Country Feature: Estonia An Exceptional Investment Destination

Overview

Estonia is located at the heart of the Baltic Sea Region, one of the fastest-growing economic blocs in Europe. It is bordered by Finland, Sweden, Latvia and Russia. The country has a land area of 45,227 sq km, with about half of it covered by lush forests. The climate in Estonia is humid and temperate, characterised by warm summers and fairly severe winters. Around 1.34 million people reside in Estonia with 30% of them concentrated in the capital Tallinn. It is reported to be one of the least densely populated countries in the world.

Historically, Estonians were once subjected to Danish, Teutonic, Swedish and Russian rule. The country regained its independence on 20 August 1991. Since then, it has embarked on a rapid programme of social and economic transformation.

Economic Overview

Estonia has a liberal market-based economy with phenomenal growth potential, offering good access to Russia, the CEE countries and the EU region. Government debt is among the lowest in Europe and the economy has shown tremendous resilience in the face of the global economic crisis. Among other international agreements and memberships, Estonia is a member of the European Union (EU) and North Atlantic Treaty Organisation (NATO). This dynamic Nordic country also has close economic ties with Scandinavia and Western Europe.

Supported by its excellent business environment, stable economic policy and moderate costs, Estonia has over the years attracted numerous international companies to its shores.

Why Estonia?

There are many advantages that make Estonia the perfect investment destination, including political and economic stability, accessibility, ease and low cost of doing business as well as investor equality. In fact, The World Bank Group has ranked Estonia among the top 25 countries in the Ease of Doing Business index.

Estonian business regulations are known to be less rigid than its neighbouring countries. The tax system is simple, transparent and extremely business friendly. Additionally, labour costs are relatively low – just one third of those in Sweden or Finland. It also boasts a highly skilled and educated workforce.

Telecommunications and transportation are well developed in Estonia, with an efficient road network spanning the entire country. Its international airport in Tallinn serves direct flights to numerous European cities.

Business Opportunities

The economy offers key opportunities for investors in a number of sectors including ICT, electronics, machinery and metalworking, wood processing, logistics/transport and food. Other key sectors include oil shale-based energy production, textiles, chemical products, banking, fishing, timber and wood products and shipbuilding.

The thriving IT sector in Scandinavia has had a positive impact on Estonia, which has developed expertise in specialised markets such as office machinery assembly services and electronic equipment manufacture. Estonia has one of Europe’s most modern telecommunications networks and a high degree of IT literacy and technology penetration.

This is a country with an exceptional business environment that has allowed highly successful companies like SKYPE (www.skype.com), Playtech (www.playtech.com), Swedbank (www.swedbank.com), Ericsson (www.ericsson.com), Tallink Group (www.tallink.com), ABB (www.abb.com), Elcoteq (www.elcoteq.com) and others to flourish.

| Several growth areas have also been indentified: |

|

Business At A Glance

- Estonia has been ranked 14th in the Index of Economic Freedom (2011, Wall Street Journal/The Heritage Foundation), 17th in the Ease of Doing Business Report (2011, World Bank), and 35th in the Global Competitiveness Report (2010, World Economic Forum).

- Estonia has some of the highest credit ratings in the region (Fitch IBCA, Standard & Poor’s, Moody’s).

- On 1 January 2011, Estonia became a member of the euro area.

- 0% corporate income tax is imposed on all reinvested earnings in Estonia.

- The Estonian cost level is still significantly lower than that of neighbouring Scandinavian countries.

- In Estonia, all capital is treated equally, foreign or domestic.

- Estonia is a member of the International Center for the Settlement of Investment Disputes, the Multilateral Investment Guarantee Agency, and the New York Convention.

- Estonia is the leading country in Central and Eastern Europe in terms of attracting foreign direct investments.

- Estonia is one of the leading countries in the world in creating and implementing e-government solutions and cyber security.

- Estonia is within 3 hours flight from most major European, Scandinavian and Russian cities.

Prime Minister of Estonia Andrus Ansip made the following statement during a meeting on 3 October 2011 with the Indian Cabinet Minister for Heavy Industries and Public Enterprises Praful Patel and the business delegation accompanying him:

![]() Although Estonia is a small country, its liberal economic model provides foreign investors with attractive prospects for business not only on the local market, but throughout the European Union. Take no notice of the fact that Estonia has such a small population. Look at Estonia as a gateway to the wider market of the European Union – with 500,000,000 people.

Although Estonia is a small country, its liberal economic model provides foreign investors with attractive prospects for business not only on the local market, but throughout the European Union. Take no notice of the fact that Estonia has such a small population. Look at Estonia as a gateway to the wider market of the European Union – with 500,000,000 people.![]()

The Honourable Prime Minister also explained that the reduced currency risk related to the transition to the single currency, the free movement of capital, people and services within the European Union and Estonia’s tax system made it an attractive base from which to do business across the continent.

Estonian Investment and Trade Agency (EITA)

For those interested in investing in Estonia, the Estonian Investment and Trade Agency (EITA) acts as a one-stop agency offering a variety of services to help facilitate the investment process.

EITA Head Office

Enterprise Estonia

Lasnamäe 2, 11412 Tallinn.

Phone: +372 6 279 700 • Fax: +372 6 279 701 • Website: www.investinestonia.com

5th INTRADE Malaysia 2011

MASSA participated in the 5th International Trade Malaysia 2011 (INTRADE Malaysia 2011) organised by Malaysia External Trade Development Corporation (MATRADE) with the support of The Ministry of International Trade and Industry (MITI), Malaysia on 22 to 24 November 2011 at the MATRADE Exhibition & Convention Centre, Kuala Lumpur.

MASSA participated in the 5th International Trade Malaysia 2011 (INTRADE Malaysia 2011) organised by Malaysia External Trade Development Corporation (MATRADE) with the support of The Ministry of International Trade and Industry (MITI), Malaysia on 22 to 24 November 2011 at the MATRADE Exhibition & Convention Centre, Kuala Lumpur.

YB Dato’ Sri Mustapa Mohamed, Minister of International Trade and Industry, Malaysia officiated the opening of INTRADE Malaysia 2011.

A total of 367 companies participated at the INTRADE Malaysia 2011 with 433 booths taken-up by these companies at this exhibition. 15 countries from Indonesia, Thailand, Philippines, Singapore, Vietnam, Laos, China, Taiwan, Hong Kong, Sri Lanka, Bangladesh, India, UAE, Korea and Japan exhibited at INTRADE Malaysia 2011 with 8,972 trade visitors visited this exhibition.

Besides the Incoming Buying Mission Programme (IBM), other programmes running concurrently at INTRADE Malaysia 2011 were FTA @ MATRADE, the Kuala Lumpur International Trade Forum (KLITF) and also the one-to-one business matching meetings held on 23 November 2011 with 6,357 business meetings arranged for participating businessmen.

The major products highlighted at this exhibition are automotive, electrical & electronics, food & beverages, furniture & interior, wood-based products, gifts, souvenirs, handicrafts & jewellery, health, pharmaceutical, cosmetics & personal care, industry support, information and communication technology, professional & business services, textile & apparels.

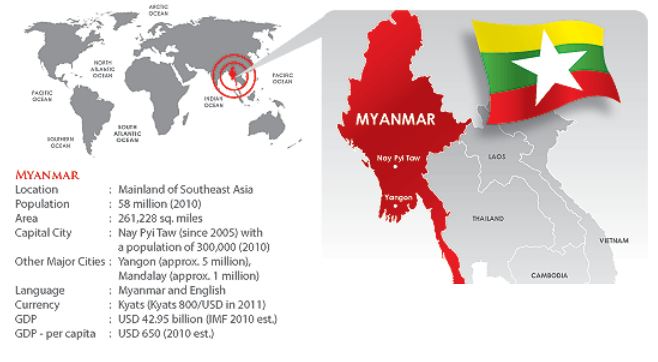

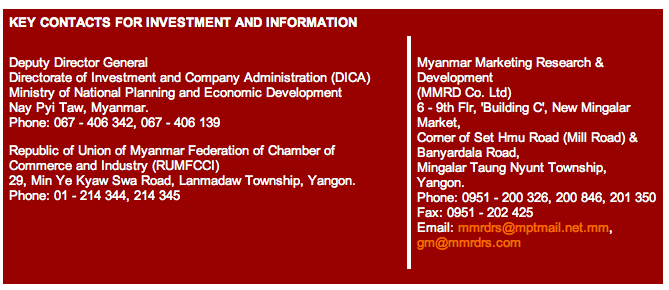

Country Feature: Investment Opportunities In Myanmar

Myanmar is the largest country in the Southeast Asian peninsula in terms of area, sharing common borders with Bangladesh, India, China, Lao PDR and Thailand. Additionally, it boasts 2,000 km of coastline along the Indian Ocean. The country is culturally diverse with 135 official ethnic groups. The Bamar (69%) constitute the ethnic majority while among the main ethnic minorities are the Kachin, Kayah, Kayin, Chin, Mon, Rakhine, and Shan. Myanmar is administratively divided into 7 states and 7 regions and, at a sub-level, into 67 districts and 330 townships. The economic system has evolved since 1989 when Myanmar started to adopt market oriented reforms which encouraged many local and foreign enterprises to enter the domestic market. The size of the Myanmar economy has grown from USD 6.48 billion in 2001 to USD 42.95 billion in 2010, a 6.6 times increase in nominal term within one decade. According to official statistics, real GDP growth rate was 11.2% on average in the period 2000 – 2010. Annual inflation rates have remained at a single digit level since 2008.

Myanmar is rich in natural resources with arable land, forestry, minerals (including oil & gas), and freshwater and marine resources. The Myanmar economy relies heavily on agricultural products and gas exports. In 2009/2010, the share of agriculture (agriculture, livestock, fishery and forestry) in the GDP was 40%, that of industry (energy, mining, electricity, manufacturing and construction) 22.5% and that of the service sector including trade 37.5%. According to official trade statistics for 2010/11, about 94% of total foreign trade was with Asian countries. Among them, Thailand was the largest with a share of 23.7% followed by Mainland China (22.1%), Singapore (13.8%), and Hong Kong (12.5%). Myanmar has enjoyed a trade surplus since 2003 when a large amount of natural gas started to be exported to Thailand. The structure of export remains dependent on natural resources such as gas and jade, and on primary products such as agricultural, marine and forestry products that are mainly exported with limited or no value being added.

After the general election in 2010, the military handed over power to a newly elected government on April 2011 under a democratic constitution with safeguards provided for the authority of the armed forces. A relaxation of trade policies and trade facilitation has been initiated since the new government was formed. It is mainly aimed at preparing the economy for the ASEAN Free Trade Area (AFTA) and ASEAN Economic Community (AEC) which will materialise in 2015.

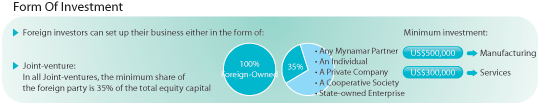

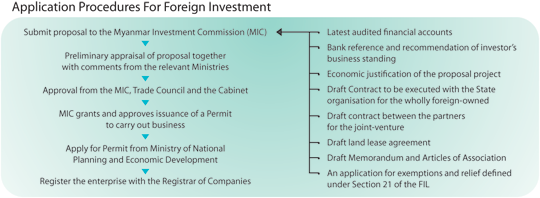

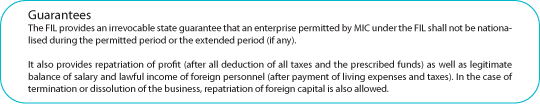

In terms of investment, the country enacted the Union of Myanmar Foreign Investment Law (FIL) in 1988, with the Myanmar Investment Commission being formed simultaneously. The law provided incentives to attract foreign investors such as exemption or relief from income tax on reinvested profits within one year, accelerated depreciation rates, 50% relief from income tax on profits accrued from exports, the right to pay income tax on behalf of foreign experts and technicians employed in the business and the right to deduct such payment from the assessable income, right to pay income tax on the income of foreign employees at the rates applicable to Myanmar nationals, the right to carry forward and set off losses up to three consecutive years from the year the loss is sustained, and the exemption or relief on customs duty or other internal taxes or both on imported raw materials for the first three years of commercial operation after completion of construction.

Inflow of FDI in 2010/11 was remarkable, with USD 20 billion being approved which pushed the total approved amount up to USD 36 billion. These approved investments mainly came from Asian countries such as Mainland China, Hong Kong, South Korea and Thailand, and were concentrated in extractive sectors such as oil & gas, hydropower and mining. In terms of FDI, Malaysia stands 7th with 47 projects and USD 2.9 billion investment. The Myanmar foreign direct investment policy is also being reviewed as part of the overall restructuring and development policy of the new government, which described as priorities, the realisation of a full-fledged market oriented system for better allocation of resources, encouragement of private investment and entrepreneurial activity, and the opening of the economy to foreign trade and investment. The majority of recent investment proposals have been approved smoothly by the new administration and its investment authority – the Myanmar Investment Commission.

INVESTMENT OPPORTUNITIES BY SECTORS

Foreign investors will be interested in various sectors in Myanmar such as agriculture, livestock and breeding, forestry, energy, mining, industry and service sectors. In the agriculture sector, foreigners, citizens or joint ventures are allowed to invest according to regulations set by the Central Committee for the Management of Cultivable Land, Fallow Land and Waste Land and allowed contract farming only in the forms of joint ventures with citizens. Foreign investment in the agricultural sector is still limited at USD 173.10 million – 0.48% of the total foreign investment. Investments in perennial crops such as rubber, oil palm and coffee are being encouraged however.

In the livestock and fisheries sector, foreigners, nationals or joint ventures can operate on fallow lands with permission from the Central Committee for the Management of Cultivable Land, Fallow Land and Waste Land. Foreigners are allowed to cultivate, capture and produce aquatic animals and to invest in value-added processing. 130 fish processing and cold storage factories exist across the country, and are located in Yangon, Tanintharyi Region and Rakhine State, i.e. areas that have potential for the development of the fisheries sector. There is good potential in the breeding of cows and oxen. Investments in this sector and distribution of good breeds are encouraged. Proper investment, production and export of cows and beef can be promoted. According to the Notification Regarding Land Use for Foreign Investments, Republic of the Union of Myanmar in September 2011, land can now be rented out to foreigners with the advanced agreement of the Union Government through a 30-year land lease.

In the forestry sector, foreigners are allowed to invest only in joint ventures with citizens for teak-based products but foreigners are allowed to invest in the production of hard wood products. 90 wood -based factories out of 281 across the country are located in the Yangon Region, which has good potential for timber-based investments as this is where the main port facilities are located.

For the energy sector, 4 foreign-funded hydropower projects help this sub-sector occupy top place among FDI with USD 14.5 billion, followed by oil & gas with USD 13.8 billion in 104 projects. The development of these sectors is expected to contribute to the development of various regions across the country, sufficient supply of energy and the earning of foreign exchange. In the oil & gas sector, there are 47 blocks of onshore oil and natural gas fields, 26 blocks of offshore oil fields in Myanmar territorial waters along the Mottama, Tanitharyi and Rakhine coasts, and 18 blocks of offshore deep sea oil fields. Exploration is being carried out in cooperation with foreign companies under joint ventures.

The mining sector also has potential for FDI, standing in third place with USD 2.7 billion in 64 projects. The mining sector is operated through foreign or joint venture investments under the management of the Ministry of Mines in order to produce copper, tin and other minerals.

For the industrial sector, businesses are encouraged to establish processing and manufacturing industries for foodstuff, textiles, consumer goods, household goods, leather products, transportation equipment, construction materials, pulp and paper, chemicals, chemical products and pharmaceuticals, iron and steel, machinery, etc. There are plants in 18 industrial zones and 24 sub-industrial zones across the country as well as upcoming plants in newly established Special Economic Zones such as Dawei, Thilawa and Kyauk Phyu. Foreign investors can participate in the SEZs through various forms of investment.

In the financial sector, the provision of domestic banking services is permitted only to private citizen banks. Foreign banks are permitted to open representative offices and in the future their branch offices will also be in a position to perform operations. There are 15 foreign bank representative offices in Myanmar but foreign banking services are not allowed yet. Currently, only two government banks provide foreign banking services, but some local private banks will soon be offering foreign banking services as well. In October 2011, the Central Bank has allowed six local private banks to carry out foreign currency trading. The Central Bank also issued Authorised Dealer Licenses to 11 private banks on 25 November 2011 which allowed them to provide foreign banking services including opening LCs and other payment transaction means for foreign trade.

Investment in the hotel and tourism sector has huge potential in Myanmar. Hotel and tourism services are allowed to be provided by foreign, national and joint ventures. In Myanmar, there are only 691 hotels with 27,000 rooms throughout the country. Tourist arrivals in Myanmar were 800,000 in 2010 – 2011 and it is estimated to reach 1.3 million in 2011 – 2012. The Ministry of Hotels and Tourism plans to meet the target of 2.5 million tourists in 2014 – 2015. Bagan, Mandalay, Inle Lake, and Ngapali and Ngwe Saung beaches are popular with international tourists.

YBHG TAN SRI AZMAN HASHIM, CHAIRMAN OF MASSCORP BERHAD VISITED MICASA HOTEL APARTMENTS IN YANGON, MYANMAR ON 3RD NOVEMBER 2011

(2nd from left to right) Ms Khin Khin Htay (Communications Manager), Ms Khin Kaythi San (Director of Sales & Marketing), Mr Michael @ Min Lwin Oo (Resident Manager/Director of Finance), Tan Sri Azman Hashim (Chairman of Masscorp Berhad), Ms Ng Su Fun (General Manager of Masscorp Berhad), Mr Lee Yai Sin (General Director Of MASSDA Land Company Limited) and Mr Steven Twang (Executive Chef/F & B Operations Manager)

(2nd from left to right) Ms Khin Khin Htay (Communications Manager), Ms Khin Kaythi San (Director of Sales & Marketing), Mr Michael @ Min Lwin Oo (Resident Manager/Director of Finance), Tan Sri Azman Hashim (Chairman of Masscorp Berhad), Ms Ng Su Fun (General Manager of Masscorp Berhad), Mr Lee Yai Sin (General Director Of MASSDA Land Company Limited) and Mr Steven Twang (Executive Chef/F & B Operations Manager)

The Strategic Trade Act (STA) 2010

Globalisation has increased the risk of transnational terrorism and spurred concerted efforts among governments to ensure a safer regional and global trading environment. Modes of production, economic relations and logistics have undergone fundamental transformation over the past 50 years. The volume of international trade has increased dramatically, with technology leading the way as the enabler in the rapid distribution of components and goods. The global supply chain is highly dependent upon transit and transshipment networks for expeditious trade and manufacturing. In this environment, export control has become a crucial element in the efforts to prevent the spread of strategic items and technologies to entities and individuals involved in the proliferation of Weapons of Mass Destruction (WMD).

Malaysia started the process of enacting the legislation on export control in 2005 after the unanimous adoption of the United Nations Security Council Resolution 1540 in 2004 by members of the United Nations (UN). The Resolution mandates member states of the UN to establish comprehensive legal and regulatory measures to control the export of strategic items and technologies. This was to address the concerns regarding the intentional abuse and misuse of certain products and technologies, particularly those that have dual-purpose use, in the military and in normal everyday use, which may facilitate the design, development and production of WMD and their delivery systems.

The Strategic Trade Act 2010 (STA) was published in the Government Gazette on 10 June 2010 and was enforced on 1 April 2011. The STA provides for control over the export, transshipment, transit and brokering of strategic items, including arms and related material, and other activities that will or may facilitate the design, development and production of WMD and their delivery systems.

Malaysia is the second country in ASEAN to have an export control law in place. The Strategic Trade Secretariat (STS) was established in the Ministry of International Trade and Industry (MITI) on 1 August 2010 to coordinate the implementation of the Strategic Trade Act (STA) 2010. There are three other partner licensing agencies under the Strategic Trade Secretariat, namely the Atomic Energy Licensing Board (AELB), Malaysian Communications and Multimedia Commission (MCMC) and Pharmaceutical Services Division assisting in the licensing process, particularly for strategic items and technologies in which they have expertise and responsibility under related laws which are in their custody and ownership.

Every individual or business entity involved in the activities of brokering, exporting, transit and transshipment of strategic items are required to comply with STA 2010 by obtaining a STA permit or broker certificate prior to undertaking the related activities. Since the implementation of STA 2010 is based on self-declaration, the responsibility to declare products as strategic items lies on the person/entity undertaking the related business activity. However, the Strategic Trade Secretariat at MITI can assist in forwarding the samples and technical specifications of the products to related Government agencies for testing. The costs incurred would have to be borne by the person/entity requesting for assistance in the classification.

The Strategic Items List in the Strategic Trade Order 2010 was adopted from the European Union’s Export Control List. The main categories are:

| Category ML : Military items |

| Category 0 : Nuclear materials, facilities and equipment |

| Category 1 : Special materials and related equipment |

| Category 2 : Materials processing |

| Category 3 : Electronics |

| Category 4 : Computers |

| Category 5 : Telecommunications and information security |

| Category 6 : Sensors and lasers |

| Category 7 : Navigation and avionics |

| Category 8 : Marine |

| Category 9 : Aerospace and propulsion |

Categories of permits available are:

- Single-use permit: A one-time export, transit or transshipment permit for a country or destination. The permit is valid for 6 months.

Special permit: A single-use export, transit or transshipment permit to a restricted end-user. The permit is valid for 12 months. - Bulk permit: A permit for multiple exports or transshipments to a single country or destination. The permit is valid for 24 months. However, only applicants with Internal Compliance Programmes (ICP) will be considered for this permit. ICP is basically a set of procedures that companies must satisfy before an item is exported to ensure that the transactions satisfy the export control regulations.

- Multiple-use permit: A permit for multiple exports or transshipment to different countries or destinations. The permit is valid for 24 months. Similar to the bulk permit, only applicants with ICP will be considered for this permit.

Brokers are required to register to obtain a broker certificate, which is valid for 12 months.

The application for permits under the STA has been available online since July 2011 allowing for faster decision-making and issuance of permits in a cost-efficient manner. While the permits have been issued for some time now, a new landmark has been reached where the permits are validated by the Royal Malaysian Customs effective 1 March 2012. This essentially means that effective enforcement of STA 2010 has started. Outreach programmes for domestic industries and law enforcement agencies are being conducted continuously to ensure a high level of awareness and compliance to the law as well as to ensure there is minimal disruption to trade.

In ensuring that STA 2010 remains relevant and pragmatic to the business community, several amendments to STA Regulations have been made effective 1 December 2011. This action was undertaken in response to feedback from the industry and the Secretariat’s experience in implementing STA 2010 in the past year. These amendments are part of the Government’s continuous efforts in ensuring that the regulations are business friendly so that compliance by the industry can be further facilitated.

STA 2010 is not intended to hinder legitimate trade but seeks to strike a balance between Malaysia’s economic interests and national interests as well as address global security concerns. In this increasingly competitive trading environment, business communities cannot undertake their activities without adapting to the ever-changing trading climate around them. Compliance to STA 2010 will reinforce the reputation of Malaysian companies as responsible traders and eventually enhances the positive image of Malaysian companies among the global business community.

For more information on the Strategic Trade Act 2010 (including the comprehensive strategic items list, procedures on application of permits, list of restricted and prohibited end-users, circulars and announcements), please visit www.miti.gov.my>STA 2010.

Kindly take note of the amendments made to the Strategic Trade Regulations 2010 and be alert of the validation of permits effective 1 March 2011 by the Royal Malaysian Customs.

For enquiries, feedback and comments on STA 2010, please e-mail admin.sts@miti.gov.my or contact our Hotline at 03-6203 9846.

We also invite face-to-face interactions and consultations with our stakeholders and for this purpose we have designated every fourth (4th) Wednesday of the month as STS Client Day. This will be held from 10.00am – 12.00pm at the Ministry of International Trade and Industry, Strategic Trade Secretariat Office, Block 8, Level 12, Government Offices Complex, Jalan Duta 50622 Kuala Lumpur.

The STS Client Day for February 2012 and March 2012 is scheduled for 22 February 2012 and 28 March 2012 respectively. Please e-mail admin.sts@miti.gov.my to register.

The Secretariat will increase the number of such meetings if there is demand from our stakeholders.

Editorial

As we bid farewell to 2011, we usher in 2012 with cautious optimism amidst global uncertainties that continue to linger.

In this edition, the spotlight falls on Estonia, Argentina and Myanmar. As Estonia is a relatively unknown country to Malaysians, our introductory article explores its potential for trade and investment, as well as its strategic position as a gateway to the European countries. Activities are currently being planned with Enterprise Estonia – the Estonian Government’s investment and trade agency. We also highlight in this edition the dynamic economy of Argentina. Sound macroeconomic fundamentals have enabled Argentina to grow steadily in the last decade. Being a member country of MERCOSUR, Argentina is a tariff-free gateway to a regional market of about 250 million people in Latin America.

Plans are also in the pipeline to organise a Trade & Investment Mission to Myanmar. This country is rapidly undergoing positive transformation and welcomes investments in many sectors of its economy. A country with a 58-million strong population, Myanmar has the potential to become an emerging powerhouse for resources as well as a target market for trade and investment activities.

On the home front, we have two articles on Malaysia’s “Strategic Trade Act (STA), 2010” which came into force on 1 January 2011 and the “Competition Act, 2010” which came into force on 1 January 2012. We urge all members to be acquainted with the provisions of these new legislations as they may have implications on your respective businesses.

Last but not least, we would like to take this opportunity to thank all members, associates, sponsors and contributors, for assisting us in the publication of the MASSA Newsletters throughout 2011. We look forward to working closely with all of you in 2012 to strengthen and further enhance the South-South platform.

We, the editorial team, would also like to wish all members and readers a happy 2012. May you have a fruitful and prosperous year ahead!

Fatimah Sulaiman

Editor

President’s Message

2011 has been a year of unprecedented events – the earthquake, tsunami and nuclear disaster in Japan, the ongoing financial turmoil in U.S., Europe, the floods in Australia, China and Thailand as well as the political changes in the Middle East and North Africa – have all indelibly affected our global view of the world.

Going into 2012, we can expect another tumultuous year as the European financial crisis continues to unfold. A weak global growth can be expected. Although the world economy may be slowing down, the developing countries of the South, especially the People’s Republic of China, India and Southeast Asia, will provide the momentum for global growth in 2012.

Barring unforeseen circumstances, Malaysia’s growth in 2011 is expected to be 5% and the projected growth for 2012 may be in the region of 4% to 5%. Though Malaysia cannot be totally insulated from the global economic uncertainty and the European financial turmoil, its economy is supported by strong fundamentals and robust domestic demand and take-off projects under the Economic Transformation Programme and the 10th Malaysia Plan (2011 – 2015), as they come on-stream in the new year. There is also sustained expansion in the services sector, which accounts for more than 50% of GDP.

As we navigate through the turbulence with caution, let us seek new ways and different strategies to meet these challenges. Indeed, tough times call for business unusual!

I wish to express MASSA’s gratitude to all members and the Executive Committee members for their invaluable participation and contribution to the Association.

I wish you and your families “Season’s Greetings”, a Happy and Successful 2012 and “Gong Xi Fa Cai”!

TAN SRI AZMAN HASHIM

President

Diary Of Events

Visit of Zambian Trade & Investment Promotion Delegation to Malaysia

from 9 – 10 February 2012

Mr Steven Mwansa, Permanent Secretary of the Ministry of Commerce, Trade and Industry (MCTI) of Zambia led a Trade and Investment Promotion delegation to Malaysia from 9 to 10 February 2012. YBhg Dato’ J. Jegathesan, Chief Executive Officer of JJ Ishwara Connect (JJIC) Malaysia and EXCO Member of MASSA coordinated this visit.

Mr Steven Mwansa, Permanent Secretary of the Ministry of Commerce, Trade and Industry (MCTI) of Zambia led a Trade and Investment Promotion delegation to Malaysia from 9 to 10 February 2012. YBhg Dato’ J. Jegathesan, Chief Executive Officer of JJ Ishwara Connect (JJIC) Malaysia and EXCO Member of MASSA coordinated this visit.

H.E. Anderson K. Chibwa, High Commissioner of Zambia to Malaysia delivered the Welcome Address. Mr Tsutomu Nagae, JICA Resident Representative in Malaysia also addressed participants at the event.

In conjunction with this visit, a seminar and one-to-one meeting were held for MASSA members to meet with the Zambian delegation at The Gardens Hotel & Residence, Kuala Lumpur.

Visit by Mr Juhan Parts, Hon. Minister of Economic Affairs

and Communications of the Republic of Estonia and Delegation to

Malaysia from 12 – 14 February 2012

Mr Juhan Parts, Hon. Minister of Economic Affairs and Communications of the Republic of Estonia led a 6-member delegation to Malaysia from 12 to 14 February 2012. The Republic of Estonia is located between Latvia and Russia, in Eastern Europe, bordering the Baltic Sea and Gulf of Finland.

A meeting was held on 13 February 2012 at the MASSA President’s office. MASSA members met the Hon. Minister and the Estonian delegation and had a lively discussion on mutual business opportunities available in the Republic of Estonia and in Malaysia. A lunch was hosted by YBhg Tan Sri Azman Hashim for the Hon. Minister and the Estonian delegation.

Col. (Rtd) Dato’ Harbans Singh, Honorary Consul for the Republic of Estonia in Malaysia accompanied the delegation at this meeting. The Hon. Minister officiated the Opening of the Estonia Consul office in Malaysia on 12 February 2012.

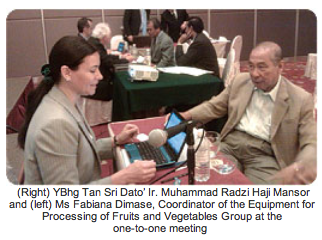

Seminar and Business Meeting with a Group of Argentinean Exporters of Manufactured Goods for Food Processing on 27 March 2012

The Embassy of the Argentine Republic in Malaysia organised a seminar and business meeting with a group of Argentinean exporters of manufactured goods for food processing on 27 March 2012 in Kuala Lumpur.

The Embassy of the Argentine Republic in Malaysia organised a seminar and business meeting with a group of Argentinean exporters of manufactured goods for food processing on 27 March 2012 in Kuala Lumpur.

Representatives from four export clusters of industrial equipment representing approximately 47 Argentine SMEs spoke at the seminar. A one-to-one meeting was also held to meet the representatives after the seminar.

ACCCIM & MASSA Trade & Investment Mission To Yangon, Myanmar, 26 – 30 April 2012

Tan Sri Dato’ Soong Siew Hoong, ACCCIM Executive Adviser and MASSA EXCO member, led a 28-member delegation to Yangon from 26 – 30 April 2012. The objectives of the mission were:

Tan Sri Dato’ Soong Siew Hoong, ACCCIM Executive Adviser and MASSA EXCO member, led a 28-member delegation to Yangon from 26 – 30 April 2012. The objectives of the mission were:

| • | To understand the host country’s policies, laws, rules and regulations, political, social and economic environment, business and work culture, etc |

| • | To promote products and services from Malaysia |

| • | To source for products from Myanmar |

| • | To explore joint-ventures and cooperation with local SMEs and in the manufacturing or services industries |

| • | To seek opportunities in infrastructure, utilities, property development and other investment projects |

| • | To offer advisory and consultancy services |

Myanmar is a rich country in terms of arable land and natural resources, and is predominantly agricultural country where two-thirds of the 55 million population live in rural areas, and depend on agriculture for their livelihood. The Malaysian participants are involved in sectors such as manufacturing, logistics, printing and publishing, air-conditioning installation and maintenance services, trading, lubricants, household products, IT solutions, development and investments.

Meetings were arranged with the Myanmar Industries Association, the Union of Myanmar Federation of Chambers of Commerce and Industry (UMFCCI) and the Malaysian-Myanmar Business Council. The Joint Secretary-General of UMFCCI, Mr Aung Khin Myint, updated the delegation on the Investment Environment in Myanmar. Some highlights of the changes in progress include:

Reorganisation Of The Myanmar Investment Commission (MIC) – the MIC is chaired by the Union Minister of Industry, with other Union Ministers of Rail Transportation, Finance & Revenue, Electric Power No. 1, Attorney General of the Union, National Planning & Economic Development.

| Revision Of The Foreign Investment Law | |

| • | Specific definition on investment |

| • | Specific definition on guarantee of land lease or guarantee of land used |

| • | Mentioned on restricted activities |

| • | Export promotion and import substitution |

| • | Description on rights & obligations of investor |

| • | 5 years tax holiday |

| • | Description on land use |

| • | Market Exchange Rate |

| • | Description on administrative penalty |

| • | Description on dispute settlement |

| Release Of Notifications | |

| 1) | Notification of Concession Rights for Land Used Relating to Foreign Investment Law (39/2011) – Investor has a right of the guarantee of land lease or land used from government owned land, governmental department, organisation owned lands and citizen owned private lands. |

| 2) | Notification Relating to Foreign Currency Relevant with the Foreign Investment Law (40/2011) – Foreign capital brought in can be exchanged with prevailing market price and investor has the right to make account transfer for payment transition. |

NOTE: Myanmar starts new forex regime at 818 kyat per 1 USD (wef 2 April 2012)

| Streamlining Procedure & Simplifying Formality | |

| • | Reduce unnecessary documents in formality |

| • | Enhance coordination with investment related ministries |

| • | Provide technical suggestion to investors |

| • | Promote public private relations |

| • | Investors can get investment permit within two weeks if documents are complete |

Setting Up Of One-Stop Service (OSS)

A one-stop service for company registration has been provided since 18 May 2011, and if the documents are complete, the process can be finished within one day. The OSS team was formed in July 2011 to ensure that information is delivered in a clear and transparent manner to Myanmar citizens and foreigners inquiring about investing in Myanmar.

The OSS team comprises senior officials from the Myanmar Investment Commission, Ministry of Finance & Revenue, Ministry of Commerce and Ministry of Construction. The OSS team meets every Friday to answer queries from investors, scrutinise investment proposals and assist in solving difficult investment issues, etc.

| Promoted Fields/Sectors For Investment | |||

| • | Agriculture | • | Construction |

| • | Livestock and fishery | • | Transport and communication |

| • | Forestry | • | Trade |

| • | Mining | • | Economic activities mentioned in section 3 of the State-owned Economic Enterprises Law, provided permission has been obtained under section 4 of the said Law |

| Investment Incentives | ||||

| 1. | Relief from income tax (re-invested profits) | 7. | Right to deduct R&D expenditure | |

| 2. | Exemption or relief from income tax (re-invested) | 8. | Right to carry forward and set off losses | |

| 3. | Accelerated depreciation rates | 9. | Exemption or relief from customs duty or other | |

| 4. | 50% relief from income tax | internal tax (machinery) | ||

| 5. | Right to pay income tax – Right to deduct | 10. | Exemption or relief from customs duty or other | |

| 6. | Right to pay income tax (foreign employees) | internal tax (raw materials) | ||

Ministry Of International Trade And Industry Malaysia: Free Trade Agreements (FTAs): A Question Of Balance

What is it about Free Trade Agreements (FTAs) that raises the hackles of some people? Are FTAs detrimental to economic development or do they bring about greater economic prosperity?

In a perfect world, multilateral, rules-based trade is the way to go. In such an environment, countries will engage to ensure fair trade and optimise resources.

Unfortunately, it isn’t a perfect world.

The WTO negotiations, the Doha Development Round, are taking too long. So countries have taken towards bilateral, regional, even plurilateral trade arrangements, because of the practical advantage of FTAs. These are quicker and easier than multilateral agreements because fewer parties are at the table. Parties can secure advantages that are harder to win in bigger fora. For Malaysia, these bilateral and regional engagements complement our efforts at the multilateral arena.

To the critics, these agreements smack of exclusive clubs, with limited membership and separate rules. Some feel that FTA negotiations are shaped by the stronger party to the detriment of the other. The negotiations are looked upon as zero sum games with the developing- country party getting the short end of the stick. But they miss the point that an FTA is a negotiated outcome that takes on board the needs of everyone involved.

An FTA is a contract between two or more parties to provide each other with preferential market access for goods and services and to facilitate the cross-border flow of investments. The essence of an FTA is its transparency and predictability that it accords to traders, exporters and investors. Parties engaged in such an agreement work towards eliminating tariffs and trade barriers in goods and services, and, in so doing, create a “freer flow of goods and services”. Apart from market access, the FTAs that Malaysia negotiates also provide a platform to address technical regulations and standards such as those applied on agricultural products for health and safety reasons.

The end result, low tariffs for both exporters and importers, is a win-win outcome for everyone. Local producers will find that their lower cost structure can make them more competitive in the international markets while exporters will have improved access to the markets of our partners.

For example, in the case of the Malaysia-Japan FTA, Malaysia’s exports of RM79.9 billion in 2011 enjoyed preferential market access in Japanese markets, whereas exports from countries which have no FTA with Japan are subjected to duties that can reach 30%. Through the ASEAN-China FTA, RM91.3 billion of Malaysia’s exports enjoyed preferential market access in 2011. China imposes tariffs as high as 30% for exports from non-FTA countries. In the Malaysia-New-Zealand FTA, Malaysia’s exports of automotive components and plastics get duty free access while exports from competitor countries without such an agreement are subjected to a 20% duty.

MITI’s data show that Malaysian exporters are increasingly making use of them. Under the ASEAN FTA, for the year 2011, a total of 5,661 exporters used the preferential market access, a 31% increase in terms of certificates issued. A total of 1,569 Malaysian exporters accessed the ASEAN-China FTA preferences in 2011, compared with 1,165 exporters in 2010.

FTAs are reciprocal arrangements. This means that Malaysia cannot expect to have market access for our goods and services but continue to keep our markets closed. There is no such thing as a free lunch.

Malaysia is a very open economy. Our domestic market is limited and our companies need scale if they are to expand and remain competitive. Our competitors have either created linkages through their own trade arrangements or have a huge and growing domestic market that are natural draws for trade and investment.

What happens in trade negotiations?

The FTA process involves much engagement at various levels of government and industry. The preparation for each round sees extensive consultations with a cross- section of ministries, agencies and businesses. The preferences sought and given are done in concert with trade and industry associations and service providers.

Critics may argue that domestic industries and service providers face increased competition from the concessions accorded to FTA parties. In the short term some companies may find that they have to become more efficient to stay competitive.

This is acceptable, given that concessions are granted in stages, over a period of time, sometimes over ten years! This gives domestic producers time to adapt to meet the increased competition in the domestic market. The agreements also contain “safeguard” clauses and provide avenues for dealing with disputes.

In addition, Malaysia negotiates for longer time frames for market access for products deemed sensitive for Malaysian industry and service providers.

MITI functions as the coordinator of the process on behalf of the government. Each relevant ministry, as custodian of a specific area in the FTA, is directly involved in the negotiations. For example, market access for agriculture products are dealt with by the Ministry of Agriculture; Bank Negara for financial services. The final package of concessions is approved by the Cabinet. Throughout the negotiations Cabinet is consulted and kept updated. Malaysia’s policy space is never compromised.

Malaysia’s foray into FTAs began in 1990 with ASEAN. We have now concluded bilaterals with Japan, Pakistan, New Zealand, Chile, India and Australia; and are negotiating with Turkey and the EU. We are also a party to the Trans Pacific Partnership (TPP) negotiations, and will soon negotiate with the Gulf countries. With ASEAN, Malaysia has concluded agreements with China, Korea, and Australia and New Zealand as well as the FTA in Goods with Japan and India.

Malaysia has the advantage of geography, being at the heart of ASEAN. Malaysia also has the advantage of history with its links to China and India. It is thus necessary to make the most of these advantages. If we do nothing about enhancing our position, it will be akin to either jogging along or, worse, running on the spot, as our competitors race past us.

We would do well to recall that in the late 1920s, certain quarters in the US – and they sound familiar in this context – rebelled against opening up America’s markets. Congress agreed and passed the Smoot-Hawley Tariff Act of 1930. And we all know what happened next.

Let not history repeat itself. Let us focus on the balance of benefits. Let’s not throw the baby out with the bathwater.

Ministry Of International Trade And Industry

Block 10, Government Offices Complex, Jalan Duta, 50622 Kuala Lumpur, Malaysia.

Tel: +603-6200 0000 • Fax: +603-6201 2337 • Email: webmiti@miti.gov.my

Website: http://www.miti.gov.my