From The MATRADE Desk: Province Of Guangdong, China

Profile Of Guangdong Province (2007)

Location:

Located at 20°13 – 25°31 North Latitude and 109°39 – 117°19 East Longitude and at the south-eastern part of the mainland of China. Guangdong is near the Nanling mountain range. It borders the Hunan, Jiangxi, Guangxi and Fujian provinces, and faces the South China Sea in the south. It is in the tropical and subtropical monsoon climate zone.

| Provincial capital | : Guangzhou | |

| Population | : 94.49 million | |

| Area | : 179,800 sq. km (1.87% of China) | |

| GDP | : RMB3.06 trillion | |

| GDP – (Growth) | : 14.5% | |

| GDP – (Per capita) | : RMB32,713, + 12.9% (USD4, 273) | |

| Per capita disposable income | : Urban | : RMB17, 699 |

| Rural (net) | : RMB5, 624 | |

GDP – (By Sector – 2007)

Primary Industry:

(agriculture such as farming, forestry, animal husbandry, fishery) RMB174.62 billion, + 3.3%

Secondary Industry:

(manufacturing & construction) RMB1.59 trillion, + 16.9%

Tertiary Industry:

(service sectors such as banking, insurance, tourism, hotels) RMB1.29 trillion, + 13%

External Trade

Total trade value:

USD634 billion, + 20.2% (USD451.33 billion, + 13.57% Jan to Aug, 2008)

Total exports value:

USD369.25 billion, + 22.2% (USD261.89 billion, + 13.46% Jan to Aug, 2008)

Total imports value:

USD264.8 billion, + 17.5% (USD189.43 billion, + 13.73% Jan to Aug, 2008)

| Total foreign direct investment (FDI) | ||

| Contracted value | : USD33.94 billion, + 38.1% | |

| Utilised value | : USD17.13 billion, + 18% | |

| No. of projects | : 9,506, + 12.5% | |

Major exports:

Major exports:

Garments and accessories, plastic, toys, furniture and parts, automotive and accessories, printing circuits, fault circuit protection devices& parts, auto data processing equipment accessories, iron& steel, yard & its products, TV sets, radio & parts, telephones, monitors, etc.

Major imports:

Crude oil, LCD boards, automotive and accessories, integrated circuits, diode and semiconductor components, fault circuit protection devices& parts, auto data processing equipment accessories, iron & steel, copper, yard & its products, primary plastic products, waste paper, etc.

Major export destinations:

U.S.A., Netherlands, U.K., Germany, Japan, Hong Kong

Major import origins:

U.S.A., Germany, Japan, Hong Kong, South Korea, Taiwan

| Bilateral Trade With Malaysia | ||

| Total trade value | : USD14.48 billion, + 28% | |

| Total exports value | : USD3.39 billion, + 34.5% | |

| Total imports value | : USD11.09 billion, + 26.2% | |

| Foreign direct investment (FDI) with Malaysia | ||

| Contracted value | : USD158.13 million, + 16.2% | |

| Utilised value | : USD52.67 million, – 4.23% | |

| No. of projects | : 51 | |

Major exports to Malaysia:

Garment & apparel, auto data processing equipment & parts, auto data processing equipment accessories, static converters, yarn & its products, aluminum, furniture & parts, shoes, etc.

Major imports from Malaysia:

Integrated circuits, edible plant oil, diode and semiconductor components, primary plastic products, auto data processing equipment & parts, auto data processing equipment accessories, waste aluminum, refined oil, etc.

Economic & Technological Development Zones

The Pearl River Delta (PRD) Economic Zone

The Pearl River Delta (PRD) Economic Zone

- The economic hub of Guangdong Province

- Covers the following 13 cities and counties (districts) of Guangzhou, Shenzhen, Zhuhai, Foshan, Jiangmen, Dongguan, Zhongshan, Huizhou city, Huidong county, Poluo county, Zhaoqing city, Gaoyao and Sihui

- Accounts for 31% of China’s GDP in 2005, with RMB5,655.75 billion

Major Economic & Technological Development Zones

Guangdong has 11 state-level economic and technological development zones, 6 bonded zones and 59 provincial-level economic and technological development zones. The four major state-level economic development zones include the city of Guangzhou, Zhanjiang and Huizhou.

Guangzhou Economic & Technological Development Zone

It is located in the center of Zhujiang Delta, adjoining Hong Kong and Macao. There are convenient communication conditions for investors from over 28 countries and areas. 47 among the top 500 famous multi-national enterprises have invested in this area.

Zhangjiang Economic & Technological Development Zone

It is one of the first national development zones in the open coastal cities of China. While the climate of this area is pleasant, convenient communication conditions and complete infrastructure facilities ensure an attractive investment environment. The development zone will adopt an open policy and a new system of management & service.

Huizhou Dayawan Economic & Technological Development Zone

Adjoining Shenzhen, this area is located 60km or 47 nautical miles away from Hong Kong. Huizhou Port is one of the better deepwater ports in South China. It has the potential of having 100 berths above 10,000 tonnage. There are currently two 35,000 tonnage berths, one 150,000 tonnage berth and one 10,000 tonnage berth which have been built. Over ten countries and areas have invested in this area. The Nanhai petrochemical project has been approved by the State Planning Commission. This is the biggest joint venture project in China now. Its total investment value is USD4.46 billion.

Guangzhou Nansha Economic & Technological Development Zone

It lies in the southeastern part of Panyu. It is 38 nautical miles away from Hong Kong, 41 nautical miles away from Macao, and 54km from Guangzhou. Guang-Shen-Zhu Expressway crosses the development zone. The development zone owns the condition of building deepwater port.

Potential Sectors Where Malaysians Can Collaborate With Guangdong Companies

Electronics and Information Industry

Electronics and Information Industry

-

Guangdong has become one of the most important bases of IT products in China.

-

Concentrated on the Pearl River Delta Region, particularly in Shenzhen, Guangzhou, Dongguan, Huizhou, Foshan and Zhongshan, a famous “corridor of electronic and information industry” has taken shape.

Electronic Appliance and Machinery Industry

Guangdong’s household electric appliance industry has proven to be as important to its country, being a key export base in China, as it is to the world. Because of its varied offerings, well-developed support system, good quality of products, and creativity in developing new products, Guangdong has for a long time maintained its leading position in the country in terms of production, export and competitiveness of household electric products. In the field of audio and visual equipment manufacturing including colour TVs, laser disc players and hi-fi systems, it ranks first in China in terms of competitiveness.

Textiles and Garments Industry

Guangdong is an important producing and exporting base for China’s textile industry. It is also the third largest exporting base in the world for garments. Guangdong’s textiles rank first in China in terms of: variety, quality, brand, total value of industrial output and sales. In 2006, Guangdong’s garment and textile industry developed first with an export volume of USD28.71 billion, increasing by 16.3%.

Food & Beverage Industry

Guangdong is a big producing and exporting province for China’s food and beverage industry. A firm focus on technical improvement and technology transfer from abroad have ensured its foodstuff industry boasts the highest standards of quality. With this obvious advantage, its beverages, baked & roasted food, health products and condiments, including a number of famous brands, are among the leading products in China.

Construction Materials Industry

Guangdong is a province with a strong construction material industry. The economic aggregate of this industry tops the highest level in the country. In 2006, the growth rate of the industry was at 30.8%. The great variety of products and strong support system make it a pillar industry in Guangdong.

Automobile Industry

Automobile Industry

Guangdong’s automotive industry is among the top in China. In recent years, Guangdong has made great efforts to create a favourable investment environment to attract more foreign investments, restructure the automobile industry, expand production scale and improve manufacturing capability. A number of famous carmakers such as Honda, Isuzu, Nissan and Toyota have settled in Guangdong.

Sources:

http://www.gddoftec.gov.cn

http://guangdong.mofcom.gov.cn

http://www.gdstats.gov.cn

http://www.tdctrade.com

Editorial

November was a busy month for MASSA, thanks to INTRADE Malaysia 2008 which brought in many business delegates from around the globe. MASSA had the privilege of meeting up again with “old acquaintances” as well as establishing new business linkages.

As the year comes to a close, we want to express our thanks to MIDA and MATRADE for the continuing collaboration to help Malaysian businesses to establish business linkages with the developing countries.

The collaboration to organise “Showcase Malaysia” in Dhaka, Bangladesh this year was well received and we hope to make this an annual affair with members’ support.

The Cross Border Investment (CBI) seminars organised with MIDA, are also informative and useful for members, as these seminars assist to identify emerging trends and business opportunities. We welcome the collaboration with the various Embassies and High Commissions of the developing countries to assist in our endeavours to locate these windows of opportunities.

As we brace ourselves for the economic uncertainties resulting from the global financial crisis, let us continue to network through MASSA for South-South opportunities.

We would like to record our appreciation to the sponsors who have made the four publications of our newsletter for 2008 possible.

As we usher in the New Year, we in the editorial team, wish all members and readers “Season’s Greetings” and a “Happy and Productive 2009”!

Hamidah Tun Ghafar

Editor

President’s Message

2008 has been an awesome year of highs and lows on the financial and economic fronts. The financial crisis that imploded onto the global stage is still unfolding and is expected to result in economic contraction in the developed economies for the coming year. Malaysia can expect a resultant knock-on effect.

Our GDP (Gross Domestic Product) growth is expected to moderate to 3.5% for 2009, whilst the threat of accelerating inflation is dissipating with the lowering of fuel and commodity prices. As Malaysia is a major trading nation, we must be vigilant of the impact of economic volatility that has been unprecedented in these times.

I am pleased to note that our Government is taking action to avert a sharp decline in our economic environment and to ensure that businesses face minimum inconvenience whilst maintaining social stability. The current global crisis requires a global concerted response that must also complement domestic measures.

Although, such circumstances may seem to be a threat to our economic progress, it also presents opportunities. It is on this note that I wish our members and readers to look beyond the “trees in the forests”. The developing countries of the South still have a lot of resources and many are in a good position to overcome and benefit from the challenges.

MASSA will be on the lookout for these emerging trends and opportunities for members.

As the year comes to a close, I wish to express MASSA’s gratitude to our Government for their continuing support of our activities and initiatives.

To all MASSA members and Executive Committee members, I thank you for your valuable participation and contribution to the Association and wish you and your families “Season’s Greetings” and a “Happy and Successful 2009”!

TAN SRI DATO’ AZMAN HASHIM

President

Diary Of Events

Visit of Minister of Trade and Industry

of Egypt, 3 – 6 January 2009

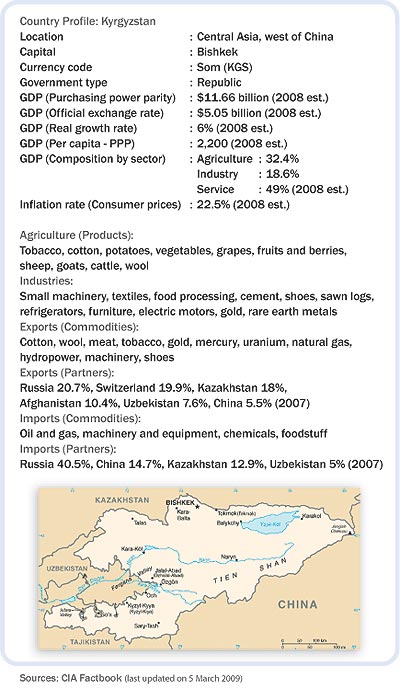

Visit of Economic Delegation from Kyrgyz Republic to MASSA on 17 March 2009

An economic mission led by H.E. Akylbek Japarov, Minister of Economic Development and Trade of the Kyrgyz Republic visited Malaysia recently and met with representatives from the Government and private sector. Mr Maksutov Nurbek, Head of the “One Stop Shop” Investment Promotion Unit of the Investment Policy Department, Ministry of Economic Development and Trade of the Kyrgyz Republic, led a delegation to MASSA to meet its members.

The Kyrgyz Republic has a 5 million population and has many areas for potential business linkages. These include:

Hydropower energy: The development of hydroelectric power stations holds great potential for private investors considering eco-friendly projects.

Mining Sector: The country has abundant mineral resources like gold, mercury, antimony, rare metals, tin, tungsten, coal and underground mineral water.

Agriculture: Opportunities abound in the reprocessing of agriculture products as well as the export of the finished goods abroad. This include:

Meat : 187,600 tons

Milk : 1197,600 tons

Wool : 10,600 tons

Tourism: There is huge potential in tourism as the country has unique natural wonders and rich cultural/historical offerings.

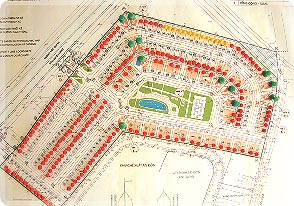

MASSDA Land Company Limited – Developer of Fortune Park at Son Tra District, Danang City, Vietnam

The Danang Industrial Park or Danang IP is a Malaysian-Vietnamese Joint Venture that was established in 1993. It is developed and managed by MASSDA Joint Venture Corporation, which is co-owned by MASSCORP-Vietnam Sdn Bhd and Danang Investment and Development Fund (DDIF). DDIF is a state financial organisation which was established with the purpose of receiving budget funds, mobilising funds from foreign and local organisations and individuals for investing in the development of socio-economic infrastructure of the city.

Danang City’s strategic and central location in the centre of Vietnam offers investors distinct inherent advantages. It is the third largest city in Vietnam and is the gateway to Myanmar, Laos, Cambodia, Southern China and North-East Thailand. Danang Industrial Park is bounded by the Ngo Quyen Road from the west and villages on the other three sides that are a source of labour for the park. Tien Sa Sea Port is approximately 7km north of the site and the International Airport and central business district of Danang City are approximately 7km and 2km west, respectively, from Danang IP.

The developer of the zone takes advantage of Malaysian expertise and experience to operate a one-stop centre in collaboration with the provincial Government authorities to provide services to potential investors in all matters ranging from investment licence applications to construction of the factories and recruitment of workers. Malaysian directors regularly visit the zone to provide hands-on input in the management and administration of the zone. The uptake of industrial land in Danang Industrial Park has achieved 98% to-date with 43 investors ranging from garment producers, industrial gloves, ICT, candle manufacturers, medicinal lotions, ceramic tiles, shoes, etc as well as service organisations like banks and logistic companies. The park provides employment for approximately 12,000 workers.

The developer of the zone takes advantage of Malaysian expertise and experience to operate a one-stop centre in collaboration with the provincial Government authorities to provide services to potential investors in all matters ranging from investment licence applications to construction of the factories and recruitment of workers. Malaysian directors regularly visit the zone to provide hands-on input in the management and administration of the zone. The uptake of industrial land in Danang Industrial Park has achieved 98% to-date with 43 investors ranging from garment producers, industrial gloves, ICT, candle manufacturers, medicinal lotions, ceramic tiles, shoes, etc as well as service organisations like banks and logistic companies. The park provides employment for approximately 12,000 workers.

In 2008, MASSDA Joint Venture Corporation was re-registered as MASSDA Land Company Limited and was also given the approval to incorporate a residential development on 70,939m2 of land north-east of Danang Industrial Park. The development is a gated community that will feature double-storey link houses, linked villas (semi-detached) and villas with contemporary designs by Malaysian architect and consultants.

In 2008, MASSDA Joint Venture Corporation was re-registered as MASSDA Land Company Limited and was also given the approval to incorporate a residential development on 70,939m2 of land north-east of Danang Industrial Park. The development is a gated community that will feature double-storey link houses, linked villas (semi-detached) and villas with contemporary designs by Malaysian architect and consultants.

The groundworks for the infrastructure development for the residential area commenced in December 2008 and is expected to be completed by April 2009.

Sales of the residential units will be launched soon after. A pre-sale launch registration exercise had indicated keen interest from the public to purchase the residential units. MASSDA Land Company Limited is confident that this residential development, aptly named Fortune Park @ Son Tra, will become a landmark address for Danang City.

Sales of the residential units will be launched soon after. A pre-sale launch registration exercise had indicated keen interest from the public to purchase the residential units. MASSDA Land Company Limited is confident that this residential development, aptly named Fortune Park @ Son Tra, will become a landmark address for Danang City.

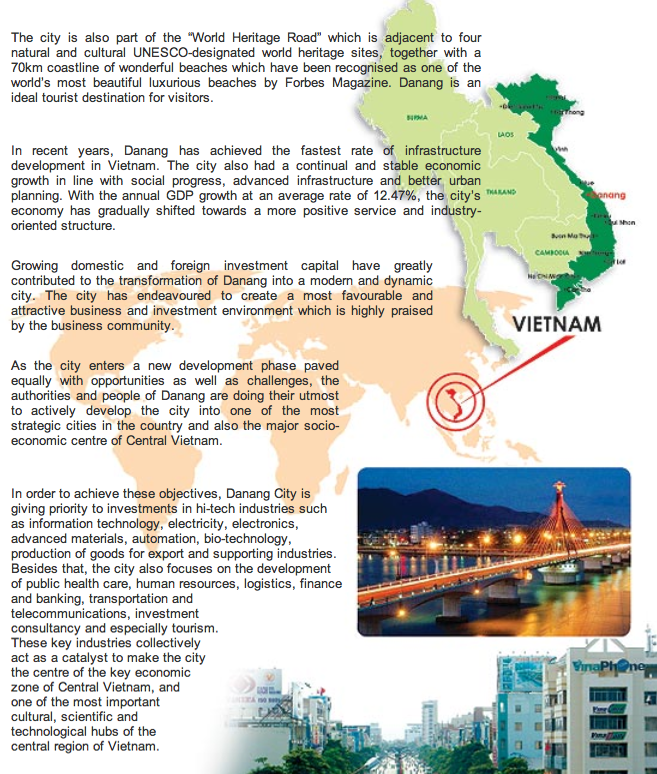

Foreign Direct Investment in Danang

Since being placed directly under the Central Government in 1997, Danang City has shown steady steps of development growth to be one of the economic, cultural and technological centres of the Central region and in Vietnam. One of the numerous factors that have contributed to the socio-economic development of the city is investment capital sources.

Since being placed directly under the Central Government in 1997, Danang City has shown steady steps of development growth to be one of the economic, cultural and technological centres of the Central region and in Vietnam. One of the numerous factors that have contributed to the socio-economic development of the city is investment capital sources.

The ability of the city to attract foreign direct investment can be attributed to its strategic location in the Central region of Vietnam, the infrastructure of its international airport, its deep water seaports, the North-South land routes, its national railways, an abundance of hardworking and highly skilled human resources as well as the Danang City’s authorities commitment to upgrading and investing in industrial infrastructure, improving and streamlining administrative procedures. In addition, the city has envisaged a number of incentive policies and procedures to create a favourable and attractive investment environment, especially in offering free undertaking land clearance and offering competitive land rental prices. One of the major steps taken to create favourable conditions for investment activities in Danang is the establishment of the Investment Promotion Centre and the promulgation of a one-stop shop policy to promote domestic and foreign investment as well as to facilitate investment licensing in Danang City.

As of end 2008, the city has licensed 147 FDI projects with a total capital of USD2.5 billion. Most of the projects are in real estate, tourism services and industrial manufacturing. FDI projects have contributed considerably to innovating local technologies, diversifying more business lines and new products, expanding markets, as well as boosting export value and creating tens of thousands of jobs for local labourers.

As of end 2008, the city has licensed 147 FDI projects with a total capital of USD2.5 billion. Most of the projects are in real estate, tourism services and industrial manufacturing. FDI projects have contributed considerably to innovating local technologies, diversifying more business lines and new products, expanding markets, as well as boosting export value and creating tens of thousands of jobs for local labourers.

The city’s achievement of topping the 2008 Provincial Competitive Index has proven that the business and investment environment of Danang is one of the most attractive and investor-friendly places for business in the country. Several landmark projects, namely Danang World Trade Centre, Indochina Riverside Tower, Da Phuoc international new town, Jade Residence Danang Centre, Golden Square, Far East Meridian and True Friends Park, have contributed significantly to changing the face of the city.

Presently, Danang has six main industrial zones, namely Danang, Hoa Khanh, expanded Hoa Khanh, Lien Chieu, Hoa Cam and Danang Tho Quang seafood processing and marine services, covering a total land area of more than 1,400 hectares. The infrastructure in these industrial zones has been improved to meet the requirements of local and foreign investors. Additionally, Danang City is encouraging investors to develop the infrastructure of a new industrial zone in Hoa Khuong with a land area of 500 hectares and more importantly a hi-tech industrial park with a total area of 1,400 hectares to attract investment in the high-tech sector which includes information technology, electricity, electronics, advanced materials, automation, bio-technology, etc.

On 27 March 2009, the Danang Investment Danang 2009 Forum at the Hi-tech Industrial Park was organised by the Danang City People’s Committee. This was a great opportunity for the city’s authorities and potential investors to exchange views on the investment environment in the high-tech development pathway for Danang and especially essential incentives to attract investment in hi-tech industrial sectors.

Message by Mr Tran Van Minh, Chairman of People’s Committee of Danang City, Vietnam

Danang City is one of the five biggest cities directly managed by the Vietnamese Government. The city is situated at the centre of Vietnam with a natural land area of 1,256km2 and a population of 860,900 people. With the advantages of being an important communications hub of the central region and Vietnam, Danang City has an international airport, deep water seaports and north-south land routes and railways which are completely and conveniently developed.

Danang City is one of the five biggest cities directly managed by the Vietnamese Government. The city is situated at the centre of Vietnam with a natural land area of 1,256km2 and a population of 860,900 people. With the advantages of being an important communications hub of the central region and Vietnam, Danang City has an international airport, deep water seaports and north-south land routes and railways which are completely and conveniently developed.

The city has abundant human resources with a highly skilled, hardworking workforce accounting for 58% of the total population. These factors have been crucial in making Danang one of the main socio-economic engines of the central region of Vietnam.

Danang is the gateway to the Pacific Ocean of the East West Economic Corridor, connecting the virtually untapped hinterlands of Laos, Northeast Thailand, Myanmar and Central Vietnam. It is strategically well-placed to ensure favourable conditions for the development of foreign economic relations, giving impetus to its efforts to be the central hub of the Key Economic Zone of Central Vietnam.

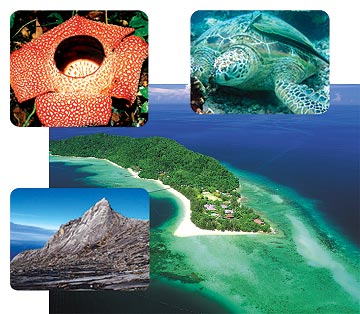

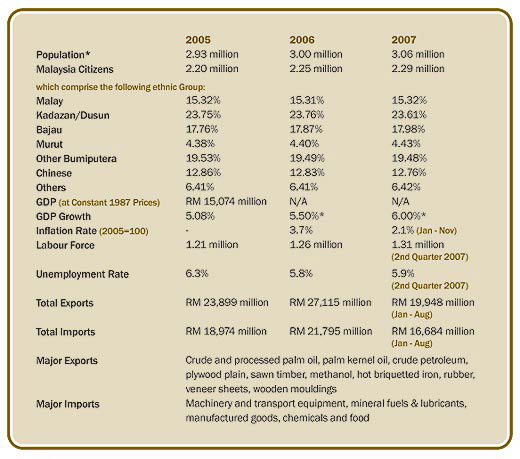

Sabah Development Corridor (SDC)

The SDC will be implemented over a period of 18 years from 2008 to 2025. The goal is to turn Sabah into a leading economic region and a preferred destination for investment, work and living. The key strength of the SDC is the state’s strategic location, abundant natural resources, rich cultural heritage and access to mega biodiversity resources.

Sub-Regional Development

The development plan of the SDC will be implemented across three sub-regions namely the Western Sub-Region, Central Sub-Region and Eastern Sub-Region. The Western Sub-Region is identified as Sabah’s industrial belt. This region provides access to market, processing, packaging and port facilities. The Central Sub-Region is Sabah’s agricultural hinterland and food production belt. The focus will be on encouraging local communities to get involved in income generation activities through agriculture and tourism. The Eastern Sub-Region is a self-sufficient corridor with large hinterland, industries,ports and other related services and also rich with agricultural and biodiversity resources. The focus for this region will be on promoting agrobio research, commercial production and processing of agricultural commodity, especially oil palm. The sub-region also has a vibrant eco-tourism industry.

Development Phases for the SDC

The SDC will be implemented in three phases to reflect programme priority and sequencing. The first phase (2008 – 2010) mainly focuses on building the foundation for growth via infrastructure development as well as initiating high impact economic and poverty eradication projects. The second phase (2011 – 2015) will see economic growth accelerating through intensified higher order value-added economic activities, with the presence of global companies and a strong base of local SMEs. The third phase (2016 – 2025) is the expansion period. During this phase, Sabah is expected to emerge as an attractive destination for FDIs with strong supporting infrastructure, global companies and knowledge workforce.

Key Principles of the SDC

The development of the SDC is guided by three key principles: firstly, to capture higher value economic activities; secondly, promoting balanced economic growth with distribution; and thirdly, ensuring sustainable growth via environmental conservation.

Higher value activities are generatedthrough downstream processing of Sabah’s rich primary commodity and natural resources, such as oil and gas, palm oil, rubber, cocoa, herbal resources and fisheries. This can be done by promoting investments in oleo-chemicals, gas processing plants, agro-industry and others.

Higher value activities are generatedthrough downstream processing of Sabah’s rich primary commodity and natural resources, such as oil and gas, palm oil, rubber, cocoa, herbal resources and fisheries. This can be done by promoting investments in oleo-chemicals, gas processing plants, agro-industry and others.

The SDC strives to promote balanced economic growth between urban and rural areas as well as between sub-regions in Sabah. The main goal is to alleviate poverty in the state. As SDC development covers the whole state of Sabah, the spillover and economic benefits under the SDC will be enjoyed not only by those living in the city, but also in the small villages. These developments are further intensified under the SDC through better provision of physical infrastructure and utilities, such as road, water and electricity.

Having one of the world’s oldest rainforest, rare wildlife and the widest genera of marine life, it is imperative for Sabah to conserve its environment and promote sustainable development. The SDC welcomes the participation of everyone, including foreign talents as well as researchers in knowledge generation, especially in conserving the states rich biodiversity as well as its ethnobotanical heritage for the benefit of current as well as future generation. The SDC also aims to promote product innovation by stimulating bio-prospecting and biotech research to spur the development of new high value industries, such as agro-biopharmaceutical industry.

The Sectoral Focus

In line with the Halatuju, the four sectors that have been earmarked as the drivers of growth in the SDC are tourism, logistics, agriculture and manufacturing.

• Tourism

The strategy under the tourism development is to target high-yield and long stay visitors. The aim is to make Sabah one of the most liveable places in the world. The SDC also plans to enhance Sabah‘s position as a premier eco-adventure destination as well as a high-end, lifestyle destination with luxury holiday villas and signature resorts. One of the targets is to encourage investors to anchor new signature tourism products and activities in Sabah, such as wellness centres, sailing activities and regatta.

• Logistics

Under logistics, the main focus will be on lowering the cost of doing business in Sabah. The strategies include reviewing the cabotage policy for shipping, providing incentives to potential investors to set up manufacturing facilities in the proposed Sepangar Free Zone (SFZ), domestic hubbing at Sapangar Bay Container Port, and positioning Sandakan as a key regional trading hub in Borneo.

• Agriculture

Under the SDC, the agriculture programme will focus on increasing overall food self-sufficiency, planting high-value crops for export and downstream processing, and assisting in poverty eradication. The programme will be designed to encourage rural communities’ participation at various levels in the agro-industry supply chain, such as in production, collection, processing, packaging, storage and distribution activities. The programme will include the promotion of science-industry linkages through optimum utilisation of science and technology, especially ICT and biotechnology.

• Manufacturing

The initial focus for the manufacturing sector under the SDC is to enhance enablers such as infrastructure and human capital. The target is to encourage foreign investment to anchor and accelerate the growth of downstream manufacturing activities in Sabah. Through this strategy, it is envisaged that Sabah will emerge as one of the leading locations of choice for resources-based manufacturing activities in Asia.

The Final Outcome

An overriding goal of SDC is to fully eradicate poverty in Sabah by the year 2025. Hardcore poverty is targeted to be eliminated by the end of the Ninth Malaysia Plan (9MP) with overall poverty halved from 23% in 2004 to 12% in 2010.

With the implementation of the SDC, Sabah is expected to experience rapid economic growth attaining a four-fold increase in its gross domestic product (GDP) to RM63.2 billion in 2025.

Unemployment rate is also expected to be reduced from 5.8% in 2006 to 3.5% by the end of 2025. The implementation of the SDC is also expected to create 900,000 new jobs.

SDC Monitoring Authority

The overall development of the SDC will be overseen by a one-stop implementation authority, Sabah Economic Development and Investment Authority (SEDIA). The state government of Sabah had passed the law to establish SEDIA on 15 January 2009. This will no doubt add further impetus to the implementation of all programmes planned under the SDC initiatives.

*Estimates

Sources: 1) Department of Statistics Malaysia, Sabah 2) The 2007 and 2008 Sabah State Budget Speech

MIDA Moving Forward Despite Challenges

The current global economic crisis has not dampened Malaysia’s efforts in promoting investments into the manufacturing and services sectors. Malaysia’s pull factors which include business-friendly policies, developed infrastructure and a host of other amenities, continue to be a magnet for foreign investors. Investment approvals are a testimony to this fact.

The current global economic crisis has not dampened Malaysia’s efforts in promoting investments into the manufacturing and services sectors. Malaysia’s pull factors which include business-friendly policies, developed infrastructure and a host of other amenities, continue to be a magnet for foreign investors. Investment approvals are a testimony to this fact.

Approvals in the manufacturing sector amounted to RM62.8 billion in 2008, compared with RM59.9 billion in 2007. Investments in 2008 were the highest recorded to-date and were more than double the target of RM27.5 billion per annum, set in the Third Industrial Master Plan (IMP3).

In 2008, a total of 2,755 projects in the services sector were approved, with investments amounting to RM47.8 billion and this figure surpassed the IMP3 target of RM45.9 billion per annum.

The significant increase in investments in 2008 indicated that foreign and domestic investors continue to respond positively to the government’s initiatives to invest in capital intensive, skills and knowledge-based, high value-added and high technology industries and service-related operations.

The setting up of the Cabinet Committee on Investments has assisted Malaysia in attracting investments into targeted areas. Several major manufacturers have already established or committed to invest in Malaysia including First Solar, Q-Cells and SunPower Corporation.

In addition to the establishment of the Cabinet Committee, the government through MIDA continues with its efforts to facilitate and provide assistance to investors. These measures have led to a higher rate of implementation of approved projects.

As a measure to further attract FDI, the Malaysian Industrial Development Authority (MIDA) will intensify its promotional activities through investment missions to attract investments from targeted countries. In 2009, a total of ten such missions will be organised to Asia, Europe, the USA and Australia.

In addition, MIDA will also be organising 25 specialised project missions to target specific industries and services sectors. The private sector is invited to participate in these missions to explore business collaborations.

Equally important to attracting FDI is the government’s continued drive to actively promote domestic investments. MIDA will continue with its efforts to increase domestic investments through domestic investment seminars. A total of 5 domestic investment seminars will be organised throughout the country aimed at updating domestic investors on business opportunities in the manufacturing and services sectors. In this challenging time, domestic investors must now look at all avenues to increase their capabilities to further expand output. The government will also continue to encourage and facilitate Malaysian companies to venture abroad to expand or capture new markets, tap new investment opportunities, gain access to supplies and acquire new technology. In the long-run, cross border investments will enable Malaysian companies to become part of the global production network and meet the challenges of a fast changing global economic environment.

Malaysian companies also need to sustain their competitiveness by taking advantage of the opportunities arising from regional agreements and the various bilateral agreements and Free Trade Agreements (FTAs), as well as the current global trends in outsourcing.

Recent trends show that Malaysian companies are increasingly undertaking investments overseas. Based on the latest figures provided by Bank Negara Malaysia (BNM), Malaysia’s overseas investment (excluding Labuan IOFC) jumped from RM22.2 billion in 2006 to RM42.5 billion in 2007 and to RM48.7 in 2008, reflecting increased interest and capability by Malaysian companies to expand and diversify their operations abroad. Cumulative investment overseas for the period 2004 – 2008 totaled RM141.75 billion.

Malaysia overseas investment destinations were mainly in ASEAN, East Asia, South Asia, North Africa and Middle East countries as well as certain developed western countries. Many Malaysian companies overseas are engaged in the oil& gas industry, services sector (hotel, telecommunications), construction industry, property & real estate, banking & finance and in the manufacturing sector (food & beverages, etc).

The Malaysian government provides the following incentives to promote and assist eligible Malaysian companies venturing overseas:

- Tax exemption on income earned overseas and remitted back to Malaysia.

- Tax deduction for pre-operating business expenditure in connection with proposals to undertake investments in business ventures overseas.

- Malaysia-Singapore Third Country Business Development Fund. It allows Malaysian and Singaporean enterprises to cooperate and jointly identify investment and business opportunities in “third countries”. This fund is a matching grant that can be used for joint missions, feasibility studies and pro-active search in third countries before making an investment.

- To further promote cross border investment, the existing Cross Border Investment Promotion Unit in MIDA has been expanded to become a full-fledged Division in 2008. MIDA provides assistance to facilitate Malaysian companies venturing/looking for investment opportunities overseas by undertaking the following initiatives:

- Update and disseminate information & data/figures on matters related to cross border investment which include information of particular interest like investment policies & procedures, incentives, facilities and opportunities available in targeted countries.

- Organise seminars on business opportunities in targeted country. Representative(s) from the targeted country will brief on the investment policies, incentives opportunities available, etc. Individual business meetings are also organised with delegation members of the visiting country.

- Organise cross border investment missions to targeted countries. Malaysian companies seeking collaboration/looking for opportunities overseas can participate in this mission.

- Conduct regular dialogues and meetings with chambers of commerce and industry associations to obtain feedback and comments from Malaysian companies with regards to their interest/business venture overseas, thus providing better understanding on issues which need to be addressed and solved.

- Established 3 new MIDA overseas offices in Guangzhou, Mumbai and Dubai to cater to the needs/facilitate Malaysian companies investing overseas. More offices will be opened in several other cities around the world for similar purpose i.e Jakarta, Bangkok, Ho Chi Minh City, Beijing and Johannesburg.

- Established strong network with investment promotion agencies/board of investment of targeted countries. This includes exchange of information on business and investment opportunities including proposals from interested companies seeking joint-venture or collaboration.

Companies are invited to participate in the seminars and missions listed above.

For more details, please contact MIDA.