Feature On ProMéxico: Mexico Speaks A Universal Language: Business

Mexico is a free market economy in the circle of the trillion dollar class. Mexico’s GDP of USD 1.017 trillion in 2009 makes it the 12th largest economy in the world and the 2nd largest in Latin America. Its economy is expected to grow by 5% in 2010 according to Agustin Carstens, Governor of Mexico’s Central Bank and former Minister of Finance, after difficulties encountered at the end of 2009 due to the global financial crisis. Mexico is on the right track to economic recovery after the sharpest fall in over 70 years. Foreign Direct Investment is expected to reach USD 16.6 billion in 2010 and exports recovered at a rate of 16% in the last quarter of 2009.

Mexico has free trade agreements with 44 countries that represent over 70% of the world’s GDP or over 1 billion consumers. Mexico is part of NAFTA, the largest free trade zone in the world, and exports to the US have more than tripled since the signing of the treaty in 1994. Mexico in 2009 reported exports of USD 259 billion which makes it the 16th largest exporter in the world. Mexico keeps on working to strengthen its participation in the global economy.

Mexico has free trade agreements with 44 countries that represent over 70% of the world’s GDP or over 1 billion consumers. Mexico is part of NAFTA, the largest free trade zone in the world, and exports to the US have more than tripled since the signing of the treaty in 1994. Mexico in 2009 reported exports of USD 259 billion which makes it the 16th largest exporter in the world. Mexico keeps on working to strengthen its participation in the global economy.

Among other emerging economies, the country stands out with several competitive advantages that make it a unique destination for productive investments. Mexico ranks 8th in the global FDI attractiveness index according to the firm AT Kearney. It also ranks first as the most cost-competitive country to supply the US in the Manufacturing-Outsourcing Cost Index by Alix Partners 2009.

Mexico’s strategic geographical location, highly skilled human recourses, processes that comply with the highest international quality standards as well as government promotion policies and programmes for strategic sectors at a competitive cost have established Mexico as a world-class manufacturing hub.

Facts:

Facts:

• One out of 10 cars sold in the US is produced in Mexico, over USD 43 billion worth of automobiles and auto parts exports in 2009.

• One out of every 4 televisions sold in the US is produced in Mexico and Mexico exported over 80 million mobile phones worldwide, over 57 billion of electric and electronic equipment exports in 2009.

• With more than 190 companies in the Aerospace sector, Mexico is the 6th largest supplier to the European Union and the 9th to the US.

• In 2009, Mexico exported over USD 138 billion in manufactured goods.

Malaysian companies that have taken advantage of investing in Mexico:

• Likom Technology has been operating in Mexico since 1998, mainly supplying the US.

• Dunham Bush has been manufacturing airconditioning equipment since 1999 in Monterrey, Mexico.

• Eagle Tractors invested USD 6.5 million in Monterrey in 2003.

One more advantage is the country’s infrastructure. Mexico is fully equipped to help Malaysian businesses expand to the Americas. Its transport system offers a remarkable competitive advantage at competitive cost giving you fast and easy access to North and South America. North and South America represent a market of over 900 million people. Mexican roads, railroads, airports and seaports provide logistics solutions for Malaysian companies, allowing them to take advantage of Mexico’s geographical location.

One more advantage is the country’s infrastructure. Mexico is fully equipped to help Malaysian businesses expand to the Americas. Its transport system offers a remarkable competitive advantage at competitive cost giving you fast and easy access to North and South America. North and South America represent a market of over 900 million people. Mexican roads, railroads, airports and seaports provide logistics solutions for Malaysian companies, allowing them to take advantage of Mexico’s geographical location.

To keep up with the huge growth in Mexican foreign trade, President Felipe Calderon has put in place the National Infrastructure Programme 2007 – 2012, a very aggressive programme worth over USD 250 billion to improve Mexico’s logistics platform. The current administration has allowed Public-Private participation which has spurred more competitive and higher quality services.

Mexico is one of the top ten tourist destinations. Each year, over 21 million visitors enjoy the 7,000 kilometres of beaches, as well as the country’s colonial cities and archaeological sites. Currently there are important infrastructure projects like the new airport in the Riviera Maya worth over USD 250 million. The public tender is scheduled to come out on the 15th of April 2010.

Mexico is one of the top ten tourist destinations. Each year, over 21 million visitors enjoy the 7,000 kilometres of beaches, as well as the country’s colonial cities and archaeological sites. Currently there are important infrastructure projects like the new airport in the Riviera Maya worth over USD 250 million. The public tender is scheduled to come out on the 15th of April 2010.

In 2010, Mexico celebrates “200 Years of Independence and 100 Years of the Revolution”. This represents a historic moment for all Mexicans. A moment that calls for unity to excel through difficult times, a moment to learn more about our past but preparing for the future and a moment to show the world who we are. We invite you to share this tremendous economic growth with us, to work with us, and to create a mutually beneficial partnership. Tomorrow, you too will be able to confirm that we both speak the same language: Business

In 2010, Mexico celebrates “200 Years of Independence and 100 Years of the Revolution”. This represents a historic moment for all Mexicans. A moment that calls for unity to excel through difficult times, a moment to learn more about our past but preparing for the future and a moment to show the world who we are. We invite you to share this tremendous economic growth with us, to work with us, and to create a mutually beneficial partnership. Tomorrow, you too will be able to confirm that we both speak the same language: Business

Visit website at www.visitmexico.com

MASSDA Land Company Limited South-South Cooperation In Vietnam: A Great Success Story

South-South Cooperation In Vietnam: A Great Success Story

Danang Industrial Park

Established in 1993, Danang Industrial Park is developed and managed by MASSDA Land Company Limited and co-owned by Malaysian company MASSCORP-Vietnam Sdn Bhd (65%) and the Danang Investment and Development Fund (35%), a Vietnamese state financial organisation established to develop and invest in the socio-economic infrastructure of the city.

The first world-class industrial park in Danang City, the park is one of six industrial parks in the city and plays an important role in supporting industries, investments and exports in the Central Region of Vietnam. Zoned for light industrial business, the park is situated about 7km from Tien Sa sea port and the International Airport, and 2km from the Danang Central Business District. The 42 enterprises currently operating here provide employment for more than 12,000 people.

Why Danang?

Vietnam has been identified as one of the developing countries having significant potential for trade and business relations with Malaysia. Danang was selected as the site for MASSDA’s first world-class industrial park investment in Vietnam based on the anticipated increasing importance of Danang to the economy of the Central Region. As the third largest city in Vietnam, Danang presents considerable local market opportunities, in addition to being a gateway to Myanmar, Laos, Cambodia, Southern China and Northeast Thailand.

A broad range of industries and opportunities

A broad range of industries and opportunities

Danang Industrial Park hosts a diverse range of industries and businesses. Currently at 100% occupancy, business categories represented in the park include safety gloves, candles, garments and apparel, shoes, ceramic tiles, bathroom ware and ICT products. Service organisations such as logistics companies and bank operations are also residents of the park.

Ongoing development in infrastructure and utilities

Since the establishment of Danang Industrial Park, the city of Danang and the Central Region have experienced unprecedented growth and positive change. Within the park alone, many considerable developments have been made. Even during the early stages, Danang Industrial Park has had its own water and waste water treatment facility to meet the operating needs of businesses in the park. Since 2001, the park has had direct access to the 500kV national grid power supply, which provides a stable environment to ensure business continuity for park residents.

From a small Central Region city, Danang has grown by leaps and bounds to achieve strong economic growth and performance in the business, investment and resident environment. It has embraced a forward thinking approach to infrastructure development in an effort to create a green, safe and economically strong city to support a healthy lifestyle for its residents as well as a dynamic business environment.

This can be seen in the improvements to the transport and logistics infrastructure with increases in scheduled international flights to Danang airport, advancements in local distribution networks, as well as enhanced road access for a range of new markets and resources throughout the East West Economic Corridor.

Evolving to meet changing market needs

In 2008, MASSDA Land Company Limited was further licensed to develop a residential development called Fortune Park at Son Tra within the Danang Industrial Park development. Fortune Park is a seven-hectare gated community featuring contemporary designs by Malaysian architects and consultants. This development will diversify the core business of MASSDA and aims to address the growing market for lifestyle residences which are in close proximity to the strong and developing business infrastructure of Danang City.

Danang Industrial Park is the first industrial park in Vietnam to receive approval to convert some of their land from industrial to residential premises, offering a unique business and living environment in Danang. Buyer interest and sales indicators for Fortune Park at Son Tra have been strong to date, with almost 100% of sales going to Vietnamese nationals, especially local Danang residents.

Growing with Danang

Since its arrival on the business and investment scene in Danang, Danang Industrial Park has progressed along with the city. The high occupancy of the park, diversity of industries and stable infrastructure reflect developments in the broader Danang marketplace, and will continue to bring about many more opportunities for business, investment and long-term community development.

1st Quarter 2010 Update: Malaysian Economic Outlook

The world economy has recovered since 4Q09, following numerous national policy measures which enhanced private demand and global trade conditions. However, the recovery path is uneven with developing Asia leading global growth, and advanced nations trailing behind. The strong economic expansion from developing Asia was led by China, India and Indonesia with their relatively large domestic demand. Policymakers have begun to normalise policy rates, given rising inflation expectations and the emergence of asset bubbles. The Malaysian economy too has rebounded in 4Q09 by +4.5% yoy, leading to a smaller contraction of 1.7% yoy in 2009. The recovery was broad-based with all economic sectors registering strong turnaround. This, along with improving consumer and business confidence, allowed MIER to raise the GDP growth rate to +5.2% yoy in 2010. Economic growth is forecasted to reach +5.0% yoy in 2011.

Private consumption improved further by +1.7% yoy in 4Q09, producing a small growth of +0.8% yoy in 2009. This was supported by strengthening consumer confidence and labour market prospects. Consumer confidence as measured by MIER’s Consumer Sentiment Index (CSI) rose by +4.6 pts qoq in 1Q10; indicating better finances and employment opportunities. Household loans remained resilient at +11.1% yoy in February 2010; it grew by +9.1% yoy in 2009. The unemployment rate eased from 4.0% in 1Q09 to 3.5% in 4Q09, while the number of retrenched workers fell from 12,590 in 1Q09 to 2,125 in 4Q09. Another indicator of private consumption, namely, sales of passenger cars rose by +18.5% yoy in 4Q09 and to +7.5% yoy in February 2010. This was also confirmed by MIER’s Automotive Industry Index (AII), which up 4.3 pts in 1Q10 suggesting recovery in the sector. Accordingly, MIER expects private consumption to accelerate by +5.6% yoy in 2010 and further to 6.8% yoy in 2011.

Gross investment improved strongly by +8.2% yoy in 4Q09 due to effects from large fiscal stimulus packages. Over 2009, public investment surged +12.9% yoy, while private investment fell 21.8%. Business sentiment as gauged by MIER’s Business Conditions Index (BCI) rose by +5.2 pts qoq in 1Q10, suggesting that private investment is gradually recovering. This is also supported by the marginal decline of 0.8 pts in the Vistage-MIER’s CEO Confidence Index (CEO). The government’s liberalisation efforts since April 2009 are expected to promote more investment in the services sector over the long term. The recent announcement of the New Economic Model also contains some positive initiatives, but more concrete measures may be required to boost the attractiveness of Malaysia as an investment destination. With improving domestic and external conditions, MIER anticipates gross investment to grow by +5.0% yoy in 2010 and further lifted to +5.5% yoy in 2011.

Measures implemented by the government to pump-prime the economy during 2008 – 2009 have led to a worsening fiscal balance to GDP ratio of -7.0% in 2009. Following recent economic recovery, public consumption growth eased to +1.3% yoy in 4Q09; it expanded by +3.7% yoy in 2009. In 2010, the government intends to consolidate its position via a 13.7% reduction in the operating expenditure, leading to a smaller budget deficit to GDP ratio of 5.6%. This may be challenging, given recent impediments in the proposed fuel restructuring as well as goods and services tax (GST) schemes. In this respect, MIER forecasts a marginal decline of 0.3% yoy in public consumption growth in 2010, before decelerating further by 2.7% in 2011.

Both exports and imports of goods and services rebounded in 4Q09 by +7.3% yoy and +6.9% yoy respectively, arising from improved global dynamics and trade conditions. Moreover, large shipments of E&E and commodities have lifted exports by +27.6% yoy in January – February 2010. Imports were also higher by +29.5% yoy in January – February 2010 due to favourable conditions. The WTO has predicted a +9.5% yoy growth in global trade in 2010 (-12.2%: 2009), and the Transpacific Stabilisation Agreement recently projected cargo growth of 6.0% to 8.0%. Thus, MIER envisages exports and imports of goods and services to rise by +8.2% yoy and +8.8% yoy respectively, in 2010. In 2011, they will improve further by +8.8% yoy and +9.4% yoy respectively.

By sector, MIER predicts that the agriculture sector will expand by +2.6% yoy in 2010 and +2.2% in 2011 on robust consumption of palm oil by China, India and the Euro zone, as well as firmer global commodity prices. Global economic recovery is expected to boost the production and consumption of crude oil further in 2010 – 2011; the mining sector will grow by +5.4% yoy in 2010 before moderating to -0.3% in 2011 on high base effects. Higher global demand for electronic chips will propel manufacturing growth to +6.2% yoy in 2010, and easing to +3.4% in 2011 on base effects.

MIER Residential Property Index (RPI) up +12.3 pts in 1Q10. Property demand is anticipated to continue moving up owing to the current low interest rate regime, attractive financing packages by developers, a stronger economic recovery, and a prominent asset reflation theme. The completion of 9MP projects along with greater emphasis on fiscal consolidation will negatively affect the construction sector; it is projected to decelerate to +2.3% yoy in 2010 and to grow by +3.3% yoy in 2011.

Lastly, the services sector is anticipated to expand by +5.2% yoy in 2010 and +6.6% yoy in 2011 due to the positive influences from recent liberalisation measures. While MIER’s Tourism Market Index (TMI) up +6.4 pts qoq in 1Q10, the Retail Trade Index (RTI) fell 4.1 pts in the same period, capping overall gains in the near term.

In tandem with economic recovery and higher global commodity prices, overall consumer price inflation is expected to grow by +2.2% in 2010. Since core inflation has been rising faster than overall inflation, MIER anticipates the OPR to settle at 2.75% by end 2010. Firmer economic expansion will further lift the OPR to 3.25% in 2011.

The downside risks to MIER’s forecasts may come from slower than expected economic recovery of the G3 economies, burgeoning sovereign debt problems in the Euro zone, overheating issues and asset bubbles in regional economies, the impact of Basel 3 on financial holding company structures, as well as unresolved domestic structural issues.

Editorial

MASSA together with Construction Industry Development Board Malaysia (CIDB) and Federation of Malaysian Manufacturers (FMM) have organised a business mission to Bangladesh in April 2010. The mission held business networking meetings with Government officials and Business Chambers in both Dhaka and Chittagong. Bangladesh is an emerging market with a population of 140 million and is brimming with burgeoning domestic demands. Members should take a serious look at the business opportunities available in that country. The report of the mission is detailed in the following pages.

Bilateral ties between Malaysia and Bangladesh have been warm and growing as evidenced by regular official visits by various senior Government officials and business delegations. The Honourable Prime Minister, H.E. Sheikh Hasina, in her forthcoming visit to Malaysia in May 2010, in conjunction with the World Islamic Economic Forum (WIEF), has set aside time to meet and hold dialogues with top Malaysian corporate leaders to attract more FDI investments in Bangladesh. MASSA is pleased to play the role of organising this forthcoming dialogue.

In this edition, besides Bangladesh, we also wish to record our appreciation to the Mexican Embassy in Kuala Lumpur, for their close collaboration with MASSA resulting in the article on emerging opportunities in Mexico. We also have an update on Masscorp’s housing development in Vietnam. We hope these articles will inspire our members to look beyond our shores in their quest to expand their businesses and to raise the Malaysian flag in these overseas investment destinations.

As the world economy gains back lost ground from the global financial crisis and Malaysia gains traction in its economic recovery, MASSA will step up its activities to assist members to develop their networkings across the developing countries especially within the Asian Pacific region.

MASSA will seek collaborations with business associations, chambers and key interest groups to maximise these networkings and linkages for its members. Since MASSA operates on a very lean secretariat, we welcome the support of members especially with ideas and suggestions on how best to improve our service delivery.

We at the Secretariat, are grateful to the ongoing support given by the various Government agencies and their continued engagement with MASSA. Our thanks are also similarly extended to the diplomatic communities of the developing countries which are based in Malaysia.

Fatimah Sulaiman

Editor

President’s Message

The 1st quarter of 2010 has just gone by and Malaysia has come through the global crisis in good shape. This recovery is in tandem with the global scenario, although the economic recovery remains fragile and uneven. We note though the economic recovery has been more pronounced in the emerging economies, particularly in Asia.

The Malaysian economy, despite a sharp contraction in the 1st quarter of 2009 by 6.2%, moderately contracted by 1.7% in 2009, as recovery strengthened in the 2nd half of 2009. Gaining traction thereon, Malaysia is back on the growth path with an estimated GDP growth of 8% for 2010. Barring unforeseen circumstances, this is a very commendable performance and is a testimony of the efforts by the Government, the business community and the people of Malaysia who have weathered the trials of the past 2 years with perseverance and tenacity.

Going forward, much effort and work still remain. As the axis of economic growth shifts to Asia, competition will intensify and Malaysian entrepreneurs need to gear up on all fronts to face the competitive headwinds.

MASSA will continue to assist its members and the investing community to identify niche markets in the developing countries to forge win-win business possibilities. Together with the support and assistance from MITI and its agencies, MATRADE, MIDA and SME Corporation, we are confident that Malaysian products and services can flourish and excel internationally.

I am thankful for the continuing support of the High Commissions and Embassies of the numerous developing countries that are based in Malaysia as well as our Malaysian Embassies and High Commissions based in the developing countries. Through their presence, support and network, our roles in MASSA have been made more effective.

TAN SRI DATO’ AZMAN HASHIM

President

Diary Of Events

Courtesy Call on MASSA President by Ambassador of the Republic of Ecuador to Malaysia, 10 May 2010

H.E. Lourdes Puma Puma, Ambassador of the Republic of Ecuador to Malaysia called on Tan Sri Azman Hashim, President of MASSA at his office. Mr. Mario Miranda, Second Secretary of the Embassy of the Republic of Ecuador in Malaysia accompanied Her Excellency at this meeting.

H.E. Lourdes Puma Puma, Ambassador of the Republic of Ecuador to Malaysia called on Tan Sri Azman Hashim, President of MASSA at his office. Mr. Mario Miranda, Second Secretary of the Embassy of the Republic of Ecuador in Malaysia accompanied Her Excellency at this meeting.

(Left) Tan Sri Azman Hashim, President of MASSA

meeting with (right) H.E. Lourdes Puma Puma, Ambassador of the Republic of Ecuador to Malaysia

Courtesy Call by Export Promotion Bureau, ProChile, Ministry of Foreign Affairs of Chile on MASSA President, 9 June 2010

Mr. Felix De Vicente, Director, Export Promotion Bureau, ProChile, Ministry of Foreign Affairs of Chile called on Tan Sri Azman Hashim, President of MASSA at his office. H.E. Jose Manuel Ovalle Bravo, Ambassador of Chile to Malaysia and Mr. Fernando Salas, Deputy Head of Mission and Commercial Director of the Chile Embassy accompanied Mr. Vicente at this meeting.

Mr. Felix De Vicente, Director, Export Promotion Bureau, ProChile, Ministry of Foreign Affairs of Chile called on Tan Sri Azman Hashim, President of MASSA at his office. H.E. Jose Manuel Ovalle Bravo, Ambassador of Chile to Malaysia and Mr. Fernando Salas, Deputy Head of Mission and Commercial Director of the Chile Embassy accompanied Mr. Vicente at this meeting.

MASSA’s 19th Annual General Meeting, 23 June 2010

MASSA held its 19th Annual General Meeting at Restoran Seri Melayu, Jalan Conlay, Kuala Lumpur,

chaired by MASSA President, Tan Sri Azman Hashim.

Visit of Senegalese Delegation to Malaysia, 18 – 20 May 2010

MASSA facilitated the visit of an 8-member delegation from Senegal to Malaysia to participate in the World Islamic Economic Forum (WIEF). Whilst in Malaysia, they called on MASSA to organise a study visit to learn about affordable housing development. MASSA arranged for the delegation to visit:

- Damansara Damai –

a 400-acre development in North Petaling Jaya comprising affordable and upmarket homes developed by EMKAY Group. This was the first large-scale privatised property development scheme in the state of Selangor Darul Ehsan. The privatisation scheme was developed to create a planned township in accordance with the aspirations of the new economic policy. - Cyberjaya Flagship Zone (CFZ) –

a self-contained intelligent city with world-class IT infrastructure, low-density urban enterprise, as well as state-of-the-art commercial, residential, enterprise and institutional developments, making it an ideal place to live, work and play. Providing a conducive living environment with amenities and facilities, Cyberjaya is home to MNCs, knowledge workers, enterprising businesses, students and families. - Bandar Sunway (Sunway City) –

The pristine, well-landscaped resort township that was transformed from 800 acres of wasteland boasts a unique “Resort Living within the City” concept. Developed by Sunway City Berhad, this integrated development comprises over 7,000 residential, commercial and light industrial units. - Selangor State Economic Development Corporation in Shah Alam. This is a statutory body and the state development agency involved in property development, commercial development, industrial development and investment for the state of Selangor in Malaysia. The Corporation’s focus is on property development with the aim to provide affordable housing ownership opportunities to all communities.

MASSA thanks the four organisations who had so freely shared their property development experience and success with the delegation.

MIDA Familiarisation Programme for Officials of Investment Promotion Agencies (IPAs) of South-South Countries, 8 – 17 July 2010

This annual event is co-sponsored by the Ministry of Foreign Affairs, Malaysia under the Malaysian Technical Co-operation Programme (MTCP) with the aim to share Malaysia’s experience in promoting foreign, domestic and cross-border investments and fostering closer ties with the participating countries’ IPAs. This year, participants from 17 countries took part in this programme. In conjunction with the above programme which was organised by MIDA, three MASSA members made a presentation on the topic “Malaysian Private Sector’s Experience in Investing Abroad” on 12 July 2010.

The speakers were Dato’ Teh Kean Ming, Deputy CEO and Deputy Managing Director of IJM Corporation Berhad, Dato’ Dr. Jayles Yeoh, Vice President, International Development, Limkokwing University of Creative Technology and Tan Sri Dato’ Soong Siew Hoong, MASSA EXCO Member. Limkokwing University is an international university with a global presence across 3 continents. Over 30,000 students from more than 150 countries study at its 12 campuses in Botswana, Cambodia, China, Indonesia, Lesotho, Malaysia, Swaziland and United Kingdom. IJM is one of Malaysia’s leading construction groups. Its business activities encompass construction, property development, manufacturing and quarrying, infrastructure concessions and plantations. Amongst the Group’s investments in major overseas infrastructure projects are the Western Access Tollway in Argentina, five tolled highways in India and the Binh An water treatment concession in Vietnam and had previously invested in several infrastructure projects in China. The group is also involved in oil palm plantations in India. Tan Sri Dato’ Soong Siew Hoong is an industrialist in the iron and steel industry who is actively involved in promoting linkages between SMEs.

Dialogue Session with H.E. Sheikh Hasina Wajed, Hon. Prime Minister

of Bangladesh, Kuala Lumpur, 20 May 2010

H.E. Sheikh Hasina Wajed, Hon. Prime Minister of Bangladesh, visited Malaysia from 18 to 20 May 2010. The Hon. Prime Minister was accompanied by Mr. Muhammad Faruk Khan, Hon. Minister of Commerce of Bangladesh, Dr. Mashiur Rahman, Hon. Adviser to the Hon. Prime Minister, Mr. Mohammad Ziauddin, Ambassador-at-large, Mr. Md. Abdul Karim, Principal Secretary, Dr. S.A. Samad, Executive Chairman of the Board of Investment of Bangladesh, Mr. Syed Moazzam Hossain, President of the Bangladesh-Malaysia Chamber of Commerce & Industry (BMCCI) and other high ranking government officials and top businessmen from Bangladesh on this visit.

In conjunction with this visit, a roundtable dialogue session with the Hon. Prime Minister was held at Istana Hotel, Jalan Raja Chulan, Kuala Lumpur. It was organised by the Construction Industry Development Board Malaysia (CIDB), Federation of Malaysian Manufacturers (FMM) and Malaysia South-South Association (MASSA).

This event is a follow-up to the recent Business Mission to Dhaka and Chittagong, Bangladesh organised by CIDB, FMM and MASSA from 25 to 29 April 2010.

The purpose of this roundtable dialogue is for the Hon. Prime Minister to inform the top Malaysian businessmen of the business potential in Bangladesh, particularly in sectors such as infrastructure development, i.e. power generation, roads, highways and railways, real estate development, ports and airports and the setting up of industries in the industrial zones and also for the Malaysian businessmen to meet with the Hon. Prime Minister and hear from her first hand on the Government’s initiatives to promote and attract FDIs in the above sectors. Tan Sri Datuk Mustafa Mansur, President of FMM delivered the opening remarks. An active dialogue session between the Hon. Prime Minister of Bangladesh and CEOs/Chairmans of Malaysian companies was held, followed by Questions and Answers session.

The purpose of this roundtable dialogue is for the Hon. Prime Minister to inform the top Malaysian businessmen of the business potential in Bangladesh, particularly in sectors such as infrastructure development, i.e. power generation, roads, highways and railways, real estate development, ports and airports and the setting up of industries in the industrial zones and also for the Malaysian businessmen to meet with the Hon. Prime Minister and hear from her first hand on the Government’s initiatives to promote and attract FDIs in the above sectors. Tan Sri Datuk Mustafa Mansur, President of FMM delivered the opening remarks. An active dialogue session between the Hon. Prime Minister of Bangladesh and CEOs/Chairmans of Malaysian companies was held, followed by Questions and Answers session.

Tan Sri Datuk Mustafa Mansur, President of FMM moderated this session. Mr. Syed Moazzam Hossain, President of the Bangladesh-Malaysia Chamber of Commerce & Industry (BMCCI) together with the board members of BMCCI participated in this dialogue. Tan Sri Datuk Mustafa Mansur, President of FMM later presented a gift to the Hon. Prime Minister, followed by a Business Networking Lunch for all the participants at this dialogue session. A total of 54 MASSA members from 40 companies attended this event.

Dinner Meeting with H.E. Mr. Nguyen Van Chi, Member of the Politburo, Secretary of the Central Committee of the Party, Chairman of the Central Inspection Committee, Former Party Committee Secretary of Quang Nam Danang, 16 August 2010

Tan Sri Dato’ Michael Chen Wing Sum, Chairman of MASSDA Land Company Limited and Vice President of MASSA had a dinner meeting with H.E. Mr. Nguyen Van Chi, member of the Politburo, Secretary of the Central Committee of the Party, Chairman of the Central Inspection Committee, Former Party Committee Secretary of Quang Nam Danang on 16 August 2010.

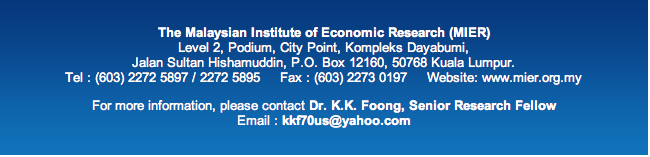

Country Feature Zambia: A New Frontier For Investments

Overview

As the world looks to Africa for new resources, Zambia has become a new frontier for trade and investments. The country is strategically located in southern central Africa and is surrounded by 8 countries with a total area of 752,614 square kilometres and a population of 12.1 million people.

As an economic hub for the southern African sub-continent, Zambia’s economic development benefits from regional integration through two major markets, namely, the Southern African Development Community (SADC) that has a population of 247 million people and a combined GDP of US$431 billion and the Common Market for Eastern and Southern Africa (COMESA) with an estimated population of 400 million and a combined GDP of US$360 billion. It is therefore strategically positioned to provide prospective businesses and investors access to two large regional markets.

Zambia has strong economic ties with the European Union through the Cotonou Agreement and the Everything But Arms Initiative. It also has access to the United States of America under the American Growth and Opportunities Act (AGOA). Additionally, efforts are underway by the Zambian Government to implement similar market access initiatives with Canada, China, Japan, Malaysia and other member states in the Association of South East Asian Nations (ASEAN).

The country’s long term national economic agenda envisages that Zambia will become a prosperous middle income country by 2030. The Vision 2030 document embodies socio-economic justice underpinned by gender responsive sustainable development, democracy and public private partnerships to name a few. Zambia’s GDP growth forecast through to 2012 is expected to be 6.0 percent per annum, supported mainly by new developments in copper production and increased construction activities around the country.

Why Zambia?

After the economic crises of the 70s, 90s and the recent economic downturn, Zambia has successfully turned the corner. Most evident over the last 10 years is the sustained growth, improved prosperity and easier market access for local and foreign investors. During this time, economic growth oscillated between 5.0 and 6.0 percent, spurred by the expansion of the country’s mining, construction and service industries.

With good governance and a vigorous pursuit of sound macroeconomic policies, Zambia’s economy is stable and considered to be one of the most favourable in the region with structural changes relating to trade facilitation, public financial management, debt and aid management and financial sector deepening. All of which have culminated in a significant reduction in the cost of doing business. Other key strengths that make Zambia an attractive investment destination include:

- An abundance of natural resources and manpower

- Political stability since attaining its independence in 1964

- The abolition of controls on prices, interest rates, foreign exchange rates and free repatriation of debt repayments

- 100% repatriation of net profits

- Guarantees and security for investors with legislated rights to full market value compensation

- Banking, financial, legal and insurance services of international standard as well as a well-developed Stock Exchange

- Double Taxation Agreements with a number of European, North American, African and Asian countries

- The establishment of Multi Facility Economic Zones (MFEZs) for investors to benefit from tax breaks, the provision of infrastructure and a lax regulatory climate in which to operate

- The acquisition of land by foreign entities facilitated by the Zambia Development Agency

Incentives

All investment promotion and facilitation for the Government of Zambia and private entities seeking joint ventures are undertaken by the Zambia Development Agency (ZDA). The ZDA exists to assist foreign investors to set up their business operations as well as acquiring primary and secondary licences. Under the ZDA Act of 2006, investors benefit from a wide range of incentives such as allowances, exemptions and concessions for prospective investors, however:

- Any investments valued at not less than US$10 million are entitled to negotiations with the Government for other incentives in addition to those they are eligible for under the Act.

- Investments of at least US$500,000 in Multi Facility Economic Zones (MFEZ) or in a priority sector are entitled to general incentives as well as a zero percent corporate tax on profits for 5 years from the first year profits were declared.

Investment Opportunities

The Government is committed to diversifying the economy away from the mining sector while increasing the number of Public Private Partnerships (PPPs), improving the country’s infrastructure and public sector delivery. The PPP Act was enforced in August 2009 under which the Government also encourages and accepts unsolicited bids from investors in any area of investment in all aspects of the economy. In addition, the Government seeks strategic partners in ICT, telecommunications, road and rail, power generation, tourism, waste management and water supply projects. Some key projects earmarked for development as PPPs are:

- Lusaka Multi Facility Economic Zone (LsMFEZ)

- Zambia International Trade Fair

- Livingstone Convention Centre (Tourism and Business facilitation)

- Kasaba Bay Resort (Tourism)

- Nansanga Farm Block (Commercialised Farming)

- Cotton Cluster

- Lusaka International Airport and Air-cargo Hubs

- Development of Railway projects

The Zambian Government is aggressively marketing these projects through its Embassies and Missions abroad. As such, in April 2009, the High Commission of the Republic of Zambia was opened on a residential basis in efforts to attract investments and market business opportunities to member states in the ASEAN. Organisations such as The Malaysia South-South Association (MASSA), the ASEAN Retail Chains Federation (ARFF), Chambers of Commerce and Industry and similar establishments in the region are encouraged to contact the High Commission for detailed information on business opportunities and investments in projects earmarked for strategic partnerships with the Zambian Government.

For more information, please contact:

The High Commission of the Republic of Zambia

Suite C, 5th Floor Menara MBF, Jalan Sultan Ismail, 50250 Kuala Lumpur, Malaysia.

Tel : +603 2145 3619 Fax : +603 2145 3619

The Economics Department:

1. Mr. Humphrey Chibanda, Counsellor at humphrey.chibanda@zhckl.com.my or

2. Ms. Nyeji Chilembo, First Secretary Economics at nyeji.chilembo@zhckl.com.my

The Zambia Development Agency

PO BOX 30819, Lusaka.

Tel : +260 211 220177 / 223859 Fax : +260 211 225270

Mr. Noah Ndumingu, Senior Investment Promotion Officer at nndumingu@zda.org.zm

Ministry Of Natural Resources And Environment Malaysia – Climate Change Multilateral Environmental Agreements: Negotiating The Future Of Malaysia’s Development Space

We all live in a carbon-based economy. Virtually every aspect of our lives involves the use of carbon-based energy. Even while we sleep, our fans whirr and our air-conditioners and fridges hum; sure signs that we are using carbon-based fuels and emitting greenhouse gases (GHGs). With the exception of the small percentage of energy that is derived from renewable sources such as hydroelectric and biomass, for the most part, our energy is provided by carbon-based fossil fuels; that is, they represent carbon that was removed from the atmosphere millions of years ago by prehistoric plants and animals and stored far below ground as coal, oil and gas. It is our continued reliance on these fuels that is driving the ever increasing extraction of these carbon pools from below ground and enriching our atmosphere with carbon-based greenhouse gases, the very gases that have been associated with the climate change that we are already experiencing.

The summer of 2010 will be remembered as one of the most violent in climatic terms; with catastrophic flooding in Pakistan and China and droughts, coupled with record high temperature and fires in Russia. It is unsurprising therefore that each successive assessment report that has been released by the Intergovernmental panel on climate change (IPCC) has further reinforced the link between human activities and climate change. When viewed comprehensively, the historical emissions of the developed countries since the beginning of the industrial revolution, thus far accounting for three quarters of all human GHG emissions, are prominent and blatantly obvious. While economic growth is currently proceeding at breakneck speed in many developing countries, including Malaysia, thus far, the developing countries collectively still only account for a small proportion of the historical emissions of GHGs.

In an attempt to address the problem, in 1992, virtually all the countries of the world agreed to establish a framework convention known as the UN Framework Convention on Climate Change (UNFCCC). Under the Convention, all Parties agreed to report their national GHG inventories and mitigation measures in their respective National Communication; but in addition, acknowledging the historical emissions mentioned earlier, developed country Parties, also known as Annex I Parties, have a commitment to reduce emissions and transfer technology and financing to developing countries to assist them in mitigating climate change and adapting to its effects.

The emissions reduction commitment of the developed country Parties was formalised under the legally binding Kyoto Protocol (KP) which was signed and ratified by most developed countries, but significantly, not by the United States. Under the KP, Annex I Parties agreed to reduce their emissions by 5% relative to 1990 GHG emissions during the period between 2008 and 2012, the period known as the first commitment period (FCP) of the KP.

While some developed country Parties are making good progress in reducing emissions and are on track to achieve their emissions reduction targets, many are falling short and continuing to emit excessive GHGs. As such, it is unlikely that these countries will be able to meet their commitment at the end of 2012 and will therefore have to carry their emissions reduction shortfall into the second commitment period (CP2) post 2012.

As 2012 approaches, Parties to the KP have begun negotiations to revise the emissions reduction targets of the developed country Parties, both in aggregate as well as individually, for the period following 2012, the second commitment period. In doing so, it has become apparent that many developed country Parties, particularly those that will not be able to achieve their emissions reduction commitments under the FCP, are very unwilling to pledge deeper cuts in emissions for fear that they will be unable to achieve them. In a more worrisome development, many developed country Parties have proposed changes to the legally binding KP instrument together with completely new instruments, rules and modalities that deviate from the principles they agreed to under the Convention in 1992.

This was most clearly expressed in Copenhagen at the 15th Conference of the Parties (COP 15) to the UNFCCC when a small group of parties led by the host country, Denmark, attempted to coerce the developing country Parties to accept and endorse a proposed legally binding document known as the Copenhagen Accord (CA). While the CA recognised the importance of keeping the increase in mean global temperatures below two degrees and contained substantial though insufficient financial pledges, it nevertheless remained unpalatable to most developing countries, both on the basis of procedure (the opaque and exclusive method by which it was drafted and foisted upon the Parties), as well as on the basis of its contents.

A primary weakness of the CA lies in the elimination of the legally-binding top-down aggregate emissions reduction target by the developed country Parties in favour of a bottom-up individual pledge approach. In stark contradiction, the emissions reduction pledges of the developed country Parties do not come close to the levels called for by the science to meet the two-degree limit in the previous paragraph. The unwritten implication was that the remainder of the emissions reduction required to achieve the two-degree limit would be undertaken by developing country Parties. In addition, the CA also placed burdensome reporting requirements on developing countries that even exceeded the current reporting requirements for developed country Parties.

For these reasons, the CA was not adopted, but merely taken note of by Parties and relegated to the status of a document outside the UNFCCC system. Nevertheless, the developed countries strongly encouraged developing country Parties to associate themselves with the document, if for no other reason, because of the significant funds pledged. Fearing that they would be otherwise ineligible to receive the funds pledged under the Accord, many developing country Parties associated with the CA, albeit with numerous conditions addressing all the shortfalls of the document.

Under the Convention, Developing Country Parties have agreed to take voluntary measures to reduce GHG emissions and to report these measures in their national communication to the UNFCCC. To this end, Malaysia’s Prime Minister, the Honourable Datuk Seri Najib Tun Razak announced at COP 15 in Copenhagen that Malaysia would voluntarily reduce its GHG emissions intensity of Gross Domestic Product (GDP) by up to 40% based on 2005 levels, by 2020, conditional on technology transfer and financial assistance by developed countries. Unfortunately this announcement by our Prime Minister is one of the most frequently misunderstood and misquoted statements, and is usually taken to mean that Malaysia intends to reduce its absolute emissions by 40%. On the contrary, this voluntary indicator that measures national GHG emissions as a function of GDP is not unlike the voluntary pledges already made by China and India and is aimed at decoupling levels of emissions from economic growth through the widespread implementation of energy efficiency measures, renewable energy measures, and low-carbon technologies and growth strategies.

As a follow up to this announcement, the Ministry of Natural Resources and Environment is initiating a process to capture all voluntary measures being undertaken by the public, private corporations, as well as the various government agencies and non-governmental organisations, towards reducing GHG emissions and improving economic sustainability. The benefits of these so called ‘low hanging fruit’ can take the form of lower resource use and reduced costs, enhanced profitability, zero waste, and a more pleasant and healthier working environment.

The ministry hopes to publicise these achievements in an effort to build ‘carbon footprint’ awareness and mainstream the ‘low-carbon’ paradigm throughout all sectors of the country. In particular, the activities involving low-cost, low-tech solutions should be exhausted before moving on to the flashier high-tech and higher-cost solutions. These initial steps will begin preparing the nation for the more daunting, higher-cost emissions reduction challenges that are yet to come to ensure that Malaysia will remain both sustainable and competitive through 2020 and beyond.

Ministry Vision

To lead in the sustainable management of natural resources and conservation of the environment towards achieving the national vision.

Ministry Mission

To provide exceptional services in the management of natural resources and conservation of the environment in line with the national vision through:

- Integrated planning of activities and programmes by the departments and agencies.

- Optimisation of manpower utilisation, hi-end technologies and financial resources.

- Maximisation of natural resources development in order to support value added activities.

- Enhancement and reinforcement of research and development activities.

- Effective dissemination and sharing of technical input and database management.

- Effective cooperation among public, private and international sectors.

- Enhancement of expertise and knowledge through effective and systematic training modules.

Ministry Objectives

- To ensure the well-balanced management of natural resources and the environment in achieving sustainable development.

- To ensure an efficient and effective service delivery system for natural resources and environment management.

- To ensure efficient and effective implementation of development projects.

- To establish training and research and development (R&D) as an innovative exploration catalyst in natural resources management and environmental conservation.

- To ensure a clean, safe, healthy, productive and unpolluted environment.

Ministry Functions

- Legislate policy, laws, procedure and guidelines related to natural resources management and environmental conservation.

- Monitor, coordinate and assess the implementation of policy, laws, procedure, guidelines and services while performing continuous restoration on natural resources management and environmental conservation.

- Manage training programmes and develop human resources to produce a competent workforce and knowledgeable and informed members of society.

- Provide adequate infrastructure and tools to equip departments and agencies.

- Inspire research and development (R&D) efforts in natural resource management and environmental conservation to enhance value added natural development.

- Ascertain and maintain boundary issues to ensure national interests, sovereignty and security.

- Leading the establishment and management of national geospatial and aspatial information.

- Ensuring that natural resource planning and development are integrated with environmental conservation.

- Coordinate, supervise and enforce legislation governing natural resource management and environmental conservation.

- Act as the focal point for multi-lateral negotiations focusing on natural resources and environmental matters.

- Safeguarding national interests in regional and international negotiations regarding natural resources and environment.

- Enhancing public awareness and public support in identifying the importance of a well-balanced utilisation of natural resources and conservation of the environment.

- Establish smart partnerships among various authorities in managing natural resources and the environment.

- Ensure continuous improvement of the service delivery systems dedicated to managing natural resources and environment.

MASSDA Land Company Limited: Handing-Over Keys Ceremony For Phase 1 Houses Of Fortune Park @ Son Tra, Danang, Vietnam On 17 August 2010

17 August 2010 was an auspicious day for MASSDA Land Company Limited as the company celebrated the handing-over of keys to the house owners of Phase 1 of its maiden housing development in Fortune Park @ Son Tra.

This event marked a major milestone in the history of MASSDA Land Company Limited. The company first came to Danang City to develop an Industrial Park in 1993. The Danang Industrial Park is now fully tenanted by 42 enterprises and have provided employment for more than 12,000 people of this city. Together with MASSDA, these enterprises have contributed to the economic upliftment of this beautiful city. With the support and co-operation of the People’s Committee of Danang City, MASSDA is confident that Danang City will continue to become a major destination for foreign investments, given its well appointed, strategic location and good infrastructure and port facilities.

In 2008, MASSDA Land Company Limited was licensed to develop a residential development in the vicinity of the Danang Industrial Park. This development named Fortune Park @ Son Tra is a seven-hectare gated community featuring houses with contemporary designs to cater to the growing market for lifestyle homes for the people of Danang City.

During the design stage of this development, MASSDA had painstakingly consulted and taken into consideration a lot of feedback and ideas from a cross-section of potential buyers in Danang. Blending this with Malaysian architectural designs and building systems, MASSDA proudly delivered Phase 1 of these houses on 17 August 2010. The second phase has already been fully sold! This is evident proof of the acceptability of our designs by Danang residents.

Phase 1 houses, comprising 90 units, have been completed in a record time of 12 months, since its sales launch. MASSDA is grateful to the entire development, suppliers, construction team and utility authorities that have worked hand-in-hand with MASSDA to deliver these houses ahead of the stipulated contract period of 24 months, without sacrificing the standard and quality of the houses. MASSDA also wishes to especially acknowledge the efforts and congratulate its Board of Directors, led by General Director, Mr. Lee Yai Sin and his deputy, Mr. Nguyen Anh Tuan, and the entire team at MASSDA for delivering the new houses ahead of schedule.

To the proud house owners, MASSDA would like to congratulate them on their excellent choice and sincerely wishes them and their respective families many happy moments and prosperity in their new abode. These Phase 1 houses have already appreciated by more than 40%!

To the proud house owners, MASSDA would like to congratulate them on their excellent choice and sincerely wishes them and their respective families many happy moments and prosperity in their new abode. These Phase 1 houses have already appreciated by more than 40%!

MASSDA Land Company Limited is very positive about this city and its future as we have all seen this beautiful city bloom and the rapid transformation brought about through economic development.

MASSDA will continue to participate in long term community development projects in this city, bringing with it leading-edge contemporary designs for residential homes, commercial and retail development together with competitive and modern building materials, building and construction systems that are eco-friendly and sustainable.

MASSDA looks forward to working with the People’s Committee of Danang City, officials from the various Ministries and Government departments to develop Danang City into a modern city of choice for discerning property owners.

2nd Quarter 2010 Update: Malaysian Economic Outlook

During 1Q10, the global economy improved further with developing Asia as the leading engine of growth. This was made possible through sustained domestic demand and better global trade conditions. In tandem with regional economies, GDP growth strengthened to +10.1% yoy in Malaysia. The recovery was led by a strong revival in the manufacturing sector, especially export-oriented industries. The industrial production index (IPI) increased to +12.5% yoy in May 2010, despite a slowdown in the rate of growth of gross exports. On a mom basis, IPI advanced +3.3% (-3.8%: April 2010). Gross exports decelerated to +21.9% yoy in May 2010 due to weaker demand for electrical and electronic (E & E) products and the effect of a stronger ringgit. On a mom basis, exports increased marginally by 0.5% (-12.4%: April 2010). Overall CPI was up +1.6% yoy in May 2010 following a recovery in domestic demand. On a mom basis, it was higher by +0.3% (+0.0%: April 2010). Meanwhile, core CPI was sustained at +1.2% yoy in May 2010.

The banking system’s outstanding loan growth expanded further to +11.7% yoy in May 2010, following a recovery in domestic demand. Household loans growth sustained at +12.5% yoy, while business loans rose to +6.1% yoy. The 3-month net NPL ratio rose to 2.0% in May 2010 (due to technical adjustment for the adoption of FRS 139), while the risk-weighted capital ratio (RWCR) maintained at 15.0%. These measures indicated that asset quality remained healthy and capital base of the banking system strong. The growth rate of broad money (M3) up +9.5% yoy in May 2010, on account of stronger credit extension by banks to the private sector and larger government spending. Narrow money (M1) accelerated by +12.1% yoy.

However, sentiments have turned sour recently. The sovereign debt crisis in Europe has led to doubt on the sustainability of global economic recovery. Furthermore, continued policy-tightening measures by China have sent adverse shocks to economic agents worldwide. News flow from BP’s accident in the Gulf of Mexico and Australia’s proposed Henry Tax also heightened uncertainty among global investors. Other risks include possible implications from the US financial reforms and capital issues from the proposed Basel III banking sector regulations. Collectively, these developments have negatively affected sentiments towards numerous sectors, particularly the exporters.

In the recent G-20 summit on June 26, world leaders agreed to halve deficits by 2013, stabilise their debt-to-GDP ratios by 2016, and pursue higher capital requirements for banks by end 2012. The G-20 also pledged to maintain existing stimulus plans and take concerted actions to sustain global growth. Measures to reduce deficits and promote recovery will be country-specific. To confront these issues, measures were proposed under the 10th Malaysia Plan based on strategies articulated earlier in the Government Transformation Program (GTP) and the New Economic Model (NEM) to sharpen the competitive edge of Malaysia. These along with further liberalisation efforts in the services sector will attract greater investor participation in the long run. In terms of addressing the burgeoning fiscal deficit problem, subsidies will be reduced progressively and the tax base widened over the next five-year period.

Against this background, MIER will be revising upwards its 2010 GDP growth rate to +6.5% yoy from +5.2% previously. Economic growth is forecast to reach +5.2% yoy in 2011. This is supported by consumer and business confidence that remains firm, as measured by MIER’s Consumer Sentiment Index (CSI) and MIER’s Business Conditions Index (BCI), at 110.4 pts and 119.6 pts respectively in 2Q10. All sectoral indices recorded mix performances during this period, however. Private consumption advanced +5.1% yoy in 1Q10 due to strengthening consumer confidence and labour market prospects. Consumer confidence as measured by MIER’s Consumer Sentiment Index (CSI) fell 3.8 pts qoq in 2Q10; indicating cautious finances and employment opportunities. Household loans remained resilient at +12.5% yoy in May 2010. The number of retrenched workers continued to fall to 1,714 in 1Q10. Another indicator of private consumption, sales of passenger cars rose by +15.1% yoy in May 2010. This was also confirmed by MIER’s Automotive Industry Index (AII), which up 11.4 pts qoq in 2Q10 suggesting recovery in the sector. Accordingly, MIER expects private consumption to accelerate by +5.4% yoy in 2010 and further to 6.8% yoy in 2011.

Gross investment eased to +5.4% yoy in 1Q10 following weaker private sector outlay. Moreover, this was supported by a lower MIER’s Business Conditions Index (BCI) of 119.6 pts in 2Q10. In contrast, the Vistage-MIER’s CEO Confidence Index (CEO) settled higher at 129.1 pts in 2Q10. While recent measures such as the New Economic Model and the 10th Malaysia Plan contain some positive initiatives, execution risks and political determination will continue to drive the success in boosting the attractiveness of Malaysia as an investment destination. With stabilising domestic and external conditions, MIER anticipates gross investment to grow by +5.0% yoy in 2010 and be further elevated to +5.5% yoy in 2011. Following strong economic expansion, the fiscal balance to GDP ratio improved to -5.6% in 1Q10. Efforts to maintain this level throughout 2010 may prove to be difficult, especially given recent impediments in the proposed fuel restructuring as well as goods and services tax (GST) schemes. Furthermore, uncertainties from Europe which may cripple global recovery might require extended government pump-priming measures in Malaysia. Hence, MIER forecasts public consumption growth to decline by 0.9% yoy in 2010. Public consumption will then revert back to a positive rate of expansion of around 2.7% in 2011.

During 1Q10, both exports and imports of goods and services accelerated by +19.3% yoy and +27.5% yoy respectively, due to better global dynamics and trade conditions. The rates of expansion in both gross exports and gross imports have somewhat stabilised in April 2010 to May 2010 to +24.2% yoy and +30.5% yoy respectively (1Q10: +30.7% and +35.1% respectively). Moreover, the WTO has predicted a +9.5% yoy growth in global trade in 2010 (-12.2%: 2009), and the Transpacific Stabilisation Agreement recently projected cargo growth of 6.0 – 8.0%. Accordingly, MIER forecasts exports and imports of goods and services to rise by +9.8% yoy and +13.8% yoy respectively, in 2010. Growth rates will then normalise in 2011, to +8.8% yoy and +9.4% yoy respectively.

In tandem with economic recovery and higher global commodity prices, overall consumer price inflation is expected to grow by +2.2% in 2010. MIER anticipates the Overnight Policy Rate (OPR) to remain at 2.75% by end 2010. This is especially useful in assessing the effects of previous rate hikes as well as the repercussions from the European sovereign debt problem. Firmer economic expansion will also help to further lift the OPR to 3.25% in 2011.