Diary of Events (December 2023 Issue)

H.E. Jagdishwar Goburdhun, High Commissioner of Mauritius to Malaysia delivered the Welcome Address.

Mr Hemraj Ramnial, Chairman, Economic Development Board Mauritius delivered the Keynote Address.

Mr Sachin Mohabeer, Deputy Chief Executive Officer, Economic Development Board Mauritius delivered the Mauritius Country Presentation – Investment Opportunities Across Sectors.

Mr Abrar Anwar, Managing Director & Chief Executive Officer, Standard Chartered Bank (Mauritius) delivered a testimonial on Standard Chartered Bank’s experience in Mauritius.

The Country Presentation highlighted how Mauritius can serve as the gateway for businesses to distribute their products and goods to the African continent and to other markets beyond Africa by leveraging Mauritius’ strong economic fundamentals, freeport services and broad FTAs especially with African nations, North America, Europe.

(from left-to-right)

Ms Sarah Bakri, MyAIRA, Ms Ng Su Fun, Executive Secretary, MASSA, Ms Naznin Nahar Begum, eCAB, Ms Farha Mahmud Trina, eCAB and Ms Hanniz Lam, MyAIRA.

| Time | Item |

| 10.00 am | Opening Remarks by YBhg Tan Sri Azman Hashim, President, MASSA

|

| 10.10 am | Current Development in the ESG Spectrum and Malaysia’s National ESG Framework by Mr Ben Ong, Chairman, MAPAN

|

| 10.30 am | ESG Adoption Journey, Best Practices and Pitfalls to Avoid by Mr Shane Guha Thakurta, General Manager, Investor Relations and Sustainability, IJM Corporation Berhad

|

| 10.50 am | Cascasding ESG Adoption to Vendors – Challenges and Lessons Learnt by Mr Chan Huan Ong, Assistant General Manager, IJM IBS Sdn Bhd

|

| 11.10 – 11.30 am | Q & A Session and Closing Remarks by Moderator,

Mdm Reshma Yousuf, Council Member, CILT Malaysia |

YBhg Tan Sri Azman Hashim, President, MASSA delivered the Opening Remarks.

YBhg Tan Sri Azman Hashim, President, MASSA delivered the Opening Remarks.

Mr Ben Ong, Chairman, MAPAN delivered a presentation titled “Current Development in the ESG Spectrum and Malaysia’s National ESG Framework”.

Mr Ben Ong, Chairman, MAPAN delivered a presentation titled “Current Development in the ESG Spectrum and Malaysia’s National ESG Framework”.

Mr Shane Guha Thakurta, General Manager, Investor Relations and Sustainability, IJM Corporation Berhad delivered a presentation titled “ESG Adoption Journey, Best Practices and Pitfalls to Avoid”.

Mr Shane Guha Thakurta, General Manager, Investor Relations and Sustainability, IJM Corporation Berhad delivered a presentation titled “ESG Adoption Journey, Best Practices and Pitfalls to Avoid”.

Mr Chan Huan Ong, Assistant General Manager, IJM IBS Sdn Bhd delivered a presentation titled “Cascading ESG Adoption to Vendors – Challenges and Lessons Learnt”.

Mr Chan Huan Ong, Assistant General Manager, IJM IBS Sdn Bhd delivered a presentation titled “Cascading ESG Adoption to Vendors – Challenges and Lessons Learnt”.

Mdm Reshma Yousuf, Council Member, CILT Malaysia moderated the session and delivered the Closing Remarks.

Mdm Reshma Yousuf, Council Member, CILT Malaysia moderated the session and delivered the Closing Remarks.

A group photo of the webinar role players.

A group photo of the webinar role players.

The webinar recording can be viewed here: https://www.youtube.com/watch?v=pqVMJX0IV_k.

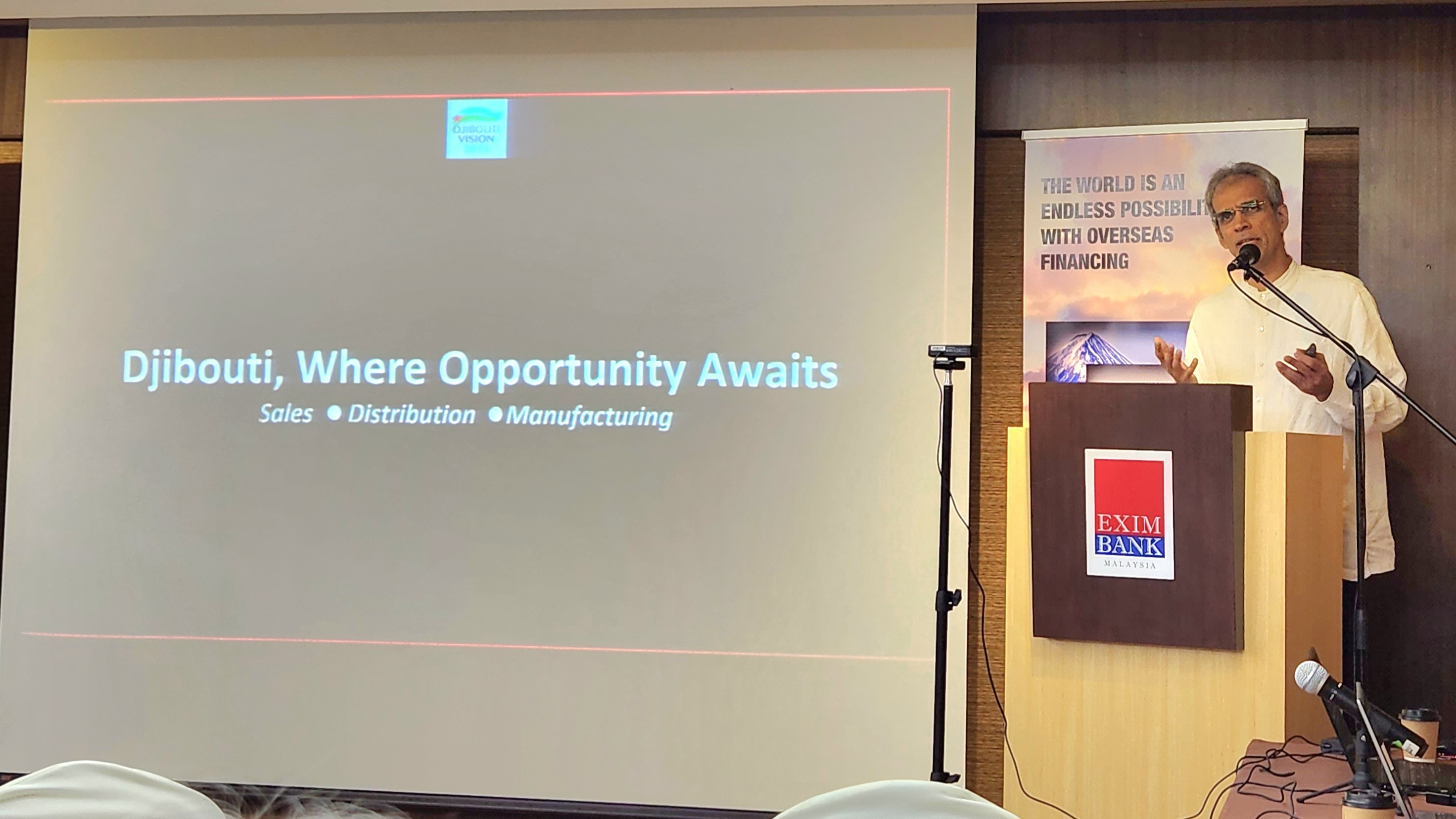

Dr Ashraf Iqbal, Chairman, Waafi Bank delivered a presentation titled “Discover & Explore Business Opportunities in Djibouti” wherein he highlighted that many Djiboutians were graduates of Malaysian universities and that Djibouti is positioning itself to become the Singapore of Africa in line with its Djibouti Vision 2035 (https://economie.gouv.dj/vision-2035-english/).

Photos of the participants at the Briefing.

Editorial

Greetings from MASSA !

In this August newsletter, we feature the Republic of Zambia. We thank the good office of the High Commission of the Republic of Zambia for their insights to bring to readers information on the Republic of Zambia, focusing on its economy and business opportunities. The Country Feature had highlighted the investment climate of Zambia, and the potential for investment into its key sectors in mining, agriculture, manufacturing, tourism and energy.

The August edition also reports on MASSA’s engagements and collaborations with the Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI) where MASSA had participated in a seminar organised by BMCCI on the Seminar on Trade and Investment Opportunities in Bangladesh at Royale Chulan Kuala Lumpur on 1 June 2023 and a series of online discussions with BMCCI on 14 June and 17 July 2023. These series of engagements were organised with the aim to inform the Malaysian business community about the latest trends, developments and business opportunities with and in Bangladesh, and to promote the 6th Showcase Malaysia 2023 in Dhaka, Bangladesh. The 6th Showcase Malaysia is a celebration of Malaysian products and services, and an opportunity for Malaysian businesses to explore the Bangladesh economy.

MASSA also had a series of meetings recently, which included a meeting with the High Commission of the Republic of Zambia on 3 May 2023, with the BMCCI leadership on 2 June 2023 and with the Undersecretary of the International Cooperation and Development Division (ICADD), Ministry of Foreign Affairs, Malaysia 15 June 2023. The discussions at these meetings, centred on areas where MASSA can collaborate, support and or complement the respective initiatives of the aforenamed offices. Our engagement with ICADD also resulted in a discussion between ICADD, MASSA and the Embassy of Malaysia in Timor Leste on 3 August 2023 to explore business opportunities in the nation as it prepares to integrate into the ASEAN membership.

We want to thank our members, ex-officio, contributors, and partners for your support to date. MASSA remains committed to present to members, trade and investment leads from the South-South countries, especially in light of the post-pandemic era that would require renewed efforts of cooperation from all levels to prepare businesses for the opportunities and challenges forthcoming.

In view of this, several events to keep an eye out for are in the works. One event we wish to highlight, and encourage readers to register and participate in is a Webinar Series on ESG for Malaysian businesses. This is a joint collaboration between MASSA, the Chartered Institute of Logistics and Transport (CILT) Malaysia and the Malaysian Association of Public Advocacy for Nature (MAPAN) on 22 September and 10 November 2023. Do look for our weekly Circulars and postings in our website www.massa.net.my.

We look forward to meet members at MASSA’s upcoming events.

Thank you.

Ng Su Fun

Editorial MASSA

President’s Message

Tan Sri Azman Hashim

President

MASSA

The global economy in 1H2023 appeared poised for a soft landing and gradual recovery from the blows of the pandemic and of Russia-Ukraine War. Supply-chain disruptions are unwinding, and the disruptions to energy and food markets are ebbing. Concurrently, the tightening of monetary policy by most central banks should start to bear fruit, with inflation tempering toward its targets.

Below the surface, however, indicators suggest that expectations should be tempered, as banking volatility and financial turbulence remain in the foreground. According to the OECD’s and IMF they anticipate global GDP growth to range between 2.7-2.8% in 2023.

The pace of expansion of the Malaysian economy is expected to moderate due to headwinds that include the uncertain global outlook, inflationary pressures, financial tightening, slower external demand and extreme climate occurrences. Nevertheless, some of the tailwinds for the Malaysian economy include the gradual recovery of international tourism arrivals with the reopening of international borders. Tourism Malaysia is targeting 16.1 million international visitor arrivals for 2023, a 60% increase compared with the estimated 10.1 million international visitor arrivals in 2022. Additionally, the decision of a number of electronics multinationals to invest in large-scale new projects in the nation also favourably attest to Malaysia’s competitiveness and position as a global hub for electronics, manufacturing, and services amongst others.

Given the global considerations, Malaysia’s strong economic fundamentals remain intact. The growth of the Malaysian economy in the first quarter of 2023 registered 5.6%, which is in line with our Government’s projection for Malaysia to achieve real GDP growth for the year 2023 to be between 4.0 – 5.0%.

The imperative for businesses to adopt ESG-compliant approaches and solutions continues to be underscored by the Government. The Ministry of Investment, Trade and Industry (MITI) reported that between 2021 – September 2022, a total of RM4.9 billion in green technology projects had been approved. The business opportunities and economic spillover benefits of ESG adoption indicate a new front for businesses to leverage alongside digitalisation and digital transformation. We look forward to the Government’s policy approach for industries particularly under the National Carbon Policy, the New Industrial Master Plan (NIMP) 2023 and the i-ESG Framework when they are announced.

MASSA held its 32nd Annual General Meeting on a hybrid basis on 28 June 2023. I would like to take this opportunity to thank the outgoing Office Bearers and Executive Committee Members for their service from the term 2021-2023, in particular, I would like to place on record MASSA’s appreciation to Datuk Lim Fung Chee and Tan Sri Ghazzali Sheikh Abdul Khalid for their services as Vice-President and Member of the Executive Committee respectively.

I also take this occasion to congratulate and welcome the Office Bearers and Executive Committee Members who have been elected to serve the Association till 2025. In particular, I would like to thank Datuk T Y Lee, Dato’ Lawrence Lim Swee Lin and Datuk Merlyn Kasimir for agreeing to serve as Vice-President, Hon. Secretary and Hon. Assistant Secretary respectively, and to the new Members of the Executive Committee, Mr Arshad Ismail, Mr Lee Chun Fai and Mr Chang Yii Tan.

During the 32nd AGM, MASSA reaffirmed its mission to bridge the South-South, and to complement the Government’s initiatives to enhance ties and business linkages with developing countries by continuing to engage and collaborate with the Ministry of Investment, Trade and Industry (MITI) and its agencies, and the Ministry of Foreign Affairs (Wisma Putra).

I appreciate the continuing support of all Members with your involvement at our regular meetings and events. I also wish to thank article and feature contributors from across the MASSA network, who have provided valuable and insightful articles for our newsletters and not forgetting the sponsors of our website.

Tan Sri Azman Hashim

President

1 August 2023

Country Feature – Republic of Zambia

REPUBLIC OF ZAMBIA

Located in the heart of Southern Africa, Zambia is one of the fastest growing economies with a population of 19.6 million people. The country, which sits on 752,618 square kilometres (over double the size of Malaysia), is blessed with abundant natural resources and vegetation, a diversity of wildlife, magnificent landscapes, and is home to the mighty Victoria Falls, one of the seven natural wonders of the world.

Image 1: Zambia’s location in the heart of Southern Africa

The country has very stable Macroeconomic Fundamentals with a growing GDP of about US$21 billion, inflation of 9.9% per annum and the local currency is performing very well against the United States Dollar and other major world-convertible currencies, appreciating by over 18.5% from January 1 to September 2022.

Zambia has proven to be a strategic hub for trade and investment due to its central location with eight neighbouring countries. Zambia is a member of the regional and continental economic communities that the Common Market for Eastern and Southern Africa (COMESA), Southern African Development Community (SADC) and African Continental Free Trade Area (AfCFTA).

Further, Zambia is well known as a haven of investments due to its unmatched investment climate, attractive investment incentives, ease of doing business, and investor-friendly policies supported by consistent policies and stable political will, rule of law, and peace that the country has enjoyed since her independence in 1964.

Economic Fundamentals

Official Language: English

Main Languages: Bemba, Tonga, Chichewa, Lozi, Kaonde, Luvale, Lunda

Population (2022): 19.6 million

GDP Per Capita: USD 1,137.6 (World Bank 2021)

GDP 2021: USD 22.15B (World Bank 2021)

Government: Presidential Republic; Multi-Party Democracy

Unemployment: 13% (World Bank 2022)

Literacy: 86.8% (2018)

Inflation: 9.9%

Zambia’s Business Environment

Zambia ranked 1st in Africa & 4th globally for Ease of Getting Credit in the 2020 project which provides objective measures of business regulations and their enforcement across 190 economies and selected cities at the subnational and regional level. The country boasts highly attractive Government securities and has a high rate of return on investment in Government bonds & bills. This is mainly due to conducive Governance, a skilled labour force and a good logistical network which helps facilitate international trade through implementation of web-based customs data management platform, ASYCUDA World, for easier exporting and importing. The wide network coverage includes 91% Public Switched Telephone Network (PSTN).

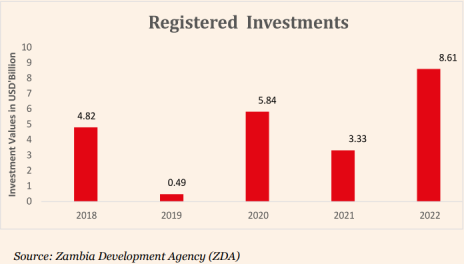

Fig. 1: Recorded Investment 2018 to 2022 (US Dollar Billions)

Fig. 2: Recorded Investment by Sector 2018 to 2022 (US Dollar Millions)

Economic growth has been stable in Zambia which has elevated it to the 6th largest economy in SADC and to becoming an attractive investment destination. The figures below indicate Zambia’s investment and trade performance between 2018 and 2022.

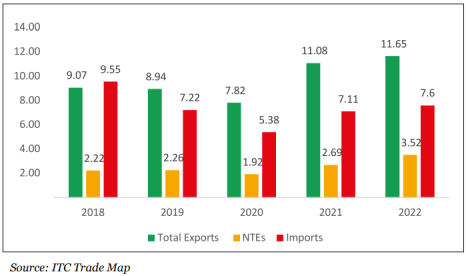

Fig. 3: Zambia’s Trade 2018 to 2022

The main trade contributors in Zambia are highlighted in the table below.

Table 1: Major Exports and Imports with their Markets

Investment Sectors

Currently, the priority sectors for investment are manufacturing, mining and mineral beneficiation, agriculture, energy, information communication technology, infrastructure and tourism.

Foreign and local investors in priority sectors are eligible to qualify for certain predetermined incentives and this is administered through the Zambia Development Agency (ZDA). In addition, investors that setup in a Multi Facility Economic Zone (MFEZ) or industrial park are eligible for additional tax incentives. Incentives come in the form of fiscal and non-fiscal incentives.

The Zambia Development Agency (ZDA) is Zambia’s premier economic development Agency with a multifaceted mandate of promoting and facilitating trade, investment and enterprise development in the country. The Agency is also responsible for building and enhancing the country’s investment profile for increased capital inflows, capital formation, employment creation and growth of the Micro Small and Medium Enterprise (MSME) Sector.

Among the key services provided include:

- • Issuance of investment and MFEZ/IP Permits

- • Participation and facilitation in regional and international trade and investment fairs, exhibitions and missions;

- • Participation and facilitation of business summits, conferences, workshops and business to business meetings;

- • Facilitation of joint-venture partnerships and business match-making events between buyers and sellers

- • Provision of export market information

- • Developing Export Readiness of the Zambian enterprises, especially MSMEs to meet international customers’ requirements and needs, and compliance standards as well as norms

- • Building the general business capacities of the entrepreneurs (the exporter and potential exporters)

- • Product development to enable Zambian products meet international buyers’ requirements in terms of quality,

- • Product Development

- • Market and financial Linkages/Access

- • Provision of Business Information and Market Intelligence e.g. identification of market opportunities and market access requirements;

- • Provision of after care Services, Business Clinics and advisory services

The following Multi Facility Economic Zone (MFEZ) and Industrial Parks are currently operational in Zambia:

- • Lusaka South Multi-Facility Economic Zone;

- • ZCCZ Chambishi Multi Facility Economic Zone;

- • ZCCZ Lusaka East Multi-Facility Economic;

- • Jiangxi Multi Facility Economic Zone;

- • Kalumbila Multi Facility Economic Zone;

- • Roma Industrial Park; and

- • Sub-Sahara Gemstone Exchange Industrial Park

These zones are provided with modern infrastructure in order to attract and facilitate the establishment of world-class enterprises in the country. The MFEZs blend the best features of the free trade zones, export processing zones, and the industrial parks/zones concept. They apply the administrative infrastructure, rules and regulations that are used as a benchmark among dynamic economies. The blending of physical infrastructure with an efficient and effective administrative infrastructure has created the ideal investment environment for attracting major world-class investors.

MINING

Zambia is the world’s eighth largest producer of copper. It produced over 880,000 metric tonnes in 2020 and holds 6% of the world’s known copper reserves. Kansanshi open pit mine is the largest copper mine in Africa, by capacity, Copper and cobalt, the country’s traditional exports, account for well over 70% of export earnings. Zambia’s copper mines are concentrated on the Copperbelt Province. More mines have been established in other parts of the country such as Solwezi and Kalumbila in the North-Western Province, which has seen accelerated growth in recent years and the Government of Zambia has taken note of the tremendous growth potential of this sector and set a target of increasing copper production from the current 800,000 metric tonnes per year, to 3 million metric tonnes per year over the next ten years. Policy revision that has removed double taxation and revised the tax framework, leveraging digital technology in the sector, and addition along the value chain will see more investment in the sector and make the target more achievable. The signing of an MOU between Zambia and the Democratic Republic of Congo leveraging regional resources towards a value chain for electronic vehicle battery manufacturing, as well as the $350 million investment by KoBold Metals to introduce Artificial Intelligence into

Other mineral endowments include gold, zinc, lead, iron ore, manganese, nickel, feldspar, sands, talc, barite, apatite, limestone, dolomite, uranium, coal, and gemstones (e.g. diamonds, emeralds, aquamarine, topaz, opal, agate and amethysts). Notably, Zambia produces over 20% of the world’s emeralds and has the capacity to increase its production. This extensive range of mineral resources, including a variety of industrial minerals and energy resources such as uranium, coal and hydrocarbons, presents investors with excellent opportunities, especially in the area of extraction and processing.

Zambia’s endowment of mineral resources is substantial, although the full potential of known deposits is yet to be realized. A 2013 World Bank geological analysis suggested that Zambia’s copper deposits were larger than previously estimated, signalling massive exploration potential. This potential is starting to be realized through recent exploration for oil and gas. Thirty Eight (38) exploration blocks have been demarcated in Zambia with twelve (12) of these blocks having been issued with licenses.

Since the privatization of the mines ended in 2000, approximately $17.50 billion has been invested in the sector by about 278 enterprises with large-scale copper mining accounting for more than 90% of these investments. In 2019, mining accounted for 9.9% of GDP, 26.7% of Government revenue, 2.4% of direct employment and 77% of exports.

Even with so much investment in the sector, existing mines have only scratched the surface of the mineral wealth yet to be mined with an estimated 61% of the country having been mapped and exploration in nickel, uranium, coal, geothermal, oil and gas still ongoing. Government policy is tailored to the promotion of value addition to minerals such as copper through the introduction of incentives such as a preferential corporate tax rate of 15% for companies that add value to copper cathodes, compared to the standard 35% for other non-incentivized firms.

AGRICULTURE

Image 3: Palm Oil Plantation in Zambia’s Muchinga Province

Agriculture plays an important role in Zambia’s economy, contributing about 13% to the country’s GDP. Zambia is endowed with a vast arable land resource base of 42 million hectares of arable land, of which only 1.5 million hectares is cultivated every year. It has abundant water resources for irrigation, which account for 40% of the water resources in the SADC region. Given this vast resource endowment, Zambia has huge potential to expand its agricultural production. Its climate is that of a tropical savannah, experiencing rainy seasons between the months of November and April. The dry season is characterized by low humidity between the months of May and November. The average temperature in the summer is 36°C and gets as low as 5°C in the winter, which suitable for both traditional and winter crops.

Despite the availability of vast arable land, transport infrastructure, large water resources and affordable labour – the agricultural sector employs more than half of the total labour force – only 10% of arable land is under cultivation. In that regard, the Government has established farming blocks to facilitate investment in agriculture. 100,000 hectares of land has been set aside in each province to make a total of 1 million hectares countrywide for the establishment of the farming blocks.

Zambia’s traditional crops include maize, cassava, wheat, sorghum, rice, sunflowers, groundnuts, soya beans, mixed beans, Irish potatoes, sweet potatoes, and tobacco. A lucrative cashew nut sub sector in has also been built in the western part of the country.

The Government is currently driving the enhancement of value addition by promoting agro-processing through programmes such as the Zambia Agri-business and Trade Project (ZATP). Agro-processing opportunities in Zambia are in peanut butter production, cashew nut processing, animal or stock feed production, cassava processing, grain milling, edible oil production, fruit canning, juice extraction, meat, dairy and leather production, fish canning, textiles, bio-diesel production, and honey processing.

MANUFACTURING

Zambia has a well-developed market economy. Its strong economic performance over the years is testimony to the nation’s open, outward-oriented development strategy. Like most global economies, Zambia’s was not spared from the negative effects of the COVID -19 global pandemic and other external shocks such as volatile commodity prices emanating from disruptions in global supply chains. However, GDP rebounded to positive figures yielding 4.7% growth in 2022.

Currently, the main manufacturing activities in Zambia are in the following industries:

1) Food and beverages;

2) Textile and leather industries;

3) Wood and wood products;

4) Paper and paper products

5) Chemicals, rubber and plastic products

6) Non-metallic mineral products;

7) Basic metal products; and

8) Fabricated metal products.

The top destinations for Zambian exports are China ($2.14bn), India ($719m), South Africa ($486m), United Arab Emirates ($392m), and Belgium-Luxemburg ($297m). Other significant markets outside Africa include Netherlands and Switzerland as well as Europe and North America through the EBA Initiative and AGOA respectively.

Zambia has traditionally been an importer of finished manufactured commodities and an exporter of primary commodities. This points to a deficit of manufactured products within the Country, thereby highlighting opportunities for investment in sub-sectors such as:

- • Agro-processing;

- • Pharmaceutical products;

- • Assembly of machinery and equipment;

- • Cement;

- • Packaging materials;

- • Fertilizers;

- • Textiles; and

- • Tobacco products, to mention a few.

TOURISM

The tourism industry has grown steadily over the years, with the establishment of hotels in the major tourist centres such as Livingstone and Lusaka. There is vast unexploited potential in the sector in Zambia due to its natural beauty, including its wealth of wildlife and the Victoria Falls, which is one of the most renowned Seven Natural Wonders of the World. The country boasts over twenty awe inspiring waterfalls that make Zambia a hub of waterfalls and a must for adventure enthusiasts; waterfalls which include Kalambo, Ngonye, Chishimba, Chipempe, Ntumbachushi, Kabwelume, Mumbuluma, Lumangwe, Chipoma, Kundalila, and Ngonye, amongst others.

Zambia has 20 national parks and 34 game management areas, with a total of 23 million hectares of land set aside for wildlife conservation. Also, the country has numerous museums that house priceless historical artifacts such as the Lusaka National Museum, Moto-Moto Museum, and Livingstone Museum. Another attraction is the traditional ceremonies that take place at different times of the year where the country’s rich cultural heritage is displayed. Lastly, the beautiful scenery and abundant wildlife have led to the growth of a tourism sub-sector in the film industry. Concessions are provided to movie production companies for shooting films or documentaries.

Image 4: Thrilling activities in Livingstone

Image 4: Thrilling activities in Livingstone

In order to support the tourism sector, Government has continued to build supporting infrastructure such as roads, railways, and bridges, and to facilitate the expansion of the service industry. Since this is a priority sector, investment attracts both fiscal and non-fiscal incentives. Therefore, the bulk of investment opportunities in the sector are in services offered to tourists such as accommodation, restaurants, entertainment facilities, sports facilities, and safaris/game watching, to mention a few.

Zambia is also positioned as a hub for Meetings, Incentives, Conferences and Exhibitions (MICE) and has in the recent past been an attractive destination hosting global dignitaries and celebrities as well as regional and global events and festivals.

ENERGY

Of the installed 2,898MW electricity generation capacity of Zambia, hydro power is the most important energy source with 2,398MW (83%), followed by diesel and coal. Zambia has about 6,000MW of unexploited hydro power potential due to its abundant water resources, providing an opportunity for investment in hydro power generation. The demand for electricity has been growing at an average rate of 4% per annum, mainly due to economic activity overall but particularly in the agriculture, manufacturing, and mining sectors. The country’s growing population has also led to an increase in the demand for other sources of energy such as petroleum and solar energy for transportation and domestic use, especially in rural areas. The state-owned Zambia Electricity Supply Cooperation (ZESCO) Ltd is the only entity that generates and transmits power, while companies such as the Copperbelt Energy Corporation (CEC) procuring power from ZESCO to sell to the mines.

In addition to water resources, Zambia has abundant renewable and non-renewable resources including:

1) Industrial minerals such as coal;

2) Agricultural land to support bio-fuels;

3) Ample forests for bio-mass;

4) Abundant wind;

5) Sunlight for solar power;

6) Abundant hot springs for geothermal energy; and

7) Uranium for nuclear power

There are currently massive exploration missions being undertaken in Northern and Luapula Provinces to ascertain Zambia’s potential for oil and gas drilling. Investment in this sector attracts fiscal and non-fiscal incentives espoused in the ZDA Act.

Image 5: The 54MWB Bangweulu solar power plant located in Lusaka South Multi-Facility Economic Zone

Image 5: The 54MWB Bangweulu solar power plant located in Lusaka South Multi-Facility Economic Zone

Some of Zambia’s profiled investment projects can be found here:

https://investment.unido.org/ACP/projects?Country=82

Prepared by:

High Commission of the Republic of Zambia in Kuala Lumpur

info@zhckl.com.my

2023 August Issue

‣ Country Feature: Republic of Zambia

‣ Diary of Events

‣ 3 May 2023

Meeting with the High Commission of the Republic of Zambia

‣ 1 June 2023

Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI) Seminar on Trade and Investment Opportunities in Bangladesh

‣ 2 June 2023

Meeting between Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI) and MASSA

‣ 15 June 2023

Meeting with International Cooperation and Development Division (ICADD) at Ministry of Foreign Affairs (Wisma Putra)

‣ 28 June 2023

32nd Annual General Meeting of MASSA

[Read here: MASSA Annual Report 2022-2023]

‣ 3 August 2023

Discussion on the Business Opportunities in Timor Leste

Diary of Events (August 2023 Issue)

(from left-to-right)

Mr Samuel Loh, Programme Executive, MASSA, Mr Hasanur Rahman Chowdhury, Executive Secretary, BMCCI, Ms Ng Su Fun, Executive Secretary, MASSA, Mr Syed Almas Kabir, President, BMCCI, Mr Mahbub Alam Shah, Director and Mr Moon Mondal Rajib, Member, BMCCI

From left-to-right:

From left-to-right:

Mr Samuel Loh, Programme Executive, MASSA, Ms Ng Su Fun, Executive Secretary, MASSA, Mr Devrin Jeck, Undersecretary, ICADD, Department of Multilateral Affairs, Wisma Putra, Mr Mogen Selvaraja, Assistant Secretary, Department of Multilateral Affairs, Wisma Putra and Ms Nur Syuhaida, Secretariat, MASSA.

MASSA 2022 – 2023 Annual Report

The MASSA 2022 – 2023 Annual Report can be read here:

2023 April Issue

‣ Country Feature: Republic of Tajikistan

– Malaysia and Central Asia – A Cursory Glance at Cooperation and Interaction

– Country Feature: Republic of Tajikistan

‣ Diary of Events (December 2022 – March 2023)

‣ 20 December 2022

Courtesy Call from MIDA Domestic Investment Division on MASSA

‣ 21 December 2022

Meeting with the Malaysian Research Accelerator for Technology & Innovation (MRANTI)

‣ 21 February 2023

MASSA Visit to the Malaysian Research Accelerator for Technology & Innovation (MRANTI)

‣ 14 March 2023

MASSA-EXIM Bank Business Briefing & Networking Session with Central Asia

FORTHCOMING EVENTS

MASSA Forthcoming Events

a. 20 March 2025 — iDeas Xchange 2

For more information, please contact the MASSA Secretariat at

mail@massa.net.my / massamssc@gmail.com

Read the latest edition of the MASSA e-Newsletter by clicking HERE

20 March 2025: MAJECA-KolaXus-MASSA’s iDeas Xchange 2

The Malaysia-Japan Economic Association (MAJECA) and the Malaysia South-South Association (MASSA) and KolaXus will be organizing the 2nd edition of its Start-up Meet-up & Sharing Session Series.

This Series aims to bring together the members of MAJECA & its co-organisers and the business community to network with selected innovative startup founders & entrepreneurs, to explore opportunity to do business and to partner up strategically in the growing startup ecosystem in Malaysia and beyond. The organisers aim to create & build a platform for the sharing & exchange of innovative ideas and insights.

- – Theme: Cross Border Collaboration & Market Expansion

- – Date / Day: Thursday, 20 March 2025

- – Time: 10.30 am – 1.00 pm (MYT) *Registration will begin at: 10.00 am

- – Venue: Bangunan AmBank Group, 55, Jalan Raja Chulan 50200 Kuala Lumpur (Google Maps: https://maps.app.goo.gl/noayyyHPdfMeNcfK6)

- – Registration: https://docs.google.com/forms/d/e/1FAIpQLSd3tyuokMOtzsXVOxrhWTR0xevlAIiFVntxojR3v7f7wlcoBw/viewform

We encourage members to actively participate in this event to hear from entrepreneurial speakers, discover innovative solutions, explore partnership opportunities, and network with a diverse range of business people. There is no participation fee. However, a prior registration is required. Please do not hesitate to reach out to the Secretariat should you need more information.

Diary of Events (April 2023 Issue)

Mr Yusnee Rahmat Yusof, General Manager Enterprise Development, MRANTI delivered the Welcome Speech.

Ms Ng Su Fun, Executive Secretary, MASSA delivered the Opening Speech.

Mr Fikri Ashraf, Senior Executive, Partnership Development, MRANTI delivered a Presentation introducing MRANTI, its aims, mission and role to encourage Research, Development, Commercialisation and Innovation in Malaysia.

Two of MRANTI’s tenant companies were then invited to share their business experiences and, on the support, and assistance provided by MRANTI in developing their business.

Ts. Tharmaindran G, CEO at Bnetworks, IoT Consultant for Property Technology

Mr Daniel Liew Chee Kin, Co-Founder, Sophic MSC

Following that, the participants were brought to visit MRANTI’s MakersLab, a prototyping space equipped with technology, tools and facilitators for guidance and assistance.

The Visit ended with a Networking Luncheon hosted by MRANTI.

Photo Gallery:

MASSA extends its appreciation to the Malaysian Research Accelerator for Commercialisation and Innovation (MRANTI) for hosting the MASSA delegation’s visit to its premises.

Tan Sri Azman Hashim (left), President, MASSA and H.E. Ardasher S. Qodiri (right), Ambassador of the Republic of Tajikistan to Malayisa

Exchange of Gifts

The meeting exchanged insights and shared the business opportunities in the Republic of Tajikistan, and highlighted the economic potential and strategic advantages the nation has.

Recognizing the synergy between the two organisations (MASSA and EXIM Bank) towards promoting and enhancing Malaysia and South-South business linkages, and building on the momentum of the previous year, which celebrated 30 Years of Central Asia – Malaysia Diplomatic Relations, the event was timely as our nations, and the global economy re-open, resume and return in line with the waning of the pandemic.

This session was organised with the aim to feature the Central Asian nations coupled with EXIM Bank’s expertise and knowledge and MASSA’s services as a business association to bring together members, clients, and stakeholders to reconnect with the view towards revitalizing business connections and form trade linkages between Malaysia and Central Asia.

From left to right:

Mr Atai Namatbaev, Charge d’ Affaires, Embassy of the Kyrgyz Republic,

H.E. Bulat Sugurbayev, Ambassador of the Republic of Kazakhstan,

H.E. Ravshan Usmanov, Ambassador of the Republic of Uzbekistan,

En Arshad bin Ismail, President & CEO, EXIM Bank,

H.E. Ardasher S. Qodiri, Ambassador of the Republic of Tajikistan,

H.E. Muhammetnyyaz Mashalov, Ambassador of Turkmenistan and

YBhg Datuk Merlyn Kasimir, Executive Committee Member, MASSA.

The programme was as follows:

En Arshad bin Ismail, President & CEO, EXIM Bank delivered the Welcome Remarks.

YBhg Datuk Merlyn Kasimir, Executive Committee Member, MASSA delivered the Opening Remarks of YBhg Tan Sri Azman Hashim, President, MASSA.

Pn Zabedah Giw, Acting Chief Strategy Officer, EXIM Bank delivered a Presentation on the Central Asia Market Outlook, Opportunities & Challenges in 2023.

The session then adjourned for a coffee break before resuming with presentations by the representatives from Central Asia.

H.E. Ravshan Usmanov, Ambassador of the Republic of Uzbekistan.

H.E. Ardasher S. Qodiri, Ambassador of the Republic of Tajikistan.

Mr Atai Namatbaev, Charge d’ Affaires, Embassy of the Kyrgyz Republic.

H.E. Bulat Sugurbayev, Ambassador of the Republic of Kazakhstan.

Representatives from EXIM Bank then delivered presentations on the Bank’s services and offerings.

Pn Nurbayu Kasim Chang, Chief Business Officer delivered a Presentation titled ‘EXIM Bank’s Financial Offerings for Malaysian Companies: The Value Proposition’

Mr Khoo Kah Jin, Head of Insrance / Takaful delivered a Presentation titled ‘Secure Trading with EXIM Bank’s Trade Credit Insurance & Takaful Proposition: Why Must Your International Business Have It?’.

Token of Appreciation

Tokens of Appreciations by EXIM Bank were presented to the representatives of the Central Asian Embassies and YBhg Datuk Merlyn Kasimir (pic below, right) by En Arshad bin Ismail (pic below, left), President & CEO of EXIM Bank.

The business briefing then adjourned to a networking luncheon hosted by EXIM Bank.

Photo Gallery:

MASSA extends its appreciation to the Export – Import Bank of Malaysia Berhad (EXIM Bank) for hosting the event, and to the Central Asian Embassies for their kind cooperation and participation at this event.