Country Feature on Arab Republic of Egypt

Egypt Flag

Map of Africa

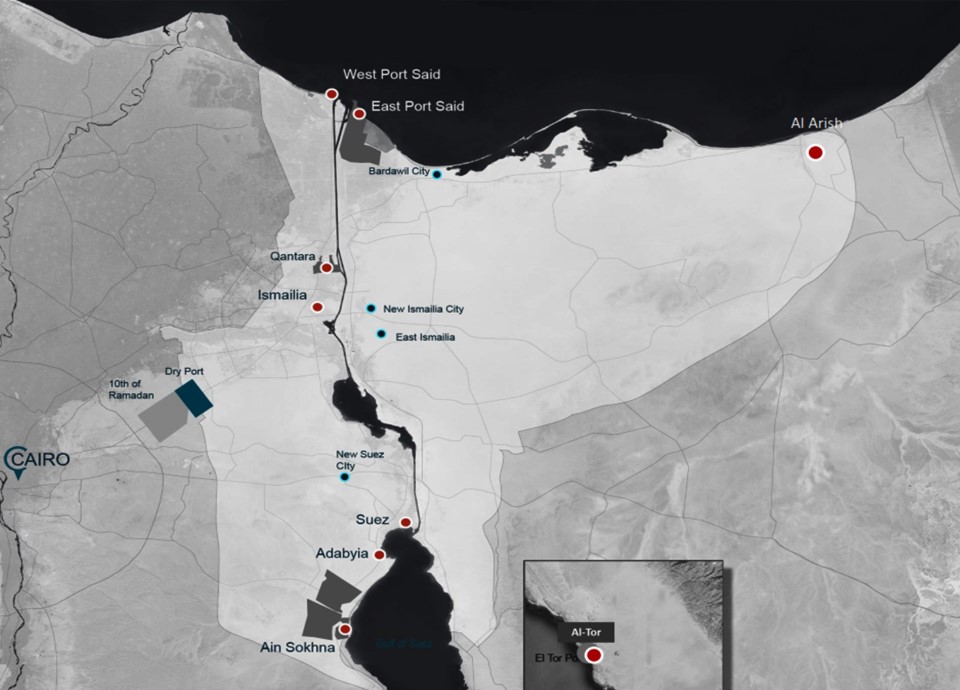

Map of Egypt Source: Egyptian State Information Service (SIS)

ARAB REPUBLIC OF EGYPT

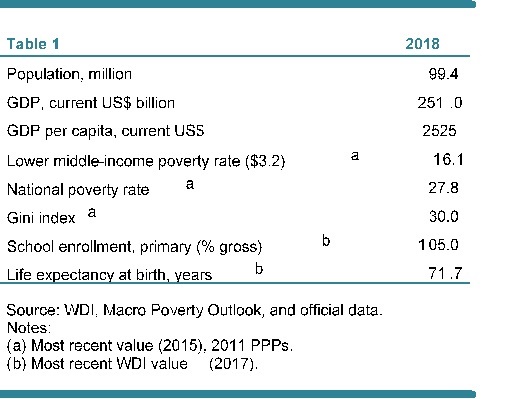

Egypt is sustaining its robust growth, fiscal outturns are improving, and external accounts are stabilizing at broadly favorable levels. Inflation receded significantly, paving the way for monetary easing. Social conditions remain difficult, as the economy recovers from the preceding period of high inflation. Resolving long-standing challenges will be key to achieve structural transformation towards a vibrant economy where the business environment is conducive for competition, and the private sector is capable of generating more and better jobs.

Recent developments

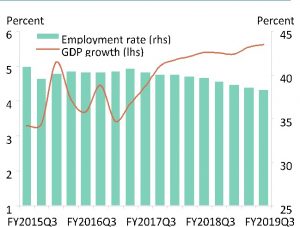

Real GDP growth reached 5.6 percent in FY19, up from 5.3 percent in FY18. Data for the first nine months of FY19 show that this pickup is driven by net exports, as goods and services exports inched up in tandem with a contraction of oil imports (supported by the increase in natural gas production). Private investment is also picking up. On the sectoral side, gas extractives, tourism, wholesale and retail trade, real estate and construction have been the main drivers of growth. Unemployment decreased to 7.5 percent in Q4-FY19 (from 9.9 percent a year earlier), although accompanied by shrinking labor force participation. The share of employed individuals remained modest, at 39 percent of the working age population, indicating relatively weak private sector job-creation. Indeed, the credit extended to private businesses averaged only 22 percent of total domestic credit during FY19 (slightly lower than the previous year). Similarly, the Purchasing Managers’ Index (PMI), an indicator for non-oil private sector activity, has been relatively feeble, averaging 49.3 throughout FY19. The Central Bank of Egypt cut policy rates by 150 basis-points in August 2019, a move that should improve private sector cash flow via its impact on lending rates.

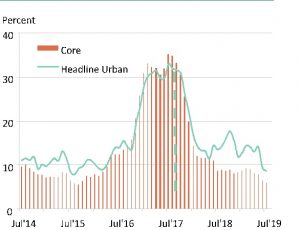

Policy rates have decreased to 14.25 percent and 15.25 percent for the overnight deposit and lending transactions, respectively, albeit still 250 basispoints higher than their levels prior to the 2016 depreciation. The monetary easing was triggered by the remarkable decline in headline inflation in July 2019 to 8.7 percent, due to favorable base effects, as well as moderating food inflation; altogether diluting the inflationary impact of the July energy price hikes.

The budget and primary balances have improved to an estimated -8.3 percent and 1.9 percent of GDP, respectively in FY19, from -9.7 percent and 0.1 percent of GDP a year earlier. This comes on the back of the containment of energy subsidies and civil servants’ wages, in addition to increased revenues collection (notably from the VAT and income tax). In tandem, government debt is estimated to have decreased to 90.5 percent of GDP in end-June 2019, from 97.3 percent of GDP in end June 2018, with the decline mostly stemming from the domestic portion. Egypt’s external position has stabilized at broadly favorable levels, as foreign reserves reached US$44.97 billion in end August 2019 (covering around eight months of merchandise imports). However, non-oil exports remain sluggish. FDI also remained modest and predominantly directed to hydrocarbons. Portfolio inflows were supported by the sovereign Eurobond issuances worth US$4 billion and EUR2 billion during H2-FY19, as well as continued foreigners’ purchases of government securities.

The Egyptian pound strengthened against the US$, reaching EGP/US$16.4 by mid-September 2019; cumulatively appreciating by around 16 percent since the Pound’s weakest point around mid-December 2016. Another component of exchange rate liberalization was achieved in September 2019 with the abolition of the “customs dollar” – a fixed exchange rate applicable to trade transactions. While the macroeconomic environment has improved, social conditions remain difficult. Between 2016 and 2018, nominal wage growth fell below inflation. Official reports indicate that 32.5 percent of the population lived below the national poverty line in FY18, with the highest poverty rates in rural Upper Egypt. If the World Bank’s internationally comparable poverty line of US$3.20 per person per day (2011 PPP) for lower middle income countries is used as the threshold, then simulations using per capita private consumption growth rates suggest that 15.8 percent of the population was poor in 2019.

FIGURE 1 – Arab Republic of Egypt / GDP growth and employment rate, FY2015Q3-FY2019Q3 Sources: Ministry of Planning and CAPMAS

FIGURE 2 – Arab Republic of Egypt – Headline and core CPI inflation, July 2014 – August 2019 Source: Central Bank of Egypt

Outlook

Assuming a continuation of macroeconomic reforms and a gradual improvement in the business environment, economic growth is expected to reach 6 percent by FY21, supported by a recovery in private consumption, investments and exports (notably in tourism and gas). If overall growth is reflected in a per capita private consumption growth (of at least 0.7 percent) that is distributed across all the income groups, then poverty rates – at the international poverty line of US$3.20 – could be reduced from 15.80 percent to 15.67 percent, during the forecast horizon. The overall fiscal deficit is also expected to continue declining gradually over the medium term. The newly adopted fuel indexation mechanism should (partially) shield the budget from exchange rate movementes or shocks in global oil prices. The external accounts are expected to remain stable over the forecase trajectory. The current account deficit is expected to hover aroung 2.6 percent of GDP (compared to 2.4 perent in FY18), due to the balancing effects of an expected improvements in the services trade surplus, against a decline in private transfers (if remittances – especially from the Gulf – continue to inch downwards).

TABLE 2: Arab Republic of Egypt / Macro Poverty Outlook Indicators

(Annual Percent Change Unless Indicated Otherwise)

| 2016 | 2017 | 2018 | 2019 e | 2020 f | 2021 f | |

| Real GDP growth, at constant market prices | 4.3 | 4.2 | 5.3 | 5.6 | 5.8 | 6.0 |

| Private Consumption | 4.7 | 4.2 | 1.1 | 0.7 | 2.0 | 2.5 |

| Government Consumption | 3.9 | 2.5 | 1.7 | 2.4 | 5.0 | 2.5 |

| Gross Fixed Capital Investment | 11.9 | 11.9 | 16.4 | 13.7 | 14.8 | 16.0 |

| Exports, Goods and Services | -15.0 | 86.0 | 32.2 | 1.2 | 6.5 | 8.5 |

| Imports, Goods and Services | -2.2 | 52.5 | 11.3 | -7.5 | 0.5 | 3.5 |

| Real GDP growth, at constant factor prices | 2.3 | 3.6 | 5.2 | 5.6 | 5.8 | 6.0 |

| Agriculture | 3.1 | 3.2 | 3.1 | 3.0 | 3.0 | 3.0 |

| Industry | 0.8 | 2.1 | 6.4 | 7.5 | 6.4 | 6.8 |

| Services | 3.2 | 4.6 | 5.0 | 5.0 | 6.0 | 6.0 |

| Inflation (Consumer Price Index) | 10.2 | 23.3 | 21.6 | 13.9 | 11.0 | 10.0 |

| Current Account Balance (% of GDP) | -6.0 | -6.1 | -2.4 | -2.6 | -2.6 | -2.6 |

| Net Foreign Direct Investment (% of GDP) | 2.0 | 3.3 | 3.0 | 2.1 | 2.3 | 2.7 |

| Fiscal Balance (% of GDP) | -12.5 | -10.9 | -9.7 | -8.3 | -7.5 | -7.0 |

| International poverty rate ($1.9 in 2011 PPP)a,b | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 | 1.4 |

| Lower middle-income poverty rate ($3.2 in 2011 PPP)a,b | 15.9 | 15.7 | 15.8 | 15.8 | 15.7 | 15.7 |

| Upper middle-income poverty rate ($5.5 in 2011 PPP)a,b | 61.0 | 60.2 | 60.4 | 60.5 | 60.2 | 60.0 |

| Source: World Bank, Poverty & Equity and Macroeconomics, Trade & Investment Global Practices.

Notes: e = estimate, f = forecast. (a) Calculations based on 2012-HIECS and 2015-HIECS. Actual data: 2015. Nowcast: 2016-2018. Forecast are from 2019 to (b) Projection using point-to-point elasticity (2012-2015) with pass-through = 0.5 based on private consumption per capita in constant LCU. |

||||||

1. Business registration and visa for directors and work visa for staff

(Fees and period)

-Foreigners interested in employment in Egypt have to obtain work permits and follow the regulations issued by the Ministry of Manpower and Migration in this regard. After a work permit is obtained, the foreign national’s visa (whether tourist or temporary) is converted into a work visa, with the same duration as the work permit.

-Work permits are usually granted to foreigners for a period of one or less than one year. It may also be issued for a period exceeding one year after settling the relative fee for the requested period.

2. The Commercial Register Law

-The process of registration whether for agents or companies, is governed by the Commercial Register Law No. 34 of 1976 and its amendments (98/1996 the basic rule is that anyone carrying on a commercial activity must register in the Commercial Register at the local Register of Commerce. A counter is available at the GAFI.

-The Commercial Register Law provides that all registrations must be renewed every 5 years.

3. Banks interest rate and loan rates

Interest Rate in Egypt averaged 11.92 percent from 1991 until 2019, reaching an all-time high of 21.40 percent in October of 1991 and a record low of 8.25 percent in September of 2009, the current interest rate announced by The Central Bank of Egypt is 14.25 percent.

The biggest Banks in Egypt are:

1. AlAhly National Bank of Egypt (NBE),

2. Bank Misr,

3. CIB Egypt’s largest private-sector bank the Commercial International

Bank,

4. The Arab African International Bank

4. Tax holiday area and other benefits

Corporate income tax (CIT) rate in Egypt is 22.5% on the net taxable profits of a company. The above rate applies to all types of business activities except for oil exploration companies, which profits are taxed at 40.55%. In addition, the profits of the Suez Canal Authority, the Egyptian Petroleum Authority, and the Central Bank of Egypt are taxable at a rate of 40%.

5. VAT % for local market

The standard VAT rate is 14% as of financial year 2017/18 unless otherwise stated.

6. Industrial zone to get maximum benefit to buy local raw materials

and process to Export

There are so many industrial zones in different Governorates of Egypt, for more data on industrial zones in the province, please visit the following website: https://www.gafi.gov.eg/English/StartaBusiness/InvestmentZones/Pages/

Industrial-Zones.aspx

Iron and Steel Factory in Egypt

7. Government Guarantees and safeguards to Foreign Investors

(according to Law No. 72 of 2017 Promulgating the Investment Law)

The new law guarantees a number of protections for international investors to encourage new development in Egypt:

-Foreign investors will receive the same treatment under law as Egyptian nationals. (National treatment)

-Foreign investors may now be granted preferential treatment, with approval from the Council of Ministers, in application of the principle of reciprocity. Investments will not be governed by arbitrary procedures or discriminatory decisions.

-Investment projects will not be nationalized.

-No administrative authority can revoke or suspend investment project licenses without proper warning, due process, and time to correct any issues.

-Foreign investors are guaranteed residence in Egypt during the term of a project.

-Investors have the right to transfer their profits abroad.

-Investors’ projects may include up to 10% foreign employees, and up to 20% for investment companies.

– Foreign employees of investment companies have the right to transfer their compensation abroad.

8. The new investment law incentives. (according to

Law No. 72 of 2017 Promulgating the Investment Law)

▪ General Incentives: Companies will receive a 2% overall customs tax exemption on the value of imported equipment and machinery. They will also be exempted from stamp tax and registration fees on articles of association, mortgages, loan agreements and land contract notarizations related to their investment.

▪ Special Incentives: The above mentioned law provides deductions from taxable net profits according to the investment map that has identified investment areas as Sectors A and B. Investors will receive a 50% discount off investment costs in Sector A and a 30% discount off investment costs in Sector B for specified priority activities. (For more details visit the following website: www.investinegypt.gov.eg)

A. Category/Sector “A” includes:

Projects located in the areas that are much in need for development (upper Egypt, Red Sea, golden triangle, Sinai, New valley, & SE ZONE).

• The Suez Canal Economic Zone.

–The Golden Triangle Economic Zone

–Other lagging, underdeveloped, regions that are in need of development, are determined by a Ministerial Cabinet’s decision

Zone “A” – Tax Deduction of 50%

The 50% shall be calculated of the Investment cost of the project. The 50% will be deducted from the taxable net profit Over 7 years.

B. Category/Sector “B” includes: Projects located in the rest of the country.

Zone “B” – Tax Deduction of 30%

• 30% of the investment cost of the project shall be granted for the

following activities: Labor-intensive projects.

• SMEs

• Renewable energy projects.

• Tourism projects as specified by the SIC.

• Vehicle and related feeders industry projects.

• Wood, furniture, printing, packaging and chemical industries.

• Antibiotic, cancer treatment and cosmetics.

• Food and agricultural products as well as agricultural waste projects.

▪ Additional Incentives: Egypt’s Council of Ministers may decree additional incentives, which will be awarded by the head of the General Authority for Investment and Free Zones (GAFI). These may include subsidized utilities, the allocation of lands free of charge for strategic activities, and other incentives.

MCV Bus Factory in Egypt

9. Controls Related to Foreign Labor

▪ The investment project has the right to employ foreign workers within 10 percent of the total number of employees in the project. This percentage may be increased to no more than 20 percent of the total number of employees in the project, in case it is not possible to employ national workers with required qualifications subject to the Executive Regulation of this Law.

▪ Foreign workers are entitled to remit their financial dues, in whole or in part, abroad.

10. Egypt’s foreign direct Investment target rate and sectors

Egypt plans to attract $11 billion in foreign direct investment in the current 2018-19 fiscal year, in the following sectors: Chemical Industry, Communication and information technology, education sector, Mining sector, pharmaceutical and medical, Automotive sector, construction.

11. Land Ownership Regulations

The ownership of land by foreigners is governed by three laws: Law No. 15 of 1963, Law No. 143 of 1981 and Law No. 230 of 1996.

Law No. 15 of 1963

Law No. 15 and its amendments (Law 104 of 1985) provides that no foreigners, whether natural or legal persons, may acquire agricultural land.

Law No. 143 of 1981

Law No. 143 and its amendments (55/1988, 205/1991, & 96/1995) governs the acquisition and ownership of desert land. Certain limits are placed on the number of feddans (one feddan is equal to approximately one hectare) that may be owned by individuals, families, co-operatives, partnerships and corporations. Partnerships are permitted to own 10,000 feddans, provided that the individual shall not own more than 150 feddans. Joint stock companies are permitted to own 50,000 feddans.

Partnerships and joint stock companies may own desert land within these limits even if foreign partners or shareholders are involved, provided that at least 51 percent of the capital is owned by Egyptians. However, upon liquidation of the company, the land must revert to Egyptians. Article 1 of Law No. 143 defines desert land as the land two kilometers outside the border of the city. Further, the lease of such land for more than a period of 50 years shall also be considered to be ownership under Law 143. Although companies formed under the Investment Law No. 8/1997 do not require Egyptian participation, companies that undertake projects over desert land must be owned in their majority by Egyptians. According to the law 55 of 1988, the President of the Republic may decide to treat Arab nationals as Egyptian nationals for purposes of this law.

Law No. 230 of 1996

On July 14, Law No. 230 of 1996 was issued superseding Law No. 56 of 1988. The new law allows non-Egyptians to own real estate whether built or vacant with the following conditions:

• That ownership be limited to only two real estate properties throughout Egypt for accommodation purposes of the person and his family (family meaning spouses and minors), in addition to the right to own real estate needed for activities licensed by the Egyptian Government.

• That the area of each real estate not be in excess of four thousand square meters.

• That the real estate is not a historical site.

Exemption from first and second conditions is subject to the approval of the Prime Minister. Ownership in tourist areas and new communities is subject to conditions established by the Cabinet of Ministers.

Furthermore, non-Egyptians owning vacant real estate in Egypt must build within a period of five years from the date their ownership is effective (the date on which the realty is recorded at the competent Notary Public Office). NonEgyptians may only sell their real estate five years after registration of ownership, unless the consent of the Prime Minister is obtained. The terms of property ownership vary according to the nature and location of the property. The type of land (desert, reclamation, agriculture) and proximity of the land from the country’s borders determine which laws apply and these laws in certain instances restrict ownership.

12. According to Article (82) in Law No. 72 of 2017 Promulgating

the Investment Law, Settlement of Investment Disputes:

Without prejudice to the right to litigation, any dispute arising between the Investor and any one or more government bodies in relation to the Investor’s capital or the interpretation or enforcement of the provisions of this Law may be settled amicably through negotiations among the disputing parties.

The Government of Egypt has embarked on a number of national mega projects that aim to enhance the competitiveness of the economy, create employment opportunities and attract foreign and domestic private investments. With work underway by more than 1,000 companies and nearly two million Egyptian workers, these national mega projects such as Suez Canal economic zone, New Administrative Capital and the Golden Triangle are contributing to a new chapter in Egypt’s economic progress.

THE SUEZ CANAL ECONOMIC ZONE

Suez Canal Economic Zone (SCEZ)

1.THE SUEZ CANAL ECONOMIC ZONE

As part of the launch of the New Suez Canal, Egypt has made the development of the Sinai Peninsula a key part of its economic strategy. Through the Suez Canal Economic Zone, Egypt is transforming 461 square kilometers and six new ports into a vibrant hub for international commerce that will connect 1.6 billion consumers across Europe, Asia, Africa and the Gulf to Egypt’s own growing market of more than 90 million people.

Incentives:

• Lies at the heart of international trade;

Strategic geographic location and benefits from its strategic location along one of the world’s main trading routes.

• Access to 1.6 billion consumers ;

Complemented by world class ports, high quality logistics services and preferential trade agreements, it allows investors to efficiently, and competitively, access regional and global markets in Europe, the Gulf, East and Southern Africa and Asia.

• Access to Domestic Market;

Egypt has a large and growing domestic market of some 90 million people of whom 65% are of working age. With rising standards of living, the purchasing power of the domestic market will drive growth in many sectors.

• Workforce;

Egypt has a huge, competitively priced workforce available to meet investor requirements.

• Strong Track Record;

Egypt is a major industrial producer. The Suez Canal Zone can draw upon and expand the existing strong ties with multinational and domestic corporations to develop a much enhanced manufacturing sector.

• A True One-Stop-Shop;

Unified and streamlined procedures and processes designed to minimize delays and costs to the investor. A unique customer service at which only one employee finish all the procedures of issuing of all approvals and licenses for the projects.

• High Quality infrastructure and linkages;

State-of-the-art infrastructure services, including power, water, wastewater, telecommunication, and transport linkages will be provided to investors.

• The Zone is supervised and managed by an independent General Authority by constituting an independent board comprised of key government ministries and private sector representatives.

• The authority has a supreme committee that supervises the tax and the customs systems and operations in the Zone.

• All imports are 100% exempted from duties and sales taxes.

2.ESTABLISHING NEW CITIES

With a continually rising population, the government has announced the establishment of several new cities, such as New Administrative Capital.

The New Administrative Capital It is a Smart Capital city that introduces a modern concept of residence and is expected to accommodate from 18 million people to 40 million people by 2050.

Incentives:

The New Administrative Capital is, therefore, designed to become the new regional investment hub, making it the ideal opportunity for those wanting toinvest in real estate.

The City also includes:

– A central park with an area of 8 km (bigger than New York’s central Park).

– A Green River, 35 Km long.

– Mega Mall.

– Conference Hall.

– Expo City.

– Medical city.

– Sports city.

– The new capital is planned to be a sustainable city, housing the ministries, parliament, Egyptian Media Production City, presidential palaces, and embassies.

The new capital’s main objective is creating a global city with smart technologies through:

– Recycling organic waste to grow and flourish local food.

– Build an integrated transportation network.

– Build a unified digital infrastructure.

– Create Smart network facilities.

– Create Smart traffic system.

3. The Golden Triangle Economic Zone

– The Golden Triangle, a new economic zone located between Qena, Safaga and Al Qusair, is considered one of the richest areas in mining sources accounting for 75% of Egypt’s mining minerals. The project is implemented by Italian Consultancy D’Appolonia, seeking to attract US$ 19 billion investments. The project aims to establish a new industrial capital by building an industrial, commercial, mineral, and touristic zone to serve, not only Egypt, but the African continent.

– The region is rich in metallic and non-metallic minerals, including iron, copper, gold, silver, granite, and phosphate, which are involved in the manufacture of many high economic industries and the manufacturing of construction and cement materials.

– The Golden Triangle lies on the outskirts of Qena and is home to Abou Tartour, a mining area in Egypt holding its largest phosphate reserves, estimated at almost a billion tons of phosphate rock.

Incentives:

– The mining wealth in this zone will allow the region to set up new factories that produce cement, glass, silicon, chemicals, and computer chips. Other projects will utilize raw materials to manufacture cement from clay and limestone and produce gasoline from oil-based clay.

– The region is also rich with tourist attractions that set the foundation for a number of tourism projects, including one example which is the Qena Qeft Road, which served as a road of pilgrimage in the past. Another tourism opportunity lies in the many inscriptions and pharaonic drawings on the road to Qena Safaga, a possible destination for organized tours. The road also contains the largest mine for “Alsamiqaa Imperial” stones, historically used by the Roman Empire to decorate their temples. Several touristic resorts are being planned for Dendara, Laqeta, and Qena Valley as well as between the Safaga and Al Qusayr areas.

– To support this opportunity, the region has an independent authority to develop the Golden Triangle area. It will govern investments in the economic zone, cut red tape, reduce bureaucratic processes and provide a familiar environment for international investors. Investments in the Golden will receive fast track licenses.

– Finally, agricultural land is being allocated within the Golden Triangle area for reclamation and cultivation under strong incentives by the new investment law. Egypt has successfully raised US$ 150 million from the International Finance Corporation for the development of its agricultural sector.

Egyptian Cables Factory

Notes: Following are 2 links about “Egypt manufacted iconic double-decker London buses” and “Elsewedy Cables” at:-

(i)https://www.youtube.com/watch?v=gRm9d3m6Gng

(ii) https://www.youtube.com/channel/UCsRZVlsQ8tFyWCNOREMus0g/videos

Contact Details

Mr Amr Abdel Halim

Minister Plenipotentiary Commercial

Economic and Commercial Office

Embassy of Egypt in Kuala Lumpur

15H, 15th Floor, Plaza Ampang City

Jalan Ampang

50450 Kuala Lumpur

MALAYSIA

Tel : +603 4257 3166 / Fax: +603-4252 4853

Email: kualalumpur@ecs.gov.eg