Hextar Chemicals Sdn Bhd

| Hextar Chemicals Sdn Bhd (133061V) |

| About Us: | Hextar has been setting its mark since 1985 as one of the country’s foremost agrochemical companies in Malaysia. Hextar chemicals, initially trading as an agrochemical marketing company. Since then Hextar has grown aggressively to an internationally known company, revolving around crop management solutions, research and development, production and distribution of pesticides and fertilizers to many countries.

Hextar groups commendable growth over the past 30 years has been down to strategic guidance and direction delivered by group chairman, Dato’ Ong Soon Ho and CEO, Dato’ Eddie Ong Choo Meng. Hextar’s management, structure, knowledge and resources are fundamental and primary reasons for the continued growth of hextar’s international growth. This, along with structured business planning will be the platform to which hextar’s brand will be known and respected in more international territories over the coming years. |

| What We Buy: | – |

| What We Sell: |

|

| Contact: | Ms. Lynn Ng |

| Job Title: | Assistant General Manager/International Marketing |

| Location: | Hextar Chemicals Sdn Bhd. Lot 5, Jalan Perigi Nenas 7/3, Fasa 1A Pulau Indah Industrial Park, 42920 Port Klang, Selangor Darul Ehsan, Malaysia. |

| Tel/Fax No: | Tel: +603-3101 3333 Fax: +603-3101 3233 |

| Industry: | Agrochemicals Fertilizers Specialty Chemicals |

| Email: | hextar@hextar.com |

| Website: | http://www.hextar.com |

MASSA Events

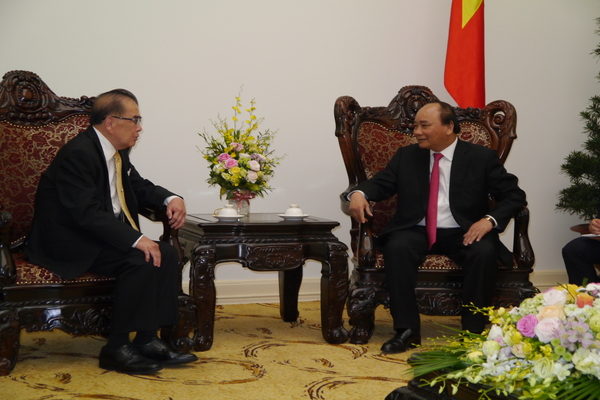

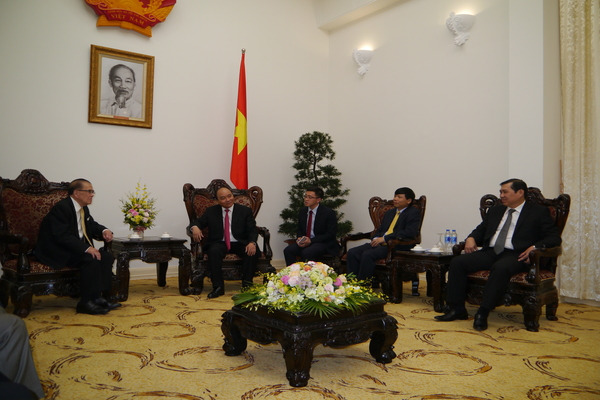

Courtesy Call on H.E. Nguyen Xuan Phuc,

Prime Minister of S.R. Vietnam on

27 September 2016 in Hanoi, Vietnam

(Left to right) H.E. Dang Dinh Quy (Deputy Foreign Minister of Vietnam), Ms Florence Khoo, Ms Ng Su Fun, Datuk Lim Fung Chee, Mr Lee Yai Sin, Tan Sri Dato’ Michael Chen Wing Sum, H.E. Nguyen Xuan Phuc (Prime Minister of S.R., Vietnam), H.E. Huynh Duc Tho (Chairman of People’s Committee of Danang City), Mr Nguyen Xuan Thanh (Deputy Director, Prime Minister’s Office) and Mr Nguyen Duy Hung (Assistant to the Prime Minister)

MASSCORP Berhad/MASSDA Land Company Limited made a courtesy call on H.E. Nguyen Xuan Phuc, Prime Minister of S.R. Vietnam on 27 September 2016 in Hanoi, Vietnam.

YBhg Tan Sri Dato’ Michael Chen Wing Sum, Chairman of MASSDA Land Company Limited, Deputy Chairman of MASSCORP Berhad and Vice-President of MASSA led a delegation that comprised of:-

1) YBhg Datuk Lim Fung Chee

(Director of MASSDA Land Company Ltd. and Vice-President of MASSA)

2) Mr Lee Yai Sin

(General Director, MASSDA Land Company Limited)

3) Ms Ng Su Fun

(General Manger, MASSCORP Berhad and Director of MASSDA

Land Company Limited

4) Ms Florence Khoo

(Manager, MASSCORP Berhad and Director of MASSDA Land

Company Limited)

5) Ms Chau Tran Tran

(Manager, MASSDA Land Company Limited)

(Right) H.E. Nguyen Xuan Phuc, Prime Minister of S.R. Vietnam meeting (left) Tan Sri Dato’ Michael Chen Wing Sum

(Left to right) Tan Sri Dato’ Michael Chen Wing, H.E. Nguyen Xuan Phuc, Prime Minister of S.R. Vietnam, Translator, H.E. Dang Dinh Quy, Deputy Foreign Minister of Vietnam and H.E. Huynh Duc Tho, Chairman of People’s Committee of Danang City

The Prime Minister was accompanied by H.E. Dang Ding Dinh Quy, Deputy Minister of Foreign Affairs, Mr Nguyen Duy Hung, Assistant to the Prime Minister and H.E. Huynh Duc Tho, Chairman of the People’s Committee of Danang City, Vietnam.

Tan Sri Dato’ Michael Chen Wing Sum congratulated H.E. Nguyen Xuan Phuc on his appointment as the Prime Minister of Vietnam.

The Prime Minister fondly recalled the historical ties with MASSDA (previously known as EPZ MASSDA JVC) when MASSDA first invested in Danang City to develop the Danang EPZ (now known as Danang Industrial Zone) almost a quarter of a century ago. He expressed his satisfaction and assured his Government’s support for our continued investments in Danang City.

(Left) Tan Sri Dato’ Michael Chen Wing Sum presented a souvenir to (right) H.E. Nguyen Xuan Phuc, Prime Minister of S.R. Vietnam

(Right) H.E. Nguyen Xuan Phuc, Prime Minister of S.R. Vietnam presented a souvenir to (left) Tan Sri Dato’ Michael Chen Wing Sum

(Left to right) Mr Lee Yai Sin, Tan Sri Dato’ Michael Chen Wing Sum, H.E. Huynh Duc Tho and Datuk Lim Fung Chee

The Prime Minister hosted a dinner for the MASSDA delegation at the Melia Hotel in Hanoi, Vietnam.

(4th from left) H.E. Nguyen Xuan Phuc, Prime Minister of S.R. Vietnam hosted a dinner for the delegation

Seminar on Trade & Investment Opportunities in African Countries on 19 October 2016 at Aloft Hotel, Kuala Lumpur

MASSA, represented by Ms Ng Su Fun, attended the Seminar on Trade & Investment Opportunities in African countries, organised by MIDA on 19 October 2016 at Aloft Hotel, Kuala Lumpur.

7 African countries, namely, Ethiopia, Angola, Nigeria, Ghana, Kenya, Zimbabwe and Zambia gave a presentation of their respective Trade & Investment climate of their country. These African delegates were in Malaysia to attend a Third Country Training Programme organised by JICA and MIDA.

Coordination Meeting on “Bangladesh Trade & Investment Summit 2016” on 28 October 2016

MASSA attended the Coordination Meeting on “Bangladesh Trade & Investment Summit 2016” at the Bangladesh High Commission.

“Bangladesh Trade & Investment Summit 2016” will be organised by Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI) and Bangladesh High Commission in Malaysia.

MASSA is one of the supporting partners for this event. The Summit will be held on 5th December 2016 at the Royale Chulan Hotel, Kuala Lumpur.

(left to right) Encik Zaidi Asraf Idris, Foreign Investment Coordination, Asst. Director, MIDA, Encik Noraslan Hadi Abdul Kadir, Deputy Director, South Asia Unit, Market Access & International Partnership Division, MATRADE, H.E. Md Shahidul Islam, High Commissioner, High Commission for Bangladesh Kuala Lumpur, Mr Ar. Md. Alamgir Jalil, President BMCCI, Mr Syed Moazzam Hossain, former President, BMCCI and Ms Ng Su Fun, Executive Secretary MASSA

“Bangladesh Trade & Investment Summit 2016” at The Royale Chulan, Kuala Lumpur

Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI) and Bangladesh High Commission in Malaysia jointly organised the “Bangladesh Trade & Investment Summit 2016” at The Royale Chulan Kuala Lumpur on 5 December 2016.

With the theme “Sustainable Business – the Road to Progress”, the event was supported by the Ministry of Foreign Affairs, Government of the People’s Republic of Bangladesh Dhaka, High Commission of Malaysia in Bangladesh, Bangladesh Economic Zones Authority (BEZA), MATRADE, MASSA and FBCCI.

The Summit aimed to highlight and to explore joint venture developments in Bangladesh, to showcase private sector investment opportunities and to demonstrate opportunities for potential value addition to sustain the economic growth in Bangladesh which has been expected to achieve more than 7% GDP growth in 2016. The Summit was also an opportunity for investors and traders to establish wider business network with potential business partners.

Mr Syed Nurul Islam, Chairman, Organizing Committee, Bangladesh Trade & Investment Summit 2016 and Former President of BMCCI delivered the Welcome Remarks at the event.

The following VIPs also delivered the Address at the event:-

1) Mr Sohail R.K. Hussain, Managing Director & CEO, The City Bank Limited, Bangladesh,

2) H.E. Md Shahidul Islam, Honorable High Commissioner, Bangladesh High Commission in Malaysia, Government of the People’s Republic of Bangladesh,

3) Ar. Md. Alamgir Jalil, President, Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI),

4) Guest of Honor, Y.B. Datuk Haji Ahmad bin Haji Maslan, Honourable Deputy Minister, Ministry of International Trade and Industry (MITI), Government of Malaysia,

5) Special Guest H.E. Md. Shahriar Alam, M.P., Honourable State Minister, Ministry of Foreign Affairs, Government of the People’s Republic of Bangladesh.

Chief Guest, H.E. Tofail Ahmed, M.P., Honourable Minister, Ministry of Commerce, Government of the People’s Republic of Bangladesh delivered the Inaugural Speech at the event.

3 Business Sessions was held as follows:-

1) Business Session I: “Bangladesh – The Most Preferred Investment Destination in South Asia”

– Chaired by Dr. A.K. Abdul Momen, Ambassador and Former Bangladesh Permanent Representative to the UN & Chairman, Bangladesh Study Trust

– Keynote Presenter: Mr Kazi M Aminul Islam, Executive Chairman, Bangladesh Investment Development Authority (BIDA), Prime Minister’s Office, Government of the People’s Republic of Bangldesh

– Panelists:

Dr Ahsan H. Mansur, Executive Director, Policy Research Institute (PRI), Bangladesh

Mr Mahtab Uddin Ahmed, Managing Director & CEO, Robi Axiata Ltd., Bangladesh

Mr Ifty Islam, Group Chairman, Asian Tiger Capital Partners BD Limited, Bangladesh

Mr K.M. Tanjib-ul Alam, Advocate, Supreme Court of Bangladesh

Mr Syed Moazzam Hossain, Managing Director, SMH Group, Dhaka, Bangladesh

2) Business Session II: “Trade: Challenges and Opportunities in Bangladesh”

– Chaired by Mr Mir Nasir Hossain, Former President, The Federation of

Bangladesh Chambers of Commerce and Industry (FBCCI), Bangladesh

– Keynote Presenter: Mr Md Rafiqul Islam, Managing Director & CEO, Green Delta Capital Limited

– Panelists:

Dr. M. Masrur Reaz, Senior Economist, World Bank Group, Bangladesh

Mr Asif Ibrahim, Vice Chairman, Newage Group, Bangladesh

Y.H. Dato’ Goonahlam Subramaniam, Director, K-Link International (Bangladesh) Pvt. Ltd., Bangladesh

Mr Syed Almad Kabir, CEO, MetroNet Bangladesh Ltd., Dhaka, Bangladesh

3) Business Session III: “Energy and Infrastructure Investment Opportunities in Bangladesh”

– Chaired by Mr Salahuddin Kasem Khan, Managing Director, A.K. Khan & Co. Ltd., Bangladesh

– Keynote Presenter: Mr Md Faruque Ahmed, Director General, Public Private Partnership Authority, Prime Minister’s Office, Bangladesh

– Panelists:

Mr Ahmad Syahrani bin Sulaiman, Regional Country Manager, Powertek, Bangladesh

Mr Humayun Rashid, Managing Director, Energypac Ltd.,

Bangladesh

Mr Zarif Munir, Managing Director, The Boston Consulting Group,

Malaysia

Mr Md. Abu Rashed, PPP Expert (Advisor) at PPPA Office, Prime

Minister’s Office, Government of the People’s Republic of

Bangladesh

Dr. S. Sabrina, CEO, BNG Global Holdings, Malaysia

(left to right) Mr Syed Moazzam Hossain, Managing Director, SMH Group, Dhaka, Bangladesh, Tan Sri Dato’ Soong Siew Hoong, EXCO Member MASSA and Executive Adviser, ACCCIM and Ms Ng Su Fun, Executive Secretary, MASSA

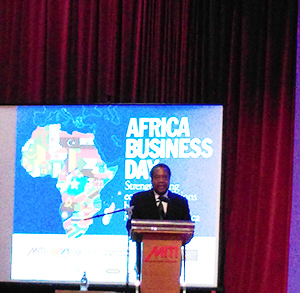

Africa Business Day on 31 October 2016 at MITI Tower, Kuala Lumpur

MITI and its agencies, namely MATRADE and MIDA hosted the “Africa Business Day” at MITI Tower, Kuala Lumpur on 31 October 3026.

It was an idea mooted by YB MITI Minister at a breakfast meeting with the Ambassadors and High Commissioners of the African countries where they strategized on ways to further develop and increase trade and investments mutually, leveraging on each others strengths.

Keynote Address by The Honorable Dato’ Sri Mustapha Mohamed, Minister of International Trade & Industry (MITI), Malaysia

Address by H.E. Cuthbert Zhakata, Ambassador of the Republic of Zimbabwe & Dean of Africa in Malaysia

Presentation by Mr Wan Latiff Wan Musa, Deputy Chief Executive Officer MATRADE on “Session I: Choose Malaysia, Your Prefered Sourcing Destination”

The event was well attended. Workshops on construction & infrastructure, agribusiness, healthcare and medical tourism highlighted the testimonies of Malaysian investors in Africa as well as African companies keen to look for strategic partnerships with Malaysian companies.

The Republic of Suriname “Trade and Business Forum” on 7 December 2016 at MARDI Headquarters, Serdang

MARDI Holdings Sdn Bhd organised a “Trade and Business Forum on The Republic of Suriname” in conjunction with Malaysia Agriculture, Horticulture and Agrotourism (MAHA) International 2016 on 7 December 2016 at the Auditorium MARDI Training Centre, MARDI Headquarters, Serdang.

The Republic of Suriname is situated on the north coast of the South American continent, bordering the Atlantic Ocean on the north, Guyana on the west, French-Guiana (EU) on the east, and Brazil on the South. Suriname’s climate is tropical, warm and humid, moderated by trade winds.

Mining remains the country’s principal currency earner with gold as the largest exported product followed by oil. Agriculture in Suriname plays a secondary role in the economy where the sector’s share in GDP fell from around 17% in 1994 to 7% in 2014. However, agriculture has significant socio-economic relevance, as it is a major provider of employment in rural areas, earns 5% of foreign exchange and is a key contributor to food security through the production of rice, the population’s main staple food. Suriname remains a country with strong agricultural development potential.

Through the facilitation of Islamic Development Bank (IDB), MARDI Holdings Sdn Bhd has been engaged to assist Suriname in improving their rice industry and maintain its sustainability. As part of its involvement in this initiative, MARDI Holdings Sdn Bhd has been working closely with the Government of Suriname to also look into other potentials that can help drive the agriculture industry further up the value chain of this country’s economy.

His Excellency Ambassador Anwer S. Lall Mohamed, Special Envoy of the President of the Republic of Suriname presented a paper on “Opportunities in Suriname for Private Investors from Malaysia” at the Forum as follow:-

Crops For The Future – Transforming Agriculture For Good

The world is heavily reliant on four major crops: maize, wheat, rice and soybean, and even then these crops are stretched to their limits – being used for uses beyond food, to animal feed and even biofuel. However, with temperatures rising, it is uncertain if we can sustain them in much warmer and drier climates. Factor in our growing population, which is estimated to rise to 9.5 billion by 2050, the demand and availability of these crops will be at an all-time high – will they be enough to keep up with an increase in population in a hotter world?

To ensure a more sustainable world for future generations, we need to transform agriculture for good which includes underutilised crops that can help diversify our food systems beyond just the world’s major crops grown as monocultures.

Crops For the Future (CFF) is the world’s first and only centre dedicated to research on underutilised crops for food and non-food uses. CFF research focuses on agricultural systems and their sustainability, address changing climates and improve food and nutrition security and economic well-being, especially for the poor.

Through its own capacities and with an alliance of over 50 international and national partners, CFF provides a new approach to addressing complex global challenges through multidisciplinary, outcome-based research on underutilised crops. The approach transcends geographical and disciplinary boundaries, leverages on existing and new capacities and provides an unparalleled opportunity to rapidly deliver global research outcomes on underutilised crops to end-users and other stakeholders.

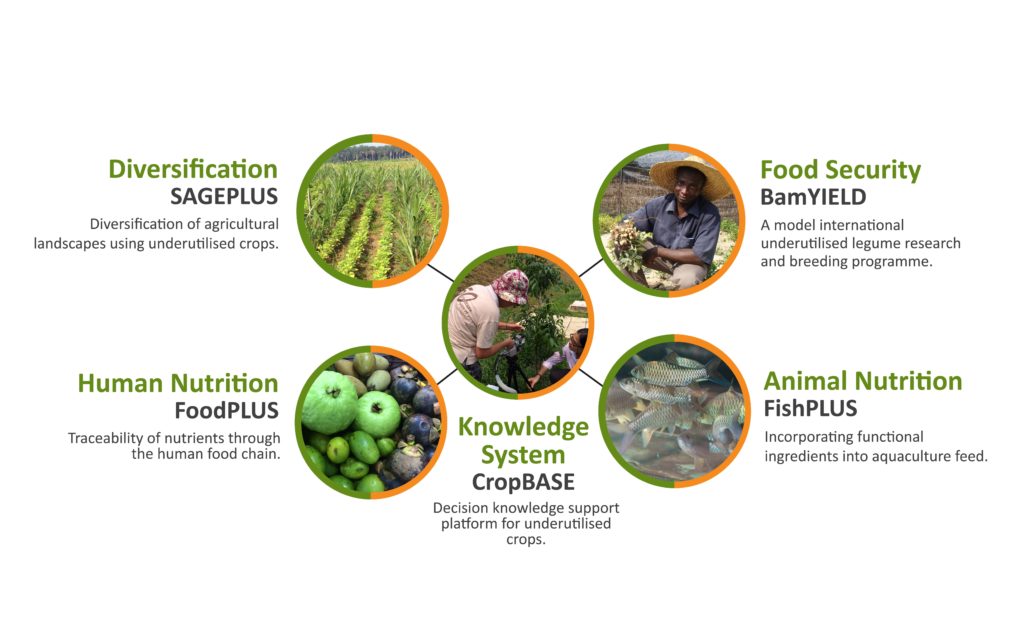

CFF RESEARCH PROGRAMME

SOME OF CFF’S CURRENT PROJECTS

NUTRIENT-PACKED ALTERNATIVES TO FAST FOOD

FoodPLUS has developed an instant moringa soup – a two-step product made from moringa leaves, which are packed with nutrients including: protein, vitamins A, B and C, and minerals. The soup requires only water to prepare, and can easily be distributed to refugees and those with insufficient access to food.

CROP DIVERSIFICATION TOOL

CropBASE is developing an online app for farmers, researchers and the agriculture industry, with the aim to provide information on which underutilised crops and cropping systems would best fit their current and future needs.

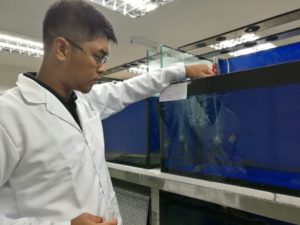

USING INSECT MEAL FOR AQUACULTURE FEED

FishPLUS is developing innovative feed ingredients to improve the nutritional value and sustainability of aquaculture. In a recent research project, FishPLUS used Black Soldier Fly (BSF) larvae as insect meal. The BSF were fed on Sesbania, an underutilised crop, which provides a good source of protein to the larvae.

CONTACT US Crops For the Future (CFF) Jalan Broga 43500 Semenyih Selangor Darul Ehsan MALAYSIA Tel: 603-8725 2800 / Fax: 603-8725 2801 Website: www.cffresearch.org

![]() cropsforthefutureresearchcentre

cropsforthefutureresearchcentre

![]() crops_for_the_future

crops_for_the_future

Kuantan Port Consortium Sdn Bhd

THE BACKGROUND OF KUANTAN PORT CONSORTIUM SDN. BHD

Kuantan Port Consortium Sdn. Bhd. (KPC), is jointly owned by IJM Corporation Berhad, a public listed company on Bursa Malaysia and Beibu Gulf Holding (Hong Kong) Co. Ltd. on a 60:40 equity holdings with the Government of Malaysia having a special rights share.

Kuantan Port, an all-weather port operating all year round is a multi-cargo deep sea port facing the South China Sea. Strategically located on the eastern seaboard of Peninsular Malaysia and in the heartland of petrochemical industries, Kuantan Port has developed into a major container terminal for the east coast region. Supported with excellent port facilities and services, a vast market outreach and a strong network of global shipping connections, Kuantan Port will be a catalyst for the rapid expansion of the industrial and manufacturing activities in the East Coast Industrial Corridor. Upon completion of the NDWT, Kuantan Port is envisaged to be the main gateway to China and the Far East, and shall act as a transhipment hub for minor ports in the region.

With the strong, dedicated and constant support of users, the maritime and industrial communities, Kuantan Port is well positioned to forge ahead and soar to greater heights of success in the coming years to achieve its vision as the premier maritime hub of Peninsular Malaysia.

FACTS OF KUANTAN PORT

1. KUANTAN PORT

• Situated strategically at Tanjung Gelang, in the state of Pahang at the crossroads of international shipping lanes of the South China Sea.

• Overall port area – 605.3 Hectares.

• Kuantan Port offers more than 4 kilometres of berths to accommodate variety of cargo ships.

2. KUANTAN PORT FACILITIES

- Kuantan Port is a service oriented port supported by a total 606 well trained, experienced and committed workforce.

- Equipped to serve users with various types of facilities and equipment to handle all their cargo.

• The berthing facilities comprise of multi-purpose berths, container berths, liquid chemical berths, palm oil berths, mineral oil berth and jetties.

⇒ Kuantan Port is globally linked to the major ports of the world.

⇒ Served weekly by 5 container shipping lines

⇒ Coupled with many other conventional shipping services.

(Liquid, dry bulk, break bulk and others)

• Storage facilities for various types of cargoes:

⇒ Container Freight station (9,600 square meters)

(Storage/stuffing/unstuffing of containers)

⇒ Container storage yard (ground slots of 1,750 TEUs)

⇒ 7 Conventional cargo warehouse (total floor coverage – 32,500

square meters)

⇒ Open storage yard – 41,250 square meters

3. THE DEVELOPMENT OF THE NEW DEEP WATER TERMINAL (NDWT)

• Kuantan Port has moved fast forward in tandem with the escalating economic development of the Eastern Industrial Corridor and Kuantan Port City.

• The present port has a limited capacity and handle ships only up to 40,000 DWT.

• Kuantan Port in collaboration with the Government has embarked on a port expansion project to cater for bigger ships up to 200,000 DWT.

• The NDWT Phase 1A is built with a basin depth of 16 meters, 400 meters berth and 20 hectares of cargo yard adjacent to it to accommodate conventional ships and cargoes.

• The 400 meters bulk terminal is targeted to be operated by early 2018 in line with completion of Steel Mill by Alliance Steel Sdn Bhd at MCKIP.

• The construction of the first phase of the New Deep Water Terminal (NDWT) is expected to be completed in Q4 of 2017 and will be able to handle ships up to 150,000 DWT.

• The construction of Phase 1B with a basin depth of 16 meters consisting of 600 meters berth and 25 hectares dry bulk yard is expected to be completed in Q4 of 2018.

• The dry bulk berth maximum capacity is 20 million tonnes per annum.

• The development of Phase 2 includes 1km berth extension and a 47 hectare backup yard to be based on future capacity requirements and demand.

• The overall progress of work almost 25% physical works in place where the reclamation works completed 75% and construction of wharf 12% completed.

• As of now, the progress of breakwater construction is 83% for Inai Kiara and 33% for IJM-CHEC JV.

4. HINTERLAND CONNECTION

• The Gebeng Industrial Estate, Pahang’s main petrochemical cluster is well connected via the East Coast Expressway to the West Coast of Peninsular Malaysia.

• In conjunction with the recent Qinzhou Day (investment promotion conference , art & cultural exchanges) organised by the Kuantan Town Council, one of the streets in Gebeng Industrial Estate was re-named to “ Qinzhou Road “.

• The Gebeng Industrial Estate, 5 kilometres from Kuantan Port has a vast expanse of land for investment.

5. FREE ZONE

• In June 2016, Kuantan Port has received approval with conditions from The Ministry of Finance to establish a Free Zone port. With this approval, Kuantan Port has started the process to establish The Free Zone divided several into stages. Once it is gazetted by the government, Kuantan Port will operate as a Free Zone port expected in the first quarter of 2017.

Kindly visit www.kuantanport.com.my for more interesting updates.

CONTACT DETAILS

Kuantan Port Consortium Sdn. Bhd.

Wisma KPC, KM 25, Tajung Gelang

P.O. Box 199, 25720

Kuatan Pahang Darul Makmur

MALAYSIA

Tel: 609-5863 888/Fax: 609-5863 777

Email: info.kuantanport@ijm.com

Website: www.kuantanport.com.my

Business Tour to Kuantan on 22 September 2016 by MASSA Members

MASSA in collaboration with MAJECA and the East Coast Economic Region Development Council (ECERDC) jointly organised a Business Tour to Kuantan.

31 business people from 20 companies/organisations, including two representatives from JETRO, participated in the business tour to Kuantan.

The event started at the Kuantan office of ECERDC with briefings and presentations on:-

• Introduction of the ECERDC

• Presentation on ECER Industries and Parks:-

o Manufacturing Industries and Malaysia – China Kuantan Industrial Park (MCKIP)

o Automotive industries

o Bio-Economy industries

o Halal industries – Food and Non-food

o Oil & Gas, Petrochemical Industries

Encik Saifol Bahri Mohammad Shamlan, General Manager ECERDC giving a presentation on ECERDC to MASSA members

(left to right) Ms Ng Su Fun, Executive Secretary MASSA, Encik Saifol Bahri Mohammad Shamlan, General Manager ECERDC and Ms Shamini Murugaya, Manager, Investor Management Division, ECERDC

(left to right) Ms Florence Khoo, Asst. Executive Secretary MASSA, Encik Saifol Bahri Mohammad Shamlan, General Manager ECERDC, Ms Ng Su Fun, Executive Secretary MASSA, Ms Shamini Murugaya, Manager, Investor Management Division, ECERDC and Mr Hiroyuki Nitta, Director, Research & Information Service, JETRO

The participants also visited the following sites:-

• Malaysia- China Kuantan Industrial Park

• Gebeng Industrial Park (drive-through)

• Kuantan Integrated Bio Park (KIBP) (drive-through)

• Kuantan Port Consortium (KPC)

Senior officials from Kuantan Port Consortium (KPC) briefed the participants on the operations of the Port and later took the participants on a tour of the port.

Country Feature: South Africa

Message from MATRADE Trade Commissioner in Johannesburg, South Africa

Encik Mohamed Hafiz Md Shariff, MATRADE Trade Commissioner at MATRADE’s office in Johannesburg, South Africa

Since the post-apartheid, the relations between Malaysia and South Africa are strong and vibrant with a dynamic commercial relationship that promotes a modest two-way trade between the countries. Malaysian companies are still active in South Africa’s economy. The latest trade figures confirm the growing links between South African and Malaysian companies.

In 2015, total trade between Malaysia and South Africa decreased by 13.7% amounted at USD1.3 billion compared to USD1.5 billion in year 2014. Malaysia’s export to South Africa was lower by 9.1% in year 2015 with export value of USD759.5 million compared to USD835.2 million in 2014. Import also recorded a decrease by 19.2% in year 2015 to USD576.6 million compared to the USD 713.4 million in year 2014.

Palm oil and palm based agriculture product was Malaysia’s largest export with 13.8% share (USD104.5 million), followed by petroleum products at 13.6% (USD103.4 million) and electrical and electronics product at 11.3% (USD85.6 million). While Malaysia’s main import from South Africa were iron and steel products, with total of USD136.4 million, followed by metal products with valued at USD89.5 million and petroleum products at USD73.7 million.

The current trade basket comprises a mix of finished products and raw materials, however there is much scope to diversify the quantum of trade and explore the untapped potential that exists between both nations.

In closing, please allow me to quote former President Mandela, who said at the meeting of the “South African Malaysian Business Council” in March 1997, words which still rings true today.

He said; “May I take this opportunity to record our deep appreciation of the confidence you have shown in our future, and the leadership you have given in putting it into practice. That is how the Malaysian people’s solidarity with our struggle for freedom is being turned into a partnership for development, peace and prosperity.”

Thank you.

Mohamed Hafiz Md Shariff

MATRADE Johannesburg

SOUTH AFRICA

The Republic of South Africa (also referred to as South Africa, SA or RSA) is a state in Southern Africa. It is a constitutional democracy in the form of a parliamentary republic and comprising nine provinces.

South Africa is one of the founding members of the African Union (AU), and has the second the largest economy of all the AU members.

The Republic is ranked as one of the top African countries in terms of economic potential, cost effectiveness, infrastructure, business friendliness and foreign direct investment. Main industries include mining (world’s largest producer of platinum), gold, chromium, automobile assembly, metalworking, machinery, textiles, iron and steel, chemicals, fertiliser, foodstuffs and commercial ship repair.

According to Census 2014, the country’s population stands at approximately 54.002 million people. Africans are in the majority, making up about 79.2% of the total population. The coloured population makes up approximately 8.9% of the total population, the white population 8.9%, the Indian/Asian population 2.5% and “other”, 0.5% of the total population.

Poverty and inequality remain widespread, with about a quarter of the population are unemployed.

Malaysia History with South Africa

Malaysia has been a very strong supporter of the anti-apartheid movement. When Nelson Mandela was inaugurated as the first president of the new democratic South Africa in May 1994, Malaysia was amongst the first from the Asian states that sent governmental representatives to attend this auspicious occasion.

Since that year, Malaysian investment has emerged as a source of FDI into South Africa second only to the US, and above South Africa’s traditional sources of foreign investment, Germany and UK.

Unfortunately, trade relations between South Africa and Malaysia were somewhat scuttled when Asian states were profoundly affected by the 1997/1998 Asian financial crisis which led to the downsizing of companies and the repatriation of funds to parent companies back home. Telekom Malaysia, Malaysia Resources Corporation Berhad (MRCB), Renong and Safuan Group pulled out from South Africa in 1998-2004.

Even though Malaysia’s investments shrunk because of the 1997-1998 Asian crises, some companies did not withdraw or disappear from the South African market; they only readjusted themselves to the revised conditions and circumstances and in the process managed to bounce back. Among the companies who decided to stay are Petronas, Mitrajaya and PASDEC.

MARKET OVERVIEW

South Africa is a country of 54 million people, enjoying relative macroeconomic stability and a largely pro-business environment. The country is a logical and attractive choice for Malaysian companies seeking to enter the sub-Saharan Africa marketplace. The country covers 1.22 million square kilometers and is the world’s largest producer of platinum, vanadium, chromium and manganese.

South Africa’s economy has traditionally been rooted in the primary sectors – the result of a wealth of mineral resources and favourable agricultural conditions. However, the economy has been characterised by a structural shift in output over the past four decades. Since the early 1990s, economic growth has been driven mainly by the tertiary sector, which includes wholesale and retail trade, tourism and communications. Currently the country is moving towards a knowledge-based economy, with a greater focus on technology, e-commerce and financial and other services.

The sectors that contributed to South Africa’s GDP, and have kept the economic engine running are:

i. Agriculture: 2.4%

ii. Mining: 9.2%

iii. Manufacturing: 11.7%

iv. Electricity and water: 3.0%

v. Construction: 3.7%

vi. Wholesale, retail and motor trade: 16.6%

vii. Transport, storage and communication: 8.0%

viii. Finance, real estate and business services: 21.52 %

ix. Government services: 17.0%

x. Personal services: 6.0%

Increasingly, the “Green Economy” is taking prominence as the country is moving away from traditional coal-fired power stations to cleaner energy production. South Africa’s strategy is to make cleaner, more efficient use of the country’s abundant, low-cost coal reserves in the near term while at the same time expanding the use of low-emission energy technologies and renewables.

South Africa has developed a diversified manufacturing base that has shown its resilience and potential to compete in the global economy. The manufacturing sector provides an opportunity to significantly accelerate the country’s growth and development. Manufacturing is dominated by the following industries:

Automotive industry

South Africa’s automotive industry is the country’s largest manufacturing sector and according to the National Association of Automobile Manufacturers (NAAMSA), the new vehicle market generated approximately R205 billion for 2013.

Total automotive industry exports increased by R7.8 billion, or 8.2%, to R102.7 billion in 2013, from R94.9 billion in 2012. The automotive and components industry is perfectly placed for investment opportunities. Vehicle manufacturers (such as BMW, Ford, Volkswagen, Nissan, Daimler-Chrysler, Toyota and FAW) have production plants in the country, while component manufacturers (Arvin Exhaust, Bloxwitch, Corning, Senior Flexonics) also have established production bases.

Agro-processing industry

The agro-processing industry spans the processing of freshwater aquaculture and mariculture, exotic and indigenous meats, nuts, herbs and fruit. It also involves the production and export of deciduous fruit and wine; confectionary manufacturing and export; and the processing of natural fibres from cotton, hemp, sisal, kenaf and pineapple. The agro-processing industry accounted for 30% and 28.4% of the total real output and real value added (GDP), respectively, of the manufacturing sector during 2012. Furthermore, it contributed 40.3% to the total employment in the manufacturing sector during the same period. According to the South Africa Industrial Policy Action Plan 15/16, the food-processing sector is the largest manufacturing sector in employment terms, with about 171,000 employees. This increases to more than a million jobs if agriculture is included.

The South African agri-food complex has a number of competitive advantages, making it both an important trading partner and a viable investment destination. A world-class infrastructure, counter-seasonality to Europe, vast biodiversity and marine resources, and competitive input costs, make the country a major player in the world’s markets.

Oil and gas

South Africa is ranked between fourth and eighth for shale gas exploration potential with 390 Trillion Cubic feet (Tcf) of recoverable resource, and Petroleum Agency of South Africa estimating the recoverable resource to be 30 Tcf. Significant exploration activity has resulted in oil and gas reserves increasing dramatically in the last few years, with some of the biggest new discoveries made in Sub-Saharan Africa. Africa remains an attractive destination for large-scale oil and gas exploration due to African countries allowing private sector exploration as countries with established industries bring their oil and gas resources under state control.

The recent activity on the East Coast of Africa shows that the Port of Saldanha Bay is situated in a competitive location in comparison to the existing facilities on the African continent. South Africa also provides an attractive location due to its relative political and economic stability, as well as a well-established logistics support infrastructure.

Aerospace and defence industry

The South African Aerospace and Defence Industry (SADI) comprises companies in the public and private sectors, which provide products and services to security forces, thus forming one of the key strategic industrial sectors of the South African economy. Over the last few years, the profile of the industry has evolved and today the SADI is a non-aligned world-class industry that supplies equipment and services to global.

Original Equipment Manufacturers (OEMs) in the aerospace, maritime and landward environments. Characterised by engineering ingenuity, technological innovativeness, affordability, reliability and cost-effectiveness, the SADI is a partner of choice for many who seek state of the art defence equipment, including multilateral organisations that are involved in peacekeeping operations, as well as countries seeking to equip their defence establishments. Though smaller in size than the defence industries of competing countries, the SADI’s capabilities range from systems engineering and integration, to the design, development, manufacture and maintenance of complex systems and their related electronics.

While it is necessary for the SADI to retain core competencies, capacities, capabilities and technologies domestically, exports are equally important for the long-term survival of the industry; hence, the increased international market penetration to become a global player. Accordingly, international joint ventures, equity partnerships and strategic alliances have been established with defence related companies in more than 20 countries, including Malaysia, with the SADI exporting approximately more than 60% of its products to clients in all continents. South Africa’s defence, aerospace and maritime industries contribute to the country’s economy through the development and maintenance of high-level scientific, engineering, technological and technical skills and jobs, as well as advanced design, development and manufacturing processes. South Africa’s aerospace and defence products range from complete systems to subsystems, to major components to parts across various continents.

Malaysian defence company DRB-Hicom Defence Technologies (Deftech) worked closely with Denel (state-owned arms manufacturer) as its technology partner for systems integration and the joint manufacture of turrets for a new infantry vehicle for the Malaysian Armed Forces

Armscor (defence acquisition agency) and Denel (state-owned arms manufacturer) support collaboration and partnerships between local companies and foreign enterprises with specific call for partnerships to share research and R&D costs, manufacturing costs and event markets.

MARKET ENTRY STRATEGY

The best strategy to enter the South Africa market is through investment. Despite the success of the country, there are many South African trapped in poverty and remain unequal society. The job opportunities also are too few and the country is still lacks in the areas of development.

The government had introduced National Development Plan (NDP) to eliminate the poverty and reduce inequality by year 2030. It is a plan to unite South Africans and grow an inclusive economy of the country. The most important ingredient in the NDP relates to the commitment of the government to engage with all sectors including incorporating with private sector which has a major role to help in achieving the objective of poverty reduction, economic growth and job creation.

The government is looking forward for any investment in the country. In fact, they perceived Malaysia as a developed country that can bring prosperity in term of technology transfer and job opportunity to their people. This is good for the transformation and sustainable of the country’s economy.

By entering the market through investment, we also can penetrate others African countries by leveraging on their regional agreement such as Southern African Development Cooperation (SADC), East African Community (EAC) and Common Market for Eastern of Southern Africa (COMESA). Recently, South Africa had signed the Tripartite Agreement which includes 26 countries that represent 48 percent of the African Union membership, 51 percent of continental GDP and a combined population of 632 million.

The Tripartite Agreement had 3 main pillars which are market integration, infrastructure development and industry development. The main objective of the COMESA-EAC-SADC Tripartite is strengthening and deepening economic integration of the southern and eastern Africa region. This will be achieved through harmonization of policies and programs across the three Regional Economic Communities (RECs) in the areas of trade, customs and infrastructure development.

South Africa also had a trade relations and development co-operation with the European Union which allows South Africa’s product to enter the European market with low tariff. This trade relation with the EU is governed by the Trade, Development and Co-operation Agreement (TDCA) which concluded since 1999. The Trade, Development and Co-operation Agreement have established a free trade area that covers 90% of bilateral trade between the EU and South Africa.

Besides, access to US market also available through the African Growth and Opportunity Act (AGOA). It is a unilateral program that provides duty-free access of thousands of products from designated African countries into the US market. Approximately 7000 product tariff lines are duty free to enter the US market. This includes products such as clothing and textiles, wine, motor vehicles and components, various agricultural products, platinum and diamonds, iron and steel products and many others.

Therefore, through investment, we are not only penetrating the South Africa market but also the neighboring countries in the region through their preferential treatment. Looking forward, we can use South Africa as a based to penetrate the whole continent of Africa and also to penetrate the Europe and US market by leveraging on their existence trade relation.

The sophisticated business environment of South Africa provides a powerful strategic export and manufacturing platform for achieving global competitive advantage, cost reductions and also new market access.

Because the South African market is sophisticated, entry should be well planned, taking into consideration the following factors:

1. The skewed demographic income distribution pattern, where 10% of the population earns 45% of national income;

2. the price-sensitive nature of the majority of consumer demand;

3. an unpredictable Rand-Dollar exchange rate;

4. an unreliable and under-capacitated electricity supply network;

5. distribution issues, given that large retail centers are concentrated in five metropolitan regions;

6. well-developed consumer protection rules and recently, better enforcement;

7. a conservative market bias that tends to stick to known suppliers and therefore requires sustained market development;

8. South Africa’s position as a stepping stone for developing market opportunities in sub-Saharan Africa: the marketing mix should anticipate this medium-term option.

However, the new-to-market foreign supplier will find markedly different conditions when venturing northwards. This lack of regional integration relates especially to financial services, trade documentation and road transportation networks and may have a significant impact on risk exposure and the cost of doing business.

A judicious selection of one of three low-risk entry strategies (representation, agency or distributorship) is required by new-to-market entities. If you are selling to the government or government-funded organizations, any local partner should comply with B-BBEE-compliant and be aware of local procurement regulations.

Broad-Based Black Economic Empowerment (B-BBEE) is a form of economic empowerment initiated by the South African government to distribute wealth across as broad a spectrum of previously disadvantaged South African society as possible.

Market Opportunities

Food Sector

African countries spend more than USD60bil annually importing food for their growing populations, but the continent has the potential to become a major food exporter South Africa has always had a well-developed food and beverage industry, partly because of the country’s major agricultural activity, and partly because of its relatively sophisticated food requirements.

Importation of food preparations (such as sauces and condiments) has shown a steady increase over the past few years. While South Africa produces many products of world-class quality for export, it is also a major importer of diverse products from most countries. Cereals constitute by far the largest category of imports, accounting for 29% of total imports of food and beverages. This is followed by animal and vegetable fats and oils, which accounted for 17% of total imports, and meat products which accounted for 9%.

South Africa is a net importer of meat and meat products. Opportunities in this sector exist mainly for frozen boneless beef forequarter cuts, certain lamb cuts, turkey, frozen boneless poultry cuts and prepared poultry cuts. Under pressure from the local poultry industry, the government has recently increased the import duty on imported frozen poultry. It remains to be seen how this affects the import market for poultry cuts.

ICT Sector

ICT sector in South Africa is more advanced compared to other African countries especially in mobile content and banking solutions. Sustainable country’s economy and well-established banking system leads many MNCs opened up their Africa subsidiary in South Africa such as Dell, Acer and CISCO.

In 2014 and 2015 weak economic growth and rand depreciation had a negative impact on ICT demand in South Africa. Although the ICT demand in South Africa is mainly driven by the government and large enterprises, there is growing interest in IT solutions among small- and medium-sized enterprises (SME) due to diversity of local market.

The higher end of the South African software market has matured to the point where a new concern for integrated platforms is likely to be a driver of spending over the next few years. However, companies remain price sensitive and cautious about investing significant capital in new technologies. There is a trend towards greater innovation around applications such as human resources and payroll as enterprises attempt to realise operational efficiencies through IT.

Despite the difficulties accessing credit by South African SMEs, but there are likely to represent an opportunity due to awareness of change and seeking efficiencies by transitioning from manual environments to full automation of back-office systems. Trade liberalisation and the growing penetration rate of IT infrastructure have led to a greater awareness among smaller companies of the advantages of enterprise software. Many companies are looking to achieve greater control of budgets and improve tracking of their marketing and spending.

Among the software that seems growing are security software and cloud computing. This is due to the growing of penetration to connected device makes consumer and business in South Africa vulnerable to attack. At the same time, they also want to put their IT applications such as mail, phone systems and document management into the cloud with high level of customization which subjected to their regulatory and data sensitivity constraint.

Energy Sector

South Africa has the most advanced power market in Africa and is sometimes coined “the powerhouse of Africa”. Its state power utility, Eskom Holdings Limited, has a net generating capacity of 41,995MW and 359,337km power lines and 232,179MVA sub-station. The company supplies 95% of South Africa’s electricity, constituting approximately 45% of Africa’s electricity supply. Currently, Eskom is not only playing the role of a vertically integrated power utility, but is the single buyer from IPPs

South Africa’s national transmission grid consists of 27,000km. Distribution lines in South Africa comprise of approximately 46,712km. However, the electricity transmission and distribution industry in South Africa is facing the following challenges:

i. Capacity shortages and backlog of investments;

ii. Networks are inadequately maintained, resulting in maintenance and refurbishment backlogs giving rise to high cost of interruptions;

iii. Inequitable treatment of consumers, resulting in a wide range of tariffs for the same or similar groups of consumers and also unfair discrepancies between Eskom and municipalities; and

iv. The electrification performance for various areas varies partly unacceptably.

Although among the best electrification rates in Sub-Saharan Africa, the South African electrification rate of 85% still leaves parts of the population without electricity. The government is still facing difficulties when dealing with energy and electricity. There is currently insufficient political will to drive ahead with structural reform of the South African power sector and also no clear strategy to deal with the ongoing financial and operational problems at their state-owned company’s utility, Eskom. This means, the South African power sector over the next few years is still be characterized by the crisis management and electricity shortages.

Medical Devices

South Africa’s domestic medical device industry remains underdeveloped, with imports catering for 90% of the market by value. The South African medical device market was estimated at USD1.2bn in 2013 generating revenues in excess of ZAR12.1bn and ranks among the top 30 largest in the world. The market is forecast to grow by a CAGR of 7.7% between 2013 and 2018, driven mainly by the development and upgrade of hospitals through public-private partnerships.

South Africa’s medical device production firms tend to be small or medium sized businesses and often combine distribution activity with manufacturing. Multinational companies present in South Africa often operate in a joint venture capacity with local firms. Most South African manufacturers focus on producing basic medical equipment and supplies. Production is focused on bandages and dressings, medical furniture and low technology items. A growing private sector is one of the key features of the South African medical device market. Close to 70% of the medical practitioners in the country work for the private sector. Nevertheless, local players are likely to take a growing share of the South African market as they move into more high-tech areas, claiming much of the extra value from the predicted market growth.

Consumables will continue to make up the largest share of South Africa’s sales of medical devices, estimated at 18% in 2012 and 19% in 2020. This is closely followed by diagnostic images accounting for 16% in 2012 and 13% in 2020. Syringes, needles and catheters continue to account for the largest share of medical devices sales in South Africa for the period 2010 to 2020. It is estimated to increase from USD56mil in 2010 to USD118.5mil in 2020. Electro-diagnostic devices and imaging parts & accessories rank second and third in 2013, valued at USD51.26mil and USD45.19mil respectively.

Prepared by :

MATRADE Johannesburg

Ground Floor Building 5

Commerce Square Office Park

39 Rivonia Road

Sandhurt, Sandton

Johannesburg

South Africa

Tel: +27-11-268 2380 / +27-11-2381

Fax: +27-11-268 2382

Email: johannesburg@matrade.gov.my

Editorial

Greetings from the MASSA Secretariat. All of us at MASSA Secretariat wish all members a happy and healthy new year 2017.

As we write this editorial, we want to remember our long serving MASSA news Editor, the late YBhg Datuk Fatimah Sulaiman, who passed on in September 2016. We in the editorial team will miss her fellowship, ideas and commitment to the Association. She will be deeply missed.

2016 flown by much too quickly. For most of the year, unprecedented global events seem to have drawn our attention and focus. As the year drew to a close, MASSA events also drew members closer to home.

The visit to Kuantan – ECER in September 2016 gave an interesting insight to the economic developments in the east coast. The visit to the Kuantan port highlighted the extensive port upgrades that are in earnest progress to anticipate the economic influx of FDI, especially from China in the coming years. Many economic and business linkages can be tapped and we urge members to earmark this region as an investment possibility.

Bangladesh – MASSA has, over the years, built a strong linkage with the Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI). In December 2016, together with MITI and MATRADE, MASSA lent its support to BMCCI to organise the Bangladesh Trade & Investment Summit in Kuala Lumpur. The event was a resounding success. The panel of speakers gave an encouraging business perspective to doing business with Bangladesh. No longer seen as a country to source competitive labour, but an investment destination to manufacture and launch our exports. MASSA will be working closely with BMCCI in 2017 to follow through, on initiatives arising from the Trade & Investment Summit.

We introduce a new developing country, Suriname. The Ambassador of Suriname, H.E. Anwer S. Lall Mohamed, delivered an encouraging presentation on his country and welcomed Malaysian corporates to explore potential for business in his country. In this new year, MASSA will be working with MARDI Holdings Sdn Bhd to explore this new emerging country.

The MASSA Secretariat will continue to endeavour to deliver timely information and updates from all quarters to members, via our weekly circulars.

We thank all members, associates, sponsors and contributors for assisting us in the publication of our e-newsletter throughout 2016. We look forward to your continuing support to bring to members, interesting and useful articles that can add value to your respective business endeavours.

We wish all members and readers “Season’s Greetings” and best wishes for a happy and healthy new year.

Ng Su Fun

MASSA Secretariat

President’s Message

Greetings and Best Wishes for a new year 2017. 2016 drew to a subdued close after a tumultuous year where many unprecedented global events came to pass. Geopolitical tensions, Brexit and the Trump election and victory dominated the headlines amidst a continuing slowdown in the global economy in 2016.

Malaysia continues to grapple with the contagion effects of the global volatility, as seen in the prices of oil and commodities. The prolonged ringgit depreciation will most likely persist longer.

MIER maintains Malaysia’s real GDP growth for 2016 was 4.2%. Going forward, GDP growth for 2017 is expected to range between 4.5% – 5.5%. This is premised on domestic demand to drive growth, amongst other factors. Bank Negara Malaysia is also confident of a more promising market outlook for Malaysia with a firmer ringgit outlook. The recent BNM ruling requiring the conversion of 75% of export proceeds into ringgit coupled with anticipated modest resumption of corporate earnings growth will be positive for the economy in 2017.

I would like to convey MASSA’s gratitude to all members and especially to the Executive Committee members for their much valued participation and contribution to the Association in the past year.

I wish you all a happy, healthy and successful 2017!

Tan Sri Azman Hashim

President

Forthcoming Events

The East Coast Economic Region (ECER)

– Business Tour to Kuantan on 22 September 2016

MASSA members are cordially invited to join the Business Tour to Kuantan on 22 September 2016. This Business Tour is jointly organised by Malaysia-Japan Economic Association (MAJECA) and East Coast Economic Region Development Council (ECERDC).

The East Coast Economic Region (ECER) covers Kelantan, Terengganu, Pahang and the district of Mersing in Johor. It occupies an area of 66,000 sq km or 51% of the total area of Peninsular Malaysia. ECER is endowed with rich natural resources that includes oil and gas, iron ore and other minerals, vast tracts of fertile land, beautiful islands and pristine beaches, making the Region an investors’ paradise.

Manufacturing is one of the key economic clusters driving the development of ECER. A number of locations within the ECER have been earmarked for the establishment of several major industrial initiatives which includes, Pekan Automotive Park (PAP), Malaysia-China Kuantan Industrial Park (MCKIP), Gambang Halal Park, Pasir Mas Halal Park, Kemaman Heavy Industry Park.

ECER serves as the strategic investment gateway to ASEAN, Asia Pacific and the Far East as the region faces the South China Sea with access to a potential market of 4 billion people and a combined GDP of US$17 trillion. This provides excellent opportunities for the business community in Malaysia and ASEAN to further enhance their regional position.

A range of incentives which include tax incentive, investment allowance, import duty and sales tax exemption and facilitation of fund are available to investors in the ECER, some of which include:-

| 1. | 100% income tax exemption for 10 years or 100% investment tax allowance on qualifying capital expenditure incurred for 5 years. |

| 2. | Customize incentive based on merit of each case. |

| 3. | Import duty and sales tax exemption for raw materials, parts and components, plants and machineries and equipment. |

| 4. | Stamp duty exemption on transfer or lease of land or building used for development. |

| 5. | Flexibility in employment of expatriates and facilitation of human capital development. |

The Business Tour to Kuantan on 22 September 2016 will include a briefing on the ECER and site visits to:-

• Malaysia-China Kuantan Industrial Park

• Gebeng Industrial Park

• Kuantan Integrated Bio Park (KIBP)

• Kuantan Port Consortium (KPC)

The objective of the Business Tour is to promote investment/expansion opportunities in the ECER to potential investors involved in manufacturing and related activities for the following sectors:

1) Manufacturing:

• Automotive, Chemical, Medical Devices, High Technology,

Renewable Energy, ICT, etc

2) Halal:

• F & B and Pharmaceutical, etc

3) Petrochemical:

• Oil & Gas, etc

4) Bioeconomy

The tentative programme is as follows:-

|

DATE OF EVENT |

22 SEPTEMBER 2016 |

|

Time |

Particulars |

| 10 am – 10.30 am | Pick up from Kuantan Haji Ahmad Shah Airport and transfer to:

ECERDC Pahang State OfficeB8002,Sri Kuantan Square,Jalan Teluk Sisek, 25000 Kuantan,Pahang, MALAYSIA |

| 10:30 am – 10.45 am | Welcome Remarks & Introduction of ECER |

| 10:45 am – 11.00 am | Speech by Pahang State Government |

| 11:00 am – 11.15 pm | Manufacturing Industries and Malaysia – China Kuantan Industrial Park (MCKIP) |

| 11.15 am – 11.30 am | Halal Industries – Food and Non- Food |

| 11.15 am – 11.30 am | Bio-economy Industries |

| 11.30 am – 11.45 am | Tea Break |

| 11.45am – 12.00 pm | Oil & Gas, Petrochemical Industries |

| 12.00 pm – 12.15pm | Automotive Industries |

| 12.15 pm – 12.30 pm | Q & A |

| 12.30 pm – 1.30 pm | Lunch |

| 1.30 pm – 3:30 pm | Site visits to:

• Malaysia-China Kuantan Industrial Park • Gebeng Industrial Park• Kuantan Integrated Bio park (KIBP) |

| 3.30 pm – 4.30 pm | Tour to Kuantan Port Consortium |

| 4.30 pm – 5.00 pm | Tea Break |

| 5 pm | Adjourn |

The ECERDC will host the Business Tour in Kuantan. Participants are requested to make their own arrangements for flights to/from Kuantan. MAS flights are available as follows:-

MAS Flight Schedule

KUL-KUA MH1268 ETD 09:05 ETA 09:45

KUA-KUL MH1281 ETD 19:45 ETA 20:30

MASSA members are kindly invited to participate in this Business Tour to Kuantan and avail yourself of the opportunities to expand your business in the ECER. As places are limited, kindly email your interest to participate in the Business Tour to MASSA Secretariat at email: mail@massa.net.my or tel. no. 03-2078 3788/fax: 03-2072 8411 as soon as possible to book your place.

We look forward to your participation in the Business Tour to Kuantan.

For further details on the Business Tour, please contact:-

MASSA Secretariat

17th Floor, Bangunan AmBank Group

Letter Box No. 17A, Jalan Raja Chulan

50200 Kuala Lumpur

Tel: 03-2078 3788; Fax: 03-20728411 / Fax: 03-20310208

Email: mail@massa.net.my

Contact Person: Ms Ng Su Fun / Ms Florence Khoo

MASSA Events

Luncheon Talk by Mr Zaw Min Win, Chairman of

Myanmar Industries Association (MIA), Myanmar on

the “Economic Outlook of Myanmar: Post Election

Period Opportunities, Issues & Challenges”

on 3 May 2016 at Concorde Hotel, Kuala Lumpur

MASSA organised a Luncheon Talk on the “Economic Outlook & Business Potential in Myanmar – Post Elections” at the Concorde Hotel, Kuala Lumpur on 3 May 2016.

Tan Sri Azman Hashim, President of MASSA delivered the Welcome Remarks at the event. Mr Zaw Min Win, Chairman, Myanmar Industries Association (MIA), Myanmar and Vice President, Union of Myanmar Federation of Chambers of Commerce & Industry (UMFCCI) delivered a presentation on the “Economic Outlook of Myanmar: Post Election Period Opportunities, Issues & Challenges” to the participants at the luncheon talk.

Mr Zaw Min Win, Chairman of Myanmar Industries Association (MIA) Myanmar and Vice-President, Union of Myanmar Federation of Chambers of Commerce & Industry (UMFCCI) delivered the presentation at the luncheon talk

(right) Tan Sri Azman Hashim and (left) Mr Zaw Min Win having a discussion prior to the start of the luncheon talk

(left to right) Tan Sri Dato’ Soong Siew Hoong, Dato’ Cheah Sam Kip, Mr Zaw Min Win and Tan Sri Azman Hashim

(left to right) Tan Sri Dato’ Michael Chen Wing Sum, Vice President (I), MASSA and Mr Tan Boon Lee, Executive Director, IGB Corporation Berhad

A Question & Answer session was held after the presentation by Mr Zaw Min Win. 3 MIA Executive Committee Members were also guests at the event. They include:-

1) Mr Aye Tun, Vice Chairman, MIA

2) Mr Aung Min, General Secretary, MIA

3) Mr Aye Win, Central Executive Committee, MIA & General Secretary of Myanmar Food Processor & Exporter Association (MFPEA)

A total of 83 MASSA members and guests attended the event.

(left to right) Mr Aye Tun, Vice Chairman, MIA and Mr Aye Win, Central Executive Committee MIA & General Secretary, Myanmar Food Processor & Exporter Association (MFPEA)

Group photo (left to right) Mr Jeff Kong, Secretary General MRCA, Mr Alagasan Gadigaselam, Senior Manager, TC Management Services Corporation Sdn Bhd, Mr Aye Tun, Vice Chairman, MIA, Mr Aung Min, Secretary-General, MIA, Mr Roger Lye, Vice President, ERA, Ms Ng Su Fun, Executive Secretary, MASSA, Mr Zaw Min Win, Chairman MIA & Vice President UMFCCI, Tan Sri Dato’ Soong Siew Hoong, EXCO MASSA & Executive Adviser, ACCCIM, Dato’ Cheah Sam Kip, EXCO MASSA & Regional Director, TC Management Services Corporation Sdn Bhd, Ms Teng Lim May Yuk, Senior Manager, TC Management Services Corporation Sdn Bhd, Mr Aye Win, Central Executive Committee MIA & General Secretary Myanmar Food Processor & Exporter Association (MFPEA)

Following are extracts from Mr Zaw Min Win’s presentation on the “Economic Outlook of Myanmars: Post Election Period Opportunities, Issues & Challenges”:-

Visit to Crops For The Future (CFF) Research

Centre at University of Nottingham, Semenyih,

Selangor on 20 June 2016

MASSA members visited the Crops For The Future (CFF) Research Centre in University of Nottingham, Semenyih, Selangor on 20 June 2016.

Crops For The Future (CFF) is the world’s first center dedicated to research and development of underutilized crops for food and non-food uses. This facility was launched by the Prime Minister of Malaysia in 2011. Crops For The Future (CFF) primary research programmes focus on the potential of underutilized crops to contribute to food security, human and animal nutrition, diversification of agricultural systems and their range of commercial uses.

Crops For The Future (CFF) (www.cffresearch.org) has identified the need for a Global Action Plan for Agricultural Diversification (GAPAD) to meet the needs of a hotter world and focussed on the following:-

(i) Four crops feed the world – Humanity depends on just four crops for most of its food and non-food needs. These are wheat, rice, maize and soybean.

(ii) The world is getting hotter – Global temperatures are predicted to increase by +2ºC. This has serious implications for production of the major crops.

(iii) Major crops alone cannot feed a hotter world – We need options for agricultural diversification that include a wider range of crops and cropping systems.

Prof. Sayed Azam-Ali, Chief Executive Officer and his team welcomed MASSA members upon arrival at Crops For The Future (CFF). He briefed the members on CFF programmes, research objectives and how members can engage as stakeholders or leverage/partner CFF for potential business tie-ups or CSR opportunities especially in environmental or social issues for long term sustainability. There was a Q & A session after the presentation by Prof. Sayed.

(right, standing) Prof. Sayed Azam-Ali, Chief Executive Officer of Crops For The Future (CFF) giving a briefing to MASSA members

MASSA members were later taken on a tour around CFF Complex which comprised Dome A – Administration Office, Dome B – Research Wing and Dome C – Control Environment and laboratory facilities. FoodPLUS and CropBASE briefed members about their programme at CFF.

MASSA members were briefed by FoodPLUS personnel on their programme on “Traceability of micronutrients from soil to end users”

Members were briefed on CropBASE’s programme on “Integrating qualitative and quantitative knowledge on underutilised crops into decision support systems”

FishPLUS staff briefing members on their programme on “Incorporating functional ingredients into aquaculture feed”

The MASSA delegation also visited the CFF Field Research Centre (FRC) and were briefed on the programmes by FishPLUS, BamYIELD and SAGEPLUS.

MASSA members being briefed on “SAGEPLUS’s programme on “Diversification of agricultural landscapes using underutilised crops”

Ms Ng Su Fun, Executive Secretary of MASSA presented a souvenir to Prof. Sayed Azam-Ali at the end of the visit.

(right) Ms Ng Su Fun, Executive Secretary of MASSA presenting a souvenir to (left) Prof. Sayed Azam-Ali

25th Annual General Meeting (AGM) of MASSA

on 21 June 2016

Tan Sri Azman Hashim, President of MASSA chaired the 25th Annual General Meeting (AGM) of MASSA at the Banquet Hall, 26th Floor, Bangunan AmBank Group, Jalan Raja Chulan, Kuala Lumpur on 21 June 2016.

(3rd from left) Tan Sri Azman Hashim, President of MASSA chairing the 25th Annual General Meeting (AGM) of MASSA with (left to right) Tan Sri Dato’ Mohd Ramli Kushairi, EXCO MASSA, Tan Sri Dato’ Michael Chen Wing Sum, Vice President (I), MASSA, Datuk Lim Fung Chee, Vice President (II) MASSA and Datuk Fatimah Sulaiman, Asst. Honorary Secretary

The meeting convened after the requisite quorum was obtained.

The President of MASSA welcomed members and Committee members and proceeded with the business of the AGM.

Tan Sri Azman Hashim delivered his address and thereafter the meeting proceeded to unanimously adopt the Annual Report and the audited accounts of the Association for the year ended 31 December 2015.

(front row) Tan Sri Dato’ Soong Siew Hoong, EXCO MASSA, Datuk Tan Kwe Hee, Bina Puri Holdings Bhd, Mr N Sivadasan, Azman, Wong, Salleh & Co. and MASSA members at the AGM

As there was no election of office bearers at this year AGM, the Executive Committee and Office Bearers for the term 2015 / 2017 remains as follow:-

OFFICE BEARERS

| President | : | Tan Sri Azman Hashim |

| Vice President (I) | : | Tan Sri Dato’ Michael Chen Wing Sum |

| Vice President (II) | : | Datuk Lim Fung Chee |

| Honorary Secretary | : | Datuk Lee Teck Yuen |

| Assistant Honorary Secretary | : | Datuk Fatimah Sulaiman |

| Honorary Treasurer | : | Tan Sri Datuk Tee Hock Seng, J.P. |

MASSA EXECUTIVE COMMITTEE MEMBERS

| Tan Sri Dato’ Mohd Ramli Kushairi | Tan Sri Dato’ Soong Siew Hoong |

| Tan Sri Ghazzali Sheikh Abdul Khalid | Dato’ Soam Heng Choon |

| Dato’ J Jegathesan | Dato’ Tan Kia Loke |

| Dato’ Lawrence Lim Swee Lin | Dato’ Cheah Sam Kip |

EX-OFFICIO

| Ms Normah Osman | – | Ministry of International Trade & Industry Malaysia (MITI) |

| Ms Fenny Nuli | – | Ministry of Foreign Affairs (Wisma Putra) |

| Datuk Dzulkifli Mahmud | – | Malaysia External Trade Development Corporation (MATRADE) |

| Dato’ Azman Mahmud | – | Malaysia Investment Development Authority (MIDA) |

The President thanked the Executive Committee and Office Bearers for their continuing support and MASSA members for their participation in MASSA events and activities.

(right) Tan Sri Azman Hashim, President of MASSA having a discussion with (left) Datuk Fatimah Sulaiman, Asst. Honorary Secretary, MASSA

(left to right) Tan Sri Azman Hashim, President of MASSA with Tan Sri Ghazzali Sheikh Abdul Khalid, EXCO MASSA

(left right) Tan Sri Ghazzali Sheikh Abdul Khalid, Dato’ Moehamad Izat bin Achmad Habechi Emir, Tan Sri Azman Hashim and Mr Mohammad bin Abdullah

Courtesy Call by H.E. Ambassador Mohd Zamruni

bin Khalid, Ambassador of Malaysia to the

Socialist Republic of Vietnam to MASSDA’s office

in Danang, Vietnam on 1 August 2016

H.E. Ambassador Mohd Zamruni bin Khalid, Ambassador of Malaysia to the Socialist Republic of Vietnam made a courtesy call and met Mr Lee Yai Sin, Director-General of MASSDA Land Company Limited at MASSDA’s office in Danang, Vietnam on the 1 of August 2016.

Mr Lee briefed the Ambassador about MASSDA’s operation followed by a tour of IZ Danang Industrial Park and Fortune Park housing estate. The Ambassador was accompanied by Mr Dickson Dee Ladi, Counsellor (Economic) of the Malaysia Embassy based in Hanoi, S.R. Vietnam.

(left to right) Mr Lee Yai Sin, Director-General, MASSDA Land Company Limited, H.E. Mohd Zamruni bin Khalid, Ambassador of Malaysia to S.R. Vietnam and Mr Dickson Dee Ladi, Counsellor (Economic), Malaysia Embassy in Hanoi, S.R. Vietnam

Services Export Fund (SEF)

SERVICES EXPORT FUND

INTRODUCTION

• The Services Export Fund (SEF) is a scheme to provide assistance to Malaysian Service Providers (MSPs) to undertake activities to expand and venture into the international market.

• The objectives of SEF are:

i. To increase the competitiveness of Malaysian Services providers (MSPs) abroad;

ii. To increase accessibility and expand export of MSPs in the global market; and

iii. To expand the scope for export promotion to gain market access and export opportunities of services.

• All services sectors are eligible to apply except tourism and financial sectors.

• The assistance is extended in the form of reimbursable grant and soft loan. The grant and soft loan disbursed is according to the maximum amount of each activity and up to a total of RM5 million per company for the duration of the period 2015 – 2020.

Eligible Activity

A. Grant

| ACTIVITY | DESCRIPTION | AMOUNT |

| Activity 1 | (a) promoting Malaysian expertise in services at international events overseas as speaker in conferences, forums and participating in services industry related competitions.

(b) travelling expenses for tender bidding. (c) Procuring commercial intelligence / market reports for assessing business opportunity or projects overseas. |

100% reimbursable grant for eligible expenses incurred up to a maximum of RM50,000 per company. |

| Activity 2 | (a) rendering services for projects undertaken overseas.

(b) presentation to potential clients for assessing business and projects overseas. (c) preparation of prototype, system customisation and localisation to meet projects requirements. |

50% reimbursable grant for eligible expenses incurred up to a maximum of RM50,000 per company. |

| Activity 3 | Initial Cost of Setting up Office Overseas. | 50% reimbursable grant for eligible expenses incurred in the initial twelve (12) months for the setting up of office overseas, up to a maximum of RM150,000 per company (whichever is earlier). |

| Activity 4 | Logistic cost of sending Malaysian products, equipment or merchandising for project abroad undertaken by Malaysian services companies. | 50% reimbursable grant for eligible expenses incurred up to a maximum of RM1 million per company. |

| Activity 5 | Grant for conducting feasibility study for specific international project overseas. | 50% reimbursable grant for eligible expenses incurred up to a maximum of RM3 million per company. |

B. Soft Loan

| ACTIVITY | DESCRIPTION | AMOUNT |

| Activity 6 | Costs incurred in preparation and submission of project proposals for overseas projects.

Financing to assist MSPs in proposing and planning for overseas’s project negotiations. Example of eligible activities are:

|

|

| Activity 7 | Expenses related to raising bank guarantee or performance bond to execute overseas project.

Examples of eligible expenses are interest rate, legal fees, documentation fees and bank insurance, excluding the principal value of the said bank guarantee of performance bond. |

|

For further information on Services Export Fund, please contact:-

Malaysia External Trade Development Corporation (MATRADE) 8th Floor, Menara MATRADE Jalan Sultan Haji Ahmad Shah Off Jalan Tunku Abdul Halim 50480 Kuala Lumpur MALAYSIA Tel: 603-6207 7593 Email: sef@matrade.gov.my Website: www.matrade.gov.my/en/malaysian-exporters/services-for-exporters/exporters-development/exports-assistance