President’s Message

Markets started 2010 with a fear of a double dip recession and fears of a repeat of the 1930s Great Depression. As we draw to a close, 2010 has turned out better than expected. Although the sovereign debt crisis in the Euro zone is not over, and demand weakness from Europe continues, we see emerging economies in Asia recovering and driving growth faster than the advanced economies. Malaysia stands proudly as one of the few Asian economies that have above-trend growth in Asia, led by China and India.

Going forward, the growth prospects for developing Asian countries in 2011, are still good. Malaysia’s growth outlook should remain favourable although the growth momentum will take on a more sustainable pace. It is estimated that Malaysia’s real Gross Domestic Product (GDP) growth will be 5.5% for 2011. As the Government’s New Economic Model (NEM) takes shape and the Government’s Economic Transformation Programme (ETP) gains traction, the private sector can expect to take a lead role to drive economic activities and create bigger economic spin-offs as high impact projects come on-stream in the new year.

While these are the new drivers of our economy, we must also continue to nurture and grow our South-South connections as they have proven to be burgeoning markets for our goods and services. Doing business in the developing South-South countries has proven to be a viable and profitable venture that can not only contribute positively to the Gross National Income (GNI) target under the ETP, but also create many economic spin-offs and multiplier effects for Malaysia. The South-South endeavours have resulted in creating Malaysian regional champions in the areas of finance, oil & gas, telecommunications, health, education and the manufacturing industries.

MASSA is pleased to have played a significant role in encouraging its members to foray into these new markets. These efforts would not have yielded the desired results, if not for the steadfast support of our Government and the host Government of these countries. Over time, effective networks and relationships were cultivated and nurtured to bring forth win-win business ventures.

I wish to express MASSA’s gratitude to all members and the Executive Committee members for their valuable participation and contribution to the Association.

I wish you and your families, “Season’s Greetings” and a “Happy & Successful 2011”!

TAN SRI AZMAN HASHIM

President

Diary Of Events

Courtesy Call on MASSA President by High Commissioner of Zambia to Malaysia, 5 January 2011

On 5 January 2011, H.E. Anderson K. Chibwa, High Commissioner of the High Commission of Zambia to Malaysia made a courtesy call on Tan Sri Azman Hashim, President of MASSA at his office. Ms Nyeji Ruth Chilembo, First Secretary (Economic) of the High Commission of the Republic of Zambia and Dato’ J. Jegathesan, EXCO member of MASSA and CEO of JJ Ishwara Connect (JJIC) Malaysia were both present at this meeting.

On 5 January 2011, H.E. Anderson K. Chibwa, High Commissioner of the High Commission of Zambia to Malaysia made a courtesy call on Tan Sri Azman Hashim, President of MASSA at his office. Ms Nyeji Ruth Chilembo, First Secretary (Economic) of the High Commission of the Republic of Zambia and Dato’ J. Jegathesan, EXCO member of MASSA and CEO of JJ Ishwara Connect (JJIC) Malaysia were both present at this meeting.

(4th from left) Tan Sri Azman Hashim (President of MASSA) with (left to right) Datin Lalita Jegathesan, Assistant Consultant of JJ Ishwara Connect (JJIC) Malaysia, Dato’ J. Jegathesan, EXCO Member of MASSA and CEO of JJ Ishwara Connect (JJIC) Malaysia, H.E. Anderson K. Chibwa, High Commissioner of the High Commission of Zambia to Malaysia, Ms Nyeji Ruth Chilembo, First Secretary (Economic) of the Zambia High Commission and Ms Ng Su Fun, Executive Secretary of MASSA

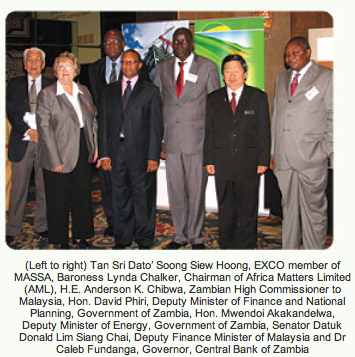

Zambia Investment Forum at Shangri-La Hotel, Kuala Lumpur, 23 February 2011

Developing Markets Associates (DMA), Africa Matters Limited (AML) and the Zambia High Commission in Malaysia, in collaboration with MASSA, organised the Zambia Investment Forum 2011 at Shangri-La Hotel, Kuala Lumpur on 23 February 2011.

Developing Markets Associates (DMA), Africa Matters Limited (AML) and the Zambia High Commission in Malaysia, in collaboration with MASSA, organised the Zambia Investment Forum 2011 at Shangri-La Hotel, Kuala Lumpur on 23 February 2011.

This forum sought to inform investors and the business communities in Malaysia of the vast investment and business opportunities in Zambia.

H.E. Anderson K. Chibwa, Zambian High Commissioner to Malaysia, Senator Datuk Donald Lim Siang Chai, Deputy Finance Minister of Malaysia, Tan Sri Dato’ Soong Siew Hoong, EXCO member of MASSA and Baroness Lynda Chalker, Chairman of Africa Matters Limited (AML) delivered the Welcome Address and Opening Comments at the Forum.

Hon. David Phiri, Deputy Minister of Finance and National Planning, Government of Zambia, together with Dr Caleb Fundanga, the Governor of the Central Bank of Zambia were present at the Session 1 of this Forum. Other speakers comprised ministerial level and high-level officials from Zambia’s private sector.

Visit by Deputy Head of Mission, Embassy of Peru in Malaysia to MASSA,

1 March 2011

Mr Carlos Vasquez Corrales, Deputy Head of Mission of the Embassy of Peru in Malaysia, visited the MASSA Secretariat on 1 March 2011 to discuss joint activities and events for MASSA members.

(Right) Ms Ng Su Fun, Executive Secretary of MASSA

with (left) Mr Carlos Vasquez Corrales, Deputy Head of

Mission of the Embassy of Peru In Malaysia

Courtersy Call on MASSA President by Ambassador of the

Republic of Azerbaijan to Malaysia, 18 March 2011

Courtesy Call by H.E. Tahir Karimov, Ambassador of the Embassy of the Republic of Azerbaijan to Malaysia on Tan Sri Azman Hashim, President of MASSA at his office. Mr Samir Abdurahimov, Commercial Counsellor (Third Secretary) of the Embassy of the Republic of Azerbaijan accompanied His Excellency to this meeting.

Courtesy Call by H.E. Tahir Karimov, Ambassador of the Embassy of the Republic of Azerbaijan to Malaysia on Tan Sri Azman Hashim, President of MASSA at his office. Mr Samir Abdurahimov, Commercial Counsellor (Third Secretary) of the Embassy of the Republic of Azerbaijan accompanied His Excellency to this meeting.

(Left) Tan Sri Azman Hashim, President of MASSA with (right) H.E. Tahir Karimov, Ambassador of the Embassy of the Republic of Azerbaijan to Malaysia

Second AfricSEA Business Forum, 19 & 20 April 2011

The second edition of the AfricSEA Business Forum was held on 19 & 20 April 2011 at the Mandarin Oriental Hotel, Kuala Lumpur. This forum aims to promote solid partnerships between African and Southeast Asian companies and to stimulate economic exchange between countries in the two regions. Dato’ Dr Michael Yeoh, Chief Executive Officer and Director, Asian Strategy & Leadership Institute (ASLI) extended a warm welcome to all delegates, while the organisers, A&G Group represented by Mr Paulo Gomes, Managing Partner, gave his introductory remarks.

The second edition of the AfricSEA Business Forum was held on 19 & 20 April 2011 at the Mandarin Oriental Hotel, Kuala Lumpur. This forum aims to promote solid partnerships between African and Southeast Asian companies and to stimulate economic exchange between countries in the two regions. Dato’ Dr Michael Yeoh, Chief Executive Officer and Director, Asian Strategy & Leadership Institute (ASLI) extended a warm welcome to all delegates, while the organisers, A&G Group represented by Mr Paulo Gomes, Managing Partner, gave his introductory remarks.

The forum was well attended by Malaysian corporate representatives as well as African delegates from all over the African continent. The opening ceremony was graced by the Secretary-General, The African, Caribbean & Pacific Group of States, Hon. Mohamed Ibn Chambas, as well as the Hon. Bruno Jean Richard Itoua, Minister of Energy & Hydraulic, Congo and Hon. Alexandre Barro Chambrier, Minister of Mining & Oil, Gabon.

Dato’ J. Jegathesan, Executive Committee Member of MASSA and Chief Executive Officer of JJ Ishwara Connect (JJIC) Malaysia and Ms Ng Su Fun, General Manager of MASSCORP Berhad and Executive Secretary of MASSA participated in the “Plenary Session 2: Doing Business in Africa and Southeast Asia” as panellists.

Attracting Foreign Investments (The First Of A Two-Part Series)

Over the last two decades, many Asian companies have ventured to invest in the developing nations of Asia, Africa, Middle East and Latin America. Arising from these overseas investments is the question “Are Asian companies, particularly the medium-sized, non-multinationals, equipped to meet the challenges they will face?” What are the factors that dictate long-term investment decisions? In this context, “long-term investments” refer to those setting up manufacturing plants, plantations, hotels, banks, etc.

Based on my forty-over years of experience in helping Malaysia attract investors and assisting Developing Nations or LDCs (Least Developed Countries) understand the science and art of Investment Promotion, I have formulated a checklist on “THE KEY FACTORS FOR AN INVESTMENT DECISION”. Assuming that business potential does exist, the key factors are:

1. POLITICAL STABILITY

Political turmoil, coup-de-tats, violence, hostile neighbouring countries or terrorist activities could wipe out overnight even the most lucrative investments and endanger the lives of personnel. Many countries and companies have paid a heavy price because of political instability.

2. ECONOMIC STRENGTH

A country with sound economic fundamentals is not likely to make drastic or negative changes. As the economy grows, there will be increasing opportunities for government development projects and private sector investments to boost the purchasing power of people. Increased purchasing power means increased multiplier effects on the economy such as a rise in house and car ownership, which will in turn act as another source of stability. No investor would want to invest in a country with weak economic fundamentals.

A country with rampant unemployment, especially where people do not see any prospect of a positive future is a “time bomb” waiting to explode. As long as citizens do not have a physical stake in their country, i.e. secure jobs, housing, etc., they could easily be incited to partake in violence or riot activities, as “they have nothing to lose”. Indeed, there is too much truth in the expression “poverty anywhere is a threat to prosperity everywhere” for it to be taken lightly.

3.ATTITUDE OF WELCOME

Investors should always be welcomed as a friend and ally of the nation who should be wooed and supported for their investments can contribute to jobs and wealth creation and as well as the transfer of technology and know-how. This key factor should be made known to all levels of government officials and the people, and reflected in all dealings with foreign investors.

4.GOVERNMENT POLICIES

All investors are concerned about government policies that could affect their business. For investors who will be investing their money, time, personnel and resources into a country, a triumvirate of factors will be critical, namely the 3Es plus an additional factor relating to the Rule of Law.

- EQUITY Guidelines:

The degree of equity ownership is a critical factor and varies depending on the type of project. If the project is export-oriented and does not depend critically on local raw materials (especially depleting raw materials), the foreign investor would insist on majority or 100% foreign ownership. Developing countries wooing export-oriented manufacturers must provide strategic options to foreign investors, especially in the issue of ownership. If a project is for the domestic market, most multinationals generally accept the need to offer local ownership, or risk losing that market through high tariff barriers.The availability of suitable local joint-venture partners is another important consideration. Must joint-venture partners come from a select group of people having connections with government authorities for projects to succeed, or are investors free to choose their business partners?

A satisfied foreign investor who is operating a successful enterprise and reinvesting is the best testimony of a country’s investment environment and a powerful ally to the government’s Investment Promotion.

- EXPATRIATE Employment

Expatriate employment is another critical issue. Any investor, investing anywhere in the world, need to have the flexibility to hire the right talent (foreign or local) to look after their project and interests. This is especially true for Asian investors in LDCs as (from their point of view) they are in an “unknown area”.Regardless of the availability of local personnel, governments must allow for permanent “foreign posts” in any project where the foreign investor has a degree of equity participation. Issues such as length of time for initial approval, yearly renewal of work permits, and multiple entry visas for expatriates and their families are important details to note in forging this policy.

- EXCHANGE Control

“How easy is it to bring my money into the country or to repatriate my profits and capital from the country?” The freedom of movement of capital and profits is not nearly enough. The ability of companies to hold foreign exchange external accounts in domestic or foreign banks (i.e. of their Forex earnings) is another positive factor, for this would help companies mitigate the foreign exchange risks they have to face. - RULE OF LAW (Legal Framework: Ownership of Land, Assets, etc.)

This relates to the question of a clear and transparent legal framework and the investor’s knowledge that the “Rule of Law” (well-documented and defined) is effective. He should feel assured that over and above his ability to seek legal re-dress through recognised International/Regional Arbitration Centres, he should, if the case warrants, be able to go to the local courts of law and seek justice, according to the Rule of Law, even against government departments at national municipal or city levels.

The second part of this series, which will be featured in our August 2011 issue, explores the key factors of Infrastructure, Labour, Banking & Finance, Government Bureaucracy, Local Business Environment and Quality of Life.

SPECIAL NOTE

If you would like to know more about investing in developing nations, or wish to improve the investment environment of your country and attract Asian investors, please con tact:

Dato’ J. Jegathesan, Chief Executive Officer

JJ Ishwara Connect (JJIC) Malaysia

Email : jjegaic@yahoo.com • Office No. : +603-2283 1559

Cyberview: The Mastermind Behind Cyberjaya, Malaysia’s Premier Cybercity

Peru is one of the most important countries in Latin America. Some of its most representative characteristics include a variety of climates, large territorial extension, important natural resources, solid economy, diverse culture and people of great skills and high academic standards.

With 29.4 million habitants, Peru is a country with rich deposits of copper, silver, gold, lead, zinc, natural gas and petroleum. Due to the weather and natural and cultural variations along its natural regions, Peru is internationally recognised as a mega diverse country. Its abundant resources are mainly found in the Highlands, through its mineral deposits, and vast coastal waters that have traditionally provided excellent fishing.

Peru has achieved significant advances in macroeconomic performance in recent years with very dynamic GDP growth rates, a stable currency exchange rate and low inflation. The country’s impressive 9.8% development rate obtained in 2008 placed it among the fastest-growing economies in the region. Although the rate fell to 0.9% in 2009 due to the global crisis, Peru’s economy has recovered very quickly. It has officially increased more than 8.78% in 2010 and is expected to grow 6% in 2011. The country’s rapid expansion has helped to reduce the national poverty rate by almost 15% in the last years to about 34.8% of its population in 2009.

The country’s recent positive development performance has much to do with the competent monetary and tax policy pursued over the last two decades, with falling levels of public debt (from 37.8% of the GDP to 21% in 2009) and consistent budget surpluses. Measures which were taken to complement the liberalisation of the goods and labour markets included: the opening of trade and foreign direct investment; and the maximisation of the country’s revenues resulting from its rich natural resources.

In the last few years Peruvian exports have also grown significantly from US$ 7.7 billion in 2002 to US$ 33.4 billion in 2010. The boom in Peruvian exports has been fostered by the signing of a series of Free Trade Agreements with the United States, China, Thailand, Canada, Singapore and the European Free Trade Association. Peru has also concluded negotiations with the European Union, Korea and Japan. Peru’s main exports consist of gold, copper, zinc textiles and fish meal; and its major trade partners are the United States, China, Brazil and Chile.

In the last few years Peruvian exports have also grown significantly from US$ 7.7 billion in 2002 to US$ 33.4 billion in 2010. The boom in Peruvian exports has been fostered by the signing of a series of Free Trade Agreements with the United States, China, Thailand, Canada, Singapore and the European Free Trade Association. Peru has also concluded negotiations with the European Union, Korea and Japan. Peru’s main exports consist of gold, copper, zinc textiles and fish meal; and its major trade partners are the United States, China, Brazil and Chile.

In December 2009, Peru’s credit rating was raised to investment grade by Moody’s Investors Service and matched similar moves by Standard & Poor’s and Fitch Ratings in the previous years. Sound economic prospects, with estimated medium-term GDP growth rates of 7% for 2010, are key factors that attributed to this upgrade. These robust development prospects are supported by rapidly increasing investment levels and a significant decline in Peru’s tax and external vulnerabilities.

In December 2009, Peru’s credit rating was raised to investment grade by Moody’s Investors Service and matched similar moves by Standard & Poor’s and Fitch Ratings in the previous years. Sound economic prospects, with estimated medium-term GDP growth rates of 7% for 2010, are key factors that attributed to this upgrade. These robust development prospects are supported by rapidly increasing investment levels and a significant decline in Peru’s tax and external vulnerabilities.

The upgrade to investment grade has brought Peru a great deal of positive attention worldwide. More importantly, it has produced a positive impact on the local economy and is currently boosting the stock market and the appreciation of the Peruvian currency in the short term. Nowadays, many multinational corporations are watching the country with greater interest. The stock of foreign investment as of June 2009 is US$ 18.8 billion.

Investment promotion conditions

Peru actively seeks to attract both foreign and domestic investment in all sectors of the economy. It has therefore taken the necessary steps to establish a consistent investment policy that eliminates the obstacles to foreign investment. As a result, Peru is now considered to have one of the most open investment regimes in the world.

Peru has adopted a framework for investments that offers automatic investment authorisation. Moreover, it has established the necessary economic stability rules to protect investors from arbitrary changes in the legal terms and conditions of their ventures. The Peruvian government guarantees foreign investors legal stability on income tax and dividend distribution regulations. The foreign investors entitled to obtain this tax and legal stability are those willing to invest in Peru for at least a two-year term; to invest a minimum amount of US$ 10 million in the mining and/or hydrocarbon sectors or of US$ 5 million in any other economic activity; or to acquire more than 50% of the shares of a privatised state-owned company.

The Peruvian legal framework protects foreign investment by offering:

- Equal and non-discriminatory treatment

- Unrestricted access to most economic sectors

- Free capital transfer

- Free competition

- Guarantee to private property (no expropriations or nationalisations)

- Freedom to purchase domestic stocks

- Freedom to access internal and external credit

- Freedom to transfer royalties

- Protection through a network of bilateral investment agreements and the membership of the Investment Committee of the Organisation for Economic Cooperation Development (OECD)

- Protection under the membership of the International Centre for Settlement of Investment Disputes (ICSID) and the Multilateral Investment Guaranty Agency (MIGA)

Investment opportunities

Peru offers great investment opportunities in the fields of agribusiness, fisheries, mining, forestry, real estate and tourism.

In the agribusiness sector, Peru boasts some of the best agricultural yields in the world for sugar cane, asparagus, olives, artichokes and grapes and seasonal windows in the most important markets. Peru exports US$ 2.5 billion of fresh and processed products to over 113 countries. Projections expect that 90,000 ha. currently used for agro exports to double as a consequence of large irrigation projects in its portfolio. Peru is already the first world producer of fresh asparagus, paprika and organic bananas; the second world producer of artichokes and the sixth world producer of coffee.

In the fisheries sector, Peru counts on an extensive coast (3,080km) and “water mirrors” that offer adequate conditions for the development of marine and continental aquaculture. It is the first producer of fishmeal and fish oil in the world and exports fisheries products to more than 100 countries.

In the mining sector, Peru stands out as one of the most important countries for the production of minerals and non-metallic goods. It is the first world producer of silver, the second of zinc, the third of copper, the forth of lead and the fifth of gold. Additionally, it possesses large deposits of iron, phosphate, tin and manganese. Only 20% of its territory with mining potential has been explored. The investment in the sector exceeded US$ 14 billion between the years 1999 and 2009; investments have been projected to total US$ 37 billion in the coming years.

In the field of forestry, Peru is the second country in Latin America with the largest natural forest area where there is a great biological diversity and highly valued timber. Its natural forests cover an area of 78.8 million ha., 10 million for reforestation and other areas for afforestation (plantations). Forestry products exports grew to US$ 296 million in 2009 and the Government is promoting investments for the development of hard tropical timber in the Amazon jungle and soft timber in the highlands, as well as industrial timber complexes.

In the real estate sector, construction’s annual average growth was 10.6% for the period 2005 – 2009 and the projections for next few years are 12.5%. Housing deficits affect 25% of households. There are several programmes for housing financing, based on economic conditions and income level. Mortgage credits grew an average of 25% in the period 2005 – 2009 and construction credits grew 33%.

Finally in the tourism sector, Peru offers important cultural destinations such as the Citadel of Machu Picchu, that was chosen as one of the new 7 Wonders Of The World, and a diversity of natural landscapes. The capital of Peru, Lima, is the gastronomic capital of Latin America where it registered significant invesments in hotels and restaurants of international recognition. There are other tourist attractions to be explored such as the North Eastern circuit, among others. Between 2002 and 2010, the numbers of tourists visiting Peru grew from 998,000 to more than 2.5 million and projections are very promising for the next few years.

Cyberview: The Mastermind Behind Cyberjaya, Malaysia’s Premier Cybercity

Established in 1996, Cyberview Sdn Bhd is a government-owned Malaysian company and the landowner of Cyberjaya, the nation’s very own “Silicon Valley”, an ICT and innovation-centric township integral to the Multimedia Super Corridor (MSC Malaysia).

Cyberview has been given the mandate by the Malaysian government to spearhead Cyberjaya’s development and help realise its potential as a global MSC Malaysia cybercity hub and preferred location for ICT, Multimedia and Services for innovation and operations, and fulfill specific government initiatives in support of the innovation economy.

Cyberview’s evolving role saw it taking the lead in promoting development as well as business and community activities in Cyberjaya by creating a supportive eco-system within the township. Today, Cyberview has transformed Cyberjaya into a premier cybercity that is host to more than 500 companies and boasts a growing population of about 41,000.

Green Technology Financing Scheme to benefit more than 100 companies with remaining fund of RM1.3 billion.

In line with the government’s aim to reduce the nation’s carbon emissions by up to 40% by 2020, the Green Technology Financing Scheme (GTFS), which was launched last year, is expected to benefit more than 120 companies with the remaining fund of RM1.3 billion. The fund will provide soft loans to companies that supply and utilise green technology, especially small and medium enterprises (SMEs).

“The Green Technology Financing Scheme (GTFS) was created to encourage the participation of companies and entrepreneurs in green technology. Under its assessment, GreenTech Malaysia has so far evaluated 96 companies and from the amount, 76 companies have been certified,” said Dr. Nazily Mohd Noor, the Chief Executive Officer of Malaysian Green Technology Corp. He added that loans for 17 companies have been approved, while 59 companies are waiting for loan approvals.

The government will bear 2% of the interest rate charged and provide a guarantee of 60% on the financing amount, with the remaining 40% by banking institutions. For green technology suppliers, the maximum loan amount is RM50 million, whereas for other companies it is RM10 million.

“Apart from technical processing, GreenTech Malaysia will also offer assistance in the financial application process to relevant institutions. We evaluate not only the technical aspects of the application from companies and suppliers but also try to assist companies in the preparation process to submit their financing applications to the bank,” expressed Dr. Nazily during the 8th Information on Green Technology (iGREET) session organised by Cyberview Sdn Bhd.

Mr. Thyaga Rajan, Technical Director of data solution provider Basis Bay Sdn Bhd, introduced the concept of green IT to the audience. Under the tagline of “Reengineering IT For A Greener World”, the company’s green framework includes the internal adoption of green best practices, smart procurement of services and e-waste, extending products life cycles, efficient operations of servers, virtualisation and cloud computing and green data centres. Among the key measures implemented by Basis Bay are the recycling of ICT equipment, collaboration with partners to ensure proper e-waste management and the effective management of power usage to reduce unused power consumption.

Basis Bay is responsible for building Cyberjaya’s first green data centre incorporating north-south orientation, wall insulation and thickness, tinted and laminated areas, ducted fresh air system, smart lights and photovoltaic panels, among other green features. This data centre was designed to maximise energy efficiency, with minimum environmental impact to reduce waste and carbon footprints.

Mr. Kidd Yam, Product and Planning Manager of BMW Malaysia, was also on hand to enlighten the audience on the concept of BMW Efficient Dynamics which is the car maker’s continuous green strategy for the reduction of fuel consumption and emission levels while simultaneously enhancing the vehicle’s performance and driving pleasure. BMW Malaysia started its operations in 2003 and is based in Cyberjaya together with its national office and the BMW Group’s Data Centre, which serves countries in the Asia Pacific region, Russia and South Africa.

According to Yam, there are 10 innovative technologies under BMW Efficient Dynamics, of which six measures are carried out in Malaysia. These include lightweight construction, high precision injection and twin turbo, advanced diesel engines, aerodynamic design, electric power steering and brake energy regeneration. Its revolutionary achievements have won the company over 11 international awards in the past two years including the World Green Car Award. In line with its commitment to R&D, the company is set to unveil more green car models in the coming years.

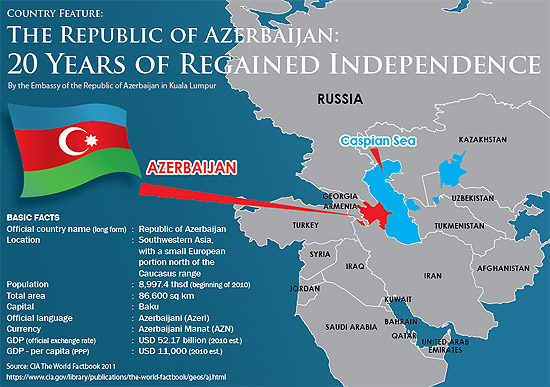

Country Feature: The Republic Of Azerbaijan: 20 Years Of Regained Independence

Located in the South-Caucasian region on the western shore of the Caspian Sea, Azerbaijan has land borders with Russia, Iran, Turkey, Georgia and Armenia, as well as sea borders with Kazakhstan and Turkmenistan. It is a democratic state with a secular society, with the vast majority of its population being Muslim.

Azerbaijan first gained independence in 1918, making it the first ever democratic state in the Muslim world. However, the country’s independence was short-lived as it became a part of the Soviet Union less than two year later. Azerbaijan’s independence was restored in 1991, and this year marks the 20th anniversary of this historical milestone.

Despite the challenges along the way, the Republic has successfully maintained its independence and achieved economic growth. Today, Azerbaijan boasts the region’s fastest growing economy and plays a significant role in providing Europe’s energy security. The main contributor to the country’s economy is the oil and gas industry, with daily oil and natural gas production exceeding one million barrels and 58.6 million cubic metres respectively. The Azerbaijani government has also diversified its economy by developing the non-oil sectors. The State Oil Fund was established to channel profits from the oil and gas industry to sectors such as agriculture, tourism and ICT.

Featuring nine out of the world’s 11 climatic zones, Azerbaijan has naturally favourable conditions for agriculture and tourism. This makes it possible to farm and cultivate a variety of agro-products, as well as offer an astonishing range of tourism experiences and scenery.

Azerbaijan has a rich history that can be traced back to prehistoric times, encompassing different civilisations and ruling dynasties. Among its most notable historical attractions are the prehistoric rock paintings in Gobustan; Khan’s Palace in Sheki; Maiden Tower, Caravan Inn and the Palace of the Shirvanshah Dynasty in Baku; and Ateshgah, the ancient temple of fire-worship in Surakhany.

The country’s geographic location at the crossroads of Europe and Asia between Caucasus and the Middle East has contributed to its unique cultural heritage. The people of Azerbaijan truly reflect its diversity as many ethnic groups coexist harmoniously, inspiring an eclectic range of cultural and gastronomic traditions. The country’s capital city Baku is a most beautiful city to live in and explore, with a distinctive skyline that unifies medieval, neoclassical, soviet, Mediterranean-style and modern western architecture.

Azerbaijan is famous for its traditional arts such as carpet-weaving, engraving and carving. Azerbaijani carpets are highly valued around the world. The country’s musical traditions include a distinctive school of music called Mugham, which is appreciated by music connoisseurs far and wide. Although Azerbaijanis treasure their traditions, they also constantly embrace modern trends and new ideas, which are evident in the country’s arts, music and architecture. In fact, the country is world-renowned for its modern jazz talents and international music festivals.

With so much going for it, Azerbaijan is indeed an amazing country with great investment potential and business

opportunities.

1st Quarter 2011 Update: Malaysian Economic Outlook

Recent statistical data indicates that the world economy seems to be gaining momentum and price pressure is slowly building up. Inflation is expected to trend upwards as a result of quantitative easing in the U.S., geopolitical tensions in the Middle East and North Africa, and on the reconstruction of Japan. In addition, the sovereign debt issue continues to affect parts of the Eurozone with repercussions on the global economy. Meanwhile, major currencies will consolidate against the USD, while emerging currencies will likely appreciate further.

GDP growth eased to 4.8% year-on-year in 4Q10 due to further normalisation of economic activities. On a quarterly basis, GDP growth ebbed to 1.5% in 4Q10, while it reached 7.2% on a year-to-date basis. All expenditure items decelerated. All sectors recorded slower rates of expansion, except construction and services.

Recent monthly data (up to Feb 2011) suggests that industrial output was revived following a rebound in gross exports. However, inflation remains stubbornly high with strong pressure coming from food and transport. Post-Chinese New Year, loans and all monetary aggregates decelerated. The performance of the Ringgit against the USD was mixed during the period of consideration.

In Malaysia, economic growth is projected to moderate to 5.2% yoy in 2011, before rising to 5.5% in 2012. Structural impediments in net exports will drag down overall GDP growth in 2011, while domestic demand will likely be strong due to supportive government policy measures.

Meanwhile, the in-house Consumer Sentiment Index moderated to 108.2 in 1Q11 on weaker access to finances and firming inflationary expectations. In contrast, firms’ outlook remains bright as suggested by a stronger Business Conditions Index of 113.3 and CEO Confidence Index of 118.1. The property sector is reasonably healthy (Residential Property Index of 130.0), while tourism weakened on more frequent occurrences of natural disasters (Tourism Market Index of 113.1). Mimicking the trend in the Consumer Sentiment Index, the Retail Trade Index also eased to 99.1. The automotive industry (Automotive Industry Index of 140.0) continues to be supported by favourable policy measures.

With GDP growth within the potential level of 5.0 – 6.0%, coupled with a manageable CPI forecast of 3.2% yoy in 2011, Bank Negara Malaysia is expected to lift the overnight policy rate marginally higher to 3.25% by end 2011. As the economy gathers momentum in 2012, CPI may edge higher to 3.3% prompting further hikes in the overnight policy rate to 3.50%.

The Ringgit is projected to strengthen to 3.05 per USD in 2011 on larger capital inflows. MIER does not anticipate the return of capital controls in the near term following recent liberalisation of the capital account and the lowering of the LTV cap to 70.0% on third home mortgages. Further macro-prudential measures are more likely. Improving macroeconomic fundamentals will see an average RM/USD of 2.95 in 2012.

The Malaysian Institute of Economic Research (MIER)

Level 2, Podium, City Point, Kompleks Dayabumi,

Jalan Sultan Hishamuddin, P.O. Box 12160, 50768 Kuala Lumpur.

Tel : (603) 2272 5897 / 2272 5895 Fax : (603) 2273 0197 Website: www.mier.org.my

For more information, please contact Dr. K.K. Foong, Senior Research Fellow

Email : kkf70us@yahoo.com

Editorial

Greetings for 2011! In this first edition for the year, we feature Peru in Latin America and Azerbaijan in Western Europe. Both these countries have shown us great potential for business linkages. We thank their respective Embassies in Kuala Lumpur for sharing their business information with our members. We encourage members to contact them directly for specific enquiries and business assistance.

YBhg Dato’ J. Jegathesan, one of MASSA’s Executive Committee members, shares with us his views and knowledge on “Attracting Foreign Investments”. His message will be useful to our members, given his many years of experience in promoting investments into Malaysia (since 1967) as he was one of the key staff members of Malaysian Industrial Development Authority (MIDA) and subsequently helping developing countries set up their Investment Promotion Agencies and formulate policies to attract investments to spur economic development. We present the 1st installment of YBhg Dato’ J. Jegathesan’s insightful article in this edition. The 2nd installment will appear in the next edition of this newsletter.

We welcome our partnership with Cyberview Sdn Bhd to bring you news on emerging “Green Initiatives”. This inaugural article features their “iGREET” series (Information on Green Technology) of talks held once a month in Cyberjaya – Malaysia’s leading cybercity and MSC Malaysia hub. We encourage our members to join these talk sessions to learn more about the upcoming emerging green technologies that will be introduced into our marketplace.

MASSA may not proceed with its proposed business mission to Colombia, Ecuador and Venezuela as response has not been encouraging. Nevertheless, members who wish to explore the potential of their products may contact our secretariat for referrals.

We hope to meet members at the forthcoming Langkawi International Dialogue and the Showcase Malaysia event in Dhaka, Bangladesh, both scheduled for June 2011.

Fatimah Sulaiman

Editor

Forthcoming Events

- MASSA Business Mission to Colombia, Ecuador & Venezuela in 2011 (to be advised)

- Showcase Malaysia 2011 at Dhaka, Bangladesh from 10 – 12 June 2011

- Malaysia Africa Business Forum – Exploring New Dimensions at Putrajaya International Convention Centre (PICC), Putrajaya, 18 June 2011 (This event is held concurrently with Langkawi International Dialogue (LID) 2011 at PICC, Putrajaya from 18 – 21 June 2011)

- Vietnam Business Summit – Conference on Investment in Vietnam at Khanh Tiet Room, National Conference Centre, Hanoi, Vietnam, 3 May 2011

- MASSA Business Mission to Myanmar, October/November 2011

President’s Message

The year 2010 closed with uncertainties and 2011 was ushered in with global challenges and competitive pressures on all fronts. However, there was an overall expectation of global economic recovery.

The 1st quarter of 2011 has just gone by. We note from the latest International Monetary Fund (IMF) World Economic Outlook 2011 that the world economy is in 2-speed recovery mode. While the advanced economies are still grappling with slow economic growth, high unemployment rates and uncertainties in the financial markets, the emerging markets are making a strong rebound. These emerging economies are expected to expand by 6.5% while the industrial economies will grow by only 2.4% in 2011, barring downside risks. The world economy is expected to grow by 4.5% in 2011.

In Malaysia, economic growth is projected to moderate to 5.5% for 2011. This growth will come from gains arising from the Government’s Economic Transformation Programme (ETP) which will drive domestic demand. As these programmes and projects under the 10th Malaysia Plan in the second half of 2011 gain traction, the growth momentum should pick up and become more evident in 2011.

Our South-South connections must continue to remain an integral part of our external trade and investment outreach. These south-south markets have emerged to become the new engine for world economic growth, given the growing population, its increasing affluence, rising disposable incomes and hence, market demand for good quality products and services. Malaysian products and services have been proven in these markets. Let us strive to better leverage on the areas of strength that we already possess and continue to seek new innovative ways and seize emerging opportunities to further expand and anchor Malaysian products and services in these markets.

TAN SRI AZMAN HASHIM

President

Diary Of Events

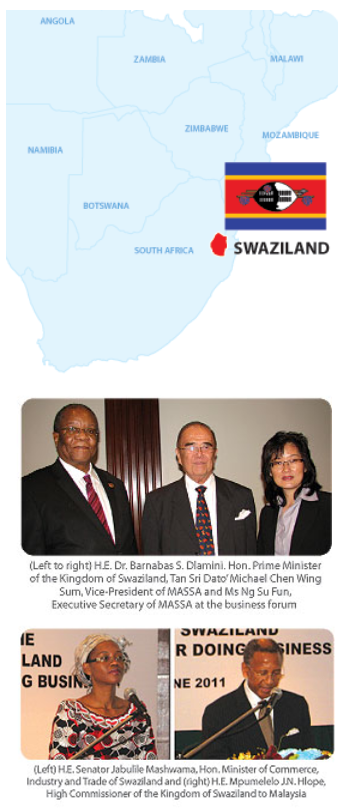

Swaziland-Malaysia Business Forum, Kuala Lumpur, 22 June 2011

The High Commission of the Kingdom of Swaziland in Malaysia organised a business forum with the theme “The Kingdom of Swaziland – An Ideal Place for Doing Business” on 22 June 2011 at the JW Marriott Hotel, Kuala Lumpur.

The High Commission of the Kingdom of Swaziland in Malaysia organised a business forum with the theme “The Kingdom of Swaziland – An Ideal Place for Doing Business” on 22 June 2011 at the JW Marriott Hotel, Kuala Lumpur.

This business forum was held in conjunction with the visit of a business delegation from Swaziland led by H.E. Senator Jabulile Mashwama, Hon. Minister of Commerce, Industry and Trade of Swaziland together with officials from the Ministry of Commerce, Industry and Trade, experts from Swaziland Investment Promotion Authority (SIPA) and CEO of Swaziland Small Enterprise Development to Malaysia from 17 to 22 June 2011. The aim of this business forum was to inform the business communities in Malaysia on the investment and trade opportunities available in the Kingdom of Swaziland and to promote and enhance the bilateral economic cooperation between Swaziland and Malaysia.

The forum was officiated by the Hon. Prime Minister of the Kingdom of Swaziland, H.E. Dr. Barnabas S. Dlamini. MASSA was represented by its Vice-President, Tan Sri Dato’ Michael Chen Wing Sum who gave a speech at the forum. Also present were H.E. Senator Jabulile Mashwama, Hon. Minister of Commerce, Industry and Trade of Swaziland and H.E. Mpumelelo J.N. Hlope, High Commissioner of the Kingdom of Swaziland to Malaysia. Officials from the Swaziland Investment Promotion Authority (SIPA) gave a presentation on Swaziland’s Business Environment and Investment opportunities.

Swaziland is situated in south-eastern Africa and comprises a land area of 17,364 sq km. It has made enormous economic progress over the last 20 years, largely from foreign direct investment (FDI) in mining, agribusiness, tourism and manufacturing. Its economy is fairly diversified with agriculture, forestry and mining accounting for about 8.2% of GDP and manufacturing (textiles and sugar-related processing) representing 42% of GDP. The Swaziland Investment Promotion Authority (SIPA) promotes and facilitates FDI and local investment.

Often referred to as the Switzerland of Africa, the country is host to a number of multinational corporations like the Coca Cola Concentrate factory, YKK Africa and Cadbury. One of the world’s Top 5 low cost sugar producers, Swaziland also cans fruit for major retailers such as Delmonte, Marks & Spencer and Tesco.

Investment opportunities are available in the following sectors:

- Agriculture: Cultivation of vegetables for local and export markets; processing of farm produce e.g. vegetable drying, frozen vegetables, tomato sauce production, peanut butter production, processed meat, dairy products, cassava processing and starch, tobacco growing, aquaculture, floriculture and cotton.

- Manufacturing: Accounts for around 65% of total FDI and provides jobs for about 26% of the workforce. Key areas for investment include engineering, steel, refrigeration and assembly, electronic components, automobile spare parts, processing of hides and skins (leather goods and footwear), pharmaceuticals, biotechnology, furniture and other related manufacturing, food, confectionery and beverage manufacturing.

- Mining of asbestos, coal, quarried stone, soapstone, kaolin, talc, silica, green chert and others.

- Tourism: Development of golf estates, casino and supporting facilities as well as holiday housing estates for foreign holidaymakers.

- Textile and garment production plus footwear manufacturing.

Investing in Swaziland is easy with the availability of industrial estates, land for business site development, road and rail transport infrastructure, energy, water, telecommunications and high-speed internet connections. Through various strategic agreements, Swaziland has access to markets such as Southern African Customs Union (SACU) which is a market of more than 40 million people, Southern African Development Community Free Trade Area (SADC FTA) comprising 14 African economies, Common Market for Eastern and Southern Africa (COMESA FTA) involving 19 member countries and more than 400 million people, Africa Growth & Opportunities Act (AGOA) which enables Swaziland’s exports to USA to enjoy duty-free and quota free access, as well as Economic Partnership Agreement with EU (EPA).

Investing in Swaziland is easy with the availability of industrial estates, land for business site development, road and rail transport infrastructure, energy, water, telecommunications and high-speed internet connections. Through various strategic agreements, Swaziland has access to markets such as Southern African Customs Union (SACU) which is a market of more than 40 million people, Southern African Development Community Free Trade Area (SADC FTA) comprising 14 African economies, Common Market for Eastern and Southern Africa (COMESA FTA) involving 19 member countries and more than 400 million people, Africa Growth & Opportunities Act (AGOA) which enables Swaziland’s exports to USA to enjoy duty-free and quota free access, as well as Economic Partnership Agreement with EU (EPA).

MASSA 20th Annual General Meeting, 29 June 2011

MASSA held its 20th Annual General Meeting (AGM) at Restoran Seri Melayu, Jalan Conlay, Kuala Lumpur, chaired by Tan Sri Azman Hashim, President of MASSA.

Courtesy Call on President of MASSA by Ambassador of Argentina to Malaysia,

22 July 2011

H.E. Maria Isabel Rendon, Ambassador of Argentina to Malaysia, made a courtesy call on Tan Sri Azman Hashim, President of MASSA at his office.

H.E. Maria Isabel Rendon, Ambassador of Argentina to Malaysia, made a courtesy call on Tan Sri Azman Hashim, President of MASSA at his office.

Her Excellency joined the Foreign Service of the Argentine Republic in 1978 and was appointed the Ambassador of Argentina to Malaysia in 2009. The discussion focused on ways to improve bilateral business ties between Malaysia and Argentina as Argentina offers investors sound fundamentals for sustainable growth and attractive business profitability including a globally and regionally integrated economy that is diversified to meet global market needs, highly skilled, innovative and talented human resources, abundant and diverse natural resources, modern infrastructure and quality connectivity, a vibrant culture, remarkable quality of life and a public sector that is highly supportive of investment.

Visitors from Vietnam, 30 July to 1 August 2011

H.E. Mr Nguyen Van Chi, accompanied by his wife, Madame Tran Thi Thuy, visited Malaysia on 30 July 2011. H.E. Mr Nguyen Van Chi is a former Member of the Politburo, Secretary of the Central Committee of the Party, former Chairman of the Central Inspection Committee of Vietnam and former Party Committee Secretary of Quang Nam, Danang, Vietnam. Madame Tran Thi Thuy is the Chairwoman of the Vietnam Women Entrepreneurs Council, Vietnam Chamber of Commerce and Industry, Vietnam. In conjunction with their visit, Tan Sri Dato’ Michael Chen Wing Sum, Chairman of MASSDA Land Company Limited and Vice-President of MASSA, hosted a dinner for the delegation on 31 July 2011 at the Grand Millennium Hotel, Kuala Lumpur.