Export-Import Bank of Malaysia Berhad (EXIM Bank)

Nature Of Business

Export-Import Bank of Malaysia Berhad (EXIM Bank) was incorporated on 29 August 1995 as a government owned development financial institution through a wholly owned subsidiary of the Minister of Finance Incorporated. The Bank was established to promote reverse investment and export of strategic sectors such as capital goods, infrastructure projects, shipping, value added manufactured products and to facilitate the entry of Malaysian companies to new markets, particularly to the non-traditional markets. EXIM BANK products/services consist of banking facilities and credit insurance facilities.

Business Opportunities

- Looking for Malaysian SMEs or companies seeking to export their products or undertaking any overseas projects or contracts.

-

Looking for Malaysian companies seeking for financing to export their goods or undertaking any overseas projects or contracts to middle east countries and other foreign countries.

Contact Details

Export-Import Bank of Malaysia Berhad (EXIM Bank)

Level 1, EXIM Bank, Jalan Sultan Ismail

50250 Kuala Lumpur

MALAYSIA

Tel: 603-2601 2000

Fax: 603-2601 2469

Website: www.exim.com.my

Contact Person:

1) Mr Baharuddin Muslim

Vice President II

Email: baharuddin@exim.com.my

2) Ms Azmin Hamzah

Vice President II

Email azmin@exim.com.my

MASSA Business Mission to Dili, Timor-Leste from 12 – 15 October 2015

TIMOR-LESTE IN BRIEF

Source: CIA World Fact Book www.cia.gov

| Country Name | Democratic Republic of Timor-Leste |

| Location | Southeastern Asia, northwest of Australia in the Lesser Sunda Islands at the eastern end of the Indonesian archipelago; note – Timor-Leste includes the eastern half of the island of Timor, the Oecussi (Ambeno) region on the northwest portion of the island of Timor, and the islands of Pulau Atauro and Pulau Jaco. |

| Area | 14,874 sq.km. |

| Climate | tropical; hot, humid; distinct rainy and dry seasons |

| Terrain | Mountainous |

| Natural resources | gold, petroleum, natural gas, manganese, marble |

| Land use | agricultural land: 25.1%; arable land 10.1%; permanent crops 4.9%; permanent pasture 10.1%; forest: 49.1%; other: 25.8% (2011 est.) |

| Ethnic groups | Austronesian (Malayo-Polynesian, Papuan, small Chinese minority |

| Population | 1,231,116 (July 2015 est) |

| Religions | Roman Catholic 96.9%, Protestant / Evangelical 2.2%, Muslim 0.3%, other 0.6% (2005) |

| Legal system | civil law system based on the Portuguese model; note – penal and civil law codes to replace the Indonesian codes were passed by Parliament and promulgated in 2009 and 2011, respectively |

| Chief of State | President Taur Matan RUAK, aka Jose Maria de VASCONCELOS (since 20 May 2012); note – the president plays a largely symbolic role but is the commander in chief of the military and is able to veto legislation, dissolve parliament, and call national elections. |

| Head of Government | Prime Minister Dr. Rui Maria de Araújo (since February 2015) |

| Economy | Overview: Since gaining its independence in 1999, Timor-Leste has faced great challenges in rebuilding its infrastructure, strengthening the civil administration, and generating jobs for young people entering the work force. The development of oil and gas resources in offshore waters has greatly supplemented government revenues. This technology-intensive industry, however, has done little to create jobs in part because there are no production facilities in Timor-Leste. Gas is currently piped to Australia for processing, but Timor-Leste has expressed interest in developing a domestic processing capacity. In June 2005, the National Parliament unanimously approved the creation of a Petroleum Fund to serve as a repository for all petroleum revenues and to preserve the value of Timor-Leste’s petroleum wealth for future generations. The Fund held assets of $16.5 billion, as of December 2014. Oil accounts for 90% of government revenues, and the drop in the price of oil in 2014 has led to concerns about the long-term sustainability of government spending. The Ministry of Finance maintains that the Petroleum Fund is sufficient to sustain government operations for the foreseeable future. Annual government budget expenditures increased markedly between 2009 and 2012 but dropped significantly in 2013 and again in 2014. Historically, the government has failed to spend as much as its budget allowed. The government has focused significant resources on basic infrastructure, including electricity and roads. Limited experience in procurement and infrastructure building has hampered these projects. The underlying economic policy challenge the country faces remains how best to use oil-and-gas wealth to lift the non-oil economy onto a higher growth path and to reduce poverty. |

| GDP- real growth rate | 6.6% (2014 est.) |

| GDP – per capita (PPP) | US$4,900 (2014 est.) |

| Agriculture – products | coffee, rice, corn, cassava (manioc, tapioca), sweet potatoes, soybeans, cabbage, mangoes, bananas, vanilla |

| Industries | printing, soap manufacturing, handicrafts, woven cloth |

| Exports | $154 million (2012 est.) – oil, coffee, sandalwood, marble. Potential for vanilla exports |

| Imports | $696.2 million (2013 est.) – food, gasoline, kerosene, machinery |

| Energy – Electricity production | 349.4 million kWh (2012 est.)Electricity consumption: 125.3 million kWh (2012 est.) |

| Crude oil | Production: 79,260 bbl/day (2013 est.)Exports : 77,280 bbl/day (2013 est.)Refined petroleum products – imports: 1,264 bbl/day (2012 est.) |

The official languages of Timor-Leste are Portuguese and Tetum. Bahasa Indonesia and English are the primary business languages. Bahasa Indonesia is widely spoken in Timor-Leste.

Timor-Leste is ranked 172 in doing business in the region of East Asia & Pacific. The Income category of Timor-Leste is Lower Middle Income with GNI Per Capita (US$) at 3,580.

Following are some of the Positive Factors in doing business in Timor-Leste:-

– A Specialised Investment Agency (www.invest-tl.com) – one stop shop for business registration

– Electricity availability

– Competitive tax regime

– Financially sound country (oil fund)

– Stable and safe for foreigners

The Challenging Factors in the business environment in Timor-Leste would include:-

– Education level low but trainability is good

– Legal system, including registration of properties

– Strained infrastructures (port, airport, roads)

– Cost of living

Business Opportunities available in Timor-Leste will be:-

– Port Construction Tibar Bar

– Airport Upgrade

– Roads Construction

– Water Sanitation

– Investment in Tourism

– Investment in Agribusiness

Customs and Logistics

Garuda, Silk Air, Air North and Sriwijaya are airlines that fly to Timor-Leste with direct flights from/to Singapore/Denpasar/Darwin.

Swire (China Navigation), Meratus, Pil and ANL (CMA Group) are shipping lines with direct service from Singapore/Surabaya/Darwin. Freight forwarding/Customs services are supported by SDV (www.sdv.com). SDV is also the agent for Swire, Meratus, Garuda, Air North and FEDEX in Timor Leste.

Informations on other customs and logistics services are:-

– Tax rate on imported goods is low (2.5% + 2.5% compounded on most

items).

– Local production is limited to coffee and artefacts (Tais = Ikat).

– Most containers are shipped back empty, possible to get very competitive

rates on export cargo.

– Current port is suffering congestion, and will ease up after opening of new

port in Tibar Bar.

MASSA BUSINESS MISSION TO DILI,

TIMOR-LESTE FROM 12-15 October 2015

1. Introduction

MASSA organised a Business Mission to Dili, Timor-Leste from 12 – 15 October 2015. 10 participants from 9 companies/organisation took part in the Business Mission. The mission was led by Tan Sri Dato’ Soong Siew Hoong, MASSA Executive Council Member.

The mission was organised as a follow-up to the visit of the Prime Minister of Timor-Leste to Malaysia in April 2014, whereby the Prime Minister had invited Malaysian businesses to avail to the trade, investment and business opportunities in the country. Potential investment sectors include:

a) Oil and gas

b) Fishery – currently mainly traditional fishing activities

c) Livestock – poultry, cattle, pigs, goats, etc

d) Agriculture (mainly coffee) – post harvest processing

e) Import substitution

f) Infrastructure and property development – Port construction, airport upgrade, roads, water sanitation, etc.

The meetings for the delegation were arranged with the kind assistance of the Embassy of Malaysia in Dili.

2. Objectives of the mission

The objectives of the Business Mission were:

a) To understand Timor-Leste’s policies, laws, rules, regulations, political, social and economic environments; business and work culture, etc.

b) To tap into the business opportunities, both trade and investments, that are available in Timor-Leste;

c) To source for resources that are available;

d) To look into setting up manufacturing facilities for import substitution;

e) To seek opportunities in the development of infrastructure, utilities, property and others projects.

3. Programme

3.1 The delegation met the Second Secretary of the Embassy of Malaysia in Dili, Encik Khairul Nazri Mohamed Taib at the Embassy, who gave a briefing to the delegation at the Embassy.

Mission members at the Embassy of Malaysia in Dili (left to right) Ms Florence Khoo (MASSA), Mr Siong Wee Heng (WH Skill Training Sdn Bhd), Mr Lim Hong Yeu (Kemajuan Arjaya Sdn Bhd), Mr Haji Mohamad Nizam B Ramli, (Second Secretary, Embassy of Malaysia in Dili) , Tan Sri Dato’ Soong Siew Hoong, (Mission Leader), Mr Khairul Nazri Mohamad Taib (Second Secretary, Embassy of Malaysia in Dili) Mr Seow Cheng Soon (Probase Manufacturing Sdn Bhd) Ms Soong Jean Penn (Planet Graphics Sdn Bhd) and Mr Tan Kok Han (Muhibbah Engineering (M) Bhd)

Secretariat of State for Arts and Culture

3.2 The delegation visited the Secretariat of State for Arts and Culture (website: www.cultura.gov.tl) and was met by the Director, Ms Maria Isabel de Jesus Ximenes. The Secretariat is tasked with preservation, safeguarding, maintaining and promoting Timor-Leste culture. An academy of arts and creative culture is being planned for the country.

(1st row, 2nd from right) Ms Maria Isabel de Jesus Ximenes, Director, Secretariat of State for Arts and Culture with the delegation members

Ministry of Commerce, Industry and Environment

3.2 The delegation called on the Minister of Commerce, Industry and Environment, H.E. Constâncio da Conceição Pinto and his officers. The delegation introduced themselves and explained their various business profile and interests.

(3rd from left) H.E. Constancio da Conceicao Pinto, Minister of Commerce, Industry and Environment, Timor-Leste with (4th from left) Tan Sri Dato’ Soong Siew Hoong and delegates meeting at his office

The Minister of Commerce, Industry and Environment has the following responsibilities: propose the policy and draft the regulation projects required for the areas under his responsibility; design, execute and assess the policies on commerce, industry and environment; add to the growth of economic activity, including national and international competitiveness; support the activities of economic agents, facilitating solutions that render procedural requirements simpler and faster; appraise and license projects of installation and operations for industrial and commercial ventures; inspect and supervise commercial and industrial activities and ventures, in accordance with the law; keep and manage an information and documentation centre on companies; propose the qualification and classification of industrial ventures, under the applicable legislation; promote the development of the co-operative sector, specially in rural areas and regarding agriculture, in coordination with the Ministry of Agriculture and Fisheries; promote the importance of the co-operative sector and micro and small enterprises, and promote training on the incorporation, organisation, management and accounting of co-operatives and small companies; organize and administer a register of co-operatives; organize and administer the registration of industrial property; promote international and internal rules for standardisation, metrology, and quality control, measurement patterns for units and physical magnitude; implement the environmental policy and assess the results achieved; promote, monitor and support the strategies for the integration of the environment in sectorial policies; Perform the strategic environmental assessment of policies, plans, programs and legislation and coordinate the environmental impact assessments of projects at a national level; Ensure, in general terms and of environmental licensing, the adoption and supervision of pollution prevention and control measures by the relevant facilities. (source: http://timor-leste.gov.tl/?p=13&lang=en)

The delegation was informed that there was differing tax treatment and incentives depending on the type of investments in the country. The main revenue earner of the country comes from the oil and gas sector. It was acknowledged that the infrastructure development in roads, ports, airports, utilities, etc were urgently needed for the country’s economic development. However, progress has been slow despite the interest from many foreign parties. A new port at Tibar Bay has been planned on PPP basis. Also, there are plans to extend the runways at Dili Airport.

Timor-Leste is considered an “LDC” – least developed country and has access to free tariffs in developed markets. The country is keen to develop its coffee industry for possible export in the future. Currently, coffee beans are exported raw to the USA.

Specialized Investment Agency of Timor-Leste (AEI)

Delegates with (5th from left) Eng. Arcanjo Da Silva, Acting President of the Specialized Investment Agency of Timor-Leste (AEI)

3.3 The delegation met with the Acting President, Eng. Arcanjo da Silva and officers from the newly formed Specialized Investment Agency of Timor-Leste, also known as “AEI” – Agencia Especializada de Investimento Timor-Leste. This is a one-stop agency for Investment and Export Promotion that came into effect on 1 January 2015 replacing TradeInvest Timor-Leste with the following mandates:

3.3.1 Organize promotional activities and attract private investment and reinvestment as well as export promotion such as visiting missions, fairs, conferences, seminars, expos, markets and others, within and outside of Timor-Leste.

3.3.2 Establish partnerships or other forms of cooperation with public and private entities, nationals and internationals, in collaboration with other relevant and competent authorities.

3.3.3 Promote training activities for the economic agents, among others, hold conferences, seminars and other initiatives, in order to disseminate legal regime applicable to private investment or reinvestment and external trade.

3.3.4 Produce six monthly reports on the opportunities and advantages of private investment or reinvestment or export of goods and services as well as brochures or other promotional materials.

3.3.5 Coordinate and promote, in a strategic linkage with government agency responsible for foreign affairs, the activity developed by the economic diplomacy of Timor-Leste abroad.

3.3.6 Act as One-Stop-Shop service for reception and guidance of private investors, providing them with all the information relating to private investment or reinvestment in the country.

3.3.7 Ensure the processing of requests for Investor Certificate or Special Investment Agreement, in coordination with other public authorities and agencies involved to obtain the permits, visas, registers and licenses necessary for the approval or implementation of investment projects or reinvestment in Timor-Leste.

3.3.8 Record all requests for Investor Certificate and Special Agreement on Investment.

3.3.9 Enter into agreements with private investors for the implementation of investment projects or reinvestment in Timor-Leste.

3.3.10 To monitor compliance with legal and contractual obligations of private investors and the obligations contained in the Investor Certificate or Special Agreement on Investment, determining the expiry or revocation in case of total or partial non-compliance with legal or contractual obligations of the investors.

3.3.11 To provide support for investments in the country in order to foster and promote reinvestment.

3.3.12 Cooperate actively with the Public Administration in the study, design and implementation of policies and procedures that facilitate and accelerate private investment or reinvestment in the country, including the drawing up of protocols or other forms of cooperation that will allow coordination between departments and agencies.

3.3.13 To study and recommend to the member of Government responsible to adopt economic, legislative, regulatory and financial measures, whenever necessary or convenient to encourage private investment or reinvestment or foreign trade.

3.3.14 Practice other acts determined by its Statute or other applicable legislation.

Source: http://www.invest-tl.com/

3.3.15 The delegation was informed:

• Investments of more than USD20 million require the approval of the Council of Ministers.

• Investments papers submitted to AEI will be evaluated to determine what kind of incentives will be granted to the business.

• Some of the incentives include tax holiday of up to 5 years in Dili, and from 8 to 10 years for investments outside Dili. Corporate/income tax is currently 10%. 50% discount on rental for lease of government land, import tax of 2.5% and export tax of 4.0%, etc. O&G related industries are taxed at up to 30%.

• 100% foreign owned businesses are allowed. Foreign investors cannot own land, but can negotiate for leases.

• The foreign investment law is being drafted and will be put to the Government for approval in February or March 2016.

• To qualify for the incentives, initial investment capital (minimum 50% in cash) required is USD1.5 million.

• Joint ventures require a minimum capital of USD750,000 of which local investment must comprise 75% of the JV.

• Domestic investment require a capital of USD50,000.

3.3.16 It was noted that the Foreign Investment Laws were still work-in-progress for the time being. The Foreign Investment Laws are expected to be in place by 2016.

3.4 A networking meeting, arranged by the Malaysian Embassy in Dili, was held on 13 October 2015 at the Orchid Room of the Timor Plaza Hotel & Apartments. Timorese business people from a wide range of business and sectors came to meet the delegation.

(left to right) Tan Sri Dato’ Soong Siew Hoong and Ms Soong Jean Penn meeting with Timorese businessman at the Timor Plaza Hotel

(2nd from left) Ms Ng Su Fun and (3rd from left) Mr Lee Yai Sin meeting with businessman from Timor-Leste

3.5 The delegation visited the Dili Port Authority (APORTIL) and met the Director who informed as follows:

1. There are plans to build a new deep-sea port at Tibar Bay. The bidding process for Tibar Port is under way and tender bids are expected to be out by end 2015. This will be a PPP project. Tibar Port development is expected to require a budget of USD200 million. The Port will have a depth of 16m. The current port at Dili will be used for passenger ferry services when the Tibar Port is operational. Dili Port has a depth of 7.5 meters and currently has a thoughput of 50,000 TEU/year. Main imports come from China and Indonesia (Sulawesi). Rice is mainly imported from Vietnam.

2. Containers go into TL full but go back empty because of the lack of goods for export from TL.

3. The fishing methods in TL are still traditional and have the potential to be further developed.

3.6 The Chamber of Commerce & Industry of Timor-Leste (CCI-TL) arranged a meeting with the delegation on 14 October 2015 at Restaurant Zella in Dili.

(Standing) Eng. Joao B.F. Alves, Vice-President of the CCI-TL asking a question during the meeting between the delegates and the Timorese businessman

Meeting in progress between the Malaysian delegates and Timorese businessman at the Restaurant Zella in Dili

3.6.1 The Chamber of Commerce and Industry of Timor – Leste (CCITL) is the foremost Chamber of Commerce and an umbrella organization representing business associations in Timor – Leste. CCITL was established following the National Congress held in Dili on 16 – 17 April 2010. The objective of CCITL is to represent the needs of its members in policy advocacy and representation and deliver a range of business services to enhance the skills, knowledge and performance of the businesses its represent to achieve private sector growth. The CCITL aims to be a strategic partner for economic growth to the government as well as a trusted third party for businesses. With the establishment of a functioning Chamber of Commerce and Industry, the private sector will have a united voice representing their business needs and aspirations for the years to come.

Though still in its infant stage, the CCITL hopes to develop and deliver a range tailored business services and solutions to assist its private sector’s growth. This will include the implementation of self-regulatory instruments and processes to assist with the classification of businesses to develop a strong, viable and competitive private sector.

Through these initiatives, the business community hopes to increase its efficiency and productivity leading to new trade, business & investment opportunities and reduced private sector dependency on public sector spending to sustain its business growth.

With the implementation of a number of initiatives targeting business growth, CCITL hopes to gradually become a sustainable organization representing the interests of Timor – Leste businesses and also a strategic partner for national development with a key role on Timor Leste’s economic growth.

The meeting was chaired by the CEO, Sr Nuno Trindade while one of the Vice-Presidents, Eng. Joao B.F. Alves, gave a welcome speech. Leader of the MASSA Delegation, Tan Sri Dato’ Soong Siew Hoong, gave a reciprocal speech.

3.6.2 There was a signing of a MOU between Probase Manufacturing Sdn Bhd, Mr Seow Cheng Soon and Ruvic Group Lda, Mr Rui Castro witnessed by Mr Khairul Nazri Mohamad Taib, Second Secretary of the Embassy of Malaysia in Dili and Eng. Joao B.F. Alves, Vice-President of the CCI-TL.

Signing of MOU between Probase Manufacturing Sdn Bhd, Mr Seow Cheng Soon and Ruvic Group Lda, Mr Rui Castro witnessed by (1st from right) Mr Khairul Nazri Mohamad Taib, Second Secretary of the Embassy of Malaysia in Dili and (4th from left) Eng. Joao B.F. Alves, Vice-President of CCI-TL

The participants then commenced to introduce themselves and their business interests, after which, there were individual meetings between the Malaysian and Timorese business people.

3.7 Meeting with the Minister for Public Works, Transport & Communication

The delegation met with the Minister for Public Works, Transport & Communication, H.E. Gastao Francisco de Sousa, at his office. He welcomed the delegation to visit and explore business opportunities in TL.

Meeting with (3rd from left) H.E. Gastao Francisco de Sousa, Minister for Public Works, Transport & Communication, Timor-Leste

The Minister acknowledged the need for development partners especially from private sector to assist his country to develop infrastructure requirements. The meeting called on the Minister to extend the Government’s co-operation to avail the business opportunities for infrastructure development in TL to Malaysia.

The Minister then immediately called on his agencies to meet our delegation, that is, Director of SENAI Vocational Training Center and the Director-General of Water & Sanitation.

3.7.1 Meeting with Director of SENAI Vocational Training Center

Meeting with (4th from left) Mr Lourenco da Silva Gusmao, Director of SENAI together 3 department directors

The Director of SENAI, Mr Lourenco da Silva Gusmao, together with three departmental directors met our delegation.

Initial discussions revealed that this training center provides vocational training to school leavers (after 11 years of formal primary and secondary school). SENAI welcomed the offer to our delegation to assist with curriculum and course content for vocational courses, technical and management courses for management, supervisors and skilled workers.

3.7.2 Meeting at the Ministry of Public Works, Transport & Communication with the Director-General of Water and Sanitation

The Director-General (DG) of Water and Sanitation, Mr Joao Pereira Jeronimo met our delegation upon the recommendation of the Minister of Public Works, Transport & Communication.

(left to right) Mr Joao Pereira Jeronimo, Director-General (DG) of Water and Sanitation, Ms Ng Su Fun and Mr Rui Castro of Ruvic Group Lda

The DG acknowledged that TL requires a comprehensive master plan to address the infrastructure requirements for water and sanitation. The country is subjected to distinct dry and wet seasons and presently do not have adequate water storage infrastructure to meet the country’s water needs especially during the drought/dry seasons.

Water source for most of the population is via well water only and is free. The town of Dili has tapped water facilities (charges are minimal) but this infrastructure is in need of upgrading. Dili has a population of 200,000 to 300,000 people.

The DG welcomed the idea for investment in infrastructure for Water and Sanitation.

The population of TL is 1.2 million, spread out all over the country. Though there are about 7 main cities including Dili, a small population size is a challenge as economies of scale may not be present.

The DG advised that ADB is undertaking a study of the water requirements of TL and may be ready for the Council of Ministers’ review by 2016.

3.8 The delegation also did a market survey at two major shopping malls in Dili, that is, Leader Supermarket and Timor Plaza (comprising shops, offices and hotel). These two malls are located adjacent to each other.

4. Findings of the Mission

4.1 Foreign Investment Law

The meeting with AEI gave us a brief understanding of TL’s Foreign Investment Law, which is still currently work-in-progress. We look forward to the promulgation of these laws soon.

4.2 Business & Work Culture

4.2.1 Unemployment is approximately 12%, mainly due to lack of industries, lack of entrepreneurial capabilities and lack of capital. Current bank business lending rates range from 9% to 12%.

4.2.2 There are 3 main banks in TL, ANZ Bank (Australian), Banco Nacional Ultramarino (Portuguese), and Bank Mandiri (Indonesian). Foreign labourers (especially Indonesians) seem to be hired mostly to undertake construction work. In the service industry, Singaporeans have established a few Chinese restaurants with chefs from Malaysia.

4.2.3 There are many NGOs operating in TL, funded by foreign donor agencies. Hence many expatriate staff of NGOs are stationed in TL. The presence of these NGOs and their families has given rise to the opportunity to develop real estate accommodation and educational requirements, and other services they are accustomed to.

5. Mission Outcome/Conclusion/Recommendations

5.1 Based on feedback gathered from the delegates, there is potential to export products and services for infrastructure development for roads, ports and airports (cranes and related machineries and equipment), post-harvest and food processing machineries, ship-building, LED lights, etc. The present infrastructure for transportation that is, ports, airport, roads are congested and strained and require upgrade/new facilities.

5.2 Export/Import – TL imports most of its requirements (at least 90%). The supermarkets reveal many food items are imported from Portugal/Indonesia and ASEAN. Members of the mission felt there was opportunity to export a myriad of Malaysian processed food items. Once these items are accepted, there is potential to set up import substitution industries in TL. Perhaps a ‘Malaysia Showcase’ event may be organized in the near future.

5.3 Resources Available in TL – TL exports raw coffee beans to USA. The mission did not have the opportunity to travel out of Dili to look at the agricultural potential. However, there were enquiries from the business networking meetings for machineries to process post-harvest resources.

5.4 Fishing Industry – Fish harvesting methods are nascent. As such, harvest is limited. TL requires marine infrastructure across the entire value chain to develop its marine industry.

5.5 Tourism – We understand that the waters off TL have good diving spots teaming with exotic marine life. This industry is not yet well known. There are no 4-5 stars hotels in Dili. Tourism infrastructure has many opportunities that can be developed further.

SME Corp. Malaysia and SME Industry in Malaysia

History and Background of SME Corp. Malaysia

It all started on 2 May 1996 when the Government of Malaysia decided to establish a specialised agency to stimulate the development of small and medium enterprises (SMEs) by providing infrastructure facilities, financial assistance, advisory services, market access and other support programmes. Known as the Small and Medium Industries Development Corporation (SMIDEC) during that period, its aim was to develop capable and resilient Malaysian SMEs to be competitive in the global market.

In 2007, the National SME Development Council (NSDC) decided to appoint a single dedicated agency to formulate overall policies and strategies for SMEs and to coordinate programmes across all related Ministries and Agencies. SMIDEC was tasked to assume the role and the official transformation into Small and Medium Enterprise Corporation Malaysia (SME Corp. Malaysia) commenced on 2 October 2009. SME Corp. Malaysia is now the central point of reference for information and advisory services for all SMEs in Malaysia.

2. Vision, mission and functions of SME Corp. Malaysia

Vision : PREMIER organisation for development of progressive SMEs to enhance wealth creation and social well-being of nation

Mission : Promote development of competitive, innovative & resilient SMEs through effective coordination & provision of business support

SME Corp. Malaysia was established not only as the Central Coordinating Agency for the SME industry but also to provide various services and assistance to the SMEs namely :

• Business advisory through the “One Referral Centre”;

One Referral Centre (ORC) is the focal meeting point for SMEs to get business advisory and information. Acting as the Central Coordinating Agency, one of SME Corp. Malaysia’s function is as a centre on advisory and information, which are to provide and disseminate relevant and updated information to the SMEs, as well as a channel for feedback on SMEs issue. Advisory services in SME Corp. Malaysia covered business matters as well as programmes available in SME Corp. Malaysia and other relevant Ministries, Agencies, Banks, Development Financial Institutions (DFIs) and Associations.

• Disseminate information on Government funds and incentives on SMEs;

All allocations given by the Government to industry will be consolidated and made known to the public. As the allocations are given to different Ministries and Agencies for the purpose of conducting programmes and giving assistance to the SMEs, it is important for SME Corp. Malaysia as the Central Coordinating Agency to have all the information in one place.

• Channel for feedback on SME issues;

The One Referral Centre is not just a one stop centre for SMEs to come and get business advisory, information and anything related to the industry but it also function as a centre for SMEs to give feedback and as well as to respond to the services provided not only by SME Corp. Malaysia but also other Ministries and Agencies.

• Liaison for domestic and international communities on SME matters;

Every year, SME Corp. Malaysia will organise the SME Annual Showcase with the purpose of showcasing the capabilities as well as the expertise that SMEs from Malaysia can offer on the international ground. This platform has been used by other countries to engage and collaborate with Malaysia exchanging the best practises that both industries can offer. Thus, SME Corp. Malaysia is considered as the embassador to link international corporation and SMEs with local SMEs creating a bridge and opportunity for development of the industries.

• Nurture and develop competitive SMEs through specific capacity building programmes and financial assistance;

SME Corp. Malaysia is committed to giving the industry not just what they need but what is important to assist them in moving forward. Several programmes and financial assistance have been introduced and implemented to ensure that Malaysia’s SMEs are competent not just locally but internationally. Programmes such as Business Accelarator Programme and Enhancement & Enrichment (E²) were introduced to assist SMEs in expanding their businesses.

• Facilitate linkages with large companies and MNCs

Business linkages is very important to ensure that SMEs have been given the relevant opportunities to expand their businesses and also the ability to export their products or services other than the local markets. SME Corp. Malaysia is committed to provide this opportunity by organising business matching session during the SME Annual Showcase, Satu Daerah Satu Industri Programme and during other national programmes that will attract SMEs to participate.

3. Assistance provided by SME Corp. Malaysia to the SME industry

Realising the potential of SMEs in the nation, Government assistance is also crucial and SME Corp. Malaysia has designed as well as commenced several development programmes to boost the growth of smaller firms and help them to stay competitive in the industry. It is important for the Government to identify the needs of the market and design programmes as well as assistance that will address the issues faced by the industry players.

To begin with, the Ministry of International Trade and Industry (MITI) through SME Corp. Malaysia has allocated RM263.5 million under the RMKe-10 for the Business Accelerator Programme (BAP), to develop and nurture dynamic, competitive and resilient SMEs through a structured manner. The programme begins with the evaluation of the applicants through the SME Competitiveness Rating for Enhancement (SCORE) system, and then the required assistance is provided based on the evaluation, be it capacity building, advisory, technical support, market access, linkage or financial support. For microenterprises, a similar programme called the Enrichment and Enhancement Programme (E²) has been given an allocation of RM72.6 million under RMKe-10.

Other financial assistance such as the Syariah Compliant SME Financing Scheme, Soft Loan Scheme for SMEs and SME Emergency Fund are among the financial assistance introduced by SME Corp. Malaysia in collaboration with several commercial banks and MIDF. These financial assistance were introduced to suit current needs of the SMEs as access to financing has been one of the issues that was brought forward by the SMEs from time to time.

It’s important for the Government to identify and evaluate the performance of a company in order to create and develop suitable programmes to cater the needs of the industry. Hence, SME Corp. Malaysia developed a star rating programme or popularly known as SCORE (SME Competitiveness Rating for Enhancement) in 2007. SCORE is a diagnostic tool that rates SME performance at firm level. The programme, initiated by SME Corp. Malaysia’s own officers, has caught the attention of international organisations as a useful diagnostic tool to measure SME competitiveness. A number of MNCs have in fact used SCORE for purposes of industrial linkages and their supplier programmes. Utilising this tool, SME Corp. Malaysia would be able to identify areas of improvement to ensure better efficiency and productivity of the SMEs.

In addition, SME Corp. Malaysia also initiated the SME Expert Advisory Panel (SEAP) which provides SMEs with expert advisory services in the areas of technology, productivity and process improvement, as well as conformance with international standards and ICT. These officers are ready to provide value-added services to the SMEs and at the same time share their vast knowledge and experience as the subject matter expert with the business owners.

To cater for SMEs which are not located at Klang Valley areas, SME Corp. Malaysia has a total of 11 State Offices which facilitate matters pertaining to SMEs. Through these initiatives, SMEs are provided with the latest information on policies, incentives, programmes and financial assistance provided by the Government.

SME Corp. Malaysia also introduced the SME@University Programme which provides a structured learning opportunity to the CEO’s of Small and Medium Enterprises (SMEs). The Programme is designed to help develop capable human capital that will drive diverse management innovation and creativity in developing business acumen among new and existing entrepreneurs. The Programme is based on the model of SME University of Japan, a hands-on approach, to ensure the participants gain knowledge on entrepreneurship and business tools.

The “SME-University Internship Programme” initiated in 2008 as an initiative to link SMEs to the universities as part of the Government efforts to enhance the synergy between the industry and university to upgrade the SMEs’ capacity and capability. An MoU was signed between SME Corp. Malaysia and Ministry of Higher Education (MOHE) to roll out this Programme to all public universities throughout Malaysia.

In reaching out to potential partners and link Malaysian SMEs across borders, SME Corp. Malaysia embarked on a strategic approach by formalising bilateral Memoranda of Understanding (MoU) with international counterpart agencies, namely from Iran, Thailand, Korea, Japan, Syria, Oman, Bangladesh, Pakistan, Turkey, Brunei, and Egypt. Areas of cooperation under the MoUs include exchange of information on policy measures adopted for the promotion of SMEs, establishment of business contacts, linkages and networking, as well as co-organising trade promotion activities in the respective countries.

In the effort to encourage SMEs to go global, SME Corp. Malaysia has introduced the National Mark of Malaysian Brand which is a certification process, audited and monitored by SIRIM. Through this initiative, it is hoped that Malaysian brands are developed not just for the local market, but more important that it is able to penetrate international markets as well.

4. SME Definition in Malaysia

In July 2013 the new SME definition was announced by the Prime Minister of Malaysia during the National SME Development Council Meeting. The definition which has been implemented since January 2014, raised the qualifying threshold for sales turnover and employment of SMEs for all economic sectors. The redefinition was timely in order to take into account the changes that have taken place in the economy since a common definition was adopted in 2005. Businesses are considered as SMEs based on:

• For Manufacturing Sector: Sales turnover ≤ RM50 million OR full-time employees ≤ 200 workers

• Services & other sectors: Sales turnover ≤ RM20 million OR full-time employees ≤ 75 workers

• Locally incorporated under Companies Act 1965; or

• Registered under ROBA (1956) or (LLP) Act 2012; or

• Registered under respective authorities in Sabah & Sarawak; or

• Registered under respective statutory bodies for professional service providers.

• Not public-listed company in main board in Malaysia or other countries

• Not a subsidiary of public-listed company in main board in Malaysia or other countries

• Not a subsidiary of large firms, MNCs, GLCs, Syarikat Menteri Kewangan Diperbadankan (MKDs) and State-owned enterprises

Contact Details SME Corporation Malaysia Level 6, SME 1, Block B Platinum Sentral Jalan Stesen Sentral 2 Kuala Lumpur Sentral 50470 Kuala Lumpur MALAYSIA Tel: +603-2775 6000 (General Line) Fax: +603-2775 6001 Info Line: 1-300-30-6000 Email: info@smecorp.gov.my Website: www.smecorp.gov.my

Editorial

2015 has flown by much too quickly. As we usher in 2016, we are constantly reminded of the challenging times going forward. The global economic uncertainties and volatility and the slowdown in China have both impacted Malaysia and the South-South economies in which we operate in.

In this edition, we provide members with an account of MASSA’s mission to Timor-Leste. The business mission was led by Tan Sri Dato’ Soong Siew Hoong, MASSA’s Executive Committee member. Tan Sri Soong is also the Executive Adviser of ACCCIM and has been a driving force to encourage Malaysian businesses especially SME companies to venture abroad and to look for new markets for their products and services. We applaud and thank Tan Sri Soong for his passion and drive to assist Malaysian SMEs to develop and grow.

Timor-Leste offers many opportunities to do business. Their Government welcomed our delegation with much enthusiasm. We want to take this opportunity to record our thanks and appreciation to H.E. Tajul Aman Mohammad and his team in the Embassy of Malaysia in Dili for their support and assistance which made our mission a success.

Also in this edition, we provide you with an account of the 4th Showcase Malaysia 2015 that was held in Dhaka, Bangladesh. This 4th edition has demonstrated that, through the steadfast efforts of Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI) together with MATRADE and MASSA, the business relationship between Malaysia and Bangladesh has grown deeper and wider. Going forward this augurs well for bilateral trade and investments between our two countries.

The Government has been intensifying its efforts to focus on SME development – the backbone of our economy. We bring you an article on SME Corp. Malaysia and the range of facilitation services that Malaysian companies can avail themselves to.

MIER’s latest report on 3Q2015 of Malaysia’s economic performance is also included in this edition for your review.

We in the editorial team take this opportunity to thank all our members, associates, sponsors and contributors for assisting us in the publication of our e-newsletter throughout 2015. We look forward to this continued collaborations to bring members and readers more interesting and useful articles that can add value to your respective business endeavours.

We wish all members and readers, “Season’s Greetings” and a happy prosperous & healthy New Year.

Fatimah Sulaiman

Editor

President’s Message

The global economic outlook continues to be challenging on all fronts in the last quarter of 2015. Oil prices have hit a record low and geo-political tensions are at an all time high. The Euro zone and Japan are struggling with the possibility of deflation, China is experiencing an economic slow down whereas the US economy continues to gain strength.

It certainly has been a tumultuous year for Malaysia. We are facing challenging economic times. The slowdown in global economic growth, the contraction in trade, low commodity prices and the depreciation of the Ringgit have impacted our economy and will continue to do so in the near future. Despite these issues, Malaysia’s GDP growth for the third quarter of the fiscal year was a commendable 4.7% and our economy is projected to grow by 4.5% in 2016.

Our country hosted the 27th ASEAN Summit this past November which culminated with the signing of the Kuala Lumpur Declaration that reaffirmed Malaysia’s commitment to creating and fostering a Southeast Asia that is peaceful, free, and prosperous. Prior to the ASEAN Summit, the APEC Summit was held in Manila where final negotiations regarding the Trans-Pacific Partnership Agreement (TPPA) were made. Malaysia is one of the twelve countries involved in the TPPA, which is expected to alter the way in which we do business in the future. The ASEAN Economic Community (AEC) is a growing market of 600 million consumers and has the potential to become the global center for trade, technology, finance, and talent recruitment. Malaysia must seize this chance and take advantage of the tremendous opportunities that ASEAN can offer at every level.

While the TPPA is expected to be ratified by member countries over the next 2 years, we must be cognizant of developments and acquaint ourselves with what will become the ‘new normal’ when it comes to doing business. Malaysia is a trading nation and markets opened through the TPPA will boost our exports. We must strive to innovate and raise our level of competitiveness. We can achieve stronger and more sustainable economic growth and in the process, we will create a stronger Malaysia.

As 2015 comes to a close, we usher in the new year with optimism and hope – hope for economic development and prosperity and hope for a world at peace. I would like to convey MASSA’s gratitude to all members and especially to Executive Committee members for their much valued participation and contribution to the Association this past year. I wish you a happy, healthy, and successful 2016!

Tan Sri Azman Hashim

President

Forthcoming Events

(1) Network & Briefing Session on “Business Opportunities and Current Developments in Timor-Leste” on 14 August 2015

A Networking and Briefing Session on “Business Opportunities and Current Developments in Timor-Leste” organised by MASSA will be held on the following:-

Date: Friday, 14 August 2015

Time: 3:00pm to 4:30pm

Venue: Banquet Hall, 26th Floor, Bangunan AmBank Group

Jalan Raja Chulan, Kuala Lumpur

The speaker at the briefing session will be Mr Eric Mancini, Commercial Manager, North West Shelf & Timor Sea of SDV Asia Pacific Corporate Pte. Ltd. Mr Mancini, who has experience in the logistics sector in Timor-Leste, will be able to provide information on the business environment in Timor-Leste, business opportunities as well as the current developments of the country.

This session is held in conjunction with the “Trade & Investment Mission to Dili, Timor-Leste” organised by MASSA, in collaboration with The Associated Chinese Chambers of Commerce & Industry of Malaysia (ACCCIM) and lead by YBhg Tan Sri Dato’ Soong Siew Hoong, EXCO Member of MASSA and Executive Adviser of ACCCIM from 12 to 15 October 2015.

MASSA members and business associates who would like to find out more on the trade & investment/business opportunities available in Timor-Leste are cordially invited to attend this briefing session by contacting MASSA Secretariat at Tel: +603-2078 3788 / Email: mail@massa.net.my

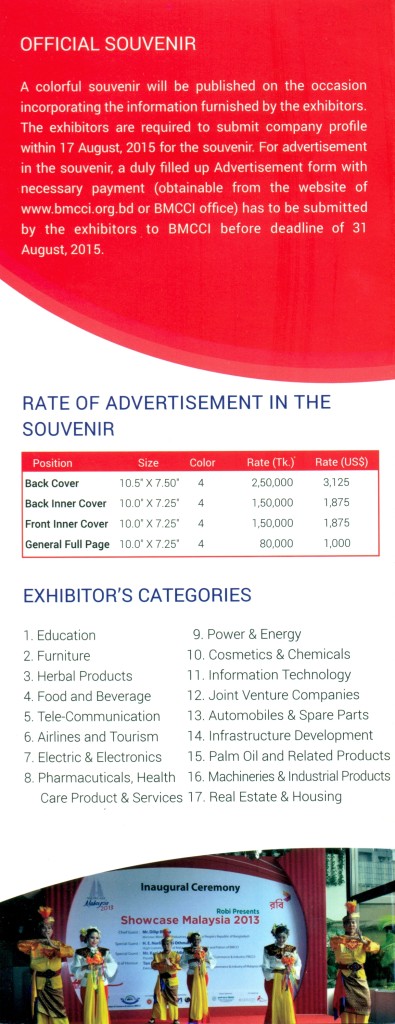

(2) “Showcase Malaysia 2015” from 15 to 17 October 2015 at Pan Pacific Sonargaon, Dhaka, Bangladesh

Bangladesh-Malaysia Chamber of Commerce & Industry (BMCCI) in collaboration with the High Commission of Malaysia in Bangladesh, High Commission of Bangladesh in Malaysia and supported by Malaysia External Trade Development Corporation (MATRADE) and Malaysia South-South Association (MASSA) is organising the “Showcase Malaysia 2015” which will be held in Dhaka, Bangladesh from 15 to 17 October 2015.

This Showcase, being the 4th of its edition, will focus on the following sectors:-

– Education

– Furniture

– Herbal Products

– Food and Beverage

– Telecommunication

– Airlines and Tourism

– Electric & Electronics

– Pharmaceuticals, Health Care Product & Services

– Power & Energy

– Cosmetics & Chemicals

– Information Technology

– Joint Venture Companies

– Automobiles & Spare Parts

– Infrastructure Development

– Palm Oil and related products

– Machineries & Industrial products

– Real Estate & Housing

For further information on this event, please log on to BMCCI’s website at www.bmcci.org.bd or www.showcase.bmcci.org.bd or Email: showcase@bmcci.org.bd

(3) INTRADE Malaysia 2015 from 4 to 7 November 2015 at Menara MATRADE, Kuala Lumpur

“INTRADE Malaysia 2015” organised by MATRADE will be held from 4 to 7 November at Menara MATRADE, Kuala Lumpur.

“International Trade Malaysia” or “INTRADE” is an annual international exhibition organised by MATRADE since 2007 which connects trade exhibitors, buyers and visitors to the global markets. INTRADE enhances networking, business matching, exchange trade ideas and inspiration amongst the business community of difference countries, especially whose who are seeking to venture into the global market.

Once again this year, INTRADE will presents FACIT @ INTRADE, a lifestyle exhibition on textile, fashion and accessories, shoes, fashion jewellery, cosmetics and personal care. FACIT @ INTRADE is a brand new segment created under INTRADE which displayed high style & unique lifestyle products which inspire, guide and motivate people and embodies the opinion of creators. FACIT is the abbreviation of Fashion, Art, Cosmetic, Interior & Textile. FACIT @ INTRADE is the trade exhibition of the inaugural Malaysia Fashion Week (MFW) 2014.

For more information on this event, please log on to www.intrade.malaysia.my or www.malaysiafashionweek.my

MASSA Events

MASSA 24th Annual General Meeting (AGM)

on 17 June 2015

Tan Sri Azman Hashim, President of MASSA chaired the 24th Annual General Meeting (AGM) of MASSA at the Banquet Hall, 26th Floor, Bangunan AmBank Group, Jalan Raja Chulan, Kuala Lumpur on 17 June 2015.

(right to left) Tan Sri Azman Hashim, President of MASSA chairing the 24th Annual General Meeting (AGM) of MASSA with Tan Sri Dato’ Michael Chen Wing Sum, Vice-President (I) of MASSA and Puan Fatimah Sulaiman, Hon. Assistant Secretary of MASSA

MASSA Executive Committee and Office Bearers elected for the term 2015 / 2017 are:-

OFFICE BEARERS

President : Tan Sri Azman Hashim

Vice President (i) : Tan Sri Dato’ Michael Chen Wing Sum

Vice President (ii) : Datuk Lim Fung Chee

Honorary Secretary : Datuk Lee Teck Yuen

Assistant Honorary Secretary : Puan Fatimah Sulaiman

Honorary Treasurer : Tan Sri Datuk Tee Hock Seng, JP

MASSA EXECUTIVE COMMITTEE MEMBERS

Tan Sri Dato’ Mohd Ramli Kushairi Tan Sri Dato’ Soong Siew Hoong

Tan Sri Ghazzali Sheikh Abdul Khalid Dato’ Soam Heng Choon

Dato’ J Jegathesan Dato’ Tan Kia Loke

Dato’ Lawrence Lim Swee Lin Dato’ Cheah Sam Kip

EX-OFFICIO

Ms Normah Osman

Ministry of International Trade & Industry Malaysia (MITI)

Ms Fenny Nuli

Ministry of Foreign Affairs (Wisma Putra)

Datuk Dzulkifli Mahmud

Malaysia External Trade Development Corporation (MATRADE)

Dato’ Azman Mahmud

Malaysia Investment Development Authority (MIDA)

(left) Dato’ Lim Fung Chee, Vice-President (II) of MASSA and (right) Tan Sri Dato’ Soong Siew Hoong, EXCO Member of MASSA

(left) Tan Sri Datuk Tee Hock Seng, JP, Hon. Treasurer, MASSA and (right) Dato’ Tan Kia Loke, EXCO Member of MASSA

(2nd from left) Datuk T.Y. Lee, Hon. Secretary of MASSA with Dato’ Lawrence Lim Swee Lim, Dato’ Soam Heng Choon and Tan Sri Dato’ Soong Siew Hoong, MASSA EXCO Members at the AGM

(left to right) Mr Mohd Roslan bin Ali, EMKAY Group, Mrs Marina Yusof, MATRADE and Ms Audrey S. Jemat, Ministry of Foreign Affairs

The President thanked the Executive Committee and Office Bearers for their continuing support and MASSA members for their participation in the MASSA events and activities.

The meeting also observed a minute of silence in respect and memory of the late Tan Sri Datuk Seri Utama Thong Yaw Hong, MASSA Vice-President, who passed away on 28 May 2015.

MASSA members were then treated to a sumptuous Hi-Tea refreshments after the meeting.

(left to right) Dato’ Soam Heng Choon, Tan Sri Azman Hashim and Datuk T. Y. Lee having a drink after the AGM

(left to right) Tan Sri Azman Hashim, President of MASSA, Mr Muhammad Khalidi Ramli, Puncak Niaga Holdings Berhad and H.E. Syed Hassan Reza, High Commissioner of Pakistan to Malaysia

NOTICE

Founding Vice-President of MASSA, YBhg Tan Sri Datuk Seri Utama Thong Yaw Hong passed away on 28 May 2015. Tan Sri has been instrumental in the founding of MASSA (and its sister organisation, MASSCORP Berhad) in 1991. He devoted much ideas, commitment and time to nurture and grow the association, especially in its formative years. As Vice-President, the Executive Committee had benefited from his wisdom and steadfast support to realize the South-South vision to expand Malaysian products & services and branding to the developing countries. He will be deeply missed.

The Association wish to express its deep appreciation to the late Tan Sri Thong for his dedicated services to MASSA, and our deepest condolences to Puan Sri Datin Lem Fong Ying and family members.

Briefing on “Business and Investment

Opportunities in Pakistan” by H.E. Syed Hassan

Reza, High Commissioner of Pakistan to

Malaysia on 17 June 2015

H.E. Syed Hassan Raza, High Commissioner of Pakistan to Malaysia delivered a presentation on “Business And Investment Opportunities in Pakistan” to MASSA members after the MASSA AGM.

(left) Tan Sri Azman Hashim, President of MASSA and (right) H.E. Syed Hassan Reza, High Commissioner of Pakistan during the Q & A session

(left to right) Mr Mohd Roslan bin Ali, EMKAY Group, Datuk Lim Fung, Vice-President (II) of MASSA and H.E. Syed Hassan Resa, High Commissioner of Pakistan to Malaysia after the briefing session

Briefing Session on “Business Opportunities and

Current Developments in Timor-Leste”

on 14 August 2015

A networking session on “Business Opportunities and Current Developments in Timor-Leste was held on 14 August 2015 in Kuala Lumpur.

The speaker at this session was Mr Eric Mancini, Commercial Manager, North West Shelf & Timor Sea of SDV Asia Pacific Corporate Pte. Ltd. who has hands on, extensive experience in integrated freight forwarding logictics sector in the North West Shelf and Timor Sea, including parts of Australia, Eastern Indonesia and East Timor. Mr Eric Mancini focused his presentation on the business environment in Timor-Leste, business opportunities as well as the current developments of this country.

(right) Ms Ng Su Fun, Executive Secretary of MASSA with (left) Mr Eric Mancini at the Timor-Leste presentation to MASSA members

The networking session was held in conjunction with the upcoming Trade & Investment Mission to Dili, Timor-Leste organized by MASSA in collaboration with The Associated Chinese Chambers of Commerce & Industry Malaysia (ACCCIM) from 12 to 15 October 2015. This Mission will be led by Tan Sri Dato’ Soong Siew Hoong, EXCO Member of MASSA and Senior Advisor of ACCCIM.

H.E. Kay Rala Xanana Gusmao, Prime Minister of Democratic Republic of Timor Leste visited Malaysia in April 2014. A Business Forum on Trade & Investment Opportunities in Timor-Leste was held at MATRADE on 1 April 2014 in conjunction with the Prime Minister’s visit.

In his keynote speech, the Prime Minister highlighted Timor Leste’s young and growing economy, as well as the vast trade, investment and business opportunities available in the country. The oil and gas sector is the main contributor to the economy.

Other Sectors for Potential Investments include:

a) Fishery Investment – Timor Leste has a coast line of 730 km. Actual productivity using mostly traditional fishing activities is 3600 ton/annum but there is potential to increase this to 640,000 tons per annum;

b) Livestock – poultry and beef are currently imported from Australia, Brazil, New Zealand and Holland. In 2012, imports of poultry amounted to 31,368 tons while beef accounted for 731.3 tons. Other meats include pork and mutton which are also imported into Timor Leste. A total of 1,561 tons of eggs was imported into the country in 2012, mainly from Malaysia and Australia.

c) Timor Leste is also promoting import substitution industries as most of their goods are imported. This also means that there is great potential for the trading business to flourish.

d) Infrastructure and property development

BRIEFS ON TIMOR-LESTE

Timor-Leste was colonized by Portugal in the 16th century and obtained Independence declaration in 1975. Timor-Leste was occupied by Indonesia from 1975 to 1999 and was in transition under UN from 1999 until its independence in 2002.

Timor-Leste has a population of 1.2 Million with a land area of 14,870 KM. Dili is the capital of Timor-Leste. The population growth rate is 2.44%. The median age is 18.5 years with urban population at 28.3%. The fertility rate is 5.11 with Infant Mortality at 38.79/1,000. This is a young nation with a fast growing population.

The official languages of Timor-Leste are Portuguese and Tetum. Bahasa Indonesia and English are the primary business languages. Bahasa Indonesia is widely spoken in Timor-Leste.

Timor-Leste is ranked 172 in doing business in the region of East Asia & Pacific. The Income category of Timor-Leste is Lower Middle Income with GNI Per Capita (US$) at 3,580.

Following are some of the Positive Factors in doing business in Timor-Leste:-

– A Specialised Investment Agency (www.invest-tl.com) – one stop shop for business registration

– Electricity availability

– Competitive tax regime

– Financially sound country (oil fund)

– Stable and safe for foreigners

The Challenging Factors in the business environment in Timor-Leste would include:-

– Education level low but trainability is good

– Legal system, including registration of properties

– Strained infrastructures (port, airport, roads)

– Cost of living

Business opportunities available in Timor-Leste will be:-

– Port Construction Tibar Bar

– Airport Upgrade

– Roads Constuction

– Water Sanitation

– Investment in Tourism

– Investment in Agribusiness

Customs and Logistics

Garuda, Silk Air, Air North and Sriwijaya are airlines that fly to Timor-Leste with direct flights from/to Singapore/Denpasar/Darwin.

Swire (China Navigation), Meratus, Pil and ANL (CMA Group) are shipping lines with direct service from Singapore/Surabaya/Darwin. Freight forwarding/Customs services are supported by SDV (www.sdv.com). SDV is also the agent for Swire, Meratus, Garuda, Air North and FEDEX in Timor Leste.

Informations on other customs and logistics services are:-

– Tax rate on imported goods is low (2.5% + 2.5% compounded on most items).

– Local production is limited to coffee and artefacts (Tais = Ikat).

– Most containers are shipped back empty, possible to get very competitive rates on export cargo.

– Current port is suffering congestion, and will ease up after opening of new port in Tibar Bar.

Note:

MASSA wish to express its appreciation to SDV and Mr Eric Mancini for his sharing and look forward to meeting him in Dili, Timor-Leste during the business mission from 12 – 15 October 2015.

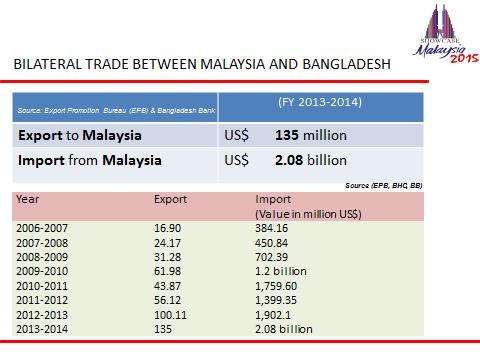

Showcase Malaysia 2015 from 15 – 17 October 2015 @ Dhaka, Bangladesh

INTRODUCTION

Greetings from BMCCI !

Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI) has been working with a mission to foster strategic capabilities through Business Forums, Trade Fairs, Exchange of Business Delegation, etc.. escalating to trade and investment opportunities between Bangladesh and Malaysia.

BMCCI organised the first Bangladesh-Malaysia Business Forum in 2004 in Dhaka with a grand success. BMCCI organized Malaysia Single Country Trade Fair, “Showcase Malaysia” in 2008, 2011 & 2013 in Dhaka respectively. BMCCI also organised three “Showcase Bangladesh” in 2010, 2012 & 2014 in Kuala Lumpur. Also, in 2012, a Seminar on “Business Opportunities in Bangladesh” and in 2014, two seminars, one on “Investment Opportunties in Bangladesh”: Emphasized on Econonic Zones and Public Private Partnerships (PPP)” and the other Seminar on “Investment Opportunities in Bangladesh: Infrastructure and other Potentials” was held in Kuala Lumpur.

This year, BMCCI is also organising the “4th Showcase Malaysia 2015” in Dhaka on 15-17 October at the Grand Ballroom, Pan Pacific Sonargaon Dhaka with the support of MATRADE and MASSA in collaboration with both the High Commissions. The main objective of this showcase is to emphasize Malaysia as a reliable and effective source of diversified products & services and creating scope for making wide network for the Malaysian businessmen with the local business community. This event will also provide a great avenue to attract large number of businessmen, visitors and professionals from Bangladesh and is expected to achieve its purpose to project Malaysia as the preferred destination and source for higher education, healthcare, tourism, property investment, automobiles, construction, building materials, petroleum explosion, banking & financial services. BMCCI believes, Bangladesh is an attractive investment and business destination for Malaysia. BMCCI welcomes Malaysian business leaders and exporters to participate in the show and strengthen the business relations with their Bangladesh counterparts.

Seminar on “Business & Investment Opportunities in

Bangladesh” on 30 July 2015

@ Menara MATRADE, Kuala Lumpur

Bangladesh-Malaysia Chamber of Commerce (BMCCI), Bangladesh High Commission and Malaysia External Trade Development Corporation (MATRADE) in collaboration with Malaysia South-South Association (MASSA) organised a Seminar on “Business & Investment Opportunities in Bangladesh” on 30 July 2014 at Menara MATRADE, Kuala Lumpur.

Dato’ Dzulkifli Mahmud, Chief Executive Officer of MATRADE delivered the Welcome Remarks with H.E. Mr Md Shahidul Islam, High Commissioner of Bangladesh to Malaysia delivered the Remarks at the Seminar.

(left) H.E. Mr Md. Shahidul Islam, High Commissioner of Bangladesh to Malaysia delivered the Remarks with (right) Dato’ Dzulkifli Mahmud, Chief Executive Officer of MATRADE at the Seminar

(left to right) Mr Syed Moazzam Hossain, Chairman, Organizing Committee of Showcase Malaysia 2015, Dato’ Dzulkifli Mahmud, Chief Executive Officer, MATRADE, H.E. Mr Md. Shahidul Islam, High Commissioner of Bangladesh to Malaysia and Ms Ng Su Fun, Executive Secretary of MASSA at the Press Conference

This Seminar was held to promote “Showcase Malaysia 2015” which will be held in Dhaka, Bangladesh from 15 – 17 October 2015. “Showcase Malaysia 2015” will be a general trade fair with special focus on the following sectors:-

• Automotive

• Personal Care

• Food & Beverages

• Halal Sector

• Chemicals & Chemical Products

• Services (construction, franchise, Islamic banking & finances).

The topics covered at the Seminar include the following:-

a. Overall Bangladesh business scenario

b. Construction / Infrastructure Projects in Bangladesh

c. Telecommunication Sector

d. Franchising Industry in Bangladesh

e. Food industry

f. Halal food prospect

g. Education supporting materials

h. Furniture sector

i. ICT sector

j. Tourism and hospitality sector

k. Rubber sector

l. Hospital equipment and supplies

m. Construction materials

n. Energy savings equipment

o. Renewable/green technology

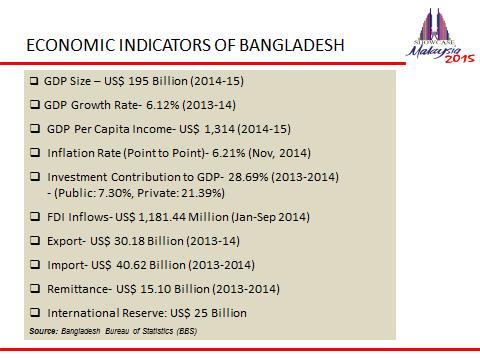

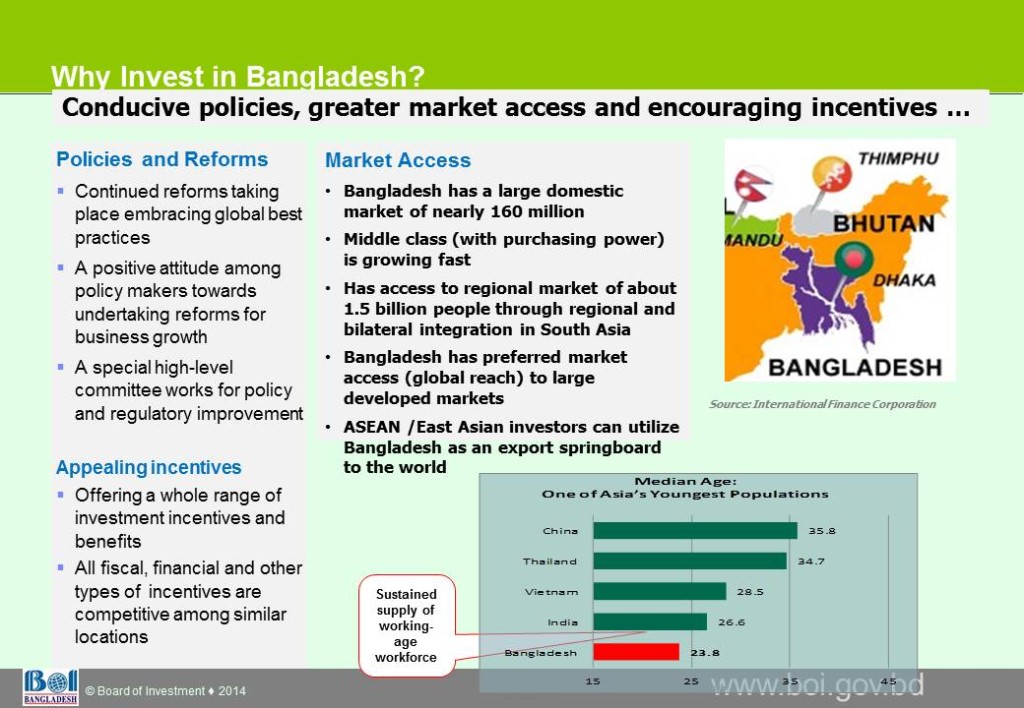

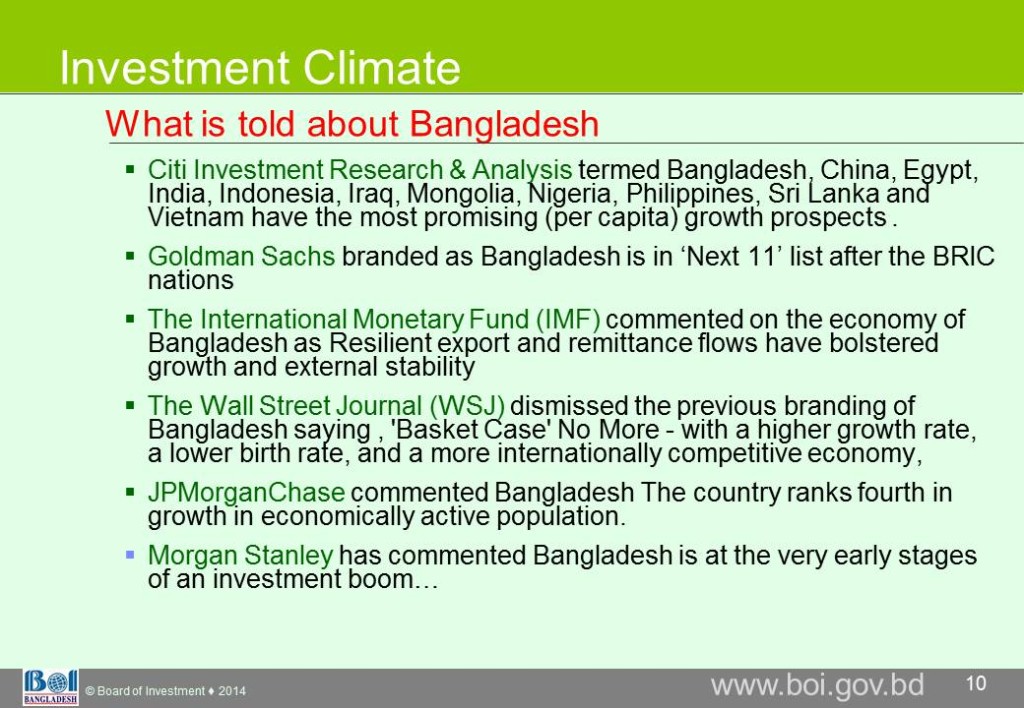

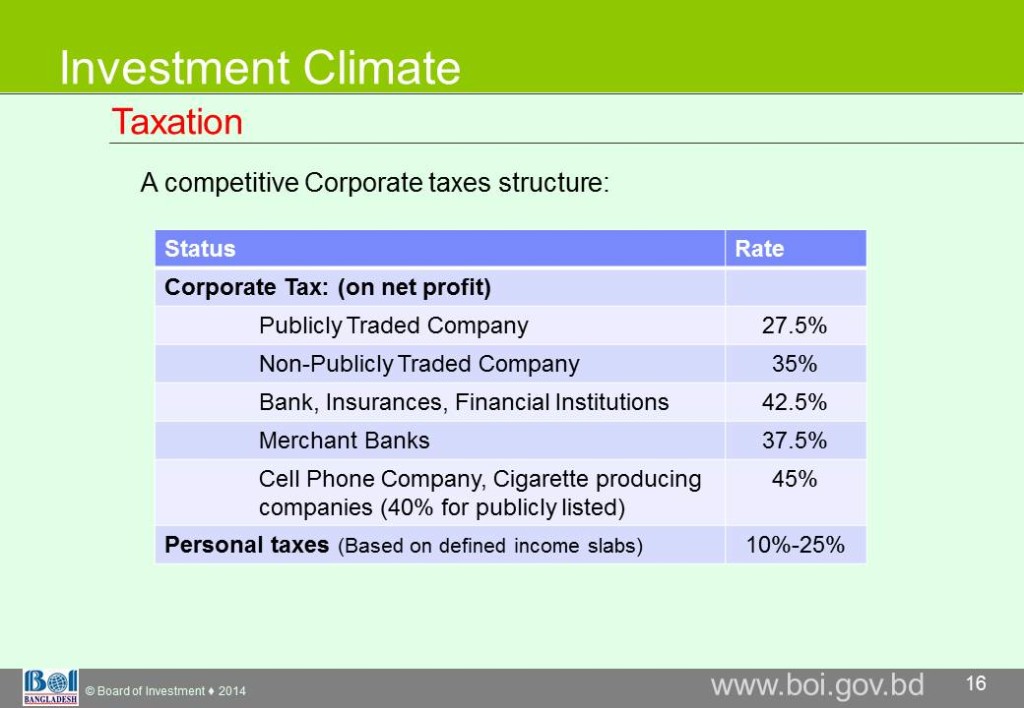

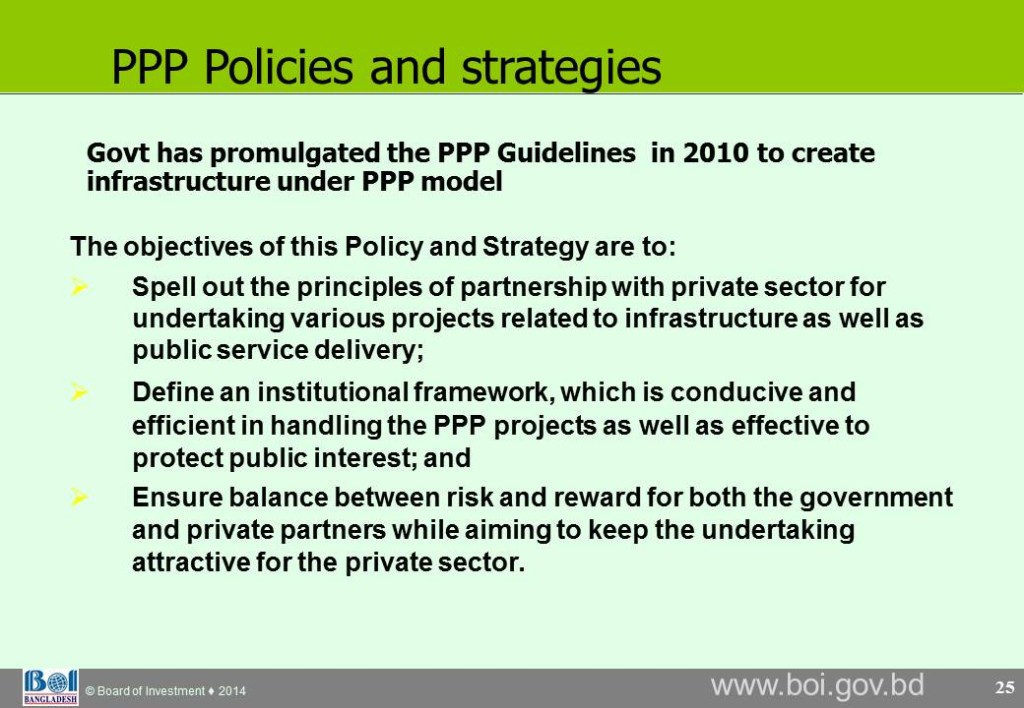

Speakers from BMCCI and the Board of Investment of Bangladesh presented papers to the participant at the Seminar with some of the papers as follows:-

There are ample opportunities to do business in and with Bangladesh.

• World Bank’s research shows that Bangladesh economic performance is doing well for the past few years as compared to the rest of countries under the south Asia region.

• There is an increase in total import of Bangladesh exports from the world for the first quarter of year 2015.

• The consumer spending is growing in line with the constant growth of GDP per capita. The GDP per capita increased by 4% from USD 597 in year 2013 to USD 625 in year 2014.

• Annual GDP Growth (%) for Bangladesh is improving from 6.0% in 2013 to 6.1% in 2014 and forecast to increase up to 7.0% in year 2017.

• As the country is moving towards the vision of middle income country by 2021, the middle income citizens are expanding with increase in the purchasing power. This is a new opportunity for Malaysian companies.

• There is high demand for electrical and electronic equipment, plastics, iron and steel, vehicles, petroleum and oil, textiles and halal food.

Malaysia Competition Commission (MyCC)

Is Compliance on your Agenda?

The obligations in the Competition Act 2010 (CA 2010) have been available to businesses since Royal Assent in June 2010, now nearly 5 years ago. Against this background, the MyCC expects that competition law is already part of the compliance activities of every business in Malaysia. If it isn’t, your business should be taking urgent steps to put a competition law compliance programme (“compliance programme”) in place immediately.

Many businesses, especially smaller ones, may be wondering exactly what a compliance programme involves. It is basically the implementation of a set of policies and procedures designed to ensure your business complies with the CA 2010. The programme must apply to all employees, including senior management and the board of directors.

Businesses that operate in jurisdictions with well-established competition regimes recognise the importance of competition law compliance. It is regarded in the same way as compliance with health & safety legislation, anti-bribery and corruption legislation and tax laws. For these businesses, competition law compliance often forms part of a wider corporate compliance programme.

If you are wondering what a good compliance programme looks like, it will be comforting to know that there is no “one size fits all” programme. Large companies will require something different to small businesses and those in high risk industries will need something different to those businesses in lower risk areas. All businesses will need to individually identify their own risk areas, assess the extent of those risks and manage those risks going forward.

The UK Office of Fair Trading recommends a four step competition law compliance process – risk identification, risk assessment, risk mitigation and review. The Australian Competition and Consumer Commission also refers to a need for businesses to identify, remedy and reduce the risk of competition law breaches as part of their compliance programme.

Although such a programme will differ from business to business, the key components should be:

(1) A statement, supported by senior management, setting out the policy of your business towards competition law compliance.

(2) Training (tailored to your business and industry) for staff, particularly those who work in risk areas.

(3) A reference manual which explains in simple language what the law says and how it applies to your business, using relevant examples. For small businesses, this may be a simple list of dos and don’ts.

(4) A competition law representative who is responsible for competition law compliance and audit and to whom questions or problems can be directed.

(5) An annual compliance report (this may not be necessary for smaller businesses).

(6) Periodic review to check that the programme is working.

Since its inception, the MyCC has been stressing the need for Malaysian businesses to become competition law compliant. Yet a 2012 survey conducted by the Federation of Malaysian Manufacturers found that almost 20% of respondents had not taken any steps to comply with the CA 2010. Another survey conducted by the MyCC based on the feedback obtained from its advocacy sessions held throughout 2012 reveals that 61.9% of the respondents were of the view that their companies probably took appropriate action to ensure compliance, 27.5% were not sure whether their companies had a compliance programme while 10.6% did not take any appropriate action. These are worrying statistics and the MyCC wants to see them improved.

It may be interesting to note that in mature jurisdictions where competition law has been in force for decades, cartels remain a substantial problem. Statistics released by the Organisation for Economic Cooperation and Development (OECD) show that between 1990 and 2005 a total of 174 companies violated laws against price fixing at least 2 times with some reoffending as many as 26 times! This has raised serious concerns which led the OECD Competition Committee to hold a roundtable on Promoting Compliance with Competition Law in June 2011 to identify and assess numerous factors that influence compliance. The delegates from around the world agreed that the objectives of a good competition compliance programme could be summarised as the “5 C’s” of compliance – Commitment, Culture, Compliance know-how and organisation, Controls and Constant monitoring and improvement. (The 5Cs were originally used by Fiona Carlin of Baker & McKenzie.)

What is clear is that competition authorities around the world remain extremely active. An inaugural Corporate Counsel Survey done by Deloitte in 2011 found that corporate counsels reported greater activity among regulators over the last five years. Conducting investigations was cited most often as a focus of regulators and among these were breaches of competition or antitrust laws.

The introduction of a compliance programme will require the investment of time and money by your business but this will be well worth it as the substantial benefits of having a compliance programme in place will far outweigh these costs.

An effective compliance programme should significantly reduce the risk of your business breaching the CA 2010 and thereby avoid being fined up to 10% of the worldwide turnover of your business.

It will be worth your effort to do a regular review of your business agreements and activities which will give your business an opportunity to identify and remedy any potential breaches before the MyCC investigates. In these circumstances, your business may choose to apply to the MyCC for leniency which could result in any fine being reduced (provided all the MyCC’s conditions are met).

An investigation by the MyCC will be both time consuming and costly for your business and should be avoided if you have an effective compliance programme in place. Without an effective compliance programme there is a greater risk of your business breaching the CA 2010, resulting in substantial negative publicity and damage to the reputation of your business. Conversely, if you have compliance programme in place, your business will be regarded as having good corporate governance and more international businesses may be willing to do business with you.

It is crucial that someone senior within your organisation ensures that a comprehensive and clear compliance programme is put in place to prevent your business from incurring the severe sanctions laid down for an infringement of the CA 2010. As the requirements for competition law compliance will differ from business to business, you should seek your own advice either from a competition law or compliance expert.

The MyCC has published a Compliance Guideline which set out more detail what is required for an effective competition law compliance programme. To download MyCC publications and for more info on the MyCC, please log on to www.mycc.gov.my.

Contact Details Malaysia Competition Commission (MyCC) 15th Floor, Menara SSM @ Sentral No. 7, Jalan Stesen Sentral 5 Kuala Lumpur Sentral 50623 Kuala Lumpur Tel: +603-2273 2277 Fax: +603-2272 2293 Email: enquiries@mycc.gov.my Website: www.mycc.gov.my Corporate Affairs Division, MyCC 1) Ms Noor Hasnizan Hassan Tel: +603-2273 2277 Ext. 111 Email: izan@mycc.gov.my 2) Ms Anis Syafiqa Tel: +603-2273 2277 Ext. 212 Email: anis@mycc.gov.my

Myanmar’s Moment, Your Opportunity – Doing Business in the Myanmar – The Frontier Market of Asia

Article by: Mr. Jonathan Rao, Counsellor (Trade) Trade Section / MATRADE Yangon

Myanmar has undergone significant changes to become one of the fastest-growing economies in the world today. Under the leadership of President U Thein Sein, the government has embarked on a series of reforms to liberalise the economy and trade while gradually shifting towards a market-driven business environment. Through its continuous engagement with the international community, the country has rebranded itself from a once-isolated nation into a bright spot in the region.

In a report compiled by The Business Insider on the ‘Top 13 Fastest-Growing Economies in the World’, Myanmar was ranked fourth fastest, driven mainly by a young labour force and abundance of natural resources. The list was compiled based on the World Bank’s Global Economic Prospects report released in June 2015, which forecasted Myanmar’s GDP to grow at the rate of 8.5 per cent this year; 8.2 per cent in 2016; and 8.0 per cent in 2017.

The positive outlook is echoed by the Asian Development Bank (ADB), which predicted that Myanmar’s GDP growth will accelerate to 8.3 per cent in the 2015-2016 fiscal year after moderating 7.7 per cent in the 2014-2015 fiscal year. Growth is expected to rise on the back of continued investments, ongoing structural reform, improved business environment, and gradual integration into the Southeast Asian sub-region.

Mr Jonathan Rao (right) receives President U Thein Sein after returning from a State Visit to Malaysia in March 2015

According to the McKinsey Global Institute (MGI), Myanmar has the potential to quadruple its current GDP to USD200 billion in 2030. At the same time, the consuming class is expected to grow from 2.5 million in 2010 to 19 million in 2030, which could potentially triple spending from USD35 billion to USD100 billion.

The opportunities are immense. A growing consumer class; largely unreached population of more than 50 million people; and access to the greater neighbouring markets of about 2.8 billion people – these are some of pull factors, which has drawn many foreign companies to establish their presence in Myanmar. From food and beverages to power stations, oil and gas, construction, consumer electronics, franchises and automobiles, companies from almost all sectors are wasting little time in securing a foothold in this market.

The changes in this country have also enticed many Myanmar professionals to return and be part of the transformation process. Realising the prospects in Myanmar, many have opted to leave their comfort zones to become returning expats or ‘repats’ to set-up businesses or contribute their skills as well as knowledge for the betterment of the country. Certainly, these are the future movers and shakers who will play an important role in developing Myanmar to its full potential.

LIBERALISATION & TRANSPARENCY, A BOOST FOR MYANMAR’S GROWTH

The liberalisation process in Myanmar has brought many positive changes and boosting economic growth. Some of the notable changes are:

Opening of the banking sector – In October 2014, Myanmar awarded the much-awaited banking license to nine foreign banks including Malaysia’s Maybank. The big winners are Japanese banks with three licences. Singapore came in second with two banking licences. China, Thailand, Malaysia and Australia won one banking licence each. The opening of Maybank’s office in Myanmar this year is expected to provide more financing options for Malaysian investors keen to venture into this market. In the bigger picture, the entry of foreign bankers will be an opportunity for the country to modernise its domestic financial sector by fostering cooperation, technical transfer and learning in a competitive environment.

Health Insurance – A health insurance plan set out by the government has started in July 2015 for the first time in Myanmar under a test period of one year. The insurance industry is regulated by Myanmar Insurance, which is a state-owned enterprise that also issues licenses. It has been the sole insurer in the country since 1952 and enjoyed a monopoly until the government decided to open up the insurance sector to local companies in June 2013. Currently, there are 12 local companies that have been authorized to sell insurance. There are 15 foreign insurance companies that have been permitted to operate as representative offices but are not allowed direct underwriting. The industry is still in its infancy whereby only a few people in Myanmar or less than 10 per cent of the population can afford insurance. For more than 50 years, private insurance did not exist in Myanmar, and many do not have much idea of the benefits for policy holders. Despite these challenges, many in the Myanmar insurance sector are positive as the economy grows with more people beginning to feel the need to protect themselves as well as their assets.

Yangon Stock Exchange – Myanmar’s first stock exchange is targeted to be launched in October 2015 and will be known as the Yangon Stock Exchange (YSE). It will be operated by the Myanmar Economic Bank in partnership with the Japan Exchange Group and Daiwa Institute of Research. Myanmar is the last country in ASEAN without a stock exchange. The Myanmar government aims to ensure that the YSE is a success with at least five companies ready for the launch. Several companies have submitted their proposals and signings with two companies – Asia Green Development (AGD) Bank and Myanmar Agribusiness Public Corporation (MAPCO) have been completed to date. The stock exchange presents an opportunity for companies to raise funds, capital and project financing to expand their business instead of relying on their own resources or contribution from international organisations as well as donor countries.