Country Feature: Nepal

Nepal, strategically located between the two world’s economic giants – China in the North and India in the East is a fertile land for investment given its rich natural resources, young and vibrant population and unique geo-topography. This strategic location not only offers unparalleled and preferential access to the China and India markets for bilateral trade and investments, but also provides the potential of Nepal acting as a transit hub which could facilitate increased trade in the future.

Nepal lies at a GMT time zone of +5:45, giving European and American countries the potential to have a 24 hour work schedule which can be vital in today’s world of business and connectivity. Similarly, this also provides Asian countries the opportunity to have a collaborative work schedule, further enhancing their productivity.

The government is deepening and broadening management while opened up to trade and FDI during the liberalization movement in the 1990’s. Nepal became the member of WTO in 2004, reinforcing its commitment to integration with South Asian and other regional and global economies. It has further established its interest in economic integration through its memberships in regional economic blocs such as SAARC (South Asian Association for Regional Cooperation), BIMSTEC (Bay of Bengal Initiative for Multi-Sectorial Technical and Economic Cooperation) and SAFTA (South Asian Free Trade Area). Involvement in various multi and regional forums has provided Nepal with free and preferential access to international market.

In addition, major reforms in laws and regulations have not only spurred growth of domestic private operations, but have also opened up key domestic sectors for foreign players.

The Nepalese Government is liberal on foreign investment and allows 100% foreign ownership in most sectors of the economy. The investment rules and procedures of Nepal are attractive, with relatively low tax rates (lowest in South Asia), and the export and import rules and procedures are open and liberal.

Low labor costs and an increasingly literate population gives global companies based in Nepal a competitive edge in the global market. About 63 minerals have been identified in Nepal so far (2010-2011) and the Himalayas are expected to have large reserves of limestone, talc and other industrial/construction minerals.

Current Economic Scenario (2013-2014)

| Economic Growth | 5.2% (Basic Price) |

| Economic Growth | 6.0% (Targeted for 2014-2015) |

| Per Capita Income | 703USD |

| Inflation | 9.0% |

| Government Revenue | 18.4% (as percentage of GDP) |

| Government Expenditure | 23.3% (as percentage of GDP) |

| Trade Balance | 32.1% -deficit (as percentage of GDP) |

| Balance of Payment | 105.0 billions (surplus) |

| Current Account Balance | 82.5 billions (surplus) |

| Remittance | 29.1 (as percentage of GDP) |

| Outstanding Public Debt | 30.1 (as percentage of GDP) |

The long term objective of Nepal’s Three Year Interim Plan is to graduate Nepal to the status of a developing country by 2022 A.D.

Priority sectors for Investment

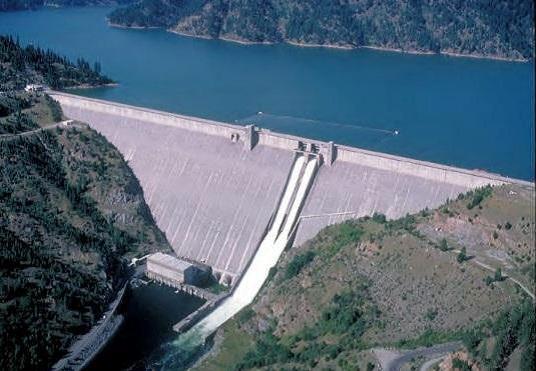

Hydropower

The most untapped sector –only 1.71% of Nepal’s economically feasible potential has been realized and holds the key to economic transformation.

Filling the peak shortage of over 500MW (not including the latent demand) domestically:

Export Potential to India

• India’s power deficit is close to 75 million units per year.

• Dhalkebar-Muzaffarpur 400 kV cross-border transmission line being built (others in pipeline)

• Power Trade Agreement signed

• Project Development Agreement signed with 2 Large Hydropower Projects

Tourism

• Naturally endowed resources, rich cultural heritage (12 World Heritage Sites and 8 out of the highest peaks) are comparative advantages

• Primary contributor of foreign exchange, one of the largest employer in service sector

• Development of the sector has the potential to uplift rural populations and create linkages with other industries like agriculture, indigenous crafts amongst others

Opportunities in Tourism Sector

• Huge Market –Capturing tourists entering China and India

• Steady increase in tourist arrivals after the end of the civil conflict leading to shortage of facilities

• Approximately 10% of visitors to Nepal were for religious purposes –Developing related infrastructure around Lumbini, Janakpurand and other religious sites could be advantageous

• Less than 25% of identified peaks are open for climbing

• Planned LumbiniInternational Airport provides scope for religious tourism

• Vision 2020: Government to plans to more than double the number of tourists by 2020

• International Hotel Chains such as Marriott and Sheraton coming up

Agriculture

– Contributes 1/3rd to GDP and almost 2/3rd of the labor force is involved

– Majority of people engaged in agriculture live below poverty

– Developing the sector a key tool for poverty alleviation and development

Opportunities

• Commercial Dairy Operations & Livestock –Nepal imports over half of its current meat and milk requirements

• Infrastructure -Slaughter houses, logistics, Fertilizer factory, irrigation projects

• Storage and cold storage facilities –Post harvest loss for offseason vegetable is 25-50%

• Numerous crops for domestic consumption and export –tea, coffee, cardamom, turmeric, fresh vegetables, exotic flowers, chili, mushroom

• Processing and R&D units to Value add businesses based on agricultural products

• Medicinal Herbs –Nepal’s unique topography and climate ideally suited

• 20 year long Agriculture Perspective Plan in effect to accelerate the growth rate in agriculture through increased factor productivity

Infrastructure

– Poor infrastructure constrains growth in other sectors like Tourism, Agribusiness

– Improving connectivity is key to development

– Large infrastructure projects generate employment

– Specialized zones required to boost exports

Opportunities

• Second International Airport (SIA –Nizgadh) ($0.6 Billion first phase) to be bundled up with Tribhuwan International Airport upgrade

• KathmanduMetro Transit System ($5.5 Billion) –Will be country’s first railway transit system

• Kathmandu-TeraiFast Track ($1.0 Billion) –Final Stage of bidding process

• North South Birgunj-RasuawagadiCorridor ($1.7 Billion) -Road project capitalizes on the burgeoning trade between India and China, complements Kathmandu-TeraiFast Track

Mining & Minerals

– Extraction of Nepal’s minerals holds the key to rural development

– Nepal’s mineral reserves are largely unexplored and the industry is largely undeveloped and not mechanized

Opportunities

• Limestone –Known reserves of 1.25 billion MT of cement grade

• Dolomite –Over 5 billion tons of known reserves

• Decorative Stones –Marble, granite, quartzite & slate

• Gemstones –Tourmaline, aquamarine, ruby, sapphire are some known precious/semi-precious reserves

• Fuel Minerals –No known reserves of Natural gas and petroleum but international conglomerates continue to explore for them.

Information, Communication & Technology

– Emerging, young, educated and employable labor available at comparatively lower costs

– Capitalize on spillover benefits from India’s IT boom

– Generation of high volume and/or high paying employment opportunities to stem the brain drain

Opportunities

• Over 10M population b/w age 15-30 of which 70% is educated.

• Cheap human resources available for Midsize companies, 500-1000 employees catering to specialized software sectors like banking services, data mining & software design

• Untapped e-governance market for investors to incorporate IT into government services such as MRPpassports, computerized citizenship cards, digitized land records

• Scope of internet services -Internet penetration still very low

• Low labor cost compared to India and other SA countries -Comparative Advantage

• Some successful international ventures in Nepal: Verisk, D2Hawkeye, Deerwalk

Health & Education

– Health & Education are the most fundamental building blocks for human development and poverty alleviation

– Investments by private sector can ease the burden on GoN, thus allowing it to allocate resources to the most needy

Opportunities

• Institutions of higher learning –In the fiscal year 2013-14, more than 28 thousand students went abroad for higher education

• State of the art medical schools and hospitals –such institutions attract students and patients from South Asia

• Vocational training schools

• Largely untapped market for institutions with foreign affiliations

Nepal encourages investments in:

• Hydropower

• Alternative energy

• Transport – highways, expressways, railways, mass transit facilities, airports, waterways

• Upgrading of existing International Airport in Kathmandu

• Construction of Second International Airport

• Tourism sector – hotels, entertainments facilities, sports, tourist services

• Services – specialized state of art medical, educational facilities, medical tourism, telecommunication and IT

• Finance sector – Agriculture Development Bank Nepal and Nepal Bank Limited

• Agriculture & Forest – organic farming, large scale livestock, dairy, herbal production and processing, export based products, value addition, highland specialties – domestic and export

• Manufacturing and trade – diversified products, export based, employment creation. Main exports are iron and steel, knotted carpets, textiles, polyester yarns, plastics, hollow tubes, beverages and vegetables.

Policies and legislation

• PPP Policy (Under formulation),

• Financial Sector Development Strategy (Under formulation)

• Industrial Policy-2010, IT Policy, Trade Policy,

• Nepal Trade Integration Strategy-2010

• Privatization Act 1994

• Three Year Interim Plan 2014-2016

• Foreign Investment and Technology Transfer Act, Labor Act, SEZ Act (Under formulation)

• BIPPA (6 countries) , DTAA (10 countries)

Institutions

• Investment Board Nepal

• Hydro Power Investment Development Company Limited (HPIDCL)

• PPP Cell is under creation in National Planning Commission

• Inter-ministerial committee headed by Finance Secretary (proposed)

Tax incentives including exemptions

• VAT refund

• Profit repatriation

• Ease of doing business

• Customs reforms

• IT based Tax administration

• Personal Tax Assessment

• Provision of Special Economic Zones

• Construction of ICPs and ICTs in Indian and Chinese borders

Source: Presentation by Board of Investment Nepal and Ministry of Finance, Nepal at Nepal Investment Summit 2015 dated 27 Jan 2015.

Contact details of the Embassy of Nepal in Malaysia

H.E. Dr. Niranjan Man Singh Basnyat

Ambassador

Embassy of Nepal

Suite C-15, Wisma Goshen (Tower C)

Bangsar Trade Centre

No. 5, Persiaran Pantai Baru Off Jalan Pantai Baru

59200 Kuala Lumpur

MALAYSIA

Tel: 603-2282 0244 / 603-2282 5934

Fax: 603-2282 1527

Email: info@nepalembassy.com.my

Federation of Nepalese Chambers of Commerce and Industry (FNCCI)

Pachali Shahid Shukra FNCCI Milan Marg, Teku

P.O. Box 269, Kathmandu

NEPAL

Tel: (00977-1) 4262061 / 4262218 / 4266889

Fax: (00977-1) 4261022 / 4262007

Email: fncci@mos.com.np

Website: http://www.fncci.org