) for the Trade Section (MATRADE Yangon) of the Embassy of Malaysian in Yangon. His past assignments include the position of Trade Commissioner of MATRADE’s office in Santiago, Chile and Miami, USA.

MATRADE Yangon is contactable at:

Embassy of Malaysia

Trade Office (MATRADE)

No. 82, Pyidaungsu Yeikhta Road

11191, Dagon Township

Yangon, Myanmar

Tel : +95-1-2301951 / 2301952

Fax : +95-1-2301954

Email : yangon@matrade.gov.my