4th Quarter 2008 Update: The Malaysian Economic Outlook

Despite concerted interest rate cuts and massive liquidity injection, the global credit crisis continues to deepen with little signs of abating. In November, the IMF had revised its global outlook to be even grimmer, taking into account the deteriorating economic trends. The IMF slashed its global growth forecast to 2.2% in 2009 (2008: 3.7%), from 3.0% in the earlier projections. The latest revision projects the three major economies of US, Europe and Japan heading into recessions in 2009. The US is foreseen to contract the most (-0.7%) in 2009, followed by Europe (-0.5%), and Japan (-0.2%). The World Bank projects the world economy to recover to a 3.9% growth in 2010, from 1.9% in 2009, with major economies returning to positive growth.

Despite concerted interest rate cuts and massive liquidity injection, the global credit crisis continues to deepen with little signs of abating. In November, the IMF had revised its global outlook to be even grimmer, taking into account the deteriorating economic trends. The IMF slashed its global growth forecast to 2.2% in 2009 (2008: 3.7%), from 3.0% in the earlier projections. The latest revision projects the three major economies of US, Europe and Japan heading into recessions in 2009. The US is foreseen to contract the most (-0.7%) in 2009, followed by Europe (-0.5%), and Japan (-0.2%). The World Bank projects the world economy to recover to a 3.9% growth in 2010, from 1.9% in 2009, with major economies returning to positive growth.

The Malaysian economy has been resilient in the first-half of 2008, but is not going to be insulated from the global downturn. As the external sector worsened, GDP growth has subsided to 4.7% in 3Q08 after a strong 7.1% gain in the first-half of 2008 (revised upwards from 6.7%), bringing growth to an average of 6.3% in the first three quarters of 2008. Resilient private consumption, steady public investment and higher fiscal spending supported the growth in 3Q08. Malaysia has no direct exposure to the US market but is increasingly feeling the shock from the slowing global economy through trade and investment linkages.

Fearing a dismal global outlook that would hurt the domestic economy, the government stretched its fiscal deficit to 4.8% in 2008, reversing a 7-year progressive deficit reduction. A RM7 billion stimulus package, to be financed by savings from subsidy reduction, was unveiled in November 2008 as a measure to stimulate domestic demand. The deficit fiscal target for 2009 has also been raised to 4.8% of GDP, from 3.6% previously. This may be justified as difficult times call for drastic measures. However, there are concerns that government revenue would be adversely affected by the falling commodity prices, which could subsequently enlarge the deficit to even exceed 5.0% of GDP, especially now that there is a possibility of an additional stimulus package being introduced by mid-2009. There is also the longer-term worry over the high dependency on oil revenue to finance fiscal spending. With most spending going into construction projects, there are questions over the delivery speed and the potential leakages from payments to foreign workers and the imports of construction materials, which would blunt the multiplier effects.

Monthly indicators up to November 2008 are losing momentum markedly. Industrial output has contracted in three successive months, as the export-oriented sectors faced diminishing demand. Total exports have declined for two months in a row, with imports showing steeper declines, resulting in sustained trade surplus. With prices climbing down, export revenues from commodities are growing at a slower pace. Thanks to reduction in domestic oil prices, inflation has eased to 5.7% in November 2008, down from a peak of 8.5% in August 2008. Inflation will likely subside further in tandem with the softening economy.

In view of the deteriorating global economy and its adverse effects on domestic conditions, Bank Negara has reduced the Overnight Policy Rate (OPR) by 25 basis points to 3.25% on 24 November 2008.

To add liquidity into the system and reduce the cost of funds, the statutory reserve requirement (SRR) has been cut from 4.0% to 3.5% effective December 2008. If domestic conditions worsen, amid subsiding inflation, the OPR may be slashed to 3.0% or even lower. The reduction of interest rate has to be done cautiously as it may unintentionally lead to a weaker ringgit that would push up the cost of imports.

Consumer and business confidence indices have both dropped sharply below the 100-points mark in the final quarter of 2008, the dividing line between optimism and pessimism, as indicated by the results of MIER’s 4Q08 surveys. The Business Conditions Index (BCI), which is based largely on firm-level information, has plunged to 53.8 points in 4Q08, shedding 45.8 points from 99.6 points in 3Q08, indicating that business confidence has deteriorated significantly. Though not as bad, the Consumer Sentiments Index (CSI) has fallen to 71.4 points in 4Q08, down 17.5 points from 88.9 points in 3Q08, as households start to feel the pinch from a softer economy. In addition, MIER’s sectoral indices for retail trade, residential property, tourism and the auto industry have all dropped below the threshold level. The sharp fall in both macro indices and the sectoral indices suggests that the outlook for the Malaysian economy would be dimmer than earlier expected.

In hindsight, when the internet bubble burst in 2001 and OECD countries languished to a 1.2% growth, Malaysia’s growth came to a halt (2001: 0.5%). The IMF predicts the OECD to contract by 0.3% growth in 2009, putting Malaysia’s prospects in jeopardy. The internet crash in 2001 did not lead to a banking crisis and so the recovery was faster. The current crisis has done extensive damage and is nowhere near the bottom. Nonetheless, there are mitigating factors that Malaysia can rely on such as a sound banking system, sizeable foreign reserves, and consistent surplus in the current account.

Given the worsening external conditions, it is likely that Malaysia’s growth will deteriorate in 2009, as it takes the hit from the knock-on effects of a flagging global economy. With limited room for policy flexibility, domestic demand can be propped up by fiscal pump-priming and easier monetary policy, providing a partial cushion to the uncertain global economy. Falling commodity prices are not helping either, but may help put a lid on inflationary pressures. The services sector will be the pillar of strength amidst a weak manufacturing sector.

In light of the deeper declines in macro indicators, the tumble in business and consumer confidence, and the dismal sectoral indices, we are compelled to adjust our estimated 2008 GDP growth to 5.1% from 5.5% previously and to revise our forecast for 2009 downwards to 1.3% from 3.4% earlier. Provided that the global economy bottoms out, as projected by the World Bank with global growth recovering to 3.9% in 2010, a marginal improvement is foreseen for Malaysia’s growth to inch up to 3.8% in 2010.

In light of the deeper declines in macro indicators, the tumble in business and consumer confidence, and the dismal sectoral indices, we are compelled to adjust our estimated 2008 GDP growth to 5.1% from 5.5% previously and to revise our forecast for 2009 downwards to 1.3% from 3.4% earlier. Provided that the global economy bottoms out, as projected by the World Bank with global growth recovering to 3.9% in 2010, a marginal improvement is foreseen for Malaysia’s growth to inch up to 3.8% in 2010.

Editorial

The first quarter of 2009 has just gone by. The past 3 months have evidently shown us that the global economic and financial environment had rapidly deteriorated and this had

a consequent effect on Malaysia’s economic performance as evidenced by the decline in exports and consequential decline in industrial production. 2009 will indeed be a challenging year for Malaysia.

Given such challenges, we must not lose sight of our respective goals.

It is important that we continue to engage and establish business linkages, especially with emerging countries that are not in financial crisis. The linkages we make today may put us in a better position to reap the rewards, when the global financial situation stabilises and recovery is back on track.

MASSA had the opportunity to meet the Minister of Trade and Industry of Egypt and also senior officials from Kyrgyz Republic. These are developing countries with enormous business opportunities. We hope members will continue to look out for opportunities to network and to link-up through MASSA. Do look out for our weekly circulars delivered to you via your email box and/or fax.

Activities organised by MASSA will pick-up speed in the coming months with a number of incoming visitors and field trips planned. An appointment with our incoming new Prime Minister who is MASSA’s patron is also in our diary.

We want to thank all our contributors, namely, Malaysian Institute of Economic Research (MIER), Malaysian Industrial Development Authority (MIDA) and Sabah Economic Development and Investment Authority (SEDIA) for their informative articles in this newsletter.

We also want to thank the Chairman of the People’s Committee of

Danang City, S.R. Vietnam and

their Investment Promotion Center (IPC Danang) for working closely with MASSA to highlight the investment potentials of this beautiful city in Central Vietnam.

Hamidah Tun Ghafar

Editor

President’s Message

What started as a sub-prime mortgage crisis in the United States of America in August 2007 has now spread quickly around the globe, melting down financial markets, crippling the banking system, eroding economic activity and slumping consumer confidence. The contagion is still spreading and the possibility of this global economic downturn morphing into a global currency crisis and/or political crisis cannot be discounted.

In the first half of 2008, economies around the globe faced intense inflationary pressures amidst high prices of oil, food and commodities. This gave way to turmoil in the international financial markets in the 2nd half of 2008, resulting in a sharp deterioration in global economic conditions.

Malaysia with an open economy has not been spared and we should all brace for a downturn. The Malaysian economy registered a growth of 4.6% in 2008, moderating from a respectable 7.1% in the first half year of 2008. Malaysia’s economy in 2008 was sustained by a robust domestic demand due to strong private consumption and strong public spending. The 2nd half of 2008’s economic performance was affected by the sharp and rapid deterioration in the global economic conditions as well as major contraction in our manufactured exports.

As the external downturn may not have bottomed, Malaysia GDP for 2009 may see a downward revision to

-1% to 1% growth.

In these uncertain times, change is inevitable going forward. Countries still need to trade with one another and cross border investments will continue to flow to where there are positive returns. I encourage members to “hang-in” and “hang-on” to your customers and investment partners in these difficult times and work out win-win solutions to ride through the turbulence. There will be opportunity in every crisis and after every downturn, there will be upturns.

In such unprecedented times, we should therefore, evaluate what are the short term and long term risks, where are these risks and how to identify and look for solutions to mitigate them. Our respective corporate goals should be aligned to these realities so that when the upturn returns, we will be able to reap from the pruning measures we painfully take today.

TAN SRI DATO’ AZMAN HASHIM

President

Diary Of Events

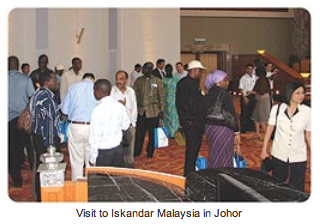

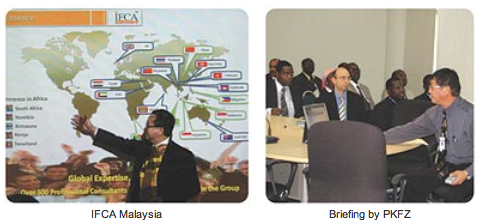

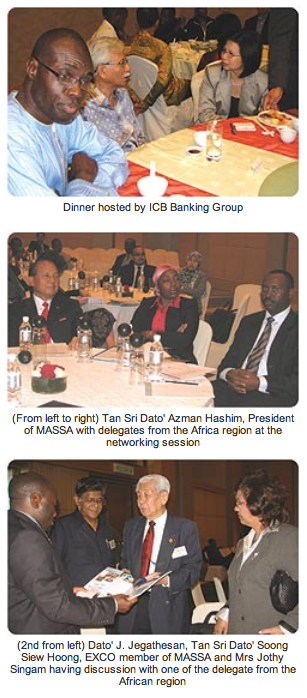

Learning Mission from World Bank Africa Region to Malaysia, 6 – 8 May 2009

The Finance and Private Sector Department in the Africa Region (AFTFP) of the World Bank Group organised an Africa-East Asia Experience Exchange Programme on Special Economic Zones and Competitive Clusters in partnership with the World Bank Institute (WBI), supported by the East Asia and Pacific Region (EAP), the Africa Region (AFR) and the AFR Capacity Development and Partnership Unit (AFRCP). The programme was held from 1 – 12 May 2009, covering Singapore, Malaysia and P.R. China (Shenzhen).

The Finance and Private Sector Department in the Africa Region (AFTFP) of the World Bank Group organised an Africa-East Asia Experience Exchange Programme on Special Economic Zones and Competitive Clusters in partnership with the World Bank Institute (WBI), supported by the East Asia and Pacific Region (EAP), the Africa Region (AFR) and the AFR Capacity Development and Partnership Unit (AFRCP). The programme was held from 1 – 12 May 2009, covering Singapore, Malaysia and P.R. China (Shenzhen).

This initiative, which benefits from the support of multiple World Bank and external partners, facilitated face-to-face discussions on the policy, strategy and technical issues related to the development and implementation of Special Economic Zones (SEZs) and the growth of competitive clusters.

Besides providing a unique opportunity for interaction amongst representatives from African countries on the theme of zones and clusters, it also allowed them to establish contact and interact with Asian investors.

Specifically, this programme sought to:

Specifically, this programme sought to:

- Facilitate the sharing of development experiences on Special Economic Zones (SEZs), Cluster Development, and Foreign Direct Investment (FDI) between African and East Asian countries.

- Build consensus on the development challenges and strategies in these fields.

- Identify possible solutions for Africa’s development bottlenecks.

- Create opportunities for continued interaction and technical exchange between counterparts in Africa and Asia.

19 senior level government officials from 10 African countries and 11 World Bank officers participated

in this event which comprised a series of workshops, field visits and other experience exchange interaction with their Asian counterparts.

MASSA/MASSCORP facilitated the Malaysian part of the programme that was held from 6 – 8 May 2009, whereby the participants visited Iskandar Malaysia, Port of Tanjung Pelepas, Selangor State Investment Centre (SSIC), Port Klang Free Zone, Westport, Multimedia Development Corporation (MDeC) at Cyberjaya and CSF Data Centre. The visits and meetings brought together the high-level representatives of the Sub-Saharan African governments and their Malaysian counterparts from both the public and private sectors, to learn from each other and share views on the developmental experiences. The visit culminated in a briefing and networking session on 8 May 2009, where the participants had individual meetings with 50 Malaysian business people from 32 companies comprising a diverse range of sectors such as education, infrastructure, ICT, construction, trading, etc.

MASSA members meet with Mr Chansa Chipili of Powerflex Ltd, Zambia, 24 April 2009

On 24 April 2009, Mr Chansa Chipili, Managing Director of Powerflex Zambia Limited, visited MASSA and met MASSA members to share business opportunities in Zambia, particularly in the construction of bridges and roads, supply of construction materials, turnkey projects for the construction of a business centre and development of housing and business complexes.

On 24 April 2009, Mr Chansa Chipili, Managing Director of Powerflex Zambia Limited, visited MASSA and met MASSA members to share business opportunities in Zambia, particularly in the construction of bridges and roads, supply of construction materials, turnkey projects for the construction of a business centre and development of housing and business complexes.

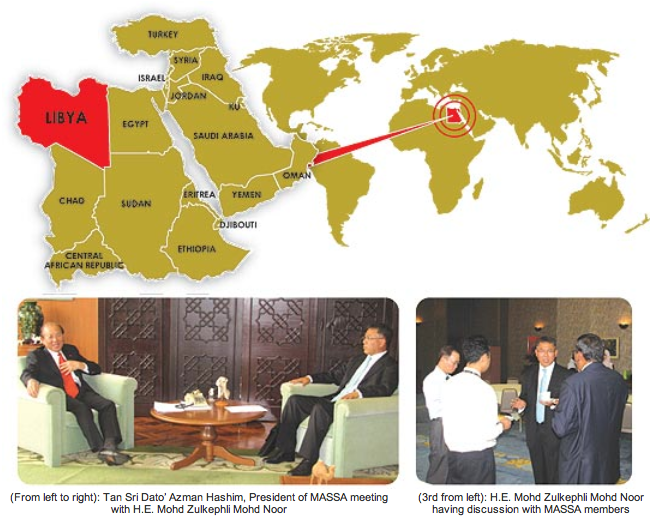

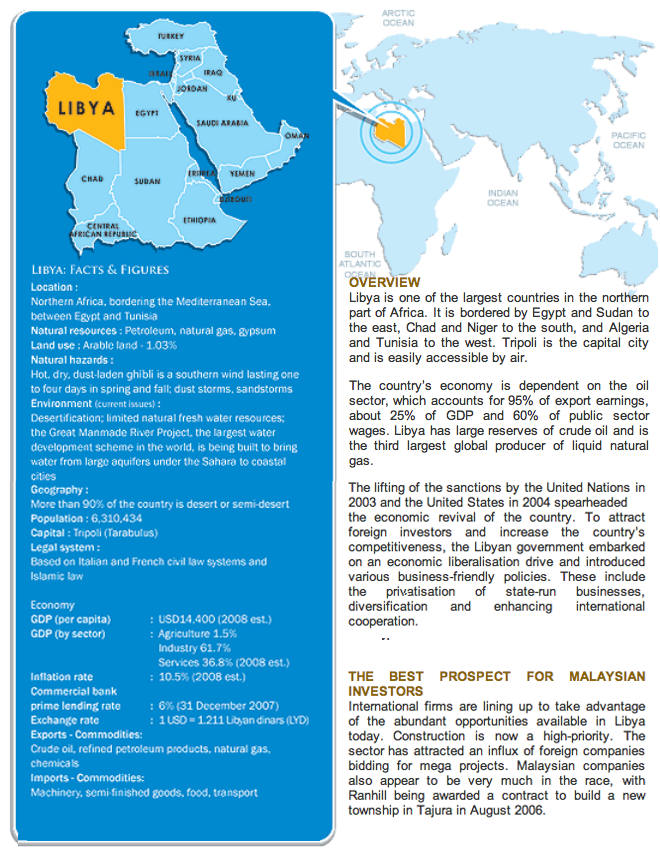

Presentation on Business Opportunities in Libya, 16 June 2009

The new Malaysian Ambassador to Libya, H.E. Mohd Zulkephli Mohd Noor recently gave a presentation to MASSA members on the ‘Emerging Business Opportunities in Libya’.

The Ambassador revealed that Libya offers tremendous investment potential for Malaysian companies. With the normalisation of diplomatic relations with the United States and European Union, the country is now fully reintegrated into the international political and economic community with numerous structural reforms in place. This has resulted in increased foreign investor interest, particularly in the hydrocarbon, banking and infrastructure sectors. Although Libya remains dependent on its substantial hydrocarbon resources, there are plans to diversify the economy into other sectors like tourism and education.

The construction sector is another rapidly developing industry. The Libyan Investment Promotion Board successfully promoted a total of 82 investment projects across all sectors in Libya between 2003 and 2007. There are also 34 tourism projects totaling LYD242 million. These projects include the construction of new hotels, tourism complexes and villages, leisure parks, tourism administration centres, and other tourist-centric facilities. Libya also intends to modernise its financial services sector, encouraging banks to consider strategic partnerships with foreign banks.

Libya at a glance

The fourth largest country in Africa, Libya has a population of around 6 million. It is North Africa’s largest oil producer and accounts for 2.2% of global production. Not surprisingly, its main export earner is oil. In 2009, growth was estimated to reach 6.5% and foreign currency reserve was estimated at USD136 billion.

MASSA 18th Annual General Meeting, 26 June 2009

MASSA recently held its 18th Annual General Meeting on 26 June 2009 at Restoran Seri Melayu, Jalan Conlay,

Kuala Lumpur chaired by MASSA President, Tan Sri Dato’ Azman Hashim.

MIDA – Sustaining Competitiveness In The Current Global Economic Environment

Despite the current uncertainties in the global economic environment, investment inflows into the manufacturing sector in Malaysia continue to be encouraging. During the first three months of 2009, a total of 194 projects involving investments of RM7.4 billion were approved. Foreign investments in manufacturing projects approved during this period amounted to RM3.3 billion, while domestic investments totaled RM4.1 billion. Malaysia continues to attract FDI into the manufacturing and services sector through, among others, Trade and Investment Missions, Specific Project Missions and its network of 19 overseas centres all over the world.

Despite the current uncertainties in the global economic environment, investment inflows into the manufacturing sector in Malaysia continue to be encouraging. During the first three months of 2009, a total of 194 projects involving investments of RM7.4 billion were approved. Foreign investments in manufacturing projects approved during this period amounted to RM3.3 billion, while domestic investments totaled RM4.1 billion. Malaysia continues to attract FDI into the manufacturing and services sector through, among others, Trade and Investment Missions, Specific Project Missions and its network of 19 overseas centres all over the world.

The country’s strong fundamentals, diversified export base and low exposure of local financial institutions to the US subprime market will enable the Malaysian economy to withstand any adverse effects of the global financial crisis. In addition, the first and second stimulus packages introduced by the government, amounting to RM67 billion, are also expected to have positive effects on the manufacturing and services sector.

Complementing the growth and development of the manufacturing sector, the Government is taking steps to promote and develop the services sector. Recognising the growth potential of the services sector, the Government recently liberalised 27 services sub-sectors with no equity restrictions. These sub-sectors are in the areas of computer and related services, health and social services, tourism services and sporting and other recreational services as well as other business services.

The initiatives to liberalise the services sector have been pursued with the view to create a conducive environment to attract investments and technology, as well as to create high value jobs. These efforts are expected to enhance the level of competitiveness of the services sector in the country.

As a measure to further sustain Malaysia’s competitiveness in the services sector, the Government established a Services Sector Capacity Development Fund (SSCDF) to provide financial assistance for capacity building of the domestic services providers. The fund is made available to services sector associations and service providers. The applications for grants are evaluated by MIDA, while applications for soft loans are processed by the Malaysian Industrial Development Finance Bhd (MIDF).

Recently, MIDA disbursed 50% of grants approved to three associations, i.e. the Bumiputra Manufacturers and Services Industry Association of Malaysia (PPIPBM), the Association of Consulting Engineers Malaysia (ACEM) and The National ICT Association of Malaysia (PIKOM) to undertake its qualifying capacity development programmes.

Carrying on the momentum in cross border investments

Even during the current global economic crisis, Malaysian companies continue to undertake investments overseas albeit at a slower pace. Based on Bank Negara Malaysia (BNM) statistics for the period January – March 2009, Malaysia’s overseas investments (excluding Labuan IOFC) amounted to RM6.59 billion compared with RM9.44 billion for the corresponding period in 2008.

Major overseas investment destinations are Thailand, Singapore, Indonesia, Vietnam, China, Hong Kong, Canada, United States, Saudi Arabia, United Arab Emirates, India, Mauritius and Egypt. Key sectors include manufacturing, financing, real estate, insurance, business services, utilities, transport & communication, agriculture, forestry, fishing and construction.

| Updated programmes and activities to be undertaken by MIDA in 2009 |

Malaysia-Singapore Third Country Business Development Fund (MSBDF)

The Malaysian and Singaporean Governments continue to encourage businessmen and companies in both countries to collaborate to venture into third countries. Towards this end, the Malaysia- Singapore Third Country Business Development Fund (MSBDF) has been set up to encourage business enterprises from both countries to team up and jointly identify business opportunities in third countries. The fund is a matching grant that can be used for joint missions, joint feasibility studies (target specific due diligence studies or pro-active searches) and joint market research in third countries prior to committing an investment.

In January 2009, to further enhance the utilisation of the fund, MIDA and International Enterprise Singapore (IES) completed reviewing the enhancement of the fund based on proposals submitted by the Federation of Malaysian Manufacturers (FMM) and Singapore Manufacturers Association (SMA).

Among the improvements made are as follows:

- Expansion of scope of fund to include joint market research (by associations).

- Flexibility in terms of submission of two years’ audited financial statements, whereby applicants are allowed to submit the documents at the point of claim instead of at point of application.

- Fine-tune and simplify the MSBDF forms i.e. only two forms for application of the fund (BDF1-2009) and submission of claims (BDF1A-2009).

- Deletion of the need to register interest with MIDA and IES before commencing the activity.

- Flexibility in terms of the 60:40 participation ratio for joint mission, provided that such flexibility will not undermine the need to ensure a balanced participation from both countries.

- Inclusion of new items to be considered as eligible expenses to claim for the grant, i.e. costs related to organising a promotional seminar locally, advertisement in local newspaper and informal networking session.

To ensure that the objective of the fund is achieved, MITI and MIDA aim to promote the fund extensively by creating awareness in the Malaysian private sector. MIDA will continue to work together with Malaysia South-South Association (MASSA) to assist Malaysian companies in the pursuit of business opportunities in both developed and developing countries. Malaysian businessmen should seize the business opportunities available abroad, in view of the benefits which can be accrued for both their companies and our country.

| Contact us Malaysian companies requiring assistance in undertaking business activities abroad can seek assistance from MIDA. |

1st Quarter 2009 Update: Malaysian Economic Outlook, 2009 – 2010

Both the World Bank and the IMF are projecting the world economy to slide into a deeper recession in 2009. The latest revision projects the three major economies of US, Europe and Japan falling into deeper recessions in 2009. Japan is foreseen to contract the most (-5.8%) in 2009, trailed by Europe (-3.2%), and the US (-2.6%). The IMF projects the world economy to recover to around 1.5 – 2.5% growth in 2010, with the US recording a meagre 0.2% growth in 2010.

Both the World Bank and the IMF are projecting the world economy to slide into a deeper recession in 2009. The latest revision projects the three major economies of US, Europe and Japan falling into deeper recessions in 2009. Japan is foreseen to contract the most (-5.8%) in 2009, trailed by Europe (-3.2%), and the US (-2.6%). The IMF projects the world economy to recover to around 1.5 – 2.5% growth in 2010, with the US recording a meagre 0.2% growth in 2010.

Given the deteriorating global economic prospects, a second stimulus package amounting to RM60 billion (about 9% of GDP) was unveiled in March 2009. The RM7 billion in the first package (November 2008) was deemed to be insufficient to counter the deepening crisis. Although the second package appears larger, the actual direct spending is only RM15 billion (or 25% of the total) to be disbursed over a two-year period. Other measures introduced are in the form of loan guarantees, investment through Khazanah and tax incentives. The loan guarantees will only work if there is demand from businesses, which is lacking at this point of time. The recurring concerns have been the speed and efficiency of implementation and the potential leakages. A notable point is the greater attention given to retrenched workers and unemployed graduates.

In view of the deteriorating global economy and its adverse effects on domestic conditions, Bank Negara reduced the Overnight Policy Rate (OPR) by 50 basis points to 2.00% on 24 February 2009, the third time in five months. Bank Negara has slashed 1.50 percentage points from 3.50% since November 2008. To add liquidity into the system and reduce the cost of funds, the statutory reserve requirement (SRR) has been progressively cut from 4.0% in November 2008 to 1.0%, effective March 2009. Bank Negara has noted that lower rates could hurt savers and those who rely on incomes from deposits.

Consumer and business confidence has remained depressed in 1Q09, but the indices have registered minor gains. Both the Business Conditions Index (BCI) and the Consumer Sentiments Index (CSI) have stayed way below the 100-points threshold that separates expansion and contraction. Despite the sharp declines in monthly indicators, the minor rise in confidence could have been propped up by the release of the second stimulus package.

The recovery from the current crisis will be difficult compared to previous ones because the scale has reached global proportions. It will take time and huge resources to revive the deeply entangled US financial sector, while policy options are running out. The weak external sector will impede a faster recovery, and the lower commodity prices are not helping either. Banks are becoming more cautious, limiting the flow of funds to firms. Domestic demand would be shored up by fiscal pump-priming and an easier monetary policy, providing a partial cushion to the sagging Malaysian economy. The services sector will be the pillar of strength amidst a glum manufacturing sector. It is almost certain that Malaysia’s growth will slide into a technical recession in the first half of 2009, as it takes the hit from the knock-on effects of a flagging global economy.

In the light of the deep declines in macro indicators, the gloomy business and consumer confidence, and the dismal sectoral indices, we are obliged to revise Malaysia’s growth forecast for 2009 downwards to -2.2% from +1.3% earlier. If exports shrink severely, the downturn could be more harmful. We have also downgraded the 2010 growth forecast to 3.3%, from 3.8% previously, in view of the anticipated gradual and bumpy recovery in the global economy.

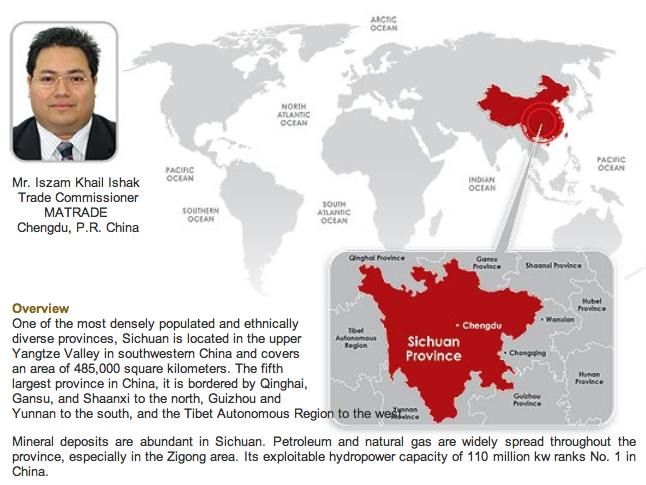

Sichuan Province, People’s Republic Of China

Along with the considerable industrial development over the years, Sichuan has become the strongest province in western China in terms of overall economic strength. It has a good natural environment, abounds in specialty products and has an ample labour force.

Economic growth is especially pronounced in Chengdu, Mianyang and Leshan. Its total value of production and social commodity retail account for a quarter of the total for all the 12 provinces and autonomous regions in west China.

Chengdu, the provincial capital, is the trading, transportation, industrial, and cultural center of the western part of China. As the key city of the ‘Chengdu-Chongqing Economic Zone’, Chengdu covers an area of 12,400 kilometers, with a total population of more than 11 million.

Economy Indicators

The economy in Sichuan has grown steadily and in a sustainable way. In 2008, this economic powerhouse’s provincial GDP reached RMB1.25 trillion or USD182.89 billion, ranking 9th in the country and 1st in western China.

The principal economy indicators of Sichuan:

* b – Billion; All figures are official and updated till end year 2007.

External Trade

External Trade

In 2008, despite adverse factors such as the global financial crisis and the powerful earthquake on 12 May 2008, foreign trade in Sichuan continued to progress significantly. Total exports amounted to USD13.11 billion, a year-to-year increase of 52.3%. Major exports included integrated circuits (IC) and micro-electronics, garments, steel products, boilers, drilling machinery and accessories. Major exports destinations were Hong Kong, USA, India, Indonesia, Russia and Japan.

Total imports in 2008 were valued at USD8.93 billion, an increase of 54.7%. Major imports were integrated circuits (IC) and micro-electronics, minerals, steel products, automotive and spare parts, measuring, testing and analysing auto-control apparatus, mainly from the USA, Japan, Hong Kong, Germany and South Korea.

Bilateral Trade with Malaysia

Sichuan and Malaysia enjoy a good bilateral trade relationship. In 2008, total trade value between the two countries amounted to USD507.29 million. Sichuan’s total exports to Malaysia in 2008 were valued at USD415.27 million, which is 3.2% of the total provincial export value. Major exports to Malaysia are electrical and mechanical, cereals and oil products, livestock and agri-products, light industry and textile products, construction material, chemicals and by-products. However, in the same year, Malaysia’s exports to Sichuan dropped 25.7% year-to-year to USD92.02 million, which is a mere 1.0% of the provincial total import value. Major imports from Malaysia are palm oil, rubber, wood and base metal.

New Opportunities in Sichuan

A recent study has shown that there will be a provincial demand for major construction materials from 2008 to 2010. The shortage of construction steel products is forecast at 11.3 million tons; the shortage for cement at 30.8 million tons, and the shortage for timber at 5.45 and 4.95 million cubic meters over the next two years respectively.

Chengdu presents numerous new opportunities for trade and investment. According to the city government’s strategic plan, six industry bases will be developed in the area, covering information technology, machinery/automobile, pharmaceutical, food/tobacco, metallurgy/construction-material and petroleum products, to gradually form industrial zones aimed at hi-tech, manufacturing and characteristic sectors. Halal food is another area that can be explored since Sichuan is the gateway to neighbouring provinces where there is a high demand for Halal products.

Chengdu presents numerous new opportunities for trade and investment. According to the city government’s strategic plan, six industry bases will be developed in the area, covering information technology, machinery/automobile, pharmaceutical, food/tobacco, metallurgy/construction-material and petroleum products, to gradually form industrial zones aimed at hi-tech, manufacturing and characteristic sectors. Halal food is another area that can be explored since Sichuan is the gateway to neighbouring provinces where there is a high demand for Halal products.

With a population of more than 87 million, Sichuan holds many opportunities for the education sector, especially when it comes to attracting Chinese students to study in Malaysia for tertiary education. The setting up of international schools is another sector with great potential due to the influx of foreign expatriates to the province as 135 of the top 500 Fortune companies have their operations here. Currently, there are three National Development Zones in Sichuan, comprising two Hi-tech Industrial Development Zones and one Economic and Technological Development zone. In addition, Export Processing Zone has been set up in Chengdu Hi-tech Industrial Development Zone.

The Western China Development and designated National Development Zones in Sichuan offers a number of favourable policies for foreign investors including taxation advantages, helpful administration personnel, quick customs clearance, easy-to-obtain production permits and so much more.

| For further enquiries, please contact MATRADE Chengdu at: Malaysia External Trade Development Corporation, Chengdu Representative Office, Level 14, Unit 1402-1404, The Office Tower, Shangri-La Centre, 9 Binjiang Road East, Chengdu 610021, Sichuan Province, People’s Republic of China. |

| Telephone : +86 28 6687 7517 | Facsimile : +86 28 6687 7524 | Email : chengdu@matrade.gov.my |

Editorial

The time has come for me to bid “adieu” to MASSA. As I look back to 1991 when MASSA was incorporated, it has been a wonderful journey of discovery that led to many friendships, business linkages, partnerships and more importantly, life’s lessons. It has been a rewarding time being associated with MASSA.

The fascination of a new country, the many exploratory trips that filtered down to serious business and eventually the “stress” of undertaking cross-border business with profit as the bottom – line and coupled with the constantly evolving regulatory and competitive landscape of the global business environment, I can only say that it has been an exhilarating roller-coaster of unmatched experience!

MASSA has come a long way in its 18 years of existence and I am proud to say that it has grown in stature and relevance. It is my sincere hope that my contributions, as editor of the MASSA newsletter, has helped to document MASSA’s journey in the developing world, thus far. I want to thank my team in the editorial committee for the excellent cooperation in the production of all the past issues of the newsletter.

I want to encourage MASSA members to stay engaged with and through MASSA and I wish all members every success in your respective South-South endeavours and to keep the Malaysia flag flying high.

Last but not least, I take this opportunity to thank the President and my fellow committee members for the “comradeship” over the years and I wish one and all, every success, good health and God’s Blessings.

Hamidah Tun Ghafar

Editor

President’s Message

Malaysia’s Gross Domestic Product (GDP) for the first quarter of the year registered a sharp contraction of 6.2%. This was mainly due to a sharp decline in exports and industrial production as well as reduced investment activities. This contraction was in tandem with the weakening of the world’s major economies.

Going forward to the second half of 2009, there are signs indicating that the free-fall of the world economy has halted, thus raising hopes for economic stabilisation to take its root. Given the improving macro-data, earnings revision and expansive Government spending filtering through to the real economy, Malaysia’s economy, barring unforeseen circumstances, may be turning the corner. While it may be too early to talk of “green shoots”, we must still be vigilant of external headwinds beyond our control that can impact our recovery process.

Recent Government announcements had highlighted the need for the services sector to contribute up to 70% of Gross Domestic Product by 2020 (currently at 54%). This significant target and shift is to ensure that Malaysia will benefit from the competitive dynamics that have been shaping the global market place for ideas, talents and funds. An enhanced services sector will plug Malaysia into the new world order that has been fast evolving. It is crucial for Malaysia to remain a competitive FDI destination.

The equity liberalisation in 27 services sub-sector announced by the Government in April 2009 heralds a new wave of business opportunities for Malaysian companies. I encourage members to explore and seize these opportunities as they would equally benefit your investments in the developing countries.

The current world financial crisis is also opening-up investment and business opportunities in many developing economies for Malaysians. MASSA stands ready to assist those interested to utilise our contacts and network.

We bid farewell to Cik Hamidah Tun Ghafar, our Assistant Honorary Secretary and Editor of our Newsletter, who retired at our 18th Annual General Meeting. We thank her for all her contributions to the Association, especially in the production of our newsletters. We welcome Puan Fatimah Sulaiman who was elected in place of Cik Hamidah Tun Ghafar. The retiring Committee for 2007 – 2009 was re-elected to serve for the new term 2009 – 2011. I thank the Committee for its commitment and dedication and look forward to working together in the future.

TAN SRI DATO’ AZMAN HASHIM

President

Doing Business In Libya

Tourism is also a fast growing sector as the country is blessed with natural wonders – from its beautiful beaches and magnificent desert landscapes to UNESCO World Heritage sites. Local and international investors have already committed USD2.44 billion to tourism projects, including the development of hotels and other tourism-related infrastructure.

Tourism is also a fast growing sector as the country is blessed with natural wonders – from its beautiful beaches and magnificent desert landscapes to UNESCO World Heritage sites. Local and international investors have already committed USD2.44 billion to tourism projects, including the development of hotels and other tourism-related infrastructure.

The financial sector is undergoing a major transformation. In 2007, 19% of the state-owned Sahara Bank was sold to France’s BNP-Paribas. Other Libyan banks are also being encouraged to consider strategic partnerships with foreign banks. There are plans to give licenses to foreign banks in 2010 to start operations in Libya – either in partnership with Libyan banks or independently. Reforms that have been introduced include a new law governing the independence of the central bank, the recognition of international and supervisory standards, electronic payment, and risk management technology.

The growing demand for healthcare services provides many investment opportunities. Libyans are increasingly looking to the private sector in search of better healthcare. In fact, the number of Libyan and expatriates travelling abroad for treatment is also rising. As a result, partnerships and collaborations have been flourishing throughout Libya. Education and training are essential to a policy of diversification. Neither the school system nor the higher education or vocational systems in Libya are producing the trained workforce that is needed to support a free market economy. Recognising this, the Libyan government is looking for partners to help modernise and update its numerous vocational training institutions.

SEIZING OPPORTUNITIES

The country is now reaping the benefits of its growing economy and tremendous investment potential. Foreign companies have a significant presence in the country especially in construction, tourism, real estate, property, services and banking.

The investment boom is apparent. Ongoing construction projects are everywhere, and trading and commercial activities are on the rise every day. A new law for the promotion of foreign capital investment has also created a very favourable investment climate.

Recognising the importance of a free trade area to the country’s economy, the Libyan Government developed the Misurata Free Zone (MFZ). Among the incentives offered to potential investors here are exemptions from registration requirements in the trade, import and export registry, custom duties and taxation as well as local tariff for water and power. All stocks and shares, financial exchanges and money transfers are exempted from taxes, additional charges and fees.

UNDERSTANDING THE LOCAL BUSINESS CULTURE

As far as doing business in Libya is concerned, Malaysian companies lack physical representation. In Libya’s unique business culture, deals are normally sealed based on the strength of the personal relationship between locals and their prospective foreign partners.

Potential investors should enter the Libyan market with an understanding that the overall business process may take longer than expected. Successes in small and less significant projects will eventually lead to bigger deals. In economic diplomacy, it is not only numbers that matter but the strength of soft diplomacy, i.e. establishing personal contacts and a good rapport will help ensure a win-win outcome for all. It is imperative for Malaysian businessmen to note that understanding these cultural differences is the key to successful business negotiations in Libya.