AMMB Holdings Berhad

| AMMB Holdings Berhad |

| About Us: | The Group comprises of AMMB Holdings Berhad, a public listed company on the Main Board of Bursa Malaysia. Through its universal banking platform capabilities, the Group caters to the needs of a broad spectrum of customer segments, for activities relating to personal banking, business banking, investment banking, stockbroking, funds management, life and general insurance, and family takaful. While AmBank Group continues to grow dynamically and gain recognition as Malaysia’s preferred financial solutions group, its strategic partnerships with key global players has paved the way for greater international connectivity. Complementing its strong reputation as a key financial solution provider in Malaysia, its partnerships with Australia and New Zealand Banking Group (ANZ), Insurance Australia Group (IAG) and MetLife Inc has brought new energy and value in how the Group conducts its business to better serve its markets. |

| What We Buy: | – |

| What We Sell: | AmBank Group offers a comprehensive suite of financial solutions which are designed to be relevant and meet our customers’ financial needs. This includes deposits, loans & financing, credit cards, wealth management, priority banking, insurance, SME banking, young professional solutions, foreign currency exchange and remittance services. |

| Contact: | Syed Anuar Bin Syed Ali |

| Job Title: | Head, Group Corporate Communication & Marketing |

| Location: | 22nd Floor, Bangunan AmBank Group, No. 55, Jalan Raja Chulan, 50200 Kuala Lumpur, Malaysia |

| Tel/Fax No: | – |

| Industry: | Banking |

| Email: | sasa@ambankgroup.com |

| Website: | ambankgroup.com |

Exim Bank

| Export-Import Bank Of Malaysia Berhad (EXIM Bank) 357198-K |

| About Us: | Export-Import Bank of Malaysia Berhad (EXIM Bank) was incorporated on 29 August 1995 as a government owned development financial institution through a wholly owned subsidiary of the Minister of Finance Incorporated. The Bank was established to promote reverse investment and export of strategic sectors such as capital goods, infrastructure projects, shipping, value added manufactured products and to facilitate the entry of Malaysian companies to new markets, particularly to the non-traditional markets. |

| What We Buy: | – |

| What We Sell: | As an agency under the purview of the Ministry of Finance, EXIM Bank’s mandated role as specified by the Government is as to provide credit facilities to finance and support exports and imports of goods, services and overseas projects with emphasis on non-traditional markets as well as the provision of export credit insurance services, export financing insurance, overseas investments insurance and guarantee facilities. |

| Contact: | Nur Hidayu Abd Latif / Tahira Faisal |

| Job Title: | Assistant Manager / Executive |

| Location: | Level 1, EXIM Bank, Jalan Sultan Ismail, 50250 Kuala Lumpur. |

| Tel/Fax No: | Tel: +603 – 2601 2392 / 2601 2390 |

| Industry: | Finance |

| Email: | Communications@exim.com.my |

| Website: | www.exim.com.my |

Forthcoming Events

(1) Expertise Resource Association (ERA) Business

Mission to Dhaka, Bangladesh on 24 -2 7 April 2017

We are pleased to inform that Expertise Resource Association (ERA) will be organizing a business mission to Dhaka, Bangladesh from 24–27 April 2017. The objectives of the mission are to enhance the networking between ERA and relevant government departments and trade associations in Bangladesh as well as to promote bilateral trade and investments between Malaysia and Bangladesh.

The participation fees for the business mission are as follows:-

* Twin-sharing room RM2,800.00 OR

* Single room RM3,800.00

This includes 3 nights hotel accommodation at Hotel Sarina (4 Star rating) with daily breakfast, 6 meals and local ground transport. It does not include the return air tickets.

Interested members are kindly requested to return the duly completed form and payment receipt via email to ERA Secretariat soonest possible.

For enquiries please contact:-

(1) Ms Saw Hui Peng at H/p: 012-693 0807 or Email: hpsaw@yahoo.com

The ERA Account Number is Expertise Resource Association

Public Bank A/C No: 3068928307

Kindly forward the bank in slip to the treasurer of ERA, Mr. Wong Lian

Kee at H/p: 019-3257173 or Email: liankee.wong@gmail.com

Kindly refer to the tentative programme and application form as below:-

(2) MASSA 26th Annual General Meeting (AGM)

on 21 June 2017

MASSA will be having its 26th Annual General Meeting (AGM) on 21st June 2017 at the Banquet Hall, 26th Floor, Bangunan AmBank Group, Jalan Raja Chulan, Kuala Lumpur. The Notice and Agenda of the AGM will send to MASSA members via email or faxes nearer to that date.

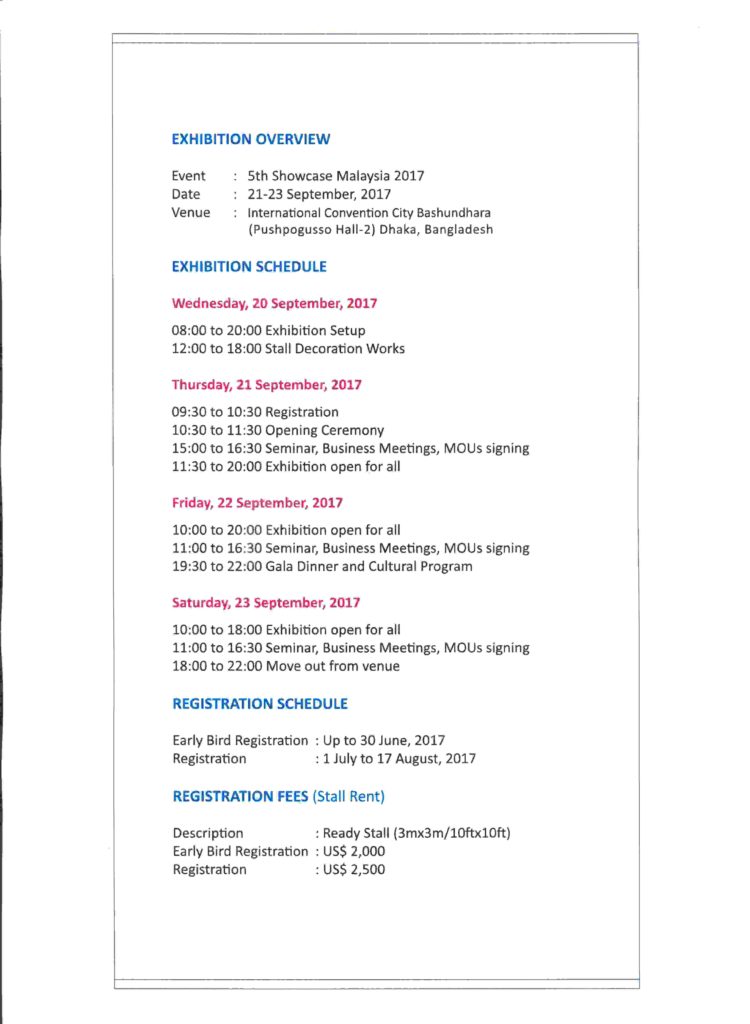

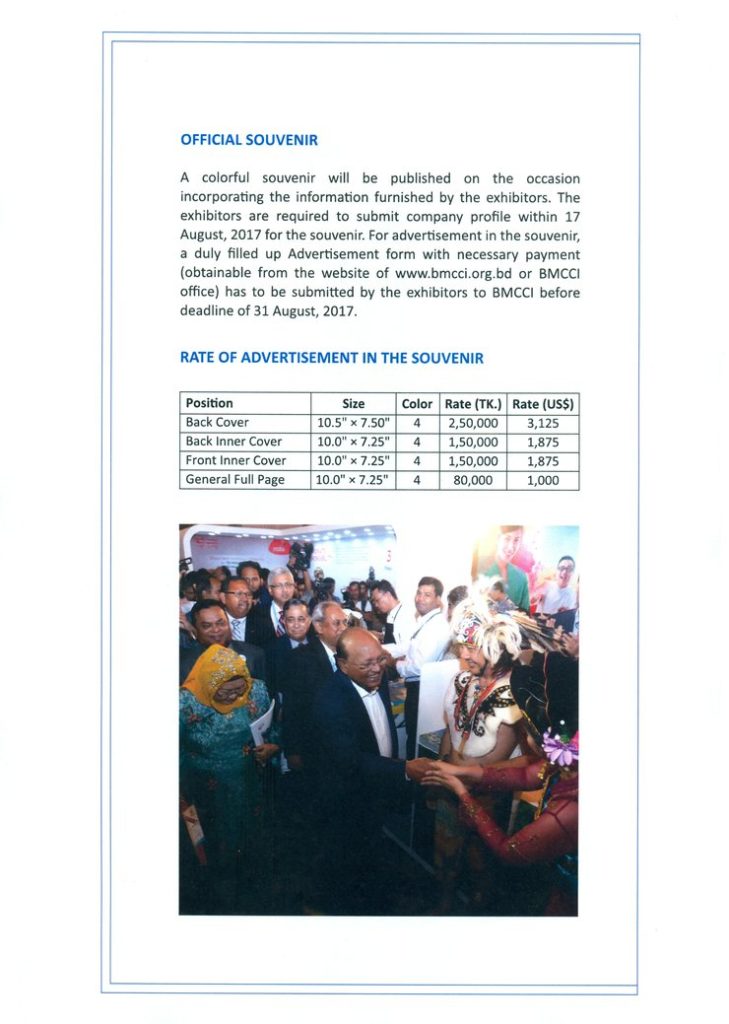

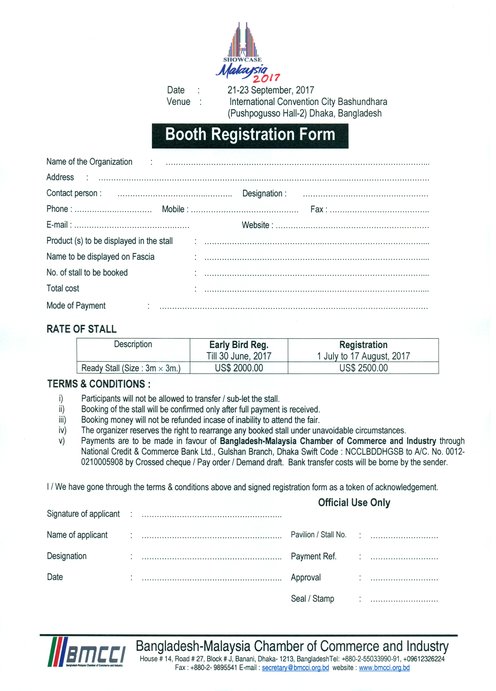

3) 5th Showcase Malaysia at International Convention

City Bashundhara (Pushpogusso Hall-2), Dhaka,

Bangladesh on 21 – 23 September 2017

Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI) is the organiser of the “5th Showcase Malaysia 2017” in collaboration with the High Commission of Malaysia in Bangladesh, High Commission of Bangladesh in Malaysia and supported by Malaysia External Trade Development Corporation (MATRADE) and Malaysia South-South Association (MASSA). This event will be held on 21 – 23 September 2017 at the International Convention City Bashundhara (Pushpogusso Hall-2) in Dhaka, Bangladesh.

This Showcase focused on the various sectors as in Furniture, Education, Power & Energy, Herbal Products, Food & Beverage, Airlines and Tourism, Electric & Electronics, Telecommunications, Real Estate & Housing, Information Technology, Joint Venture Companies, Automobiles & Spare Parts, Infrastructure Development, Cosmetics & Beauty Products, Palm Oil and related products, Pharmaceuticals and Health Care, Machineries & Industrial Products.

There will also be B2B meetings held between exhibitors and interested buyers for business matching during the showcase.

For further details on the “5th Showcase Malaysia 2017”, kindly contact BMCCI at Tel: +880-2-55033990-91, 09612326224 or email: secretary@bmcci.org.bd /

president@bmcci.org.bd

MASSA Events

Courtesy Call by Honorary Consul of Mongolia

on 20 January 2017

Mr Reynolds Augustine, Honorary Consul of Mongolia and Mr Andrew Rajandra, Asst. to Honorary Consul of Mongolia visited MASSA Secretariat and met with Ms Ng Su Fun, Executive Secretary and Ms Florence Khoo, Asst. Executive Secretary of MASSA.

The meeting discussed collaboration of activities and business and trade opportunities available in Mongolia for MASSA members.

(left to right) Mr Andrew Rajandra, Assistant to Honorary Consul of Mongolia, Ms Florence Khoo, Asst. Executive Secretary MASSA, Mr Loo Yow Ming, Director of Business Development, CREST Global Resources Sdn Bhd, Ms Ng Su Fun, Executive Secretary MASSA and Mr Reynolds Augustine, Honorary Consul of Mongolia

Tan Sri Azman Hashim, President MASSA meeting

Chief Executive Officer, MATRADE on 24 February 2017

(left) Tan Sri Azman Hashim, President of MASSA meeting with (right) Ir. Dr. Mohd Shahreen Zainooreen Madros, Chief Executive Officer of MATRADE

Courtesy Call on Tan Sri Azman Hashim, President of MASSA by Ir. Dr. Mohd Shahreen Zainooreen Madros, the new Chief Executive Officer of Malaysia External Trade Development Corporation (MATRADE) at his office.

Briefing and Tour to Malaysia Digital Economy

Corporation (MDEC) on 18 April 2017

Malaysia Digital Economy Corporation or MDEC (formerly known as Multimedia Development Corporation Sdn. Bhd.) is an agency under the Ministry of Communications and Multimedia Malaysia. MDEC’s mission is to develop, coordinate and promote the nation’s digital economy, information and communication technology (ICT) industry and the adoption of digital technology in the country. MDEC’s implementation efforts are centred on driving investments, building local tech champions, catalysing digital innovation ecosystems and propagating digital inclusivity.

MDEC is also entrusted to ensure that Malaysia plays an integral part in developing and nurturing talent to drive digital innovation forward for Malaysia, while attracting participation from global ICT companies to invest and develop cutting edge digital and creative solutions in the country.

MDEC believes that being ahead of the technology curve is the way to future – proof businesses as the future lies in innovation. Big Data Analytics (BDA), the Internet (IoT), E-Commerce and Data Centre & Cloud are the key focus areas that have been identified as catalysts to kick-start, build and sustain an ecosystem of digital innovation, that will keep Malaysia at the forefront of technology.

MASSA in collaboration with MAJECA & ERA jointly organised a Business Tour to MDEC Headquarters in Cyberjaya.

23 representatives from 16 companies/ organisations participated in the Briefing and Tour of MDEC on 18 April 2017.

The event started at the MDEC HQ in Cyberjaya.

Introduction and Welcome

Mr Siva Ramanathan, MDEC’s Chief Strategy Officer gave a welcome to all participants and introduced the role, objectives and visions of MDEC.

Malaysia Digital Economy Corporation (MDEC)

Mr Raja Segaran, MDEC’s Senior Manager of Strategy, gave a presentation on how Multimedia Development Corporation Sdn. Bhd., transformed to the present Malaysia Digital Economy Corporation Sdn. Bhd. (MDEC) – https://mdec.com.my/

Mr Raja Segaran, MDEC’s Senior Manager of Strategy giving a presentation on MDEC’s role and functions to participants at the visit

Delegates at MDEC HQ

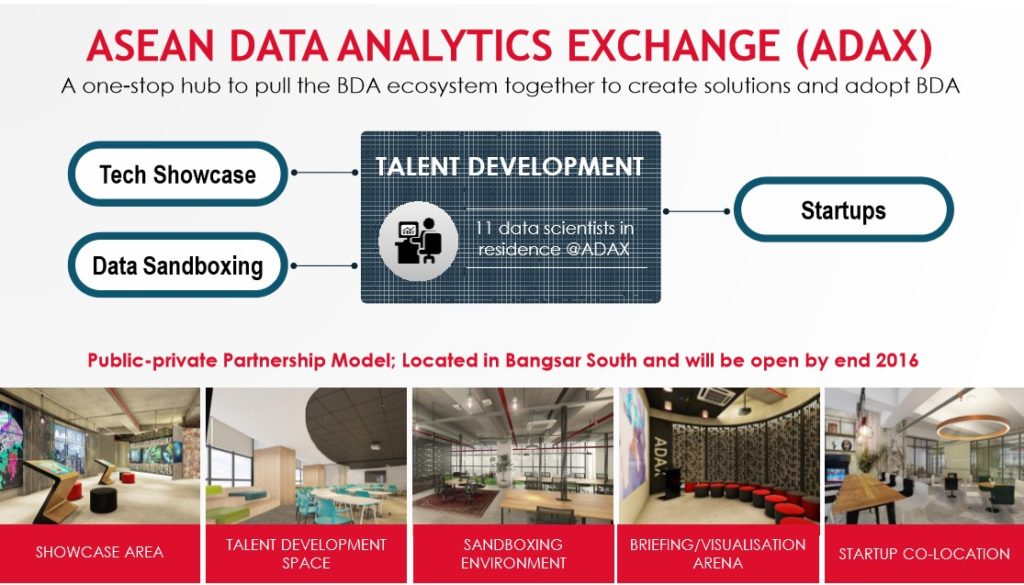

ASEAN Data Analytics eXchange (ADAX)

Mr Jack Lim Senior Manager, of MDEC’s Data Economy introduced ASEAN Data Analytics eXchange or ADAX.

Presentation on ADAX by Mr Jack Lim

This is an initiative spearheaded by the Malaysia Digital Economy Corporation (MDEC) to catalyse a one stop hub for big data analytics ecosystem. ADAX’s office is the world’s first physical data exchange platform located in Bangsar South.

Kasatria Technologies Sdn Bhd (Kasatria)

Kasatria is the leading company in Malaysia that can provide an end-to-end Google Analytics Premium Solution. Kasatria CEO, Mr Chan Kin Peng gave a presentation on how Malaysian companies, who have an online business presence, can enlist Google Analytics Tools to do the following:-

* Develop an online marketing strategy to plan market and trade online marketing activities to gain competitive edge.

* Use customer demographic analysis to distinguish customers and understand their challenges in order to serve them better.

* Help companies to grow online brand visibility

* Assist companies to track media performance and achieve better ROI throughout online advertising campaigns.

* Identify and influence key steps that will lead towards completion of online goals.

* Increase reach, relevance and conversion rates by learning and adapting to customers’ needs and wants – http://www.kasatria.com/

Presentation by Mr Chan Kin Peng, CEO of Kasatria

The participants then visited two Global Tech Companies located in Cyberjaya. They were Experian and CXS Conexus.

Experian Global Delivery Centre

Experian is a global tech company located in Cyberjaya. It is a global leader in commerce and business credit reporting and marketing services, supporting clients in more than 80 countries and employing approximately 17000 people in 37 countries. Experian’s strength is in gathering, analysing and processing data for organisations and consumers to help manage the risks and rewards of commercial and financial decisions.

Mr Eddy Wong Kok Hoe, General Manager of Experian at Cyberjaya office met our delegates and gave a briefing and tour of its offices in Cyberjaya – http://www.experian.com.my/

MASSA members touring Experian office

Group photo of MASSA members at Experian office

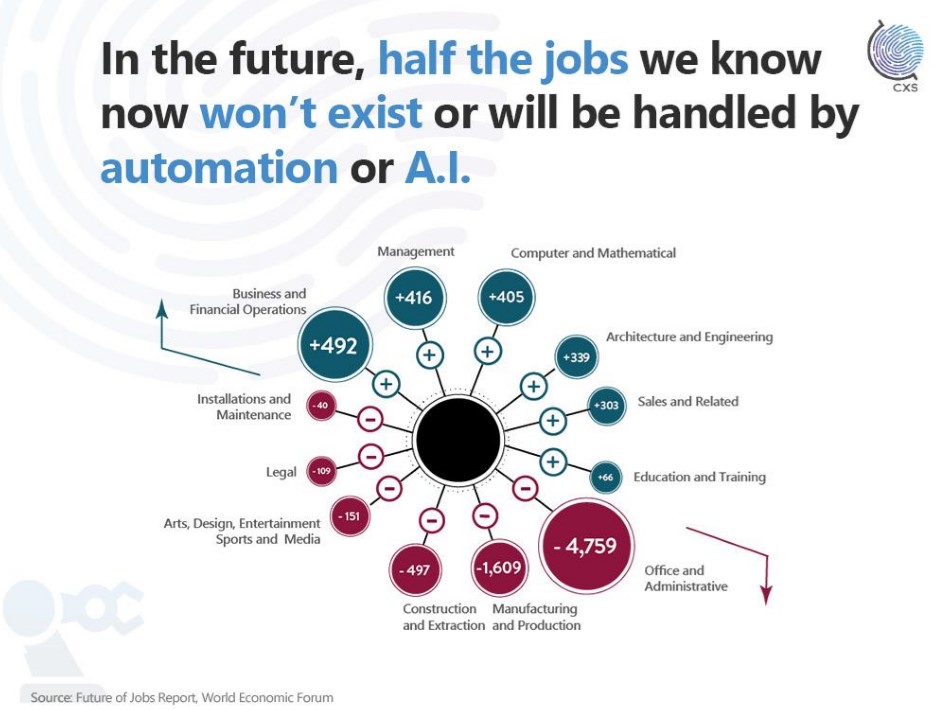

CXS Conexus

CXS is a provider of big data and data analytics tools focusing on education and the workforce of the future. CXS offers a full suite of profiling, learning analytics and validated research tools. This organization connects education and employability data to provide their clients with insights to drive their business forward for today and beyond. CXS affiliate company Conexus Norway has over 15 years of proprietary content and validated research. They believe that the combinations of big data analytics, validated academic research and pedagogical frameworks will usher a fundamental change in the way we learn.

The international headquarters will be located in Cyberjaya to serve and support a growing base of 4,000 organisations, 20 national systems and millions of user profiles – http://www.cxsinternational.com/index.html

Mr Jan Lambrechts, CEO of Conexus Malaysia giving his presentation to the delegates

Visit to CXS Conexus

Agensi Nuklear Malaysia – Nuclear Technology for Malaysian Sustainable Development

Introduction

On September 25th 2015, at the United Nation (UN) Headquarters in New York, member countries adopted a set of goals to end poverty, protect the planet, and ensure prosperity for all as part of a new sustainable development agenda. Each goal has specific targets to be achieved over the next 15 years. Altogether there are 17 specific goals ranging from poverty, hunger, health, clean water, affordable clean energy, climate change, environment, industry, innovation etc. For the goals to be reached, everyone needs to do their part: governments, the private sector, civil society and people like us.

The International Atomic Energy Agency (IAEA) one of the agencies under the UN, is mandated to prevent the spread of Nuclear Weapon. However, another key role of IAEA is to make nuclear science and technology available to member states to ensure that development and progress are sustainable. The main focus areas are electricity generation, improving human health, increase food production, industrial enhancement, mitigate problems related to climate change, etc. Since joining IAEA in January 1969, Malaysia has benefitted enormously from assistance and collaboration in the development of human resources, expertise and development and application of nuclear science and technology. Malaysia through the Malaysian Nuclear Agency (Nuclear Malaysia) as well as other agencies has participated in numerous collaborative projects regionally or inter-regionally and outputs of these projects have been successfully adopted by various socio-economic sectors.

The establishment of a Nuclear Agency in Malaysia was mooted from an idea of the late Malaysian Deputy Prime Minister, Tun Dr Ismail Dato’ Abdul Rahman, that Malaysia should be enhancing and benefitting from the development of nuclear science and technology for peaceful purposes. Neighbouring countries such as Indonesia, Thailand, Philippines and Vietnam had their nuclear research centres equipped with research reactors since early 60’s. Following the oil crisis of the early 1970’s and nuclear energy was considered as alternative, the Cabinet then officially approved the establishment of the Tun Ismail Atomic Research Centre on 19 September 1972. The era of nuclear in Malaysia began when the Reaktor TRIGA PUSPATI reaching its first criticality on 28 June 1982.

Currently, Nuclear Malaysia is equipped with major facilities such as Nuclear Research Reactor, Gamma Irradiator, Electron Beam Machine, Radioisotope and Radiopharmaceutical Production Facility, Radioactive Waste Treatment Centre, and various other nuclear equipments. Apart from that, nuclear science and technology is also used in hospitals, manufacturing, various industries, universities, as well as in agricultural practices. Since operational in 1984, Nuclear Malaysia has embarked into the development of applications and promotion of Nuclear Technology in sectors namely Energy, Medicine, Industry, Food and Agriculture, Environment, Water and Soil Management and development of New Materials.

View of Nuclear Malaysia complex then and now

Reactor Technology and Application

Nuclear Malaysia has been operating a 1 MW research reactor for more than 30 years in a safe and peaceful manner. The research reactor has been used for radioisotope production for medical and industrial uses. The reactor other main uses are for the analysis of environmental samples and industrial materials as well as for education and training in reactor design and engineering. Annually more than 3000 samples are analysed by using the reactor which has benefitted industries, researchers as well as the education sector. Without this reactor such analysis and research has to be carried out overseas.

Reactor TRIGA PUSPATI – Top view

Reactor pool

Reactor control console

Closeup view of the reactor top

Industrial Applications and Development of New Materials

Industrial testing using nuclear technology (X-Ray and Gamma Ray) has contributed tremendously to the competitiveness of Malaysia’s manufacturing and industrial sector. Since companies can have access to a good quality non-destructive testing (NDT) services at reasonable cost, have allow them to spend money on inspection, and thus improving Malaysia’s competitiveness as well as the level of safety of facilities such as oil refineries, manufacturing plants as well as gas plants. Prior the development of local NDT industry and accreditation system for testing services, PETRONAS and other oil companies in Malaysia had to rely on foreign NDT providers, or local companies hiring operators certified abroad. Oil pipes, boilers, pressure vessels, aircraft components and ships, especially joints and welds are among the products whose quality and integrity are tested with the technique. With the assistance of IAEA, Nuclear Malaysia and skill accreditation agencies have successfully established accredited training and certification system that meets international standards. Malaysia has also built itself an export niche in South-East Asia and the middle-east, offering NDT using nuclear technique to industries. Currently there are over 100 NDT companies in Malaysia, employing more than 1000 certified engineers and technicians to carry out NDT testing. The success of Malaysia in this area has been acknowledged by IAEA. Malaysian experts have been deployed in numerous developing countries to assist in the development of similar scheme.

Apart from developing technique and certification in NDT, various instruments and detection systems are developed for plant evaluation purposes. Examples are density, moisture, thickness, corrosion as well as material interface gauges that utilises radiation in the sensing systems.

Mobile Gamma Tomography For Industrial Material Inspection

Solid & Gas Flow Test Rig

Pipe Corrosion Gauge

Moisture detection in concrete

By using radiation technique numerous new materials have been developed world-wide. In Malaysia, use of indigenous resources such as palm-oil, rubber, kenaf and petroleum products has been the focus. New composites and polymeric compounds have been developed from these sources are used in industry, for making medical kits and others. Nuclear Malaysia is collaborating with PROTON, a national car manufacturer to produce and test radiation induced cable insulation material which can withstand higher temperature so as to enhance car safety.

Nuclear Malaysia receiving a Proton test car for a project on cable material and insulation

Another area that radiation technology has contributed immensely to the socio-economic development in Malaysia is in the sterilisation of medical kits such as catheters, surgical gloves, syringes as well as contraceptive sheets. In the 1980’s there were only a few surgical glove manufacturers as well as other medical products in Malaysia. These manufacturers have to sterilise either by other method which is less preferred by the industry or to get it done by radiation method overseas. This was rather difficult to new entrepreneurs. Due to increasing demand for sterilised medical products and kits at that time, Nuclear Malaysia had promoted to companies to invest on gamma sterilisation technology. However due to uncertainty on the return of investment and the complexity of the technology no company was willing to invest. In 1989 with the budget provided by the government, Nuclear Malaysia commissioned a gamma sterilisation plant for research as well giving services to the rubber medical glove and other medical products industries. The business model of this semi-commercial plant was very successful in demonstrating the technology and it was also a catalyst in the growth of medical products manufacturing industry. The business model was adopted by a company called Sterilgamma Sdn. Bhd where a similar plant with higher capacity was built in Rawang in 1993 to service expanding demand. Further increasing in demand of such service another plant was commissioned at Kuala Ketil Kedah in 2000. In 2015 another gamma plant was commissioned by another company in Sepang Selangor. With the availability of such services, it has encouraged the expansion of medical kits manufacturing in Malaysia. The export revenue from medical glove and other medical products has grown from RM 1.4 billion in 2010 to RM 2.1 billion in 2015.

Medical Applications

Nuclear medicine is a medical specialty involving the use of radioactive substances in the diagnosis and treatment of diseases. Nuclear medicine tests differ from other imaging modalities. Nuclear Medicine diagnosis primarily shows the physiological function of the system being investigated (e.g.: heart or liver function). Nuclear medicine imaging studies are generally more organ-, tissue- or disease-specific (e.g.: lungs scan, heart scan, bone scan, brain scan, tumor, infection, Parkinson etc.). In conventional radiology imaging, will focus on a particular section of the body (e.g.: chest X-ray, abdomen/pelvis CT scan, head CT scan, etc.). Radionuclide therapy using Iodine-131 can be used to treat conditions such as hyperthyroidism and thyroid cancer, while Samarium-153 or Strontium-89 is for bone pain. In nuclear medicine therapy, the radiation treatment dose is administered internally e.g. by injection or oral routes, rather than from an external radiation source such as radiotherapy. The radiopharmaceuticals used in nuclear medicine therapy emit ionizing radiation that travels only a short distance, thereby minimizing unwanted side effects and damage to non-involved organs. Currently new radiopharmaceuticals for cancer imaging and treatment are being studied and developed.

Nuclear Malaysia was involved in research and development in Nuclear Medicine for hospital uses since 1984 and radiopharmaceuticals such as Technetium-99m and Iodine-131 was produced. At that time there were only 2 nuclear medicine centres in Malaysia. In early 90’s Nuclear Malaysia was routinely producing radiopharmaceuticals for hospital uses and as the demand increases more centres were established. Currently there are more than 20 hospitals in Malaysia that uses nuclear technology in diagnosis or treatment.

Testing of radiopharmaceutical produced at Nuclear Malaysia prior to routine use at hospitals

Tc-99m eluted from generator used for imaging and studying organs

Facility for production of medical products

Product of radiopharmaceutical cold-kits

Environment, Water Resources and Climate Change

Water is a precondition for human, animal and plant life, as well as a necessary resource for the economic activities. Surface and groundwater resources are at risk because of indiscriminate use, rapidly growing populations, increasing agricultural demands, and threat of pollution in the surrounding areas. These risks are often compounded by a lack of understanding about local conditions governing the occurrence, distribution and management of surface and groundwater resources at large. Such hydrological problems in sustainable water resources development and management can be investigated and mostly solved by using nuclear-isotope techniques (environmental and radioisotope tracers). Nuclear Malaysia has been involved in assessment of groundwater, freshwater quality, salt water encroachment, Surface water / groundwater pollution, dam sustainability and safety and effects of climate change to marine ecosystem in various states as well as doing studies for water and agriculture authorities in Malaysia.

Food, Agriculture and Soil Management

Sustainable food supply is a precursor for human survival. Nuclear technology has been widely used for crop improvement, management of agro-ecosystems for productivity enhancement and development of radiation based bio products and bioprocesses. By exposing seeds or seedlings to certain level of radiation, new traits of plants that have superior characteristics compared to the original variety can be achieved. Exposing plants to different types of radiation, damages the plant’s DNA and causes new mutations resulting in a new useful trait. However, the plants are not contaminated or contain radioactive material, similarly as we undergo x-ray examination, only repairable minor cell damage may occur but our body does not become radioactive. Therefore the plants or grains produced are safe for human consumption. In Nuclear Malaysia the current focus for crop improvement is on rice, bananas, pineapple, kenaf and stevia for obtaining the characteristics required by the industry as well as to cope with climate change. As an example new rice variety with higher yield can be cultivated on dry land with water sprinkler instead of traditional irrigation system.

New variety of Stevia with higher biomass content produced using nuclear technology

Field Trial of New Rice develop using nuclear science in Perlis

Plant growth promoter from irradiated chitosan

Food and agricultural product preservation are vital to ensure fresh food supply and reduce wastage. Food preservation using radiation technique has been accepted world-wide. In Malaysia, The Ministry of Health had approved this technique and sale of irradiated food under the Food Irradiation Regulations 2011. The demand for this preservation technique is growing steadily. In 2011 Nuclear Malaysia irradiated around 300 ton of food products and in 2015 it has grown to more than 1000 ton. The food products irradiated ranges from spices, herbs, as well as frozen foods. This has contributed substantially to Malaysian economy not only due to reduce wastage but also in terms of environmental sustainability where chemical free process is used. United States Department of Agriculture (USDA) requires fresh fruits imported from Malaysia to undergo irradiation to ensure that they are free of insects and meet the phytosanitary procedures. Malaysian Department of Agriculture has been working closely with Nuclear Malaysia to irradiate rambutan and to get USDA approval so that it can be exported to the US.

Mock trial on irradiation of Rambutan to meet US phytosanitary requirements

Clean Energy and Climate Change

Nuclear power is one of the lowest carbon technologies available to produce electricity in an affordable manner and can play a significant role in mitigating climate change. Nuclear power can make a significant contribution to reducing greenhouse gas emissions while delivering energy in the increasingly large quantities needed for growing populations and socioeconomic development. Nuclear power plants produce virtually no greenhouse gas emissions or air pollutants during their operation and only very low emissions over their entire life cycle. Despite of a relatively higher deployment cost compared to other power plants, issues of spent nuclear fuel, Fukushima and Chernobyl, as of May 2016, 30 countries worldwide are operating 444 nuclear reactors for electricity generation and 63 new nuclear reactors are under construction in 15 countries. This shows that the economic and public perception of nuclear power is still favourable, in many countries. South Korea with smaller land mass compared to Peninsula Malaysia, there are 25 nuclear power reactors in operation and 3 more are under construction.

In September 2010 Malaysia announced that post 2020 there will be 2 nuclear power reactors to be deployed to meet the growing demand of electricity and to reduce over dependence on fossil fuels such as coal, whereby 100% is imported. In Malaysia nuclear power program is under the purview of Malaysia Nuclear Power Corporation in the Prime Minister’s Department. The current revised plan is for Malaysia to start operating the first nuclear power plant by 2030.

Nuclear Malaysia has been operating a 1 MW research reactor for more than 30 years in a safe and peaceful manner. The knowledge and safety culture adopted and practised at Nuclear Malaysia is a strong foundation for public confidence. Furthermore understanding that strict adherence to regulatory procedures and compliance to international peer review regime has also contributed to safety and can further enhance public acceptance. Therefore Malaysian public should be ready to listen and analyse the risk mitigation, pros and cons of nuclear power in objective manner, so that the benefit of nuclear energy can be harnessed to ensure energy security and environmental sustainability. With that Malaysia can contribute immensely to the global effort in limiting green-house gas emission as well as combatting climate change.

Safety and Radiation Protection

In Malaysia there are more than 20,000 registered radiation workers involved in handling of tools and equipments with radioactive and radiation sources. Most of these workers are in hospitals, manufacturing and processing industries, airports, ports, research institutes, universities and so on. According to Malaysian Law, Acts 304 regulated by Atomic Energy Licensing Board (AELB) an agency under MOSTI, radiation workers are required to have a monitoring device to measure the total radiation dose received on a monthly basis. This device will be sent to the Nuclear Malaysia for the analysis and reading of the dose will be reported to AELB and MOH. Further investigation will be conducted if a worker received doses exceeding the permitted levels. Apart from monitoring of radiation workers, the working environment and the immediate vicinity are also monitored. Nuclear Malaysia has the expertise to carry out investigations in the case of excess radiation dose readings of radiation workers by looking at the chromosomal damage. This is done by chromosome aberration test at the Biological Dosimetry Laboratory. This laboratory was established in 1986 to meet the requirements of the Basic Safety Standards, Regulations on Radiation Protection and to support AELB and MOH. On average, the laboratory receives about ten blood samples for investigation per year.

Calibration of radiation measuring instruments

Since 1979, Nuclear Malaysia has conducted environmental radioactivity surveillance and monitoring program in the surrounding area including along the nearby Sungai Langat. Surveillance and monitoring program is carried out to detect any changes in the level of radioactivity in the environment that may results from the activities carried out in Nuclear Malaysia. Monitoring of environmental radiation and radioactivity is also implemented to meet the licensing requirements set by AELB. Until today the environmental radiation level recorded is lower than 20mSv/year and radioactivity level of samples within 10km radius is below 1Bq/gm similar to the natural background level in other countries. This shows that activities in Nuclear Malaysia do not release any radioactive materials, and hence, population within 5 km radius do not receive any extra radiation dose other than from the natural radiation.

Laboratories in Nuclear Malaysia that meet international standards are always in a state of readiness to carry out analysis when required. For example during the incident at Chernobyl and Fukushima, samples of food and goods imported from areas and countries near the nuclear incident were sent to Nuclear Malaysia to determine the level of radioactivity before selling was permitted. Malaysian citizens returning from nuclear accident affected areas may also get contamination checks at Nuclear Malaysia. Apart from That Nuclear Malaysia has also been providing analysis of radioactive material content in foods and drinks for exports if the importing country requires them.

Currently, Nuclear Malaysia is operating a large volume air sampler station to collect dust in the air and analyse it for atmospheric radioactive content if any. Any activities in the region such as nuclear explosion or any other minute radioactive releseas that may contaminate the environment can be detected and investigated. The station located at Cameron Highlands is own by an international body, Comprehensive Test Ban Treaty Organization (CTBTO). Currently there are 80 similar stations all over the world and the data from the stations are shared to all CTBTO member states which include Malaysia.

Powerful air sampler unit to collect air dust sample for atmospheric radioactive contamination detection and analysis at CTBTO station in Cameron Highlands

Conclusion

Although the world was introduced to nuclear by atomic bomb detonation, the technology has found numerous peaceful applications that benefit mankind. Being a member of IAEA Malaysia has been able to acquire expertise and nuclear technologies from advance countries through collaboration and training and applied these technologies locally. For the last 30 years nuclear science and technology has been safely and widely used in mainstream sectors of sosio-economic activities in Malaysia. Subsequently Malaysia is also developing her own indigenous nuclear technologies through R&D to enhance the effort towards achieving sustainable development goal. With proven safety record and applications benefitting the nation, Malaysian public should not be fearful and should be willing to learn and understand the risk mitigation and benefit of nuclear science and technology.

Article by YB Datuk Seri Panglima Wilfred Madius Tangau, Minister, Ministry of Science, Technology & Innovation (MOSTI) extracted from The Daily Express on 18 February 2017

Contact Details

Agensi Nuklear Malaysia (Malaysian Nuclear Agency)

Bangi

43000 Kajang

Selangor

Tel: +603-8911 2000 / Fax: +603-8911 2175

Website: www.nuclearmalaysia.gov.my

Technical Visit to Agensi Nuklear Malaysia on 2nd March 2017

MASSA, together with the Malaysia-Japan Economic Association (MAJECA) and the Expertise Resource Association (ERA) organised a Technical Visit to Agensi Nuklear Malaysia (Malaysia Nuclear Agency) on 2 March 2017 from 10.00 am to 2.00 pm.

The Agensi Nuklear Malaysia (Nuklear Malaysia) is a premier research and development (R&D) organisation in nuclear science and technology. The agency plays an active role and contributes to the implementation and realisation of national science and technology (S&T) policies to ensure it remains a relevant public research institute for the country.

The functions of Agensi Nuklear Malaysia are as follows:

• To conduct research and development (R&D), services and training in the field of nuclear technology for national development;

• To encourage application, transfer and commercialisation of nuclear technology; and,

• To coordinate and manage the national and international nuclear affairs, and act as the liaison agency with International Atomic Energy Agency (IAEA) and Comprehensive Nuclear-Test-Ban Treaty Organization (CTBTO).

With more than three decades in operation, Nuklear Malaysia has matured and is capable of facing the challenges and managing the changes efficiently. In line with the current needs and development, a strategic action plan and its implementation has been developed to meet set targets. Nuklear Malaysia currently has four programmes, namely:

• research and technology development,

• technical and corporate support,

• transfer and commercialisation of technology planning,

• management services

These programmes will provide the means for Nuklear Malaysia to focus on its activities, including the readiness to be a technical support organisation, if Malaysia decides to embark on nuclear power programme as an alternative option for future electricity generation. For more detailed information, please visit Nuklear Malaysia’s website at http://www.nuclearmalaysia.gov.my/new/index.php .

The Agency’s 2015 Annual Report is available for your reference at http://www.nuclearmalaysia.gov.my/annual%20report/web/main.htm

Technology Planning and Development / Commercialisation of

Technology

The R&D activities of Nuklear Malaysia focus on six priority areas, namely, advanced material, advanced manufacturing, biotechnology, ICT, advanced alternative energy and nanotechnology. The R&D projects are market driven to produce beneficial products to generate economic returns through downstream activities. The implementation of R&D projects are periodically monitored and analysed to ensure that the projects are on the right track and meet the set target within the time frame. To strengthen project implementation and optimising resources sharing, several related projects have been consolidated into a few main projects, which will produce more significant socioeconomic impact. In this respect, apart from conducting collaborative research internally through the matrix system, research is also conducted through collaboration with other research organisations. Research collaborations with industrial partners have been also enhanced to produce research products that can be directly beneficial to end users. Thus, efforts have been made to ensure that research products can be commercialised through technology transfer and licensing. These activities will certainly augur well for the development of innovative technologies to enhance Malaysia’s products and services.

Malaysia has been gearing towards being a high-income nation and corporates in Malaysia need to take a leap to embrace new technologies to remain competitive. As such, the technical visit to Nuklear Malaysia was aimed to create more awareness and knowledge about the areas of focus and R&D components at Nuklear Malaysia and how corporations from various sectors, could adopt or play a part in the commercialisation possibilities of their R&D to upgrade and enhanced their products and services in niche areas to remain competitive in the global arena.

The Director-General, Dr Mohd Ashhar bin Hj Khalid and his management team met our delegation and gave a detailed briefing on the aims and functions of this organisation. Agensi Nuklear Malaysia hosted the participants to a luncheon after the briefing and tour.

(Center) Dr Mohd Ashhar bin Hj Khalid, Director General, Agensi Nuklear Malaysia briefing MASSA members with (right) Ms Ng Su Fun, Executive Secretary of MASSA

(Left) Ms Ng Su Fun, Executive Secretary of MASSA presenting a souvenir to (right) Dr Mohd Ashhar bin Hj Khalid, Director General, Agensi Nuklear Malaysia

Group photo taken at the Agensi Nuklear Malaysia’s office

The participants toured the following facilities at Nuklear Malaysia:

1) SINAGAMA Irradiation Plant

2) Polymer blend and composites laboratory

3) The MINT Tech-park which houses a Flora Vitro Laboratory

4) The Gamma Greenhouse (GGH)

GAMMA Greenhouse

GAMMA Greenhouse inside view

5) Reaktor Triga PUSPATI (RTP) Facility or TRIGA PUSPATI Reactor

Message by MATRADE Trade Commissioner in Yangon, Myanmar and Country Feature on Myanmar

DOING BUSINESS IN MYANMAR

Renewing partnerships, strengthening collaborations

Opportunities and challenges in a changing landscape

Article by:

Sadat Foster, Trade Commissioner

MATRADE Yangon, Myanmar

Myanmar has undergone remarkable economic growth over the past few years to become one of the most exciting destinations for trade and investments. Since 2011, the country has taken steps to liberalise and strengthen the business environment by addressing some of the stumbling blocks facing Myanmar’s economy. These include the passing a new foreign investment law; unifying multiple exchange rates; lowering restrictions on importing and exporting activities; reforming the policy on taxes; and improving the public delivery system. Fast forward a few years later, another wave of excitement swept across the country as it welcomed a newly elected government in April 2016 as a result of the historic parliamentary elections that concluded successfully in November 2015.

Myanmar’s progress in the span of a little more than five years since the country reintegrated into the international fold has caught the world by surprise for good reason, and drew much acclaim from the international community. This development certainly has reinvigorated interest in what many call as the ‘last frontier market in Asia’ and saw many businesses making a beeline to establish a presence in this burgeoning market. Rich in natural resources with a large untapped market of more than 50 million people; young labour force; and strategic location between China, India as well as ASEAN, the country certainly presents many unique opportunities for joint ventures and business partnerships.

Economic growth

Myanmar has shown steady gross domestic product (GDP) growth in recent years, albeit starting from a small economic base. In the fiscal year 2016-2017 (FY2016-17), the country’s GDP expanded by 6.4 percent, according to data from the Asian Development Bank (ADB). In FY2017-18 and FY2018-19, ADB forecasted that Myanmar’s GDP would expand by 7.7 per cent and 8 per cent respectively. Notwithstanding the slowdown in GDP growth for FY2016-17, Myanmar’s economic activity is anticipated to strengthen further, spurred by fast-growing sectors such as labour intensive manufacturing; tourism; retail; oil and gas exploration; as well as construction.

Source: Asian Development Bank (ADB). *Note: ADB forecast. Graphics by MATRADE Yangon

In addition to solid GDP growth, Myanmar’s manufacturing sector experienced an uptick in activity at the end of the first quarter of 2017 with the Nikkei Myanmar Manufacturing Purchasing Manager’s Index or PMI rising to 53.1 in March compared to 51.9 in February. This is the highest on record since the survey began in December 2015. The latest figure marked the third consecutive month of growth whereby a reading above 50 indicates economic expansion, while a reading below 50 points toward contraction. Overall in the survey, firms reported increases in output with new orders, business growth and employment in Myanmar.

Recent developments

• The Ministry of Commerce in Myanmar issued Notification No. 11/2016 on 19 February 2016, which lifted existing trade restrictions on foreign-owned joint ventures (JVs) and allowed the respective companies to trade in specific goods, namely, fertilisers; insemination seeds; pesticides; and hospital equipment, of which these sectors are considered essential to support the country’s growth. Similarly on 7 July 2016, the Ministry issued another notification to remove trade restrictions on JV companies trading in construction materials. With the removal of these trade restrictions, local-foreign JVs can now conduct both retail and wholesale trading, and they are subject to the same rules and regulations that govern local companies. The removal of trade restrictions in these industries represents a new opportunity not only to expand in the region but also to maintain direct control over all aspects of brand protection and the supply chain. Although the notification is limited to just these classes of goods, foreign investors should view this as a significant development because foreign-owned companies previously faced restrictions in trade across most industries.

• The government announced its first economic policy in July 2016, which among others promised to provide support in important sectors such agriculture, infrastructure and manufacturing. At the same time, the policy highlights the need to boost foreign investments and further improve the ease of doing business in Myanmar.

• In October 2016, Parliament approved the new Myanmar Investment Law (MIL), which consolidates and replaces the Foreign Investment Law of 2012 and the Myanmar Citizen’s Investment Law of 2013. The new law will be implemented effective April 2017. Among others, the new law aims to level the playing field between local and foreign investors while providing targeted incentives as well as a more streamlined investment application process. Please refer to Appendix I for the link to online resources with further details and full list of promoted sectors under the MIL.

• As part of the on-going import-liberalisation process, the Ministry of Commerce in October 2016 lifted the import licence requirements for 150 commodities including nickel piping; synthetic rubber; fire extinguishers; and auto parts. The Ministry first launched this initiative in August 2015, which then withdrew import licence requirements for all products except 4,405 designated items. That prescribed list was further reduced in August 2016 whereby another 267 commodities were freed from import licence requirements including cotton; sanitary ware; food manufacturing machinery, offset printing equipment, ink-jet printers and robotic technology. For further details, please visit www.commerce.gov.mm

• The US has moved to terminate remaining economic and financial sanctions against Myanmar in October 2016. Prior to being terminated, the sanctions made it very difficult for US banks, financial institutions and companies to do business in Myanmar. The impact on Myanmar will be positive over time as it brings more transparency and reduces the risk for foreign companies operating in Myanmar via JVs. Together with the granting of the Generalised System of Preferences (GSP) programme for Myanmar’s exports, especially textile and garment entering the US, which was announced on 15 Sep 2016, it will do much to spur more manufacturing and investment activities in Myanmar.

• The US has reinstated Myanmar’s eligibility for benefits under the Generalised System of Preferences (GSP) programme effective from November 13, 2016 after being suspended for more than two decades. The country has been seeking to regain the trade benefits with the US since 2013, which is the same year it gained GSP status from the European Union. Myanmar, which is under the least developed country (LDC) category can now export 5,000 products to the US duty-free under this programme. Regaining GSP trade benefits is expected to spur economic development; generate opportunities for exports; and create jobs for Myanmar.

• Total foreign direct investment (FDI) into Myanmar reached USD70.35 billion at the end of FY2016-17 ending March 2017 (accumulative figure since data was first recorded in 1988). Primary sources of FDI were from countries such as China, Singapore, Thailand, Hong Kong and the United Kingdom (UK). Malaysia ranks as the eighth largest investor in Myanmar with investments totalling USD1.93 billion in sectors such as oil & gas exploration; automotive assembly; manufacturing (paper packaging, cement, seafood, snack food products) as well as financial services.

Source: Directorate of Investment & Company Administration (DICA) Myanmar. Note: Accumulative figure since 1988. Graphics by MATRADE Yangon

Source: Directorate of Investment & Company Administration (DICA) Myanmar. Note: Accumulative figure since 1988. Graphics by MATRADE Yangon

Source: Directorate of Investment & Company Administration (DICA) Myanmar. Graphics by MATRADE Yangon

• Myanmar’s foreign trade volume reached USD26billion in FY2016-17, a figure that is larger by USD547.6 million compared to the same period in FY2015-16. According to the Ministry of Commerce, Myanmar’s export volume totalled USD10.7 billion while Myanmar’s import volume totalled USD15.7 billion in FY2016-17. The trade balance is more than a USD5 billion in deficit as the country continues to reply on imports due to Myanmar’s rapid growth and local manufacturer’s lack of capacity and capability. Overall, Myanmar exported agricultural products, animal products, marine products, minerals, forest products, industrial finished products and other ones. Among these products, the export volume of minerals and industrial finished-products declined compared to FY2015-16. The import volume of investment materials also declined, but personal goods and raw material products increased in volume.

Source: Ministry of Commerce Myanmar. Graphics by MATRADE Yangon

Source: Ministry of Commerce Myanmar. Graphics by MATRADE Yangon

Source: Ministry of Commerce Myanmar. Graphics by MATRADE Yangon

Source: Ministry of Commerce Myanmar. Graphics by MATRADE Yangon

Source: Ministry of Commerce Myanmar. Graphics by MATRADE Yangon

Upcoming developments

• The Myanmar Companies Law is an important piece of legislation that will replace the colonial-era Myanmar Companies Act from 1914. In addition to simplifying requirements for small and family-owned businesses; improving corporate governance standards; and removing outdated regulations, the law will also allow foreign investors to hold shares of up 35 per cent in Myanmar firms. The changes will also enable foreign investors to purchase shares on the Yangon Stock Exchange (YSX), which in turn is expected to aid the development of the YSX as a trading platform by opening it up to more institutional investors. The government hopes that this will make it easier for local companies to attract international funding, expertise and more investments. The new Myanmar Companies Law was submitted to the Parliament in early January 2017 and is expected to be given the final approval by mid-2017.

Sectors with opportunities

Myanmar’s reintegration to the global economy has opened up business opportunities in almost every sector. Among the sectors that offer good potential are:

1. Automotive and parts & components

The total number of registered vehicles has increased by more than 220 percent to 1.02 million (passenger and private vehicles) in 2016 from 460,000 in 2012 according to data from Myanmar’s Road Transport Administration Department (RTAD). At the same time, the number of motorcycles increased 163 percent to 5.12 million motorcycles in 2016 from 3.15 million motorcycles in 2012. The number of vehicles has grown substantially since 2012 when the government eased import regulations as a part of the recent reforms. While the number of automobiles in the country is increasing, the private passenger vehicle penetration rate is still low compared to other countries in the region. More than 90 percent of registered vehicles are reconditioned imports from Japan with Toyota comprising more than 65 percent of the market share. Spare parts, accessories and service centres have good potential as Myanmar’s climate and poor road conditions tend to wear out parts faster. Among the spare parts and accessories with strong demand include oil filters, battery, tyres as well as lubricants. Overall, the automotive sector is expected to grow at about 7.8 percent through 2019, driven by a growing economy, expanding infrastructure, less stringent regulations, and rising income in Myanmar. As such, the future for automotive spare parts looks positive with a projected market size of more than USD80 million in the years to come.

Source: Road Transport Administration Department (RTAD) Myanmar. Graphics by MATRADE Yangon

Tan Chong Motors’s launch of the new Nissan Sunny in Myanmar. Photo credit: MATRADE Yangon

Launching of Demak motorcycles in Myanmar. Photo credit: Demak Myanmar

2. Construction, engineering, infrastructure and building materials

Myanmar’s size of the construction market is estimated at USD3.5 billion with capital expenditure in Myanmar increasing mainly due to heavy investments in residential, commercial, hotel, retail and office space. Yangon has been the centre of construction activity and is likely to undergo more development in the near future. Furthermore, the increasing number of expats and locals moving to Yangon for job opportunities will contribute to higher demand for housing. Overall, the construction sector is expected to expand at an annual rate of at least eight percent over the next five years buoyed by growing international investor interest and rising business confidence. In addition, the government is increasing its focus on utility and transport, while pushing forward with its affordable housing programmes. Myanmar is also planning several major projects to support its economic development, including the construction of hydropower plants; roads and railway networks; ports; and new aviation hubs, which will require foreign investment.

3. Fast Moving Consumer Goods (FMCG)

The FMCG market in Myanmar has changed as a result of efforts to liberalise trade and ease restrictions on import procedures that has brought the influx of foreign brands as well as products into the country. Market demand is growing at a steady pace and competition between local and foreign brands is becoming fiercer. As purchasing power grows, there is an increasing number of consumers demanding more choices and niche products such as health drinks; or products of higher quality. Indeed, consumer behaviour is changing as more foreign brands appear on retail shelves nationwide. Today’s consumers are spoiled for choice and tend to spend based on their wants or occasions. Studies have estimated that the average spending per basket by shoppers is between USD20 to USD80. This is expected to increase or even double within the next three or four years. To stand out among the competition, suppliers must undertake aggressive promotions not only at the point of sales but collaborate and work closely with local distributors in order to capture the hearts and minds of consumers in this burgeoning market.

4. Franchising

Myanmar’s rapid growth and increasing consumer activity makes it a conducive market for international franchises. Up until recently, the country had little exposure to foreign brands but now has experienced a flood of international franchises, particularly food and beverages, mainly Asian countries such as Malaysia, Singapore, Thailand, Indonesia, South Korea and Japan have made inroads in Myanmar. MarryBrown, Old Town and Globalart are some of the Malaysian franchises that have established a solid presence in Myanmar. The country’s franchise sector started with the growth of local and international fast food franchise chains in 2013. Fast forward to 2016, more than 50 franchises are operating in major cities including Yangon, Mandalay and Nay Pyi Taw. Rising incomes; young population; expanding middle class and increasing exposure to international lifestyles are some of the factors that will drive growth for Malaysian franchises in Myanmar. Among the sectors that offer good prospects for franchising include food and beverages; quick service restaurants; coffee shops; childhood education; adult education; foreign languages; spas; beauty salons; fitness centres; consumer services; as well as car workshops.

GlobalArt has expanded its presence in Myanmar and is now located in the major cities of Yangon and Nay Pyi Taw. Photo credit: GlobalArt Myanmar

MarryBrown’s new outlet at Kyaikkasan Road, Yangon. Photo credit: MarryBrown Myanmar

The Chicken Rice Shop opens for business in Yangon. Photo credit: The Chicken Rice Shop Myanmar

5. Healthcare

Consumer spending on over-the-counter healthcare products is anticipated to grow three to four times in size, from about USD140 million in 2013 to USD480 million by 2020. In addition, the medical devices market in Myanmar is anticipated to grow threefold by 2020. It is estimated that eight out of ten of consumers in Myanmar are willing to fork out more money on better healthcare products and services. At the same time, Myanmar’s pharmaceutical sector is expected to grow 10 – 15 percent a year as the government spends more on the healthcare sector. According to the Myanmar Pharmaceutical and Medical Equipment Entrepreneurs Association (MPMEEA), the market is now estimated to be worth about USD100 million to USD120 million. The industry imports more than 90 per cent of its products, whereby suppliers from India enjoy the largest share of 35.4 percent, followed by Thailand, China, Pakistan, Bangladesh, South Korea and Indonesia. About 60 percent of all products are sold in Yangon and Mandalay. As there are only 10 domestic manufacturers, Myanmar will continue to rely on imports to meet local demand.

6. Education and human resource development

Myanmar is facing a shortage of skilled and capable labour in a range of industrial sectors that could undermine the nation’s growth prospects. The country’s demand for skilled workers is expected to reach a level equal to almost half the population by 2015. By 2015, Myanmar will require 32 million workers to meet the needs of various sectors such as agriculture, forestry, energy, mining, industry, electrical, construction, social management and trading. In 2010, the demand for skilled workers stood at 29.7 million people, and the number is expected to reach over 34.6 million by 2020. There is good prospect for foreign companies to establish vocational training institutes that provide training and education for Myanmar citizens to improve their employability.

7. Oil & Gas

The energy sector is poised to grow further given the energy shortage problem in many parts of the country. Traditionally, almost 85 per cent of Myanmar’s oil and gas resources are exported to neighbouring Thailand and China, leaving some 15 per cent for domestic use. The Myanmar government plans to renegotiate current agreements to meet energy needs in the country. According to data by BP Plc, Myanmar has 7.8 trillion cubic feet of proven natural gas resources or worth about USD75 billion waiting to be discovered. However, experts believe that the potential gas reserves could be much bigger that what is known. Furthermore, Myanmar’s oil and gas reserves have not been sufficiently explored using modern seismic technology, making it an exciting prospective exploration target. This is a good opportunity for Malaysian oil and gas companies in the upstream (exploration and production), midstream (transportation, pipeline) and in the future downstream (refinery) services providers. Among the major oil and gas companies currently operating in Myanmar include Petronas, Daewoo E&P, PTTEP and Total E&P. In Myanmar, the first onshore bidding round for 18 blocks was launched in 2011 and nine blocks were subsequently awarded to international companies. Later in 2013, Myanmar launched its second onshore bidding round for 18 blocks and the first offshore round for 30 blocks. Of these, a total of 16 onshore and 20 offshore blocks have been awarded. This is also an opportunity for Malaysian oil and gas companies to participate in potential projects by the operators and provide services to enhance their operations. In the future, there could also be potential for foreign companies to develop an oil and gas supply base within Myanmar as the government has plans to further enhance the distribution and network in the country.

8. Power generation

Myanmar plans to increase the country’s electricity reserves by 30 percent to address the problem of nationwide power shortages. Myanmar’s annual electricity consumption rate is about 4,362 MW and this is expected to increase by 13 percent every year. Though the country is blessed with abundant natural gas and hydropower potential, only about 30 percent of Myanmar’s population has access to electricity, which makes it among the lowest rates in Asia. While this rate is higher for the major cities, many in the outskirts of Myanmar have almost no access to electricity. The World Bank Group has committed USD1 billion in financial support for Myanmar’s energy development through projects to expand electricity generation, transmission and distribution in the country. The Bank is working closely with Myanmar’s government including the Ministry of Electric Power (MOEP) to develop the National Electrification Plan (NEP) with the goal of achieving universal electricity access by 2030.

9. Tourism & hospitality

The tourism sector has been earmarked as an important growth driver for Myanmar under the government’s National Export Strategy (NES). It is estimated that the direct contribution of travel and tourism to Myanmar’s GDP was 2.2 per cent of total GDP in 2014, and is forecast to rise by 8.4 percent between 2015 and 2025. In comparison, Myanmar received the least amount of visitors among ASEAN countries, but the number has increased by more than 350 percent over the period from 2012 to 2016, receiving 2.9 million tourists last year. Overall, Myanmar is expecting to host 7.5 million visitors by 2020. The McKinsey Global Institute has estimated that tourism will contribute approximately USD14.1 billion to Myanmar’s GDP by 2030. Taking this into cognizance, there is good market opportunity to supply hotel equipment such as room fittings and amenities; textiles; pool or spa items; bathroom accessories; food and beverage supplies; dining ware; as well as services such as hotel and facility management. In the future, it is expected that eco-tourism will play a bigger role as the country has much to offer in terms of its natural beauty, mountains, beaches, rivers, lakes and waterfalls.

Source: Ministry of Hotels & Tourism Myanmar. Graphics by MATRADE Yangon

Obstacles and challenges

Though the Myanmar business environment has improved tremendously, there are still several challenges that investors and market entrants must take into consideration before taking the plunge.

Firstly, obtaining market and financial information as well as relevant data can be an uphill task. The situation is exacerbated by limited public information while many official records are still being maintained using manual methods.

Foreigners are not allowed to purchase land though rental prices are prohibitively high between USD8 – 15 per square metre per year for some of the prime locations around Yangon. This is comparable to some of the high-end rentals in more developed economies around the region. In addition, basic infrastructure such as roads, bridges, ports, electricity and water are still insufficient and many factories rely heavily on their own short-term yet costly solutions such as generator sets to achieve output.

The pool of skilled workers are limited as the rush of multinational companies into Myanmar scramble to attract the best talent. Demand for well-educated and trained workers is high, especially for returning Myanmar candidates with overseas experience.

In the public sector, Ministers and their staff are overwhelmed due to increasing interest as well as expectations from foreign governments; foreign businesses; and non-governmental organisations (NGOs) vying for projects or collaborations in Myanmar.

In addition, the country’s economic policy, legal framework and legal system are continually evolving with regular updates from time to time. An example is the gap in protecting intellectual property (IP) rights, thought the government is currently reviewing laws to safeguard brand owners.

Unpolished gem with large potential

Notwithstanding the challenges, foreign multinational companies, investors and businesses continue to make their way to Myanmar and conclude deals along the way. With its strategic location; access to the largest markets in the world; and ready market of more than 50 million consumers, it is no wonder that many are still keen to prospect in the golden land of Myanmar.

Malaysian companies are at an advantage due to the proximity to Myanmar as well as connectivity via flights and shipping routes. Furthermore, Malaysian products and services are well received in terms of perception and quality and both countries share common values under ASEAN, which makes it easier to engage in JVs and business partnerships.

The clock is ticking and many foreign businesses are competing to establish a foothold in Myanmar. Malaysian companies must not miss the boat and leverage on the bilateral relationship that Malaysia and Myanmar has established over the past few decades. Most importantly, Malaysian exporters and investors must be willing to be present in Myanmar; build solid long-term relationship with their local partners; persevere; and contribute back to society.

It is only the beginning as the country continues to grow from where it is today. The rapid pace of change, development and reforms will surely provide the much-needed boost to transform Myanmar into a dynamic and prosperous economy in the region.

MATRADE activities in Myanmar

MATRADE with Malaysian companies during the Go-Ex Market Immersion Mission to Myanmar in 2016

MATRADE arranged a courtesy visit for Malaysian construction companies on HE U Win Khaing, Minister of Construction (centre) in Nay Pyi Taw, Myanmar

Sadat (centre) in discussion with HE Dr Than Myint, Minister of Commerce (right), together with Mr. Mohd Zahiruddin Nordin, Second Secretary (Trade)

Individual business matching session for Malaysian companies during the Export Acceleration Mission (EAM) for the Construction and Related Services Sector to Yangon, Myanmar in August 2016

Sadat (left) welcomes HE U Phyo Min Thein, Chief Minister of Yangon Region (centre) at MATRADE’s promotion booth

MATRADE Yangon can be contacted at:

Embassy of Malaysia

Trade Office (MATRADE)

No. 82, Pyidaungsu Yeikhta Road

11191, Dagon Township

Yangon, Myanmar

Tel : +95 – 1 – 230 1951 / 952

Fax : +95 – 1 – 230 1954

Email : yangon@matrade.gov.my

ONLINE RESOURCES

Ministry of Commerce

www.commerce.gov.mm

MYANTRADE

www.trade.gov.mm/en/myantrade

Myanmar Trade Portal

www.myanmartradeportal.gov.mm

Directorate of Investment & Company Administration (DICA)

www.dica.gov.mm

Myanmar Investment Law 2016; investment rules & DICA reports

http://www.dica.gov.mm/en/all-informations

Central Bank of Myanmar (CBM)

www.cbm.gov.mm

Union of Myanmar Federation of Chambers of Commerce & Industry (UMFCCI)

www.umfcci.com.mm

Food & Drug Administration (FDA)

www.fdamyanmar.gov.mm

Malaysian Association of Myanmar (MAM)

www.mam.com.mm

Malaysian Business Chamber (MBC)

www.mbcmyanmar.org

Maybank Myanmar

http://www.maybank.com/en/worldwide/all-countries/myanmar.page

Ministries in Myanmar

https://evisa.moip.gov.mm/government.aspx

Myanmar eVisa

https://evisa.moip.gov.mm

Editorial

The first quarter of 2017 has just passed us. We are cautiously optimistic that global market sentiment is improving, albeit uncertainties from Brexit, and the new US administration. Nevertheless, Malaysia can face these challenges from a position of strength, given its highly diversified economic structure.

MASSA organised a visit to Agensi Nuklear Malaysia on 2 March 2017. The Director-General, Dr. Mohd Ashhar bin Hj Khalid and his Management team met our delegation on arrival. Dr Ashhar gave a very detailed presentation on the roles, objectives and contribution of the Agency to the economic development of Malaysia. It was an eye-opening visit for our members as we learnt of the positive attributes of nuclear energy and radiation therapies applied to industry, agriculture, medical and power generation. Agensi Nuklear Malaysia has given us an informative article and we urge members to read and share.

MATRADE’s Trade Commissioner in Yangon has given us an excellent article on the recent developments in Myanmar and the prospects for the various business sectors. In October 2016, Parliament approved the new Myanmar Investment Law (MIL) and will take effect from April 2017. Also a new piece of legislation, The Myanmar Companies Law, was submitted to Parliament in January 2017 and is expected to be given final approval by mid-2017. Once this is in place, foreign investors can expect much transparency which will bode well for business and investments.

The 5th Showcase Malaysia 2017 will be held in Dhaka, Bangladesh from 21 – 23 September 2017. This event has grown bigger and better since its inaugural event in 2008. We urge members to consider participating in this event as it is an excellent platform to showcase your products and services on a Business to Business (B2B) and Business to Consumer (B2C) platform. This country has a population of 184 million people with growing disposable incomes. The Expertise Resource Association (ERA) will be organising a business mission to Dhaka from 24 – 28 April 2017 led by Tan Sri Dato’ Soong Siew Hoong (ERA’s Honorary Advisor), who is also MASSA’s executive committee member. MASSA is a supporting organisation of ERA and will collaborate and encourage MASSA members to join this mission to Dhaka, as a prelude to participating in the 5th Showcase Malaysia event in September 2017.

We thank members who have responded to our invitation to be listed in our “Business Listing” section on MASSA’s website. To those who have placed their banner advertisements on MASSA’s website, a big thank you too. We also want to record our thanks to Agensi Nuklear Malaysia and Trade Commissioner in Yangon of contributing their informative articles.

We look forward to work closely with all our members to strengthen and further enhance the South-South linkages.

Ng Su Fun

MASSA Secretariat

President’s Message

Bank Negara Annual Report 2016 reported that the world economy in 2016 recorded its lowest growth rate since the Global Financial Crisis. Major political and social dynamics shifts have created challenging situations resulting in uncertainty and volatility for the global economy and financial markets.

Inspite of this, the Malaysian economy registered a commendable growth of 4.2% in 2016 (5.0% in 2015). This growth was anchored by domestic demand and private sector spending. The strong fundamentals of the Malaysian economy characterized by its diversified sources of growth, have accorded Malaysia the ability to weather the external challenges and helped to contain the spillover effects of sector – specific shocks.

Going forward, global economic activity is expected to improve in 2017. This is underpinned by an expansion in domestic demand in the advanced and emerging market economies which will have positive spillover effects for Malaysia. The Malaysian economy will continue to be supported by stable labour market conditions amid continued healthy wage growth which in turn, will support household spending. Bank Negara is confident Malaysia can register a sustained growth of 4.3% – 4.8% in 2017 barring external shocks.

Given the improving sentiments, we in the business private sector, must be agile and nimble to tap new opportunities in the fast changing environment of today. The velocity of change brought on by advances in technological innovation and Internet of Things (IoT) would require us to be constantly appraised of new developments and emerging trends. Towards this end, MASSA will endeavour to look for new growth markets, identify potential growth sectors and trends for members to pursue.

MASSA will hold its 26th Annual General Meeting on 21 June 2017. The term of office of current executive committee members will expire and there will be election of members. I do encourage all members to attend and to come forward to serve on the committee.

I appreciate the continuing support and cooperation of all our members and your participation in the activities organised.

Tan Sri Azman Hashim

President

Salcon Berhad

| Salcon Berhad (593796-T) |

| About Us: | Salcon Berhad is a Malaysia-based company, which is engaged in investment holding activities.Salcon is a total water and wastewater solutions provider, offering strong technical and management capability, as well as advanced technology and expertise in the water and wastewater industries. Besides providing management, operation and maintenance services in Malaysia, Salcon also owns a water concession in Vietnam with a total capacity of 100 million litres per day (MLD). To date, the Group has completed more than 900 water and wastewater projects in Malaysia, Thailand, Sri Lanka, Vietnam and China.The Group other businesses include transport services, property development, solar power, petroleum services and China’s e-commerce and tourism businesses. |

| What We Buy: | – |

| What We Sell: | – |

| Contact: | Chern Meng Gaik |

| Job Title: | General Manager-Corporate |

| Location: | 15th Floor, Menara Summit Persiaran Kewajipan, USJ 1, 47600 Subang Jaya Selangor Darul Ehsan Malaysia |

| Tel/Fax No: | Tel: +603-8024 8822 Fax: +603-8024 8811 |

| Industry: | Construction/Engineering Services |

| Email: | corporate@salcon.com.my |

| Website: | www.salcon.com.my |

Norwest Holdings Sdn Bhd

| Norwest Holdings Sdn Bhd (131102-V) |

| About Us: | NORWEST group is founded on the philosophy of “Exceeding Expectation Through Quality”. We seek to delight by exceeding expectations in the pursuance of Excellence in all our ventures. Norwest is actively participating in the Country’s growth and progress especially in activities such as Engineering, Construction Management, Property Development, Manufacturing and Energy Management. The company have successfully undertaken projects ranging from School Complexes, Government Buildings, Expressway and Roads, Bridges, Port Facilities, Sewerage and Waste Disposal Systems, Water Distribution Systems as well as turnkey projects. Notwithstanding these, Norwest has also extended its involvement in Energy Management, Mechanical and Electrical Engineering, Operation of Quarries, Readymix Concrete Supplies, Manufacturing of Bitumen Based Products, Coating materials for Corrosion Membranes, Emulsions, Scanclimbers and other specific products. |

| What We Buy: | – |

| What We Sell: | Our Most Valuable Asset – We believe that the employee constitute as the heart and soul of the Company. Qualification-Registered with PKK, CIDB and Kementerian Kewangan. Financial Strength-Attention in building up strong financial to ensure continuous establish and success. Plant and Equipment-We have acquired sufficient number of machineries to carry out work efficiently. Quality Management System-ISO 9001:2000 Safety, Health and Environment Management System-Safety applies in the workplace. |

| Contact: | Ms Anna Maria Aziz-Bahaman |

| Job Title: | Admin Manager |

| Location: | No.1A, Jalan Astaka M U8/M Bukit Jelutong 40150 Shah Alam Selangor Darul Ehsan Malaysia |

| Tel/Fax No: | Tel: +603-7846 7622 Fax: +603-7846 7673 |

| Industry: | Construction |

| Email: | info@norwest.com.my |

| Website: | – |