Country Feature – Republic of Zambia

REPUBLIC OF ZAMBIA

Located in the heart of Southern Africa, Zambia is one of the fastest growing economies with a population of 19.6 million people. The country, which sits on 752,618 square kilometres (over double the size of Malaysia), is blessed with abundant natural resources and vegetation, a diversity of wildlife, magnificent landscapes, and is home to the mighty Victoria Falls, one of the seven natural wonders of the world.

Image 1: Zambia’s location in the heart of Southern Africa

The country has very stable Macroeconomic Fundamentals with a growing GDP of about US$21 billion, inflation of 9.9% per annum and the local currency is performing very well against the United States Dollar and other major world-convertible currencies, appreciating by over 18.5% from January 1 to September 2022.

Zambia has proven to be a strategic hub for trade and investment due to its central location with eight neighbouring countries. Zambia is a member of the regional and continental economic communities that the Common Market for Eastern and Southern Africa (COMESA), Southern African Development Community (SADC) and African Continental Free Trade Area (AfCFTA).

Further, Zambia is well known as a haven of investments due to its unmatched investment climate, attractive investment incentives, ease of doing business, and investor-friendly policies supported by consistent policies and stable political will, rule of law, and peace that the country has enjoyed since her independence in 1964.

Economic Fundamentals

Official Language: English

Main Languages: Bemba, Tonga, Chichewa, Lozi, Kaonde, Luvale, Lunda

Population (2022): 19.6 million

GDP Per Capita: USD 1,137.6 (World Bank 2021)

GDP 2021: USD 22.15B (World Bank 2021)

Government: Presidential Republic; Multi-Party Democracy

Unemployment: 13% (World Bank 2022)

Literacy: 86.8% (2018)

Inflation: 9.9%

Zambia’s Business Environment

Zambia ranked 1st in Africa & 4th globally for Ease of Getting Credit in the 2020 project which provides objective measures of business regulations and their enforcement across 190 economies and selected cities at the subnational and regional level. The country boasts highly attractive Government securities and has a high rate of return on investment in Government bonds & bills. This is mainly due to conducive Governance, a skilled labour force and a good logistical network which helps facilitate international trade through implementation of web-based customs data management platform, ASYCUDA World, for easier exporting and importing. The wide network coverage includes 91% Public Switched Telephone Network (PSTN).

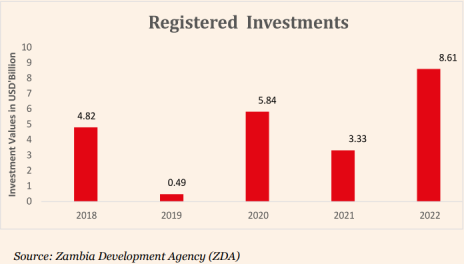

Fig. 1: Recorded Investment 2018 to 2022 (US Dollar Billions)

Fig. 2: Recorded Investment by Sector 2018 to 2022 (US Dollar Millions)

Economic growth has been stable in Zambia which has elevated it to the 6th largest economy in SADC and to becoming an attractive investment destination. The figures below indicate Zambia’s investment and trade performance between 2018 and 2022.

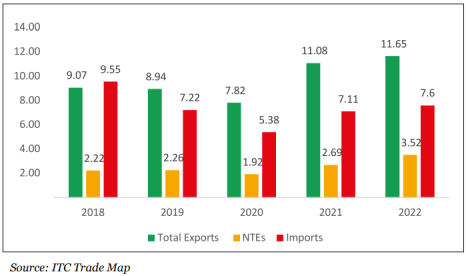

Fig. 3: Zambia’s Trade 2018 to 2022

The main trade contributors in Zambia are highlighted in the table below.

Table 1: Major Exports and Imports with their Markets

Investment Sectors

Currently, the priority sectors for investment are manufacturing, mining and mineral beneficiation, agriculture, energy, information communication technology, infrastructure and tourism.

Foreign and local investors in priority sectors are eligible to qualify for certain predetermined incentives and this is administered through the Zambia Development Agency (ZDA). In addition, investors that setup in a Multi Facility Economic Zone (MFEZ) or industrial park are eligible for additional tax incentives. Incentives come in the form of fiscal and non-fiscal incentives.

The Zambia Development Agency (ZDA) is Zambia’s premier economic development Agency with a multifaceted mandate of promoting and facilitating trade, investment and enterprise development in the country. The Agency is also responsible for building and enhancing the country’s investment profile for increased capital inflows, capital formation, employment creation and growth of the Micro Small and Medium Enterprise (MSME) Sector.

Among the key services provided include:

- • Issuance of investment and MFEZ/IP Permits

- • Participation and facilitation in regional and international trade and investment fairs, exhibitions and missions;

- • Participation and facilitation of business summits, conferences, workshops and business to business meetings;

- • Facilitation of joint-venture partnerships and business match-making events between buyers and sellers

- • Provision of export market information

- • Developing Export Readiness of the Zambian enterprises, especially MSMEs to meet international customers’ requirements and needs, and compliance standards as well as norms

- • Building the general business capacities of the entrepreneurs (the exporter and potential exporters)

- • Product development to enable Zambian products meet international buyers’ requirements in terms of quality,

- • Product Development

- • Market and financial Linkages/Access

- • Provision of Business Information and Market Intelligence e.g. identification of market opportunities and market access requirements;

- • Provision of after care Services, Business Clinics and advisory services

The following Multi Facility Economic Zone (MFEZ) and Industrial Parks are currently operational in Zambia:

- • Lusaka South Multi-Facility Economic Zone;

- • ZCCZ Chambishi Multi Facility Economic Zone;

- • ZCCZ Lusaka East Multi-Facility Economic;

- • Jiangxi Multi Facility Economic Zone;

- • Kalumbila Multi Facility Economic Zone;

- • Roma Industrial Park; and

- • Sub-Sahara Gemstone Exchange Industrial Park

These zones are provided with modern infrastructure in order to attract and facilitate the establishment of world-class enterprises in the country. The MFEZs blend the best features of the free trade zones, export processing zones, and the industrial parks/zones concept. They apply the administrative infrastructure, rules and regulations that are used as a benchmark among dynamic economies. The blending of physical infrastructure with an efficient and effective administrative infrastructure has created the ideal investment environment for attracting major world-class investors.

MINING

Zambia is the world’s eighth largest producer of copper. It produced over 880,000 metric tonnes in 2020 and holds 6% of the world’s known copper reserves. Kansanshi open pit mine is the largest copper mine in Africa, by capacity, Copper and cobalt, the country’s traditional exports, account for well over 70% of export earnings. Zambia’s copper mines are concentrated on the Copperbelt Province. More mines have been established in other parts of the country such as Solwezi and Kalumbila in the North-Western Province, which has seen accelerated growth in recent years and the Government of Zambia has taken note of the tremendous growth potential of this sector and set a target of increasing copper production from the current 800,000 metric tonnes per year, to 3 million metric tonnes per year over the next ten years. Policy revision that has removed double taxation and revised the tax framework, leveraging digital technology in the sector, and addition along the value chain will see more investment in the sector and make the target more achievable. The signing of an MOU between Zambia and the Democratic Republic of Congo leveraging regional resources towards a value chain for electronic vehicle battery manufacturing, as well as the $350 million investment by KoBold Metals to introduce Artificial Intelligence into

Other mineral endowments include gold, zinc, lead, iron ore, manganese, nickel, feldspar, sands, talc, barite, apatite, limestone, dolomite, uranium, coal, and gemstones (e.g. diamonds, emeralds, aquamarine, topaz, opal, agate and amethysts). Notably, Zambia produces over 20% of the world’s emeralds and has the capacity to increase its production. This extensive range of mineral resources, including a variety of industrial minerals and energy resources such as uranium, coal and hydrocarbons, presents investors with excellent opportunities, especially in the area of extraction and processing.

Zambia’s endowment of mineral resources is substantial, although the full potential of known deposits is yet to be realized. A 2013 World Bank geological analysis suggested that Zambia’s copper deposits were larger than previously estimated, signalling massive exploration potential. This potential is starting to be realized through recent exploration for oil and gas. Thirty Eight (38) exploration blocks have been demarcated in Zambia with twelve (12) of these blocks having been issued with licenses.

Since the privatization of the mines ended in 2000, approximately $17.50 billion has been invested in the sector by about 278 enterprises with large-scale copper mining accounting for more than 90% of these investments. In 2019, mining accounted for 9.9% of GDP, 26.7% of Government revenue, 2.4% of direct employment and 77% of exports.

Even with so much investment in the sector, existing mines have only scratched the surface of the mineral wealth yet to be mined with an estimated 61% of the country having been mapped and exploration in nickel, uranium, coal, geothermal, oil and gas still ongoing. Government policy is tailored to the promotion of value addition to minerals such as copper through the introduction of incentives such as a preferential corporate tax rate of 15% for companies that add value to copper cathodes, compared to the standard 35% for other non-incentivized firms.

AGRICULTURE

Image 3: Palm Oil Plantation in Zambia’s Muchinga Province

Agriculture plays an important role in Zambia’s economy, contributing about 13% to the country’s GDP. Zambia is endowed with a vast arable land resource base of 42 million hectares of arable land, of which only 1.5 million hectares is cultivated every year. It has abundant water resources for irrigation, which account for 40% of the water resources in the SADC region. Given this vast resource endowment, Zambia has huge potential to expand its agricultural production. Its climate is that of a tropical savannah, experiencing rainy seasons between the months of November and April. The dry season is characterized by low humidity between the months of May and November. The average temperature in the summer is 36°C and gets as low as 5°C in the winter, which suitable for both traditional and winter crops.

Despite the availability of vast arable land, transport infrastructure, large water resources and affordable labour – the agricultural sector employs more than half of the total labour force – only 10% of arable land is under cultivation. In that regard, the Government has established farming blocks to facilitate investment in agriculture. 100,000 hectares of land has been set aside in each province to make a total of 1 million hectares countrywide for the establishment of the farming blocks.

Zambia’s traditional crops include maize, cassava, wheat, sorghum, rice, sunflowers, groundnuts, soya beans, mixed beans, Irish potatoes, sweet potatoes, and tobacco. A lucrative cashew nut sub sector in has also been built in the western part of the country.

The Government is currently driving the enhancement of value addition by promoting agro-processing through programmes such as the Zambia Agri-business and Trade Project (ZATP). Agro-processing opportunities in Zambia are in peanut butter production, cashew nut processing, animal or stock feed production, cassava processing, grain milling, edible oil production, fruit canning, juice extraction, meat, dairy and leather production, fish canning, textiles, bio-diesel production, and honey processing.

MANUFACTURING

Zambia has a well-developed market economy. Its strong economic performance over the years is testimony to the nation’s open, outward-oriented development strategy. Like most global economies, Zambia’s was not spared from the negative effects of the COVID -19 global pandemic and other external shocks such as volatile commodity prices emanating from disruptions in global supply chains. However, GDP rebounded to positive figures yielding 4.7% growth in 2022.

Currently, the main manufacturing activities in Zambia are in the following industries:

1) Food and beverages;

2) Textile and leather industries;

3) Wood and wood products;

4) Paper and paper products

5) Chemicals, rubber and plastic products

6) Non-metallic mineral products;

7) Basic metal products; and

8) Fabricated metal products.

The top destinations for Zambian exports are China ($2.14bn), India ($719m), South Africa ($486m), United Arab Emirates ($392m), and Belgium-Luxemburg ($297m). Other significant markets outside Africa include Netherlands and Switzerland as well as Europe and North America through the EBA Initiative and AGOA respectively.

Zambia has traditionally been an importer of finished manufactured commodities and an exporter of primary commodities. This points to a deficit of manufactured products within the Country, thereby highlighting opportunities for investment in sub-sectors such as:

- • Agro-processing;

- • Pharmaceutical products;

- • Assembly of machinery and equipment;

- • Cement;

- • Packaging materials;

- • Fertilizers;

- • Textiles; and

- • Tobacco products, to mention a few.

TOURISM

The tourism industry has grown steadily over the years, with the establishment of hotels in the major tourist centres such as Livingstone and Lusaka. There is vast unexploited potential in the sector in Zambia due to its natural beauty, including its wealth of wildlife and the Victoria Falls, which is one of the most renowned Seven Natural Wonders of the World. The country boasts over twenty awe inspiring waterfalls that make Zambia a hub of waterfalls and a must for adventure enthusiasts; waterfalls which include Kalambo, Ngonye, Chishimba, Chipempe, Ntumbachushi, Kabwelume, Mumbuluma, Lumangwe, Chipoma, Kundalila, and Ngonye, amongst others.

Zambia has 20 national parks and 34 game management areas, with a total of 23 million hectares of land set aside for wildlife conservation. Also, the country has numerous museums that house priceless historical artifacts such as the Lusaka National Museum, Moto-Moto Museum, and Livingstone Museum. Another attraction is the traditional ceremonies that take place at different times of the year where the country’s rich cultural heritage is displayed. Lastly, the beautiful scenery and abundant wildlife have led to the growth of a tourism sub-sector in the film industry. Concessions are provided to movie production companies for shooting films or documentaries.

Image 4: Thrilling activities in Livingstone

Image 4: Thrilling activities in Livingstone

In order to support the tourism sector, Government has continued to build supporting infrastructure such as roads, railways, and bridges, and to facilitate the expansion of the service industry. Since this is a priority sector, investment attracts both fiscal and non-fiscal incentives. Therefore, the bulk of investment opportunities in the sector are in services offered to tourists such as accommodation, restaurants, entertainment facilities, sports facilities, and safaris/game watching, to mention a few.

Zambia is also positioned as a hub for Meetings, Incentives, Conferences and Exhibitions (MICE) and has in the recent past been an attractive destination hosting global dignitaries and celebrities as well as regional and global events and festivals.

ENERGY

Of the installed 2,898MW electricity generation capacity of Zambia, hydro power is the most important energy source with 2,398MW (83%), followed by diesel and coal. Zambia has about 6,000MW of unexploited hydro power potential due to its abundant water resources, providing an opportunity for investment in hydro power generation. The demand for electricity has been growing at an average rate of 4% per annum, mainly due to economic activity overall but particularly in the agriculture, manufacturing, and mining sectors. The country’s growing population has also led to an increase in the demand for other sources of energy such as petroleum and solar energy for transportation and domestic use, especially in rural areas. The state-owned Zambia Electricity Supply Cooperation (ZESCO) Ltd is the only entity that generates and transmits power, while companies such as the Copperbelt Energy Corporation (CEC) procuring power from ZESCO to sell to the mines.

In addition to water resources, Zambia has abundant renewable and non-renewable resources including:

1) Industrial minerals such as coal;

2) Agricultural land to support bio-fuels;

3) Ample forests for bio-mass;

4) Abundant wind;

5) Sunlight for solar power;

6) Abundant hot springs for geothermal energy; and

7) Uranium for nuclear power

There are currently massive exploration missions being undertaken in Northern and Luapula Provinces to ascertain Zambia’s potential for oil and gas drilling. Investment in this sector attracts fiscal and non-fiscal incentives espoused in the ZDA Act.

Image 5: The 54MWB Bangweulu solar power plant located in Lusaka South Multi-Facility Economic Zone

Image 5: The 54MWB Bangweulu solar power plant located in Lusaka South Multi-Facility Economic Zone

Some of Zambia’s profiled investment projects can be found here:

https://investment.unido.org/ACP/projects?Country=82

Prepared by:

High Commission of the Republic of Zambia in Kuala Lumpur

info@zhckl.com.my