Feature On ProMéxico: Mexico – A Gateway To The World

Mexico’s business environment has become very attractive for investments; the country’s economic stability and constant growth have strengthened its competitiveness. According to JP Morgan, Mexico’s risk index reached its lowest point over the past year. Therefore, Mexico is an attractive destination for investors looking for business opportunities.

The Mexican government has made several changes in order to provide competitive conditions for long-term investment strategies. With Mexico’s simplified regulatory and legal framework, entrepreneurs will have easy access to the relevant resources to help start up their businesses.

Further investments are being made in education to improve Mexico’s competitiveness and workforce, with an average age of 27 years old. Additionally, Mexico’s dependency index is at its lowest.

The government has implemented a strong industrial policy to support development in several regions of the country. As an example, the ‘Marginal Areas Employment Program’ encourages companies to settle in low-income and highly populated geographical areas.

With its strong promotion strategies and stable economy, Mexico has become an important foreign direct investment recipient. In 2007, the country attracted US$24.7 billion in FDI. Mexico’s geographic location makes investment opportunities particularly attractive, providing access to both North and South America. The country shares a 3,152km border with the United States and the ports provide access to both the Atlantic and Pacific Oceans, where goods can be easily shipped to Asia, Europe or South America, and by road or railroad to the United States; collectively elevating Mexico to become the largest trader in Latin America.

Companies established in Mexico can take advantage of its Free Trade Agreements, which give preferential access to 44 countries, which adds up to 75% of the world’s GDP, as customers. Mexico looks at markets in Asia and Europe with great enthusiasm in order to diversify its markets.

In 2007, Mexico achieved outstanding trade results: Exports to Europe reached US$272,084 million, representing an increase of 33%. As for Asia and South America, exports grew 20% and 37% respectively.

Its strong economic stability has been strengthened by a solid monetary policy that had been implemented by the government. During 2007, Mexico registered an inflation rate of 3.76% which was the lowest in the continent together with Canada, and lower than China, Brazil, India and Russia.

ProMéxico

ProMéxico

ProMéxico opened its doors one year ago. It is the first agency specialised on promoting exports and investment between Mexico and the rest of the world. Currently, ProMéxico has over 30 offices around the world and is constantly expanding its network.

ProMéxico is the one stop shop that helps companies do business in Mexico. It coordinates actions from different agencies in the Mexican government in order to attract and facilitate doing business in and with Mexico. ProMéxico operates with four important units within its organisation:

- Intelligence Unit: It is in charge of gathering and analysing information, and providing it to whoever needs it, whether its customers or anyone at ProMéxico.

- International Promotion Unit: It is in charge of all the offices around the world, looking for new possible investors, promoting exports and assisting companies who want to do business with Mexico.

- Investor Relations Unit: It is in charge of coordinating any effort with the state governments, other organisations and assisting foreign companies establish in Mexico.

- Exports Development Unit: It is in charge of determining what products Mexico can export and promote them with the international offices.

The organisation provides a ‘One Stop Shop’ for investors, ‘Soft-Landing’ services, government procedures advisory, an Ombudsman and Investor aftercare. It’s a good time to explore opportunities in Mexico. Mexico has an infrastructure programme worth over US$226 billion and is expected to be fully completed by 2012. With its stable economy, low inflation, steady growth, low risk, strong qualified labor force and unprecedented joint investment participation of public and private sectors, Mexico makes an exceptional opportunity for investment.

“We want to have more of the world in Mexico, and more Mexico around the world.”

Bina Puri Group Of Companies

Bina Puri has been in the Malaysian construction industry since 1975. Bina Puri Holdings Bhd, the holding company, has been a public listed company on the Main Board of Bursa Malaysia since 1995. The core businesses of the Bina Puri Group of Companies are construction-related activities which include Civil and Building Construction, Quarry Operations and Construction Materials, Polyurethane System House, Property Development and International Ventures.

Bina Puri has been in the Malaysian construction industry since 1975. Bina Puri Holdings Bhd, the holding company, has been a public listed company on the Main Board of Bursa Malaysia since 1995. The core businesses of the Bina Puri Group of Companies are construction-related activities which include Civil and Building Construction, Quarry Operations and Construction Materials, Polyurethane System House, Property Development and International Ventures.

On the corporate front, Bina Puri is an active member of the Malaysian Industry Group for High Technology, an agency under the Ministry of Science Malaysia that promotes high technology initiatives. We are also a member of the Master Builders Association of Malaysia and the Malaysia South-South Association. We are registered with the Construction Industry Development Board of Malaysia, in the G7 category, which permits the Group to bid and undertake projects of unlimited value. Five of our major subsidiaries are certified with SIRIM ISO 9001:2000 Quality System Certification, including SIRIM OHSAS 18001:1999 and UKAS Quality System Management.

Among the highest achievements of Bina Puri was when our Group Managing Director, Yang Berhormat Senator Tan Sri Datuk Tee Hock Seng was awarded the CIDB Prominent Player Award at the Construction Industry Excellence Awards 2005. In December 2007, Bina Puri once again received the Contractor Award (Category G7) in the Malaysian Construction Industry Excellence Awards 2007, in recognition of the Group’s excellent completion of the 39-storey Capital Square high-end condominium in Kuala Lumpur. This award category is for construction work projects ranging from RM50 million to RM100 million.

The Core Business, Civil and Building Construction Division

The Core Business, Civil and Building Construction Division

Today, Bina Puri is one of the leading construction companies in Malaysia with a large pool of dedicated, qualified and experienced professionals as well as having a substantial number of heavy machinery resources in hand, with a proven track record in handling various types of contracts.

In Civil and Infrastructure works, the Group has completed in value of 4.4 billion ringgit in projects including mega infrastructure works, more than 1,000 kilometers of roads and highways, bridges and interchanges, airport works, waterworks and land reclamation works.

For building works, the Group has completed various types of buildings including low, medium and high-rise residential building, commercial and educational buildings, Government complexes, hotels, hospitals, port administration and office buildings as well as township development.

International Front

Bina Puri is continuously expanding it’s business activities through overseas project ventures. Its projects in India include 3 major highways, namely the Vijayawada-Eluru Expressway, the Tada-Nellore Expressway in Andhra Pradesh and the Chittorgarh-Mangalwar Highway in Rajasthan which was completed 6 months ahead of schedule. In Kathmandu, Nepal, Bina Puri completed the 5-star Hyatt Regency hotel while in Beijing, China, it completed the Malaysian Embassy and the Ambassador’s Residence Building. In Bangkok, Thailand, the Group successfully completed the Access and At – Grade roads leading to the Suvarnabhumi International Airport. Besides the above projects, Bina Puri also has projects in the United Arab Emirates, Pakistan and Brunei Darussalam.

Editorial

MASSA together with the Cross Border Investment Division of MIDA had a busy quarter organising a number of Cross Border Investment seminars that covered 6 countries. These countries include Venezuela, Zambia, Egypt, Uganda, Swaziland and Rwanda. The one-to-one meetings were well attended and we are hopeful that these networking opportunities will yield businesses for members.

Following the good response at the Egypt Cross Border Investment seminar, the MIDA Cross Border Investment Division will be organising an investment mission to Egypt from 14 to 20 November 2008. MASSA members are invited to join this mission.

Our collaboration with MATRADE for this edition highlights India – an emerging giant with economic potential in all sectors of the economy. Also highlighted in this edition are interesting articles on Mexico and Pakistan, courtesy of the respective trade commissions of these two developing economies.

MASSA is pleased to inform members that the High Commissions or Embassies of most of the developing countries that have an office in Kuala Lumpur are a good source of business information. Members should avail themselves to these useful sources of information in their quest to explore cross border business ventures.

INTRADE Malaysia 2008 is happening again from 13 to 16 November 2008. This year’s event will prove to be an even bigger and better event for Malaysians and our business visitors.

MASSA staff will be on hand to assist members at our booth at the event. We hope to see you at INTRADE 2008.

Hamidah Tun Ghafar

Editor

President’s Message

The ongoing financial turmoil fuelled by bankruptcies and bailouts in the United States marks the further unraveling of the United States credit crisis. This has resulted in continued market volatility around the globe. These challenging headwinds are expected to result in weakening global demand. Malaysia, whilst not directly affected, is also not spared from the spillover effects.

However, it is heartening to note that Malaysia’s economic fundamentals are still good. Its foreign reserves are high at US$119 billion, sufficient to finance more than nine months of retained imports and 4.2 times short-term external debt. There is also sufficient liquidity in our system. Our export markets are highly diversified and the domestic sector continues to be one of the main sources of growth. Overall, the Malaysian economy had performed commendably, achieving a strong growth of 7.2% in the first half of 2008 in spite of inflationary pressures and the weakening global demand.

Going forward, we must remain vigilant to emerging developments. We must quicken our efforts to remain competitive and yet, nimble enough to seize emerging business opportunities as they arise. The current global financial turmoil and credit crunch may offer great opportunities for Malaysians to invest in some developing economies.

In this context, MASSA will continue in its efforts to avail to members the information on South-South developments and keep members updated on happenings via our weekly news briefs.

I take this occasion to wish our members and readers a “Selamat Hari Raya Aidil Fitri” and “Happy Deepavali”!

TAN SRI DATO’ AZMAN HASHIM

President

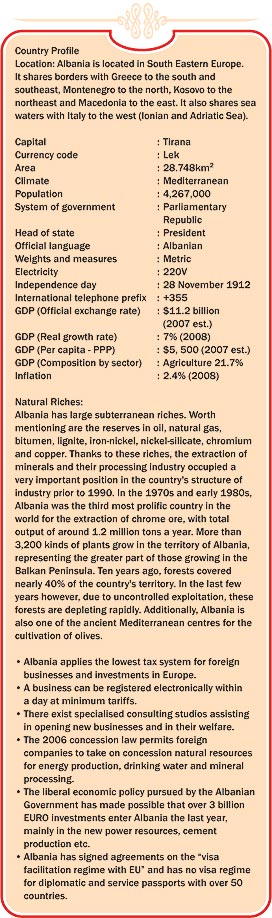

Country Focus: The Republic Of Albania

Albania has a favourable geographic position, enabling it to develop trade relations with the bordering countries and other countries in Europe and farther, by land, by air and by sea. Its two big ports, in Durres and Vlora, are equipped with all kinds of facilities harbour and handle ships of various capacities.

Albania has a favourable geographic position, enabling it to develop trade relations with the bordering countries and other countries in Europe and farther, by land, by air and by sea. Its two big ports, in Durres and Vlora, are equipped with all kinds of facilities harbour and handle ships of various capacities.

Albania has a stable political and economic situation. It has already signed the Stabilisation and Association agreement with EU and is fast meeting EU standards to become a full fledged member in the coming years. Albania has also received the invitation to NATO and is expected to join it as a full member on April 2009. It is a member of UN, OIC, and OSCE (Organisation for Security and Cooperation in Europe). Albania is also a member of the WTO (World Trade Organisation) and has signed bilateral economic agreements with numerous of countries it has economic relations with. The Islamic Bank is also a strategic partner of Albania.

The consecutive governments of Albania have paid special attention to accomplishing the legal framework with all the respective laws required for carrying out business activities and investments in Albania. Foreigners can set up their own companies, buy land, and carry out their business protected by special laws.

Opportunities & Incentives For Foreign Investors

Notwithstanding the difficulties and challenges, Albania is a country that offers many investment opportunities to foreign entities and individuals. The country has considerable natural resources, including oil, gas, coal, iron, copper, chrome, water and hydroelectric potential.

The privatisation process in itself offers a wide range of options. Potentially high profit sectors include mining and oil extraction, both of which are export-oriented industries. Albania is the only country in Europe with substantial reserves of chromium, which before 1990 made it the world’s third largest producer of chrome ore. Nevertheless, significant capital investments and capacity upgrades are needed in order to modernise the old, outdated production methods. Other areas of interest include thermal and hydro power production, alternative sources of energy production, infrastructure, agriculture as well as light industry sectors such as textiles, leather and footwear, confections and meat processing.

The privatisation strategy explicitly seeks qualified foreign firms as strategic investors for these key sectors. The process has already attracted foreign investors, mainly from Greece, Italy and Turkey.

Tourism also offers great investment prospects. Albania has spectacular mountain scenery, a beautiful and pristine coastline, as well as ancient history and culture. Tourism could be one of the main attractions for foreign investors in the future, but currently Albania offers all facilities to promote investments in this sector. Albania has 400km coastline.

Investors in Albania enjoy full legal protection of their investments. Private investments cannot be nationalised, expropriated or subject to any similar measure, except in special cases provided by law such as public interest. Parties in a dispute may agree to submit claims for consideration by an arbitration institution. Foreign investors have the right also to submit disputes to an Albanian court.

Other legal incentives include:

• Equal treatment of foreign and domestic

investors

• Full profit and dividend repatriation,

after taxation

• Repatriation of funds from liquidated

companies

• Bilateral agreements on the promotion

and protection of reciprocal investments

with Austria, Belgium, Bulgaria, China,

Croatia, Czech Republic, Denmark,

Egypt, Finland, France, FYROM, Germany,

Greece, Hungary, Israel, Italy,

Luxembourg, Malaysia, the Netherlands,

Poland, Portugal, Romania, Slovenia,

Sweden, Switzerland, Tunisia, Turkey,

United Kingdom and the United States.

The former President of Albania, who is also the head of Government, Dr. Sali Berisha and the former Prime Minister of Malaysia, Tun Dr. Mahathir have visited the respective countries. These visits served to boost the bilateral relations between the two countries and lay down the ground for economic cooperation.

The former President of Albania, who is also the head of Government, Dr. Sali Berisha and the former Prime Minister of Malaysia, Tun Dr. Mahathir have visited the respective countries. These visits served to boost the bilateral relations between the two countries and lay down the ground for economic cooperation.

The following agreements have been signed between the two countries:

• Abolition of double taxation and prevention

of fiscal evasion

• Cooperation in the areas of Economy,

Science and Technology

• Trade agreements

• Promotion and protection of investment

• Payments adjustment between the Bank

of Albania and Bank Negara of Malaysia

• Agreement for abolishment visa for citizen of

two countries

The Chamber of Industry and Commerce of Albania and The International Commercial Bank, which is part of the ICB Financial Group (Malaysia), are two important institutions operating in Tirana that can provide all the information one needs when it comes to doing business in Albania.

References:

Ministry of Economy, Trade and Energy

http://www.mete.gov.al

Chamber of Commerce and Industry of Tirana

http://www.cci.gov.al

Albania – A New Mediterranean Love

http://www.albaniantourism.com

ICB Global Management Sdn Bhd

http://www.icbglobal.com.my

Diary Of Events

INTRADE Malaysia 2008 @ MECC, Kuala Lumpur (13 – 16 November 2008)

Organised by MATRADE, the much anticipated 2nd International Trade Malaysia 2008 Exhibition (INTRADE Malaysia 2008) which was held at the MATRADE Exhibition and Convention Centre (MECC) from 13 to 16 November 2008 had generated sales worth RM2.6 billion.

Aptly themed ‘Optimising Global Opportunities’, the event offered a dynamic platform for Malaysian companies to showcase their products and services to international buyers, as well as explore exciting opportunities for business expansion and to establish linkages.

With a total of 368 exhibitors representing 27 countries, INTRADE Malaysia 2008 was a resounding success and attracted over 10,000 visitors from 55 countries. About 80% of the exhibitors were Malaysian companies from a variety of industries including food and beverages, automotive, furniture, tiles, building materials and household items.

MASSA was present at the event and facilitated enquiries from visitors, both local and foreign. Through the event, MASSA was able to establish new linkages for business, especially with the developing countries.

In conjunction with INTRADE Malaysia 2008, MATRADE also organised the Incoming Buying Mission (IBM), a series of unique marketing programmes that provided buyers with an insight into the wide range of products and services available in Malaysia. The IBM has proven to be a cost-effective way for local companies to promote and sell their offerings as this unique programme brings the international buyers directly to them through one-to-one business meetings.

Visit of South African delegation to MASSA Booth

MASSA members’ participation at INTRADE Malaysia 2008

Goodmaid Chemicals Corporation Sdn Bhd Goodmaid Chemicals Corporation Sdn Bhd (GCC) is 100% Malaysian-owned and is also one of the first cleaning chemicals companies to achieve ISO 9001 QMS certification in Malaysia. It manufactures high quality cleaning products in three major segments – household, industrial and OEM under the brand name of”Goodmaid”, “Cocorex”, “Goodmaid Bio” and “Goodmaid Pro” – and is positioned as”The Total Cleaning Specialist”. By constantly optimising its latest technology and production techniques through cutting-edge research and development facilities, GCC is able to meet market demands and consumer needs both locally and globally.

Goodmaid Chemicals Corporation Sdn Bhd Goodmaid Chemicals Corporation Sdn Bhd (GCC) is 100% Malaysian-owned and is also one of the first cleaning chemicals companies to achieve ISO 9001 QMS certification in Malaysia. It manufactures high quality cleaning products in three major segments – household, industrial and OEM under the brand name of”Goodmaid”, “Cocorex”, “Goodmaid Bio” and “Goodmaid Pro” – and is positioned as”The Total Cleaning Specialist”. By constantly optimising its latest technology and production techniques through cutting-edge research and development facilities, GCC is able to meet market demands and consumer needs both locally and globally.

Muhibbah Engineering Berhad Group

The Group’s principal activities are constructing petroleum hub and bunkering facilities, oil and gas terminals, liquefied natural gas jetty works, marine ports, bridges and dams, airport terminals and facility support buildings, heavy concrete foundations and other similar construction works, engineering contract works and technical assistance services. Other activities include the designing, manufacturing, supplying, servicing and rental of offshore oil and gas pedestal cranes, tower cranes, shipyard cranes and other heavy lifting equipment cranes, building and repairing of anchor handling tug boats, supply vessels, accommodation ships and marine vessels for the offshore oil and gas exploration and production workships and privatisation of international airports in Cambodia and road maintenance works in the central region of Peninsular Malaysia. Operations are carried out in Malaysia, Qatar, Yemen, Syria, Singapore, Cambodia and Sudan.

The Group’s principal activities are constructing petroleum hub and bunkering facilities, oil and gas terminals, liquefied natural gas jetty works, marine ports, bridges and dams, airport terminals and facility support buildings, heavy concrete foundations and other similar construction works, engineering contract works and technical assistance services. Other activities include the designing, manufacturing, supplying, servicing and rental of offshore oil and gas pedestal cranes, tower cranes, shipyard cranes and other heavy lifting equipment cranes, building and repairing of anchor handling tug boats, supply vessels, accommodation ships and marine vessels for the offshore oil and gas exploration and production workships and privatisation of international airports in Cambodia and road maintenance works in the central region of Peninsular Malaysia. Operations are carried out in Malaysia, Qatar, Yemen, Syria, Singapore, Cambodia and Sudan.

Maybank

Maybank is the largest financial services group in Malaysia, offering a comprehensive range of financial services ranging from commercial banking, investment banking, Islamic banking, offshore banking, leasing and hire purchase, factoring, cards, insurance, trustee services, asset management, stock broking, nominee services, venture capital and internet banking. Over the years, Maybank has introduced a range of innovative products, both conventional and Islamic for the SMEs, solutions for asset and property financing, working capital, import, export, treasury, insurance and cash management requirements. Our domestic network consists of 39 Business Centres, 17 Trade Finance Centres and over 360 branches. For further details on our products and services, please visit www.maybank2e.net or any of our business centres/branches nationwide.

Maybank is the largest financial services group in Malaysia, offering a comprehensive range of financial services ranging from commercial banking, investment banking, Islamic banking, offshore banking, leasing and hire purchase, factoring, cards, insurance, trustee services, asset management, stock broking, nominee services, venture capital and internet banking. Over the years, Maybank has introduced a range of innovative products, both conventional and Islamic for the SMEs, solutions for asset and property financing, working capital, import, export, treasury, insurance and cash management requirements. Our domestic network consists of 39 Business Centres, 17 Trade Finance Centres and over 360 branches. For further details on our products and services, please visit www.maybank2e.net or any of our business centres/branches nationwide.

CIMB Bank

Whether you are just starting up, an established SME or a mid-sized corporation, CIMB Bank offers a complete range of products and services that can assist your business. From working capital and trade finance facilities to Internet banking, CIMB Bank can assist to finance your assets and even manage your day-to-day administration and business operations such as payroll and remittances. The bank’s trained and experienced sales personnel are ever ready to advise you on the relevant financing packages that will accelerate your business growth.

Whether you are just starting up, an established SME or a mid-sized corporation, CIMB Bank offers a complete range of products and services that can assist your business. From working capital and trade finance facilities to Internet banking, CIMB Bank can assist to finance your assets and even manage your day-to-day administration and business operations such as payroll and remittances. The bank’s trained and experienced sales personnel are ever ready to advise you on the relevant financing packages that will accelerate your business growth.

Alami Vegetable Oil Products Sdn Bhd

Alami Vegetable Oil Products Sdn Bhd continues to distinguish itself through the manufacture and export of prime quality Palm Oil, its derivatives and downstream products to satisfy and delight discerning, informed, cosmopolitan consumers for stable and nutritious oil and fats free from trans-fatty acids commonly found in the other edible oils.

Alami Vegetable Oil Products Sdn Bhd continues to distinguish itself through the manufacture and export of prime quality Palm Oil, its derivatives and downstream products to satisfy and delight discerning, informed, cosmopolitan consumers for stable and nutritious oil and fats free from trans-fatty acids commonly found in the other edible oils.

The company’s products are exported to several destinations, across diverse cultures and form a vital ingredient in a broad spectrum of foods, pastries and confectioneries. This seamless integration of Palm Oil derivatives derives from its unique composition of liquid and semi solid fractions. Alami has a long association with palm oil and is to its customers a one-stop centre for premium grade Palm Oil Products. Its portfolio of export products include RBD Palm Olein (Cooking Oil), Vegetable Ghee, Shortening, Margarine, Ice-cream Dough, Creaming, Coating and other specialty fats. All products are available in consumer and industrial packing and manufactured to specifications that surpass international food quality standards.

Chemical Company Of Malaysia (CCM) Berhad

Chemical Company of Malaysia (CCM) has a significant corporate presence as a public-listed company since 1966, initially as a subsidiary of ICI PLC of the United Kingdom and now as a Malaysian owned corporation. CCM Berhad has since progressed to become a “blue-chip” company on the Main Board of Bursa Malaysia.

Chemical Company of Malaysia (CCM) has a significant corporate presence as a public-listed company since 1966, initially as a subsidiary of ICI PLC of the United Kingdom and now as a Malaysian owned corporation. CCM Berhad has since progressed to become a “blue-chip” company on the Main Board of Bursa Malaysia.

CCM Group offers a wide range of products and services to the chemicals, healthcare and agricultural industries. Our integrated approach to business makes us a unique “one-stop” agency. Our business activities include: • Chemical products and applications • Fertilisers and technical advisory services • Pharmaceuticals and healthcare products and services

Our business operations are structured into four major subsidiaries: CCM Chemicals, CCM Fertilisers, CCM Pharmaceuticals and CCM Duopharma Biotech. Today, CCM Group is one of the nation’s largest chemicals, fertilisers and healthcare companies, manufacturing a wide range of products to meet the growing needs of the domestic and overseas markets.

Participation of various countries at the exhibition

Interview of Tan Sri Dato’ Azman Hashim, MASSA President

by the Aljazeera Channel

On 10th December, the Aljazeera Channel had an interview with Tan Sri Dato’ Azman Hashim, MASSA President. The interview was premised on “Smart Co-Partnership” and gave an opportunity for Tan Sri President to share the philosophy of South-South cooperation between developing countries through the creation of smart partnerships in business between the developing countries. This interview will be one in the series of documentary films to be produced by the Aljazeera Channel.

On 10th December, the Aljazeera Channel had an interview with Tan Sri Dato’ Azman Hashim, MASSA President. The interview was premised on “Smart Co-Partnership” and gave an opportunity for Tan Sri President to share the philosophy of South-South cooperation between developing countries through the creation of smart partnerships in business between the developing countries. This interview will be one in the series of documentary films to be produced by the Aljazeera Channel.

Courtesy Call On MASSA President by the High Commissioner of Pakistan on 10th December 2008

H.E. Lt Gen (Retd) Tahir Mammud Qasi, High Commissioner of Pakistan based in Malaysia made a courtesy call on Tan Sri Dato’ Azman Hashim, MASSA President at his office. His Excellency was accompanied by Mr Majid Qureshi, Commercial Counsellor and Mr Qamar Bashir, Press Attache of the Pakistan High Commission on this visit.

H.E. Lt Gen (Retd) Tahir Mammud Qasi, High Commissioner of Pakistan based in Malaysia made a courtesy call on Tan Sri Dato’ Azman Hashim, MASSA President at his office. His Excellency was accompanied by Mr Majid Qureshi, Commercial Counsellor and Mr Qamar Bashir, Press Attache of the Pakistan High Commission on this visit.

(2nd from right) H.E. Lt Gen (Retd) Tahir Mammud Qasi

presenting a momento to Tan Sri Dato’ Azman Hashim

(3rd from right)

3rd Quarter 2008 Update: The Malaysian Economic Outlook

Executive Summary

Executive Summary

The global economy is under threat of a recession with the contagion from the US financial chaos spreading worldwide. Despite concerted interest rate cuts and massive liquidity injection, the credit crisis continues to deepen without signs of abating. Confidence has been badly dented with banks fearing to lend out while governments have raised the limits of deposit insurance to shore up confidence. Conditions would deteriorate further if the credit squeeze dries up funds for investment and household spending. The IMF foresees the impact on the global economy becoming more severe in 2009, with global growth projected to slow down to 3.0%, the slowest rate since 2002 (2008: 3.9%). In view of the ailing US economy, the IMF has drastically lowered the US growth forecast to a stagnant 0.1% in 2009 (2008: 1.6%). The spillover effects are predicted to slash Europe’s growth to 0.2% in 2009 (2008: 1.3%), and to soften Japan’s expansion to 0.5% (2008: 0.7%).

The Malaysian economy has been resilient in the first half of 2008, but is increasingly being affected by the global downturn. GDP growth has moderated to 6.3% in 2Q08 after a strong 7.1% gain in 1Q08, bringing growth to a high average of 6.7% in the first half. The growth was driven by high commodity prices, strong private consumption and steady investment, partly supported by fiscal spending. Malaysia has no direct exposure to the US market but is increasingly feeling the shock from the slowing US economy through trade and investment linkages. The external downturn has not reached bottom yet. The US economy is on the brink of a recession, Japan has reported a contraction and Europe is coming to a standstill. Singapore has gone into recession in 3Q08 based on quarter-on-quarter growth. Fearing a dismal global outlook and hit by rising prices of raw materials, the government stretched the fiscal deficit to 4.8% in 2008, reversing a nine-year progressive deficit reduction. This may be justified as difficult times call for drastic measures. The longer-term worry is the high dependency on oil revenue to finance fiscal spending. Government revenue will be affected by the decline in commodity prices if other sources of revenue are not sought. Given the heightening pressure on the economy and decreasing oil prices, the budget deficit is likely to exceed 5.0% of the GDP in 2008. The deficit may even exceed 4.0% of the GDP in 2009 with the increasingly unnerving outlook.

Monthly indicators up to July/August 2008 are starting to lose momentum. Industrial output is flattening further as the export-oriented sectors faced diminishing demand. Total exports have decelerated with electronics exports stalling, while commodity revenues are growing at a slower pace. The leading index is creeping up at its slowest pace this year, suggesting sluggish growth ahead. Inflationary pressures have gathered steam, with elevated food prices lifting inflation to 8.5% in August 2008. Despite small reductions in oil prices, domestic inflation has remained sticky so far. Despite soaring inflation, the Overnight Policy Rate (OPR) has been kept at 3.5% in view of the worsening downturn in the US economy and its potential negative effects on the domestic economy. With the risk of a severe economic slowdown exceeding that of inflation, the policy rate has been kept unchanged. The backlash to demand conditions will likely lead to the softening of inflation. Oil prices have fallen as demand subsides with the increasing slack in economic activity.

Consumer and business confidence indices have both dropped below the 100-point mark, the dividing line between optimism and pessimism as indicated by the results of MIER’s 3Q08 surveys. The Business Conditions Index (BCI), which is based largely on firm-level information, has slipped to 99.6 points in 3Q08 from 114.1 points in 2Q08, down 14.5 points, indicating that business confidence has deteriorated. Though still below 100 points, the Consumer Sentiments Index (CSI) has stabilised somewhat in 3Q08, rebounding to 88.9 points from the historical low of 70.60 points in 2Q08, aided by recent moves to lower domestic oil prices and bonus payment to public servants. With both indices staying below the threshold, the outlook for the Malaysian economy appears to be lacklustre.

With the financial crisis still unfolding and confidence failing, the bigger fear is the credit squeeze. Tight credit will have grave implications on consumer spending and investment activity, crippling the already slowing economy. The damage to the global economy will be deeper in 2009 with all major economies expected to slow down markedly. In hindsight, when the internet bubble burst in 2001 and OECD countries languished to a 1.2% growth, Malaysia’s growth came to a halt (2001: 0.5%). The IMF predicts the OECD will weaken to a 0.5% growth in 2009, putting Malaysia’s prospects in jeopardy. The internet crash did not lead to a banking crisis so the recovery was faster. The current crisis has done extensive damage and is nowhere near the bottom.

The US has managed to post a good growth in 2Q08 (2.8%) and delay a severe slowdown thanks to tax rebates, a previously weak dollar, and the cut in interest rates. In light of the resilient US economy and the higher-than-expected domestic growth during the first half of 2008, we are adjusting our estimates for GDP growth in 2008 to 5.3%, from 4.6% previously. It is likely that growth would deteriorate in late 2008, as the Malaysian economy takes the hit from the knock-on effects of a flagging global economy. Domestic demand will be propped up by fiscal spending, providing a partial cushion to the uncertain global economy.  Falling commodity prices are not helping either, but may help soften inflationary pressures. The services sector will be the pillar of strength amidst a weak manufacturing sector. With the outlook for the global economy turning increasingly dismal, Malaysia’s GDP growth could decelerate to 3.4% in 2009 (2008: 5.3%). The downside risks of further fallout from the financial woes have amplified, meaning that unpleasant possibilities are not totally excluded.

Falling commodity prices are not helping either, but may help soften inflationary pressures. The services sector will be the pillar of strength amidst a weak manufacturing sector. With the outlook for the global economy turning increasingly dismal, Malaysia’s GDP growth could decelerate to 3.4% in 2009 (2008: 5.3%). The downside risks of further fallout from the financial woes have amplified, meaning that unpleasant possibilities are not totally excluded.