Forthcoming Events – 4th Showcase Bangladesh 2019 – Go Global

4th Showcase Bangladesh 2019 – Go Global

4th Showcase

Bangladesh 2019

-Go Global

Date: To be announced

Introduction

SHOWCASE BANGLADESH 2019 – GO GLOBAL is set to become the most exciting event for the 4th times in Kuala Lumpur, organized by Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI) in collaboration with the Bangladesh High Commission in Kuala Lumpur, Malaysia South-South Association (MASSA), Malaysia External Trade Development Corporation (MATRADE).

The main objective of the showcase is to promote and project strong Bangladeshi products for export. Bangladesh has definite export product lines that are of export quality. They include Readymade Woven & knit Garments, Frozen fish, leather goods, Jute and Jute products, Tea, Pharmaceutical products, Ceramic tableware, Halal products, Leather products, ICT.

MASSA Events

(1) 17 May 2018 – Meeting with Director, ASEAN &

Oceania Section, Exports Promotion & Market

Access Division, MATRADE, Kuala Lumpur

MASSA Secretariat together with FMM Secretariat representative, Ms Koh Wee Leng, met the Director, ASEAN & Oceania Section, Exports Promotion & Market Access Division, MATRADE, Encik Raja Badrulnizam Raja Kamalzaman and his team at MATRADE on 17 May 2018.

The meeting discussed the potential to do business in the Oceania countries. Encouraged by MATRADE, the meeting discussed the possibility to organise a business mission to Fiji and New Zealand. Working together with MATRADE and its offices in the region, MASSA and FMM members can explore these markets for Malaysian products and services.

(left to right) Puan Jamilah Ibrahim, Senior Manager, Lifestyle Unit, Trade and Services Promotion Division, Puan Anisah Ali, Senior Manager, ASEAN & Oceania Section, Exports Promotion & Market Access Division, Encik Raja Badrulnizam Raja Kamalzaman, Director, ASEAN & Oceania Section, Exports Promotion & Market Access Division, Ms Koh Wee Leng, FMM, Ms Ng Su Fun, Executive Secretary, MASSA and Ms Florence Khoo, MASSA

(2) 17 May 2018 – Meeting at BRINS Secretariat, MITI

MASSA (MAJECA) Secretariat met Mr Unny Sankar Ravi Sankar, Senior Principal Assistant Director of BRINS and Mr Kiew Chia Meng (from Bilateral Economic and Trade Relations Division) on 17 May 2018 at MITI Tower, Kuala Lumpur.

The meeting discussed the roles and objectives of the BRINS Secretariat and how MASSA can work alongside BRINS to encourage MASSA members to tap the business opportunities arising in the 71 countries connected under the Belt & Road Initiative.

(3) 25 June 2018 – Selangor Human Resource

Development Centre (SHRDC)’s presentation

on the “Roles, Functions and Programmes”

and Malaysian Smart Factory 4.0”

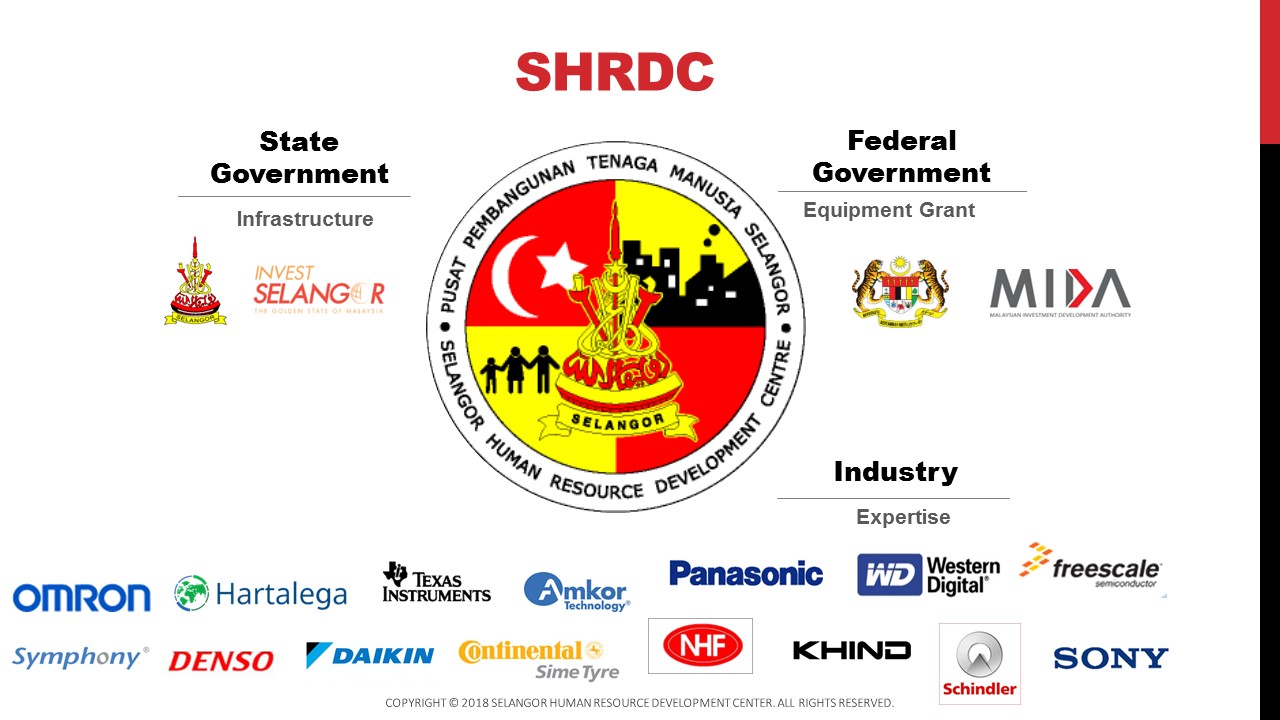

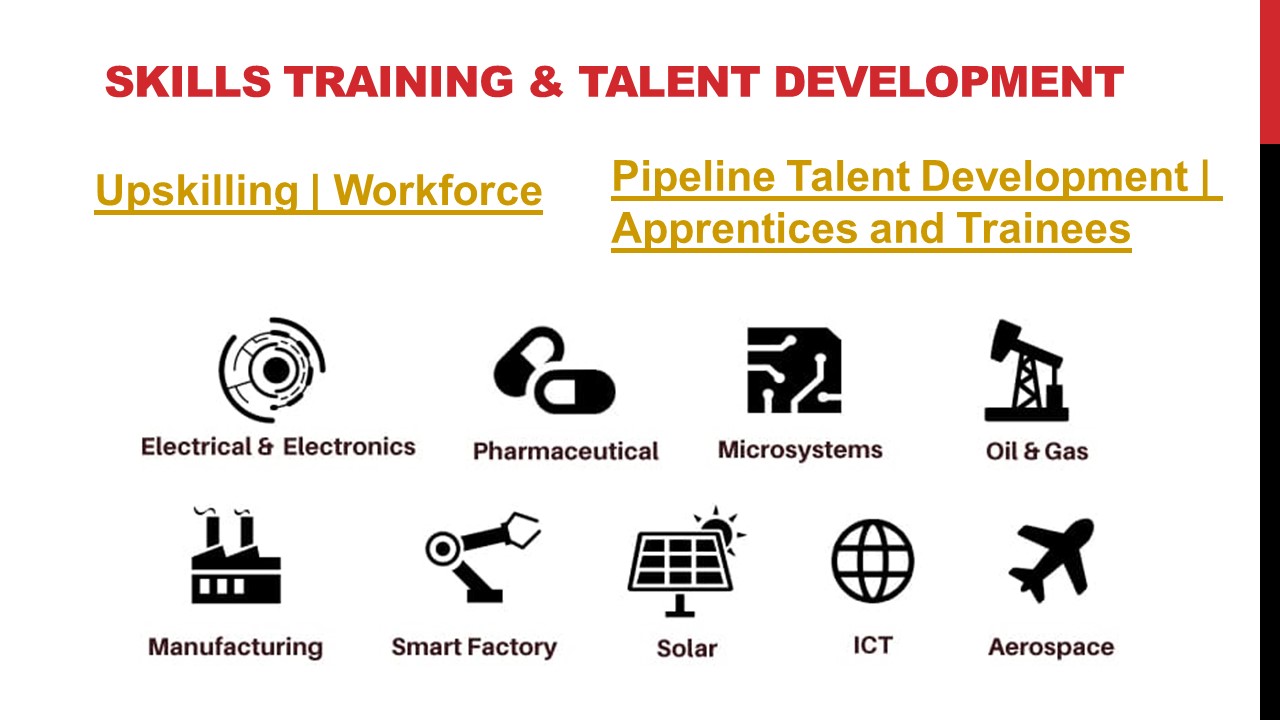

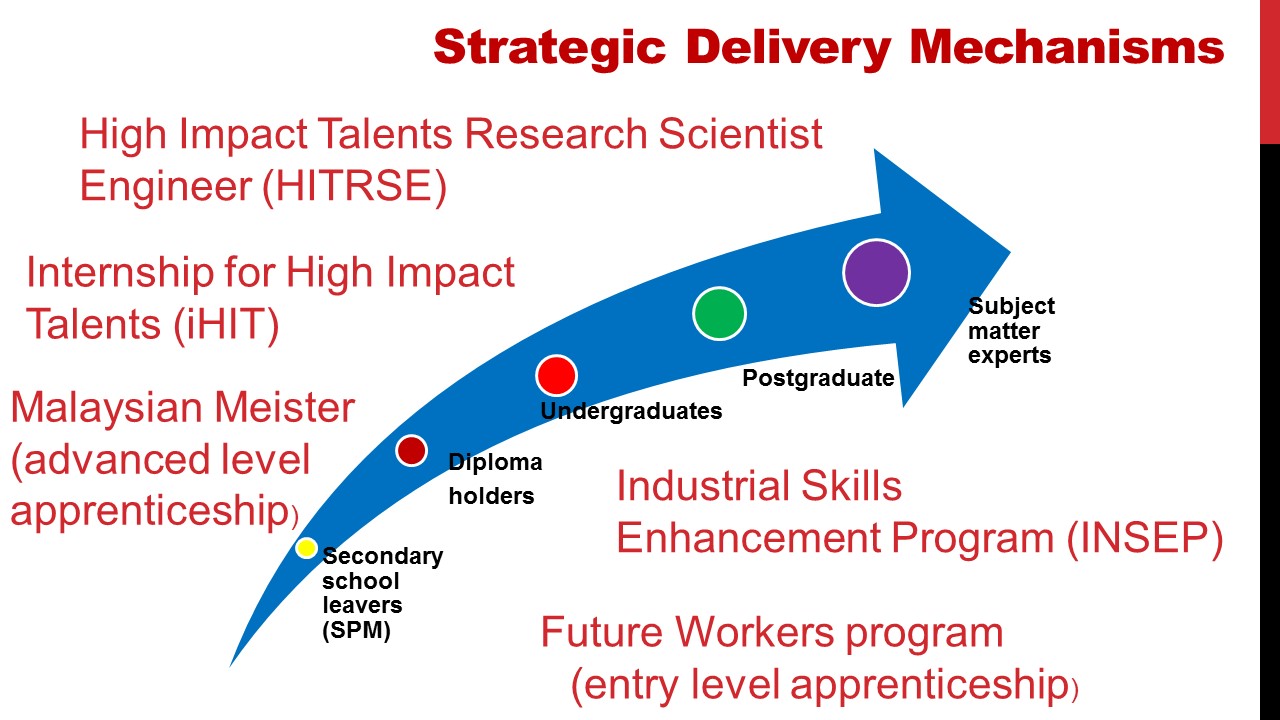

Mr Tan Beng Teong, Executive Director of the Selangor Human Resource Development Centre (SHRDC) gave a presentation on SHRDC’s roles, functions and programmes aimed at training, retraining and upskilling our industrial labour force to meet current industry needs, with special emphasis on alignment to the Malaysian Smart Factory 4.0 concept to MASSA members on 25 June 2018.

Mr Tan Beng Teong, Executive Director of the Selangor Human Resource Development Centre (SHRDC)

Mr Tan Beng Teong, Executive Director of SHRDC sharing his presentation with MASSA members

MASSA Members attended the SHRDC’s presentation

The Selangor Human Resource Development Centre (www.shrdc.org.my) or SHRDC is an industry-driven training and development centre located in Shah Alam. The SHRDC was founded in 1992 as a smart partnership with the Industry and the Federal and State Government.

SHRDC’s partners comprise the following:

• Digital citizenship institute

• International Thought Leader Network

• Swiss Smart Factory

• Kotter International

• SEDA (Sustainable Energy Development Authority Malaysia)

• SAS (business analytics software and services)

• IHK (Industrie-und Handelskammer, German Chamber of Commerce)

• IPC (Association Connecting Electronics Industries)

• Box Hill Institute

The programmes offered at the SHRDC include:

• Aviation MRO

• Microsystem

• Solar Technology

• ICT

• Industry 4.0

• Leadership & Change Management

• Engineering, Design and Mechatronics

Following are some of the SHRDC slides on the “Roles, Functions and Programmes of SHRDC & Malaysian Smart Factory 4.0” presented on 25 June 2018:-

Contact Details:-

Selangor Human Resource Development Centre (SHRDC)

No. 1, Ground Floor, Block 2

Pusat Perniagaan Worldwide

Jalan Tinju 13/50, Sect 13

40100 Shah Alam

Selangor Darul Ehsan

Tel: +603-5513 3560

Fax: +603-5513 3490

Email: info@shrdc.org.my

Website: www.shrdc.org.my

(4) 18th July 2018 – Technical Visit to MIMOS by

MASSA & MAJECA Members

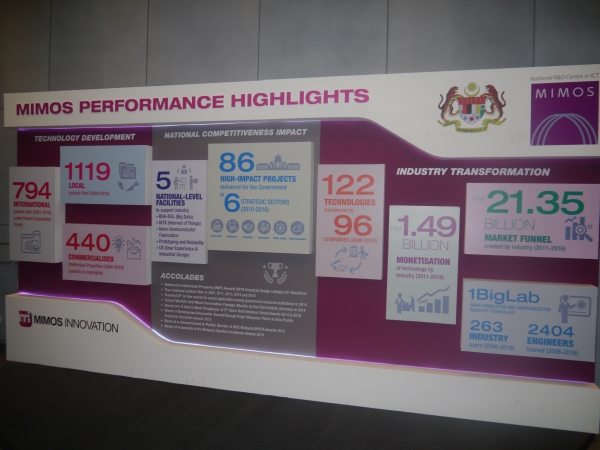

MIMOS Berhad (or MIMOS) is a research and development centre in Kuala Lumpur, Malaysia under purview of the Ministry of Energy, Science, Technology, Environment & Climate Change (MESTECC). The company was founded as the Malaysian Institute of Microelectronic Systems in 1985. MIMOS Berhad provides applied Research and Development (R&D) service in Information and Communications technology, Industrial Electronics Technology and Nano-Semiconductor Technology.

MIMOS conducts R&D in the areas of advanced analysis and modelling, such as developing and analysing mathematical models and computer simulations of research problems; advanced computing, including spearhead R&D activities in large-scale computing, cloud computing and services delivery platform; information security solutions focusing on trusted computing group specifications; intelligent informatics solutions, such as the processing and representation of information in image processing and pattern recognition; and knowledge technology solutions focusing on activities in semantic Web and semantic technologies.

Over the past 12 years, MIMOS has filed more than 2,000 Intellectual Properties in various technology domains and across key socio-economic areas. Serving a central role in Malaysia’s transformation journey and ICT Vision, MIMOS endeavours to create a culture of innovation by nurturing relationships with internal and external stakeholders, in the spirit of smart partnerships and inclusive growth models and strategies.

Through its Technological Leadership, MIMOS role and objectives have been defined to grow key economic sectors, provide innovative solutions to enhance productivity, support local industries and improve capacities through technology, and above all, position Malaysia in the global market as an advanced, regional centre of excellence.

MASSA in collaboration with MAJECA jointly organised a Technical Visit to MIMOS for a briefing and tour of their facilities.

20 representatives from 14 companies/ organisations participated in the Technical Visit to MIMOS on 18 July 2018.

Introduction and Welcome

The CEO & President of MIMOS; Mr Ahmad Rizan Ibrahim welcomed all participants and introduced the role, objectives and vision of MIMOS.

Mr Ahmad Rizan, CEO & President of MIMOS interacting with participants after his welcoming speech.

Mr Ng Kwan Ming the Senior Director, Corporate Technology gave an overview of MIMOS and showcased some applications of solutions created resulting from its R&D analysis – the National High-Performance Computing GRID platform, known as KnowledgeGRID Malaysia.

Presentation by Mr Ng Kwan Ming, Senior Director, Corporate Technology

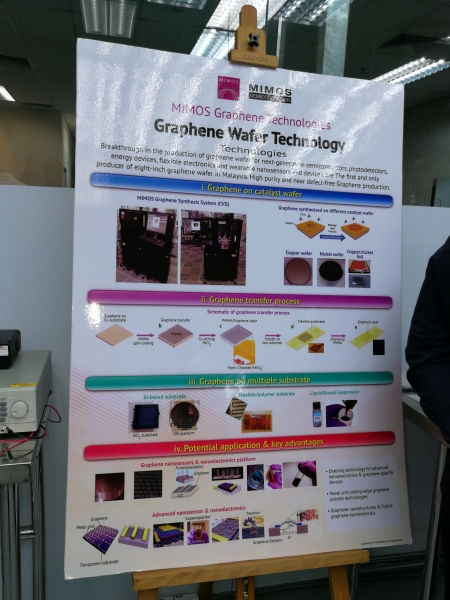

Mr Wan Azli Bin Wan Ismail, Vice President, Nanofab & Semiconductor introduced our group to graphene wafer production that can have the potential to boost the electrical and electronics (E&E) sector by enhancing high value-added electronics applications.

(left) Mr Wan Azli Bin Wan Ismail, Vice President, Nanofab & Semiconductor briefing MASSA & MAJECA members about the silicon ingot

MIMOS Technology Venture and Incubation

MIMOS Technology Venture and Incubation

Group photo taken at Big Data Analytics Lab

Tour of Laboratory facilities

* Big Data IoT Technology Accelerator (BITX) Lab

* Augmented Reality (AR) & Virtual Reality (VR) Lab

* Electronics Prototyping Lab

* Reliability Lab – which provides strategic, internationally-compliant hardware reliability testing services

* Failure Analysis (FA) & Material Analysis (MA) Lab

* Wafer Pilot Line

Mr Chong Foo Boon, Senior Director of Wireless Innovation giving a briefing at BITX Lab

Dr Hon Hock Woon, Senior Principle Researcher briefing members at BITX Lab

(center) Dato’ Chew Chee Kin, President of Sunway Berhad experimenting with the

VR3D device in the Virtual Reality (VR) Lab

Silicon Ingot display at the Semiconductor Lab

Silicon wafers display at the Semiconductor Lab

Graphene Wafer Technology Chart

Sample of Nano-Crystalline Graphene Schottky Diode

(left) Dr Pannirselvam, Director, Wireless Technology & System Design Lab giving a briefing at Electronics Prototyping Lab

MIMOS Performance Highlight chart

(left) Mr Wan Azli Bin Wan Ismail, Vice President, Nanofab & Semiconductor presenting a souvenir to (right) Ms Ng Su Fun, Executive Secretary of MASSA

Group photo taken at MIMOS Lobby

We would like to thank MIMOS Berhad for hosting the informative tour for MASSSA & MAJECA members.

Contact Details

MIMOS Berhad (336183-H)

Jalan Inovasi 3,

Technology Park Malaysia

57000 Kuala Lumpur, Malaysia

Tel: 603- 8995 5000

Fax: 603- 8996 2755

E-mail: info@mimos.my

Website: http://www.mimos.my

(5) 25 July 2018 – Courtesy Call on Tan Sri Azman

Hashim, President of MASSA by Ambassador of

Bosnia and Herzegovina to Malaysia

H.E. Emir Hadzikadunic, Ambassador of Bosnia and Herzegovina to Malaysia made a courtesy call on President of MASSA, Tan Sri Azman Hashim on 25th July 2018 at his office.

The Ambassador was accompanied by Mr. Amer Bukvic, Chief Executive Officer, Bosna Bank International and Mr. Mirza Vejzagic, Advisor to President and Project Management Office of Bosna Bank International.

(left to right) H.E. Emir Hadzikadunic, Ambassador of Bosnia and Herzegovina to Malaysia, Tan Sri Azman Hashim and Mr. Amer Bukvic, Chief Executive Officer, Bosna Bank International

(6) 9 August 2018 – Meeting with BMCCI and ERA

at MASSA Secretariat

Mr Syed Moazzam Hossain, President of Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI) and Mr Ar. Md. Alamgir Jalil, Former President 2016-2017 of BMCCI visited MASSA’s Secretariat. The meeting discussed amongst others, the promotion of the “4th Showcase Bangladesh 2019 – Go Global” next year.

Ms Ng Su Fun, Executive Secretary and Ms Florence Khoo, Asst. Executive Secretary of MASSA met them together with YBhg Datin Paduka Yong Dai Ying, Past President of Expertise Resource Association (ERA), Mr L T Lim and Mr PrameKumar VNP Nair, both EXCO member of ERA at the meeting.

(left to right) Ms Florence Khoo, YBhg Datin Paduka Yong Dai Ying, Ms Ng Su Fun, Mr Syed Moazzam Hossain, Mr PrameKumar VNP Nair, Mr LT Lim and Mr Ar. Alamgir Jalil

MASSA 27th Annual General Meeting (AGM) on 25 June 2018

YBhg Tan Sri Azman Hashim, President of MASSA convened the Twenty-Seventh (27th) Annual General Meeting (AGM) of MASSA at the Banquet Hall, 26th Floor, Bangunan Ambank Group, Jalan Raja Chulan, Kuala Lumpur.

The President of MASSA welcomed members and Committee members and proceeded with the business of the AGM.

(3rd from left) Tan Sri Azman Hashim, President of MASSA chairing the 27th Annual General Meeting (AGM) of MASSA with (left to right) Tan Sri Ghazzali Sheikh Abdul Khalid, YABhg Tun Michael Chen Wing Sum, Tan Sri Datuk Tee Hock Seng, JP and Tan Sri Dato’ Soong Siew Hoong

YBhg Tan Sri Azman Hashim delivered his address and the meeting proceeded to unanimously adopt the Annual Report and the audited accounts of the Association for the year ended 31st December 2017.

(3rd from left) Tan Sri Azman Hashim, President of MASSA delivered his Address at the MASSA 27th Annual General Meeting (AGM) with MASSA EXCO members

MASSA members attending the 27th Annual General Meeting (AGM) of MASSA

MASSA Annual Report 2017 – 2018

President’s Statement

The Executive Committee and Office Bearers for the term 2017 – 2019 remains as follow:-

OFFICE BEARERS

President : YBhg Tan Sri Azman Hashim

Vice President (i) : YABhg Tun Michael Chen Wing Sum

Vice President (ii) : YBhg Datuk Lim Fung Chee

Honorary Secretary : YBhg Datuk Lee Teck Yuen

Honorary Treasurer : YBhg Tan Sri Datuk Tee Hock Seng, J.P.

Honorary Assistant Secretary : YBhg Dato’ Lawrence Lim Swee Lin

MASSA EXECUTIVE COMMITTEE MEMBERS

YBhg Tan Sri Dato’ Mohd Ramli YBhg Tan Sri Dato’ Soong

Kushairi Siew Hoong

YBhg Tan Sri Ghazzali Sheikh YBhg Dato’ Soam Heng Choon

Abdul Khalid

YBhg Dato’ J. Jegathesan YBhg Dato’ Tan Kia Loke

YBhg Dato’ Cheah Sam Kip Ms Norzilah Mohammed

EX-OFFICIO

Ms Bahria Mohd Tamil

– Ministry of International Trade & Industry Malaysia (MITI)

H E Ambassador Norman Muhamad

– Ministry of Foreign Affairs (Wisma Putra)

YBhg Dato’ Azman Mahmud

– Malaysian Investment Development Authority (MIDA)

Ir. Dr. Mohd Shareen Zainooreen B. Madros

– Malaysia External Trade Development Corporation (MATRADE)

The President thanked the Executive Committee and Office Bearers for their continuing support and MASSA members for their participation in MASSA events and activities.

(right to left) Tan Sri Azman Hashim, Datuk Lim Fung Chee and YABhg Tun Michael Chen Wing Sum

(left to right) Tan Sri Datuk Tee Hock Seng, JP, Tan Sri Azman Hashim, Tan Sri Dato’ Professor Joseph Adaikalam and YABhg Tun Michael Chen Wing Sum

(left to right) Tan Sri Azman Hashim and Dato’ Kuah Lai Huat

(left to right) Dato’ Aziz Bahaman and Dato’ Yaacob Arshad

(left to right) Encik Tajuddin Shahruddin and Mr Alagasan Gadigaselam

(left to right) HE Ambassador Norman Muhamad and Tan Sri Ghazzali Sheikh Abdul Khalid

(left to right) Mr Michael T.C. Lee and Ms Ng Su Fun

“Think On Your Feet (TOYF)” by Selangor Human Resource Development Centre (SHRDC)

TOYFR is now available at SHRDC for in-house and public class options!

Upcoming session available for public participation:

Date: 3-4 September 2018

Time: 9 am-5 pm

Venue: SHRDC Training Centre, Shah Alam

Fee: RM 1,800/pax inclusive GST 0%

HRDF SBL/SBL Khas claimable

#training #communication #concision #clarity #persuasion #impact

Video comment: https://www.thinkonyourfeet.com/how-we-change-lives/

Review: https://www.thinkonyourfeet.com/success-stories/think-on-your-feet-reviews/

Contact SHRDC for more information:

T: +603 5513 3560

Find us online:

Contact Details:-

Selangor Human Resource Development Centre (SHRDC)

No. 1, Ground Floor, Block 2

Pusat Perniagaan Worldwide

Jalan Tinju 13/50, Sect 13

40100 Shah Alam

Selangor Darul Ehsan

Tel: +603-5513 3560

Fax: +603-5513 3490

Email: info@shrdc.org.my

Website: www.shrdc.org.my

Country Feature on Papua New Guinea and Republic of Fiji Islands

COUNTRY FEATURE ON PAPUA NEW GUINEA

*Article prepared by MATRADE Melbourne

Papua New Guinea map

|

GENERAL INFORMATION AND ECONOMIC INDICATORS |

||

| Capital | Port Moresby | |

| Land area | 462,840 sq km | |

| Population | 8.3 million (2017 est) | |

| Official

language(s) |

Tok Pisin, English, Hiri Motu | |

| Ethnic Groups | Melanesian, Papuan, Negrito, Micronesian, Polynesian | |

| Currency | Kina | |

| GDP | USD 23.6 billion (2017 est.)

– Agriculture: 22.1% – Industry: 42.9% – Services: 35% (2017 est.) |

|

| Exports | USD9.526 billion (2017 est.)

(LNG, oil, gold, copper ore, nickel, cobalt logs, palm oil, coffee, cocoa, copra, spice (turmeric, vanilla, ginger, cardamom), crayfish, prawns, tuna, sea cucumber) |

|

| Imports | USD1.878 billion (2017 est.)

(manufactured goods, machinery and transport equipment, petroleum products, food, chemicals) |

|

| Trade Balance | USD7.648 billion (2017 est) | |

MALAYSIA-PAPUA NEW GUINEA TRADE PERFORMANCE

| Year | TOTAL EXPORTS | TOTAL IMPORTS | TRADE BALANCE | TOTAL TRADE | ||||

| RM Mil | Growth Rate % | RM Mil | Growth Rate % | RM Mil | Growth Rate % | RM Mil | Growth Rate % | |

| 2013 | 1,732.4 | 0.0 | 325.8 | 0.0 | 1,406.6 | 0.0 | 2,058.2 | 0.0 |

| 2014 | 1,417.0 | -18.2 | 278.0 | -14.7 | 1,139.0 | -19.0 | 1,695.0 | -17.6 |

| 2015 | 1,374.9 | -3.0 | 476.7 | 71.5 | 898.3 | -21.1 | 1,851.6 | 9.2 |

| 2016 | 1,393.6 | 1.4 | 710.4 | 49.0 | 683.2 | -23.9 | 2,103.9 | 13.6 |

| 2017 | 1,445.2 | 3.7 | 945.2 | 33.1 | 500.0 | -26.8 | 2,390.4 | 13.6 |

Source: Department of Statistics, Malaysia (DOSM)

INDUSTRY PROFILE – PAPUA NEW GUINEA

In 2017, Malaysia’s trade with Papua New Guinea (PNG) registered a trade surplus, amounted to RM2.39 billion, an increase of 13.6% from 2016. Exports amounted to RM1.45 billion, an increase of 3.7% from the year before while imports grew by 33.1% to reach RM945.2 million. Major products exported to PNG are:

-Machinery, equipment & parts (RM286.7 mil or 19.8% of total exports);

-Petroleum products (RM216.4 mil or 15.0%);

-Beverages & tobacco (RM179.9 mil or 12.5%)

-Chemicals & chemical products (RM142.0 mil or 9.8%); and

-Processed food (RM82.6 mil or 5.7%).

Executive Summary

1. Papua New Guinea (PNG) is classified as a developing country and is one of the most culturally diverse countries in the world with over 800 languages and over 1,000 distinct ethnic groups. Most of the country’s population live in rural communities and are faced with significant challenges in health, education and economic opportunity.

2. The indigenous population of Papua New Guinea (PNG) is one of the most heterogeneous in the world. PNG has several thousand separate communities, mostly with only a few hundred people – divided by language, customs and tradition.

3. The minerals, timber, and fish sectors are dominated by foreign investors. Manufacturing is limited and the formal labour sector consequently is also limited. The economy of PNG is dominated by labour-intensive agriculture and capital-intensive extraction of oil and gas, gold, copper, and silver. Mining and petrochemicals now account for over 25% of PNG’s GDP and over 80% of its exports. The country continues to face significant challenges in making economic growth more inclusive and sustainable. Many areas of service delivery – such as health, education, transport, energy and water – remain weak, especially in rural areas. Agriculture provides a subsistence livelihood for 85% of the people.

4. Following construction of a $19 billion LNG project, PNG LNG, a consortium led by Exxon Mobil began exporting LNG to Asian markets in May 2014. The success of the project has encouraged other companies to look at similar LNG projects. As such, more opportunities for Malaysian companies to provide products, services and expertise in the oil & gas sector as well as exploration work through Joint Venture.

5. With 2.5 million square kilometres of fisheries area known as the Exclusive Economic Zone, PNG accommodates an extensive and valuable marine resource. Fishing operations range from small-scale coastal commercial operations to large-scale deep water tuna fishing operations. The tuna industry in the country has evolved from licensed harvesting by international fishing vessels to now include in-country production and canning operations. PNG delivers 14% of the world’s tuna catch and has an existing agreement with the EU to allow duty free exportation of tuna to the region.

6. In general, the PNG economy is highly dependent on imports for manufactured goods. Its industrial sector – exclusive of mining – accounts for only 9% of GDP and contributes little to exports. Small scale industries produce beer, soap, concrete products, clothing, paper products, matches, ice cream, canned meat, fruit juices, furniture, plywood, and paint. The small domestic market, relatively high wages, and high transport costs are constraints to industrial development.

7. Numerous challenges still face the government of PNG, including providing physical security for foreign investors, regaining investor confidence, restoring integrity to state institutions and maintaining economic growth. Although PNG economy grew moderately to 3% in 2017, a more challenging environment is expected in 2018 due to economic slowdown in China.

Major Industries

1. Mining and Petroleum

• The mining industry is capitalising on the wealth of natural resources within the country, with the Exxon-led liquefied natural gas project serving as a case in point. This project alone has the potential to double GDP in the near term and significantly boost PNG’s export revenue.

• The current unfavourable economic climate may result in some mining investment projects being put on hold, but investments in new capacity are expected to develop the Elk-Antelope, P’nyang and Stanley gas, owing to the size and relatively low development cost of PNG’s gas fields and the predicted growth in demand for LNG from Asia. The resulting investment spending will support acceleration in economic growth from 2019.

• Obtaining more revenue from the mineral and petroleum sector by discontinuing the practice of providing significant tax concessions to companies operating in this sector will improve both the fiscal balance and the foreign exchange position in PNG. Further, translating revenues into strong, tangible improvements in living standards for all Papua New Guineans remains the key challenge for the Government of PNG.

2. Manufacturing

• The manufacturing industry has traditionally played a fairly small role in Papua New Guinea. This is attributed to a small domestic market, high labour costs and high transport costs.

• Traditional industrial products from Papua New Guinea include fish, timber, coffee, cocoa, copra and palm oil. Traditionally most manufactured products were produced for domestic consumption.

• While manufacturing still plays a small role in the economy, the country’s manufactured products have begun to enter global market places. These products include food and beverages, building materials, handicrafts, household items and furniture, packaging, and paints and coatings.

• One of the most widely known food production companies in PNG is Paradise Foods Limited, which is the oldest established food manufacturing company in the country. Paradise Foods produce food products for the international and regional markets, including biscuits, corn chips and potato chips.

3. Agriculture

• Agriculture dominates the rural economy of PNG. More than 5 million rural dwellers earn a living from subsistence agriculture and selling crops in domestic and international markets.

• PNG has fertile soils and favourable climate, which permits the cultivation of a wide variety of cash crops particularly in the highlands, coastal and island regions. Production of cash crops is usually centered on plantations but significant smallholder productions among rural communities also exist.

• Small scale farmers either sell their product to the plantations, or to the numerous community boards acting as centralised buyer and seller, set up to stabilise prices and improve bargaining power.

• The main agricultural exports of the country include cocoa, coffee, copra, palm oil, rubber and tea.

• Palm oil is a growing business in PNG, with very large capital investments reaching hundreds of millions of kina and targets tens of thousands of hectares per project. New infrastructure plans are in the pipeline, including an estimated 1300 km of provincial and plantation roads.

• Palm oil is PNG’s most successful agricultural crop, accounting for around 40% of agricultural export earnings over the last decade while directly providing income for over 160,000 people living in rural households.

4. Building & Construction:

• PNG’s construction industry experienced a marked expansion in 2010 thanks to the start of construction on the ExxonMobil-led PNG LNG project. The industry recorded five consecutive years of double digit growth, growing at an average rate of 20.8%.

• The PNG LNG project began commercial operations ahead of schedule in April 2014, with the country delivering its first LNG cargo the following month. While this had a positive impact on state revenues, the construction industry slowed in the wake of the project’s completion.

• The worst of the shocks were cushioned by state investment in infrastructure projects, while long term plans to upgrade the national power grid and planned development of the Konebada Petroleum Park and Elk-Antelope LNG Project could see the country return to growth in the medium term.

• PNG’s partnership with the Asian Development Bank (ADB) is the most significant for the country’s construction portfolio. PNG joined the ADB in 1971, and today stands as the bank’s largest Pacific region borrower for private and public sector development, while the bank represents the nation’s second-largest development partner after AusAID.

• Through its partnership with the ADB, PNG has made significant progress in updating major infrastructure, most notable the Lae Port tidal basin, in addition to improvements under way at its airports. The ADB’s second flagship project, the $640 million Civil Aviation Development Investment Programme, will upgrade safety and security at seven airports, including Jackson’s International Airport in Port Moresby.

• Industry players are aiming to finish projects in time for the 2018 APEC Summit. The typical customer profile of the hotel industry comprises mostly business travellers, so there is an opportunity to attract other kinds of tourists.

• Home building is forecasted to accelerate as the market moves to meet demand. The obstacle to this growth is the lack of freehold land as over 90 percent of land in PNG is customary title. Most of the commercial activity involves deals directly with landholders.

5. Forestry

• In PNG, the forest industry makes an important contribution to the country’s economy. The vast majority of timber is produced as raw logs for export – this account for 97% of the value of all exports of forest products, with woodchips covering almost all of the remainder.

• According to the FAO (2015), Papua New Guinea (PNG) has around 33.6 million hectares of forested land, which constitutes to 72.5% of the total land area. Almost the full extent of the forested area is defined as primary or otherwise naturally regenerated forest, and PNG has about 62,000 hectares of forest plantations.

• It is estimated that only 3% of the country’s land area is publicly owned, most of which are towns and cities, and the remaining 97% is owned by local communities or indigenous groups. The customary rights include rights to almost all natural resources, including forests, and landowner groups are consequently legally entitled to be involved in decisions concerning the management of their forest land.

• The country’s forest industry is predominantly based on the export of logs from natural forests. There are many species harvested from PNG’s forests. The top-10 of most important species for export from Papua New Guinea include Taun (Pometia pinnata), Merbau, locally known as Kwila (Intsia spp.), Malas (Homalium foetidum), Calophyllum (Calophyllum spp.), Terminalia (Terminalia spp.), Kamarere (Eucalyptus deglupta) from plantations, Dillenea (Dillenea spp., mainly D. papuana), Red Canarium (Canarium spp.), Pencil Cedar (Palaquium spp), and PNG Mersawa, also known as Palosapis (Anisoptera thurifera).

Trade Opportunities

1. Building Materials, Hardware & Household Products

Opportunities:

-Machinery & Equipment

-Building Materials

-Mechanical & Electrical Appliances and parts

-Household products

-Energy and Renewable Energy products

-Security and automated access systems

-Sanitation and eco-friendly management systems

2. Food and Beverage

Opportunities:

-General Food Stuff (e.g. biscuits, tinned / canned and dried food, snacks, etc.)

-Beverages – energy drinks, aerated beverages and natural waters

-Accessories such as equipment and packaging for the F&B industry including packaging

-Tobacco

3. Pharmaceutical (non-drugs)

Opportunities:

-Medical gloves, syringes, sutures and disinfectants

-Plastic medical disposables

4. ICT

Opportunities:

-Mobile application and value add service providers

-International cables for connectivity

Investment Opportunities

The following profiles have been identified by the Investment Promotion Authority PNG for overseas inbound investment:

1. Agriculture:

a) Coffee, cocoa, coconut (copra), palm oil, spices, tea and rubber.

2. Communications

a) Digitization of telephone exchanges;

b) Upgrading of transmission technology; and

c) Mobile communication providers.

3. Fisheries:

a) Aquaculture – Lobster, Sea Cucumber, Beche-de-mer, Trout, Carp; and

b) Offshore fishery – Tuna species – Big-eyed, Yellow fin, Albacore, Skipjack.

4. Forestry:

a) Tropical Hardwoods; and

b) Palm Oil

5. Financial Services

a) Banking services; and

b) Insurance services

6. Manufacturing:

a) Downstream processing;

b) Processed Food; and

c) Household consumer products

7. Mining and Energy:

a) Rural Electrification;

b) Renewable Energy;

c) Transport; and

d) Energy Efficiency

8. Health:

a) Medical professionals;

b) Clinics; and

c) Hospitals

9. Tourism:

a) Adventure Tourism; and

b) Nature Tourism;

Prepared by:

MATRADE Melbourne

Country Feature on Republic of Fiji Islands

*Article prepared by MATRADE Melbourne

Republic of Fiji Islands map

|

GENERAL INFORMATION AND ECONOMIC INDICATORS |

|

| Capital | Suva |

| Land area | 18,274 sq km |

| Population | 920,938 (July 2017 est) |

| Official language(s) | English, Fijian, Hindustani |

| Ethnic Groups | iTaukei 56.8% (predominantly Melanesian with a Polynesian mixture), Indian 37.5%, Rotuman 1.2%, other 4.5% (European, part European, other Pacific Islanders, Chinese) |

| Currency | Fiji Dollar |

| GDP | USD 5.054 billion (2017 est.)

– Agriculture: 10.6% – Industry: 17.9% – Services: 71.5% (2017 est.) |

| Exports | USD758.6 million (2017 est.)

(Fuel, sugar, beverages, gems, garments, gold, timber, fish, molasses, coconut oil, mineral water) |

| Imports | USD1.918 billion (2017 est.)

(manufactured goods, machinery and transport equipment, petroleum products, food, chemicals) |

| Trade Balance | -USD1.159 billion (2017 est) |

MALAYSIA – FIJI TRADE PERFORMANCE

| Year | TOTAL EXPORTS | TOTAL IMPORTS | TRADE BALANCE | TOTAL TRADE | ||||

| RM Mil | Growth Rate % | RM Mil | Growth Rate % | RM Mil | Growth Rate % | RM Mil | Growth Rate % | |

| 2013 | 807.2 | 0.0 | 7.7 | 0.0 | 799.5 | 0.0 | 814.9 | 0.0 |

| 2014 | 221.0 | -72.6 | 6.7 | -13.5 | 214.3 | -73.2 | 227.6 | -72.1 |

| 2015 | 210.9 | -4.6 | 7.8 | 17.5 | 203.1 | -5.2 | 218.7 | -3.9 |

| 2016 | 235.3 | 11.6 | 17.5 | 123.9 | 217.7 | 7.2 | 252.8 | 15.6 |

| 2017 | 305.6 | 29.9 | 19.5 | 11.1 | 286.1 | 31.4 | 325.1 | 28.6 |

Source: Department of Statistics, Malaysia (DOSM)

INDUSTRY PROFILE-REPUBLIC OF FIJI ISLANDS

In 2017, Malaysia’s trade with Fiji recorded a trade surplus, amounted to RM325.1 million, an increase of 28.6% from 2016. Exports amounted to RM305.6 million, an increase of 29.9% from the year before while imports grew by 11.1% to reach RM19.5 million. Major products exported to Fiji are:

-Other vegetable oil (RM54.1 mil or 17.7% of total exports);

–Electrical & electronic products (RM45.0 mil or 14.7%);

–Petroleum products (RM43.8 mil or 14.3%)

–Processed food (RM26.7 mil or 8.7%); and

–Chemicals & chemical products (RM21.4 mil or 7.0%).

Executive Summary

1. Fiji is described as middle-income country and one of the more developed of the Pacific island economies, although it remains a developing country with a large subsistence agriculture sector.

2. For many years, sugar and textile exports drove Fiji’s economy. However, decline in preferential market access and the phasing out of a preferential price agreement with the European Union [to sugar price reductions of 36%] undermined earnings and the potential of these two sectors in becoming competitive in globalized markets.

3. Fiji has extensive mahogany timber reserves, which are being exploited. Fishing is an important export and local food source. From 2011, fish became one of the leading domestic export commodities. Gold from Fiji’s only gold mine is also an important export industry and is expected to continue its positive performance with rising gold prices.

4. From 2000 the export of still mineral water, mainly to the United States, had expanded rapidly. Water exports in 2016 were estimated at $129.2 million.

5. In recent years, growth in Fiji has been largely driven by a strong tourism industry. Tourism has expanded since the early 1980s and is the leading economic activity in the islands. About 40% of Fiji’s visitors come from Australia, with large contingents also coming from New Zealand, the United States, the United Kingdom, and the Pacific Islands. Tourist arrivals grew by 6.4% in 2017 and reached the 842,884 (2016: 792,320). Fiji’s gross earnings from tourism in 2017 was estimated at $1.70 billion, more than the combined revenues of the country’s top five exports (fish, water, garments, timber, and gold), with arrivals expected to increase by approximately 5% in 2018.

6. Sector contribution to GDP (2013):

a) Service – 48.6 per cent

b) Hotels & restaurants – 13.6 per cent

c) Manufacturing – 13.0 per cent

d) Agriculture – 10.9 per cent

e) Government Services – 5.8 per cent

f) Construction – 3.1 per cent

g) Sugar (including sugar manufacturing) – 1.4 per cent

h) Electricity and water – 1.4 per cent

i) Garments – 1.1 per cent

j) Mining and quarrying – 0.9 per cent

7. In 2017, the Fijian government passed a suite of changes that look to assist in the continued modernisation of the Fijian economy. Chief among these is Fiji’s accession to the UN Convention on the Use of Electronic Communications in International Contracts, and changes to the Electronic Transactions and Financial Transactions Act. The changes bring Fiji in line with international best practice guidelines with the intent of promoting ease of transactions and transparency.

8. This is in line with its key policy objective – to be a hub of e-commerce in the Pacific. The aim of the Fijian Government’s trade and economic policy is for Fiji to be a vibrant, dynamic and internationally competitive economy serving as the hub of the Pacific.

Major Industries

1. Tourism

• The Tourism industry has become Fiji’s largest source of foreign exchange in comparison to other industries such as sugar, fisheries, garments, forestry and even remittance receipts. The sector is mainly private sector driven and has grown substantially over the past few decades. Tourism contributes approximately 17.0 percent to GDP and provides direct and indirect employment to around 40,000 people.

• Tourism is therefore a critical pillar of the economy. In 2017, it is estimated that gross earnings from the tourism industry was $1.7bn, which is about 34.0 percent of GDP. Visitor arrivals have continued to increase over the past 20 years. In 1993, visitor arrivals stood at 318,874, which increased to 842,884 by 2017, an average increase of around 4.5 percent annually.

2. Manufacturing:

• One of the most thriving sectors within Fiji’s growing economy is manufacturing. This includes the manufacture of textiles, garments, footwear, sugar, tobacco, food processing, beverages (including mineral water) and wood based industries. The sector employs approximately 26,000 workers and is one of the nation’s top growing sectors. Fijian-made products have made substantial progress in the international trading arena such as Pure Fiji, Fiji Water, Pacific Green Furniture and FMF Foods Ltd, to name a few.

• Fiji has a highly trained and skilled labour force that is both cost effective and productive. Fiji’s natural advantage in the manufacturing sector mainly lies in the raw natural proximity in terms of sourcing:

-Timber/Wood for furniture;

–Agri-processing (sugarcane, pawpaw, taro, cassava, coconut, ginger, tobacco, herbals);

–Marine;

–Mining;

–Mineral and Water; and

–Dairy, meat and poultry processing.

3. Agriculture

• Agriculture being the mainstay of Fiji’s economy, contributes around 28% to total employment in the formal sector and indirectly employing many more. This sector which was once a major stronghold of Fiji’s economy is the third largest now, contributing $535 million (10.6%) annually to the nations GDP. Sugarcane which used to dominate the sector now only contributes (0.9%) and has been surpassed by other crops, horticulture, and livestock production and subsistence sector.

4. Building & Construction:

• The building and construction industry in Fiji has seen a renewed level of confidence after the general elections in September 2014. Local and overseas investors have announced a few multi-million dollar projects. The government has committed to investing in capital works in roads, water and sewerage and airports.

• The Fiji tourism sector drives building and construction projects for resorts, hotels, airports, marinas and accommodation. Asset maintenance is an essential area of need for hotels, resorts and commercial buildings.

• With increased investments in infrastructure projects and rehabilitation after tropical cyclone Winston, the building and construction industry in Fiji is operating at capacity. Being the biggest storm ever recorded in the Southern Hemisphere, parts of Fiji have been left utterly destroyed, with urgent access to medical care, food, water and shelter being a priority.

5. Forestry

• Export earnings from forest products have been moderately pegged around one percent of GDP in the last three years. However, this contribution can change should the focus is to maximize harvested logs targeting veneer and value addition products. Over 50 percent of Fiji’s land cover is made up of native forests. There is about another 5% to 6% land in pine and hardwood plantations.

• Softwood plantations, mainly of pine (Pinus Caribaea), representing 2.5 percent (46,379 hectares) of the land area, have been established on the leeward and grasslands areas and there is great potential for further plantation expansion. Hardwood plantations of mainly mahogany (Swietania Macrophylla), representing 2.9 percent of the land area, have been established on logged over rainforests, mainly on the eastern and central parts of the larger islands.

• The estimate is based on the anticipated increase in production of indigenous and pine logs as well as harvesting of mahogany plantations. At present wood products ranks as Fiji’s fifth most important domestic export commodity after sugar, fish, mineral water and garments. Earnings from forestry products are greatly influenced by the price of exports and weather patterns.

• Fiji has been self-sufficient in most timber products through utilisation of its natural forests and plantation resources for more than ten years. The outlook however continues to be heavily reliant on the commencement of large-scale utilization of Fiji’s mahogany plantation resource.

Trade Opportunities & Challenges

1. ICT:

a) Opportunities:

-Network integrators and managed service providers

-E-commerce that will enhance customer service and experience

–E-gov and e-tax

-Online learning for corporate and education providers

-Mobile application and value add service providers

-Professional services and billing systems

-Software products particularly in HRM, distribution and logistics, library, medical, manufacturing, agriculture, hospitality, retail and POS systems data integration and backup and document management systems.

b) Challenges:

-Other overseas businesses (in particular Australian and New Zealand) have already invested in and are operating call centres, data/voucher processing, tele-hosting/warehousing, software development and disaster recovery management.

-Understanding and complying with investment procedures without seeking professional advice

-Limited infrastructure in regional areas with readily accessible utilities

-Relatively high costs of utilities, especially power and communication

2. Building Materials, Hardware & Household Products

a) Opportunities:

-Building Materials – tiles, drainage, plumbing, paint, adhesives, glass, etc)

-Mechanical & Electrical Appliances and parts – electrical socket & cables, locks, edging, bolts & nuts, etc)

-Machinery & Equipment – telephony and wireless equipment

-Household products – plastic containers, mat, toilet tidy, water filter, etc)

-Resorts furnishings – furniture and fittings

-Energy and Renewable Energy products – solar, wind, hydro

-Security and automated access systems

-Sanitation and eco-friendly management systems

-Wood and Cork – for re-export of woodchips

b) Challenges:

-Price sensitive market

-Fijian companies prefer to deal with products and services that can be sourced locally which allows for easy access and guidance on maintenance and repairs

-For extensive distribution in the market, collaboration with the 3 major hardware retail and wholesale outlets (Vinod Patel & Co Ltd, R.C. Manubhai& Co. Ltd & Carpenters Hardware) is crucial.

3. Food and Beverage

a) Opportunities:

-General Food Stuff (e.g. spices, biscuits, tinned / canned and dried food, snack, etc.)

-Beverages – energy drinks, aerated beverages and natural waters

-Accessories such as equipment and packaging for the F&B industry including packing

-Tobacco

b) Challenges:

-Due to the small market size, export orders are expected to be in small volumes at regular intervals.

-Competition from existing distributors and suppliers in Australia and New Zealand

-Tariffs ranges from 0 – 32 per cent and industry standards (packing and labelling requirements, quarantine regulations) are applicable.

4. Pharmaceutical (non-drugs)

a) Opportunities:

-Medical gloves, syringes, sutures and disinfectants.

-Plastic medical disposables

b) Challenges:

-Price sensitive market and heavy competitive from products originating from low manufacturing cost countries.

-Government procurement accounts for approximately 70 per cent of the overall market and suppliers must be preapproved to be eligible to participate in tenders.

Investment Opportunities

The following profiles have been identified by Investment Fiji for overseas in bound investment:

1. Agriculture:

a) Production and export of high value niche agricultural produce;

b) Animal Feed Supply, using local resources from existing industries;

c) Dairy Farming;

d) Production and supply of organic farm inputs.

2. Audio Visual:

a) Movie shootings

3. Fisheries:

a) Aquaculture – Prawns, Shrimp, Seaweed, Sea Cucumber, Tilapia, Milkfish, Pearl Oyster, Sea grapes, Asian Carp, Ornament fish, Giant clams and Trochus.

b) Offshore fishery – Deep water snapper; Tuna species – Big-eyed, Yellow fin, Albacore, Skipjack.

4. Forestry:

a) Softwood (Pine)

b) Hardwood (Mohogany)

5. Information Communication Technology (ICT):

a) Call Centres

b) Mail Management

c) Data/ Voucher Processing

d) Tele-hosting/ Warehousing

e) Software Development

f) Audio Visual

g) Disaster Recovery Management System.

6. Manufacturing:

a) Timber/Wood for furniture

b) Agri-processing (sugarcane, pawpaw, taro, cassava, coconut, ginger, tobacco, herbals)

c) Marine

d) Mining

e) Mineral and Water

f) Dairy, meat and poultry processing

7. Energy:

a) Grid Based Power Supply

b) Rural Electrification

c) Renewable Energy

d) Transport

e) Petroleum and Biofuels

f) Energy Efficiency

8. Health:

a) Medical professionals

b) Clinics

c) Hospitals

d) Diagnostic facilities

9. Mining & Groundwater:

a) Mineral water.

b) Gold, silver, manganese, base metals (copper, silver, zinc, etc.), industrial minerals (marble/limestone, aggregate etc.), phosphate, placer materials mineral sands (magnetite, hematite, ilmenite, rutile, zircon, topaz etc.), petroleum & gas, and deep sea minerals including nickel, cobalt, copper and manganese.

10. Tourism:

a) Agro Tourism;

b) Spa Tourism;

c) Health Tourism;

d) Sport Tourism;

e) Nautical Tourism;

f) Retirement Resort Village;

g) Integrated Resort; and

h) Resorts & Villas.

Prepared by:

MATRADE Melbourne

Editorial

Greetings from MASSA !

Malaysia’s General Elections in May 2018 saw the peaceful transition to a new Government in place with Malaysia’s 4th Prime Minister back as the 7th Prime Minister. The new Government has given Malaysians new hope and fresh aspirations to build upon the efforts of the last 60 years and to put the country’s growth on an upward trajectory.

In this August edition, we present readers with 2 country features – namely, Papua New Guinea and Fiji. We are grateful to MATRADE for their excellent field work and research to filter out the latest information and leads for our readers. MASSA and FMM’s business mission to Papua New Guinea has not been finalised, but will now include another country, i.e. Fiji on this mission. Members will be updated once our consultations with the respective Embassies and MATRADE’s network are in place.

MASSA held its 27th Annual General Meeting on 25 June 2018 and took this occasion to organise a talk by the Executive Director of Selangor Human Research Development Centre (SHRDC), Mr Tan Beng Teong. SHRDC has been innovating to meet the HR needs of its stakeholders, namely the industrial corporate sector in tandem with developments arising from IR4.0. The Executive Director gave an interesting and enlightening talk highlighting examples of applications of web enabled technology on the Factory Floor and the extensive range of skills enrichment programmes that are available to upskill and reskill our labour force. As a follow-up, MASSA will be organising a visit to SHRDC for members soon. SHRDC will be sharing information on a regular basis for the benefit of MASSA members. Please look out for our weekly circulars and on our MASSA website.

MASSA visited MIMOS Bhd on 18 July 2018. This organisation is an agency under the purview of the Ministry of Energy, Science, Technology, Environment & Climate Change (MESTECC). It is a leading depository of more than 2,000 Intellectual Properties (IP) in various technology domains and across the socio-economic sectors, resulting from its extensive R & D activities. Members are welcome to work with MIMOS to avail of the myriad emerging applications that have good potential for commercialisation.

H.E. Emir Hadzikadunic, Ambassador of Bosnia and Herzegovina made a courtesy call on MASSA President, Tan Sri Azman Hashim. Accompanying him were representatives from Bosna Bank International. Members can expect more information on this emerging market in the months ahead.

We want to express our thanks to all our contributors and partners for sharing the information and insights for this August edition.

Editorial Committee

MASSA Secretariat

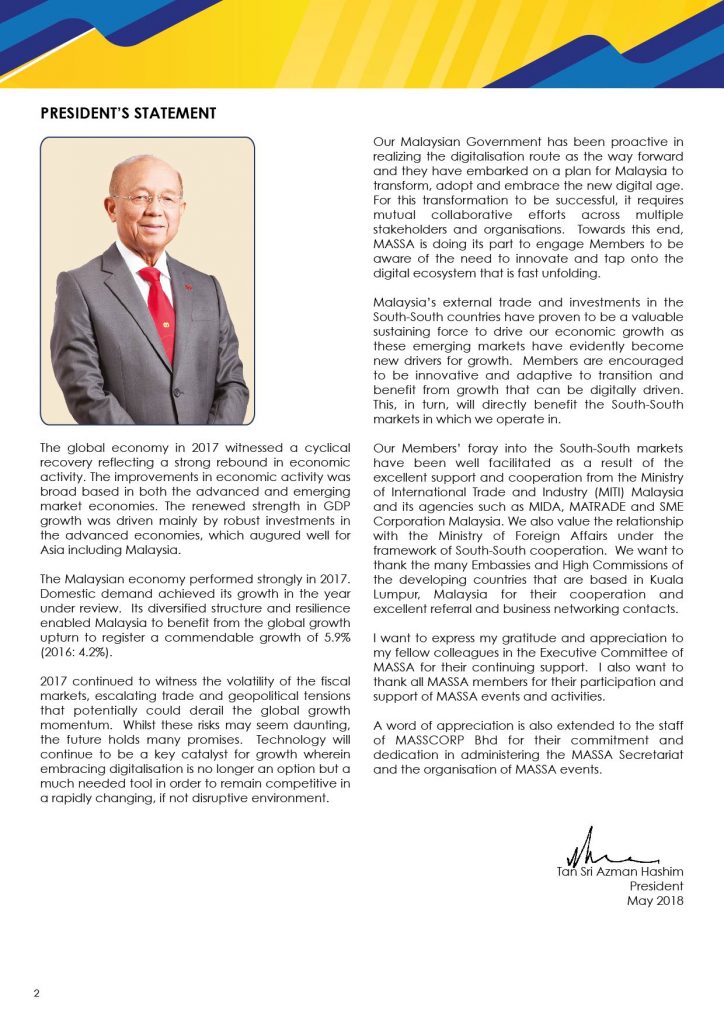

President’s Message

The Malaysian Institute of Economic Research (MIER) released its 2Q2018 report recently revealing that the Malaysian economy is expected to grow at a moderate pace for 2018. Real GDP is projected to grow at 5.5% year-on-year this year and moderate to a range of 4.8% – 5.3% for 2019. This growth will be driven by domestic demand attributed mainly to private consumption. The newly elected Malaysian Government is reviewing and working on all monetary and fiscal fronts to maintain a sustainable growth momentum going forward.

The global economic conditions continue to remain buoyant and IMF opines that world economy will grow at 3.9% for 2018 and 2019, baring the geopolitical tensions, environmental calamities and the US-China trade protectionism issues. This growth is attributed to the surge in trade activities for manufactured goods, especially due to the global technology upcycle and better commodity prices particularly for crude oil. This, in turn, augurs well to boost Malaysia’s export-oriented industries.

MASSA welcomes YABhg Tun Dr. Mahathir Mohamad and his new Cabinet ushering in a new era for Malaysia under the Pakatan Government. YABhg Tun Mahathir is MASSA’s founding PATRON. During MASSA’s formative years in the 1990s, YABhg Tun Dr. Mahathir guided MASSA and fully supported its endeavours to lead the way for corporate Malaysia to venture into the developing countries of the South-South. Today, after 26 years, many of these developing markets have grown to become emerging markets and are major export destinations for our manufactured goods and trade in services. A number of these countries have also become significant investors in our country.

Going forward, the Fourth Industrial Revolution and Industry 4.0 will open up many new areas and sectors for business. Together with our development partners from these emerging markets, the South-South ties will have the opportunity to go further and wider with better possibilities for efficiency, productivity and profitability.

MASSA will continue its efforts to highlight some of these sectors and bring to members for their evaluation.

Tan Sri Azman Hashim

President

Forthcoming Events

1.0 Technical Visit to SIRIM Berhad on 15 May 2018

MASSA will be organising a Technical Visit to SIRIM Berhad on 15 May 2018. The objective of the visit is to learn about SIRIM’s programmes to enable Malaysian SMEs to adopt new technologies and innovate their businesses to drive productivity and remain competitive, particularly in the digital space/economy. It is hoped that the SMEs will be able to equip themselves with the necessary tools/technology to help them to upgrade/innovate their business and production processes to increase efficiency and lower costs.

For more information on the visit, please contact MASSA Secretariat at Tel: +603-2078 3788 or Email: mail@massa.net.my

2.0 MASSA 27th Annual General Meeting (AGM) on

25 June 2018

MASSA will hold its 27th Annual General Meeting (AGM) on 25 June 2018 at the 26th Floor, Banquet Hall, Bangunan Ambank Group, Jalan Raja Chulan, Kuala Lumpur.

3.0 Business Mission to Papua New Guinea (PNG)

MASSA and FMM will co-organise a Business Mission to Papua New Guinea (PNG) from 4 to 8 August, 2018.

If you are interested to join the business mission, kindly contact MASSA Secretariat at Tel: +603-2078 3788 or Email: mail@massa.net.my for further information.

Eligible participants will be able to claim the Market Development Grant, that MATRADE had re-instated.

4.0 Business Mission to Mongolia

A business mission to Mongolia will be organised sometime in August or September 2018. MASSA is working with the Honorary Consul of Mongolia to finalise the arrangements, in particular to check on the availability of the President of Mongolia to meet the delegation.

Further details on this business mission will be sent to members through its weekly Circulars.

MASSA Events

(1) Farewell Dinner for Mr Dhanajoy Kumar Dass,

First Secretary (Commercial), Bangladesh

High Commission on 25 January 2018

Tan Sri Dato’ Soong Siew Hoong, EXCO MASSA hosted a farewell dinner for the outgoing First Secretary (Commercial) of the Bangladesh High Commission, Mr Dhanajoy Kumar Dass.

(Seated, 2nd from left) Mr Dhanajoy Kumar Dass, First Secretary (Commercial), Bangladesh High Commission and (next) Tan Sri Dato’ Soong Siew Hoong, EXCO MASSA (standing, 2nd from left to right) Datin Paduka Yong Dai Ying, President ERA, Ms Ng Su Fun, Executive Secretary MASSA, Ms Florence Khoo, Asst Executive Secretary, MASSA and Dato’ Lim Hong Yeu, Director, Kemajuan Arjaya Sdn Bhd

(right) Tan Sri Dato’ Soong Siew Hoong receiving a souvenir from Mr Dhanajoy Kumar Dass

(2) Mr Md Rajibul Ahsan, the new First Secretary

(Commercial) of the Bangladesh High

Commission visited MASSA Secretariat

on 19 April 2018

Mr Md Rajibul Ahsan, the new First Secretary (Commercial) of the Bangladesh High Commission in Kuala Lumpur visited MASSA Secretariat. The First Secretary commenced his tour of duty in Malaysia in January 2018.

Ms Ng Su Fun and Ms Florence Khoo welcomed Mr Md Rajibul Ahsan to MASSA Secretariat. MASSA reviewed the past activities and programmes held in cooperation with the Bangladesh High Commission in Kuala Lumpur and discussed various activities that MASSA could undertake to foster greater and closer cooperation between the private sectors of both countries.

(left to right) Ms Florence Khoo, Asst. Executive Secretary, MASSA, Mr Md Rajibul Ahsan, First Secretary (Commercial), Bangladesh High Commission and Ms Ng Su Fu, Executive Secretary, MASSA

(3) The Honorable Richard Maru, MP, Minister

for National Planning and Monitoring and

Honorable Petrus Thomas, MP, Minister of

Immigration, Papua New Guinea and

Delegation to MASSA on 18 April 2018

The Honorable Richard Maru, MP, Minister for National Planning and Monitoring of Papua New Guinea together with a delegation that comprised of officials from his Ministry and the Minister of Immigration, Honorable Petrus Thomas, MP accompanied by High Commissioner of Papua New Guinea to Malaysia, H.E. Mr Peter Vincent OL and First Secretary, Mr Philemon Senginawa called on MASSA.

Tan Sri Azman Hashim, MASSA President together with Executive committee and MASSA members met the delegation.

(left to right) Dato’ J Jegathesan, EXCO MASSA, H.E. Mr Peter Vincent OL, High Commissioner of Papua New Guinea to Malaysia, Dato’ G Ramakrishnan, Director, Konsultant Process Sdn Bhd and Ms Ng Su Fun, Executive Secretary, MASSA

MASSA EXCO members meeting wtih the Papua New Guinea Delegation

(2nd from left) Tan Sri Azman Hashim, President of MASSA chairing the meeting with (left) Dato’ J. Jegathesan, EXCO MASSA (3rd from left to right) Ms Ng Su Fun, Executive Secretary, MASSA, Mr Chairil Mohd Tamil, Special Officer to PCEO, Exim Bank and Mr Baharuddin Muslim, Head/Vice President, Stakeholder Management Unit, EXIM Bank

The delegation from Papua New Guinea was on a familiarisation and learning visit to Kuala Lumpur to meet key Government Ministries and officials and private sector to learn how Malaysia successfully transformed its economy from agriculture to an industrial based economy, connect with business enterprises and associations like MASSA, to encourage greater 2-way trade and investment flows.

Papua New Guinea Delegation at the meeting

(left) Honorable Richard Maru, MP, Minister for National Planning and Monitoring, Papua New Guinea and (right) Honorable Petrus Thomas, MP, Minister of Immigration, Papua New Guinea

(left to right) Ms Harry Hakaua, Secretary, Dept of National Planning and Monitoring, PNG and H.E. Mr Peter Vincent, OL, High Commissioner of Papua New Guinea to Malaysia

(left to right) Mr Philemon Senginawa, First Secretary, High Commission of Papua New Guinea in Malaysia, Mr Solomon Kantha, Chief Migration Officer, PNG and Mr Noel Collin Mobiha,, ICT Consultant

Papua New Guinea is an island nation that is richly endowed with natural resources and fertile soils. It is seeking to diversify its sources of economic growth which is currently based on extractive industries and primary resource exportation.

The Hon. Minister welcomed MASSA to bring a business mission to visit Papua New Guinea to explore opportunities in the following areas:-

– Banking & Financial Sector, especially Micro & SME Sectors

– Property & Real Estate Sector, especially Hotel Development

– Fishery & Forestry – downstream processing

– Telecommunication Sector

– Green & Renewable Energy Sector

MASSA and FMM will be organising a Business Mission to Papua New Guinea from 4 – 8 August 2018.

Group photo (3rd from left) Tan Sri Azman Hashim, President MASSA with the PNG delegation after the meeting

(centre) Tan Sri Azman Hashim, President MASSA presenting a souvenir to (left) Hon. Richard Maru, MP, Minister for National Planning and Monitoring, Papua New Guinea and (right) Hon. Petrus Thomas, MP, Minister of Immigration, Papua New Guinea

(left to right) Mr Baharuddin Muslim, EXIM Bank, Ms Harry Hakaua, Secretary, Dept of National Planning and Monitoring, PNG and Mr Chairil Mohd Tamil, EXIM Bank

(4) MASSA Technical Visit to Inari Amertron Berhad’s

Facilities and Penang Skills Development Centre

(PSDC) on 26 April 2018

MASSA organised a visit to Inari Amertron Berhad and Penang Skills Development Centre (PSDC) on 26 April 2018.

Inari Amertron Berhad is a home grown Malaysian MNC in the OSAT (Outsourced Semiconductor Assembly and Test) and EMS (Electronics Manufacturing Services) Industry. Listed on Bursa Malaysia in 2011, it has a market capitalization of more than RM5.57 billion employing more than 6,600 employees across 12 factories spread over 3 countries.

The broad based global economic recovery in 2017 was partly due to the global technology upswing that was supported by a number of launches of popular flagship smart devices. This triggered a wave of new orders for firms along the supply chain of these products. Malaysia is the world’s 7th largest semiconductor exporter with extensive linkages in the global value chain. As a result, the technology upcycle translated into robust demand for E & E products from the regional and advanced economies.

Inari Amertron Berhad Group of Companies has embarked on the adoption of Industry 4.0 smart manufacturing features in their operations.

(5th from left) Ms Ng Su Fun, Executive Secretary MASSA and (7th from left) Mr Lau Kean Cheong, Executive Director cum Group CEO, Inari Amertron Berhad with MASSA members during their visit to Inari Amertron Berhad’s facilities on 26 April 2018

Mr Lau Kean Cheong, Executive Director cum Group Chief Executive Officer met our delegation and personally welcomed us and shared with us, Inari Amertron Berhad’s experiential Industry 4.0 journey and how the company has adapted and adopted smart manufacturing features, and, how these features being part of its innovation strategy, have translated to operational efficiencies, productivity and profitability.

Industry 4.0 is a journey and it should begin with the top management of the company, leading the charge for corporate transformation through the adaptation and adoption IOT enabled technology.

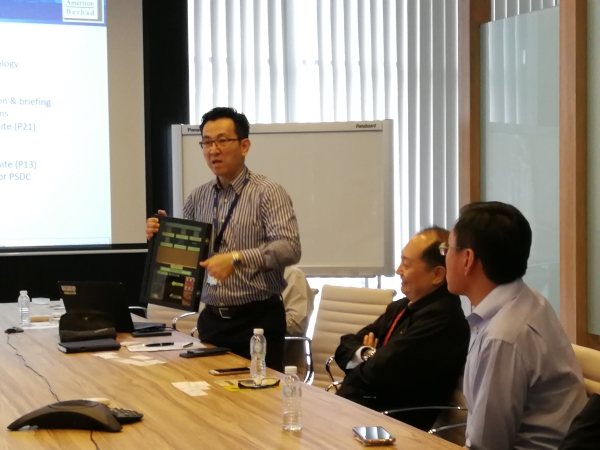

(standing, on the left) Mr Lau Kean Cheong, Executive Director cum Group Chief Officer of Inari Amertron Berhad giving a presentation on Inari Amertron Berhad’s operations and its facilities to MASSA members

(left to right) Mr Noorazidi Bin Che Azib, Deputy President, Operation Technology & Strategic Programme Dept. and Mr Lau Kean Cheong, Executive Director cum Group Chief Executive Officer of Inari Amertron Berhad at the meeting

(standing, on the left) Ms Ng Su Fun, Executive Secretary MASSA giving a brief on MASSA to the Management of Inari Amertron Berhad

(left to right) Mr Noorazidi Bin Che Azib, Deputy Vice President, Operation Technology & Strategic Program Department, Inari Amertron Berhad, Mr Lau Kean Cheong, Group CEO cum Executive Director, Inari Amertron Berhad, Dato’ Jimmy C.K. Ong, FMM Vice Chairman (Penang Branch), Dato’ Lim Hong Yeu, ERA, Mr Matin Ng Chin Liang, FMM (Penang Branch) and Mr Zainal Adnan Zainudin, Senior Manager-Human Resource, Inari Amertron Berhad

(left) Ms Ng Su Fun presenting the MASSA Annual Report to Mr Noorazidi Bin Che Azib

Mr Noorazidi Bin Che Azib, Deputy Vice President, Operation Technology & Strategic Programe Department shared with our delegation the detailed operational aspects of embracing these technological upgrades and enhancements to boost its competitiveness. This can only be made possible through strong employee engagement and teamwork. The visit included a walk through Inari’s production floor at 2 of their plants.

We thank the Management of Inari Amertron Berhad, especially Mr Lau Kean Cheong, Mr Noorazidi Bin Che Azib, Mr Zainal Adnan Zainudin (Senior Manager – Human Resource) and Ms Connie Chan (PA, Administration) for their time, hospitality and the sumptuous lunch !

We came away very impressed and we learnt a lot. We wish the Management and Staff of Inari Amertron Berhad every success.

MASSA members at Inari Amertron Berhad’s facilities

Visit to Penang Skills Development Centre (PSDC)

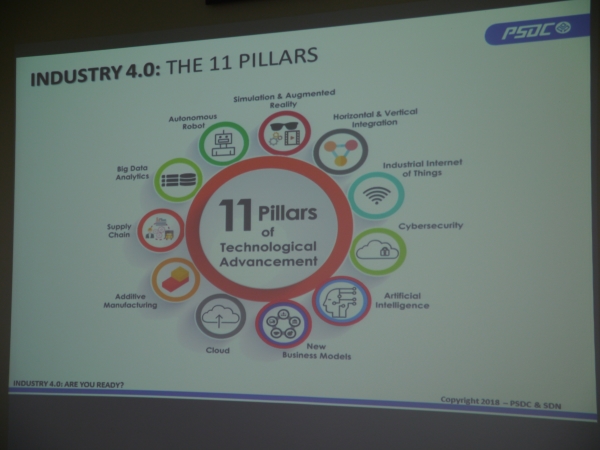

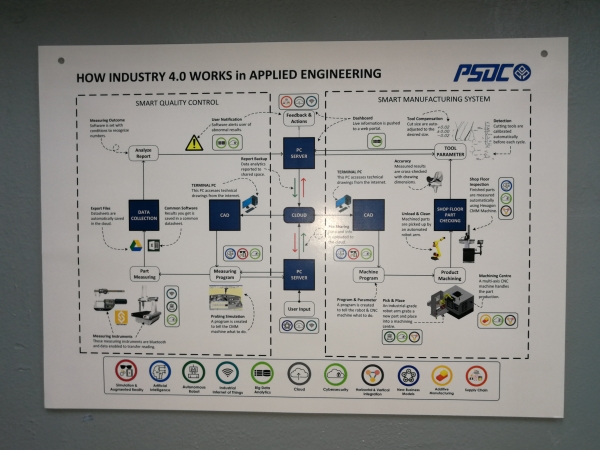

The Chief Executive Officer of PSDC, Mr Muhamed Ali Hajah Mydin and his team, Encik Azhar Bin Md Nayan, Technical Advisor and Ms Diana Teoh Choon Hooi, Program Manager, Industry Technical Collaboration warmly received us and gave us a presentation of PSDC’s objectives and its programmes and activities to help companies, amongst others, to become Industry 4.0 ready.

PSDC has over the years trained and developed training programmes to equip the industry with quality workforce. More so now with the advent of digitalisation transformation driven by the IOT, human skills and talent need to adapt to these changes, thus giving rise to talent upgrading, upskilling and reskilling.

((left) Ms Ng Su Fun, Executive Secretary MASSA and MASSA members at Penang Skills Development Centre (PSDC) office in Penang

Mr Azhar bin Md Nayan, Technical Advisor of Penang Skills Development Centre (PSDC) giving a presentation on “Industry 4.0 – Centre of Excellence (CoE)” to MASSA members

The 11 Pillars of Industry 4.0

(left) Ms Diana Teoh Choon Hooi, Program Manager, Industry Technical Collaboration, PSDC and Mr Azhar Bin Md Nayan, Technical Advisor, PSDC at the meeting

PSDC has established an “Industry 4.0 – Centre of Excellence” in its premises. Our delegation was given a tour of its learning facilities. This academy is driven and supported by corporate members and its learning programmes are designed to be directly relevant to immediate and forecasted industry needs.

Learning facilities at PSDC

(left) Dr. Helena Eian Yeut Lan, FMM Council Member and (right) Ms Diana Teoh Choon Hooi, Program Manager, Industry Technical Collaboration, PSDC showing MASSA members the learning facilities at PSDC

MIMOS Innovation Hub at PSDC

Ms Diana Teoh Choon Hooi giving an explanation on PSDC’s learning facilities to MASSA members

Mr Muhamed Ali Hajah Mydin, Chief Executive Officer, PSDC introducing features and facilities of the PSDC Learning Lab to MASSA members

MASSA members touring the PSDC Learning Lab

Chart depicting on “How Industry 4.0 Works in Applied Engineering” at PSDC

Group photo of MASSA members at the Penang Skills Development Centre (PSDC)

We thank Mr Muhamed Ali Hajah Mydin, Chief Executive Officer and his team for their time and passionate sharing to inform us about the extensive range of training and academy programmes for students and the workforce. PSDC also has shared services facilities via its EMC Lab and other event management services for corporates.

Readers can find out more by visiting PSDC website at www.psdc.org.my

Selangor Human Resource Development Centre (SHRDC)

Malaysian Smart Factory 4.0 – Hands On Industry 4.0

The term “Industry 4.0” refers to the combination of major innovations in digital technology that are poised to transform the way we work and is set to revolutionize the manufacturing sector. From advanced robotics and machine learning to the Industrial Internet of Things (IoT), these changes enable powerful new ways that will enhance processes, create new jobs that will lead to new levels of productivity, ultimately impacting business operations and the economic growth of a nation.

Smart manufacturing or Smart Factory is a broad categorization that refers to the goal of optimizing existing manufacturing process, through the adoption and application of IoT, cyber-physical systems (CPS) and advanced human-machine interactions.

Smart Factory takes current manufacturing practices to Industry 4.0 standards by transforming production lines into highly agile, efficient and automated lines that will eventually integrate into a smart logistics and service network.

To prepare for the challenges of Industry 4.0, SHRDC has recently embarked on a new partnership with the Swiss Smart Factory (SSF) to provide practical solutions for technological progress and talent development. Part of the Switzerland Innovation Park Biel/Bienne, SSF is a R & D and test platform for industrial and applied research and innovation accelerators.

SHRDC’s Industry 4.0 training program is known as the Malaysian Smart Factory (MSF) 4.0. It provides hands-on experience, training, technology and talent development for Industry 4.0 and Smart Factory competencies.

The key and sub components of MSF 4.0 are:

MSF 4.0 will focus on four key areas:

These four areas are designed to support Malaysian industry in their adoption of Smart Factory practices and standards.

Based on SHRDC’s ongoing engagement with industry, key players in the manufacturing sector acknowledge that the transformation process will likely create new competencies and roles, improve productivity and take the sector to higher levels of value and output. But they have also highlighted that the most crucial step is the application of Smart Factory competencies by trained talent to their existing production lines.

As such, SHRDC’s first key area to focus on is Talent Development. We have recently previewed the first two training programs for MSF 4.0:

| No | Program | Duration | Target Audience |

| 1. | Smart Factory Technical Overview: Enabling Technology for Industry.

The program offers a platform for knowledge sharing and demonstrations of technology to help industries upgrade and digitize operations to Industry 4.0 standards

|

2-day | Business Development Managers, Engineers, Technicians, Technical Managers, Production Managers, Academia with relevant background |

| 2. | Operational Technologies Fundamental

The program offers hands-on training and remote-access learning for the following modules: · Cyber Physical System (CPS) based automation · CPS based communication systems · CPS based drivers and sensors · IoT Gateway

|

26-day | Engineers, Technicians, Academia with relevant background

Skills area: Industry 4.0, Industrial IoT, Mechatronics, Electrical & Electronics |

We are also building our MSF 4.0 learning platform and have recently completed two proof of concept (POC) projects for Khind-Mistral Industries Sdn Bhd and New Hoong Fatt Holdings Bhd.

In both POCs, the main goal is to enable the extraction, transmission, storage, retrieval and monitoring of relevant production data, from existing Plastic Injection Molding Machines (PIMM) that does not already have, built-in or installed internet ready capabilities.

At New Hoong Fatt (NHF), SHRDC trainers, who are also practicing industrial System Integrators, collaborated with NHF’s staff to complete SHRDC’s first POC project. The outcome of the project demonstrated a palm-sized device that can be connected to a USB port that is available on an existing PIMM that is operating in NHF’s production floor.

The POC device is capable of extracting and storing RAW data from the PIMM and can successfully proceed to decode the RAW data into a readable format such as a Microsoft Excel file. All the stored data residing within this POC device is made conveniently accessible wirelessly, after logging in with the proper security credentials, from any web browser within a computer or a smartphone.

The web browser interface has been set up with simple Graphical User Interface, which gives the user options to view various types of reports related to NHF’s production requirement.

By 2019, our 40,000 sq training centre in Shah Alam will feature a Smart Factory Laboratory with a Smart Factory Live Demonstrator area that will house various application equipment and offer visualization of technology at work. It will be made available to our members, industry partners, lecturers and students.

For more information on MSF 4.0 and SHRDC please contact:

Selangor Human Resource Development Centre (SHRDC)

No. 1, Ground Floor, Block 2

Pusat Perniagaan Worldwide

Jalan Tinju 13/50, Section 13

40100 Shah Alam

Selangor Darul Ehsan

E: info@shrdc.org.my

T: +603 5513 3560

F: +603 5513 3490

W: www.shrdc.org.my