Country Feature: Investment Opportunities In Myanmar

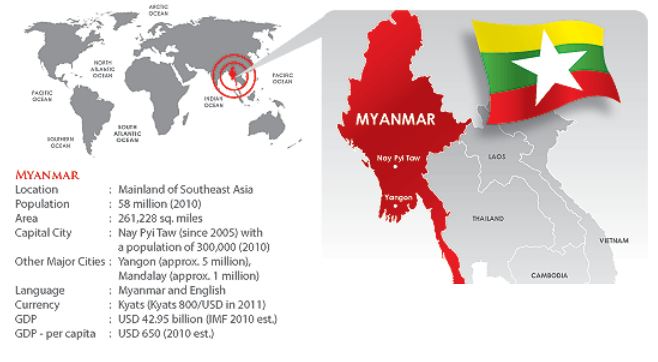

Myanmar is the largest country in the Southeast Asian peninsula in terms of area, sharing common borders with Bangladesh, India, China, Lao PDR and Thailand. Additionally, it boasts 2,000 km of coastline along the Indian Ocean. The country is culturally diverse with 135 official ethnic groups. The Bamar (69%) constitute the ethnic majority while among the main ethnic minorities are the Kachin, Kayah, Kayin, Chin, Mon, Rakhine, and Shan. Myanmar is administratively divided into 7 states and 7 regions and, at a sub-level, into 67 districts and 330 townships. The economic system has evolved since 1989 when Myanmar started to adopt market oriented reforms which encouraged many local and foreign enterprises to enter the domestic market. The size of the Myanmar economy has grown from USD 6.48 billion in 2001 to USD 42.95 billion in 2010, a 6.6 times increase in nominal term within one decade. According to official statistics, real GDP growth rate was 11.2% on average in the period 2000 – 2010. Annual inflation rates have remained at a single digit level since 2008.

Myanmar is rich in natural resources with arable land, forestry, minerals (including oil & gas), and freshwater and marine resources. The Myanmar economy relies heavily on agricultural products and gas exports. In 2009/2010, the share of agriculture (agriculture, livestock, fishery and forestry) in the GDP was 40%, that of industry (energy, mining, electricity, manufacturing and construction) 22.5% and that of the service sector including trade 37.5%. According to official trade statistics for 2010/11, about 94% of total foreign trade was with Asian countries. Among them, Thailand was the largest with a share of 23.7% followed by Mainland China (22.1%), Singapore (13.8%), and Hong Kong (12.5%). Myanmar has enjoyed a trade surplus since 2003 when a large amount of natural gas started to be exported to Thailand. The structure of export remains dependent on natural resources such as gas and jade, and on primary products such as agricultural, marine and forestry products that are mainly exported with limited or no value being added.

After the general election in 2010, the military handed over power to a newly elected government on April 2011 under a democratic constitution with safeguards provided for the authority of the armed forces. A relaxation of trade policies and trade facilitation has been initiated since the new government was formed. It is mainly aimed at preparing the economy for the ASEAN Free Trade Area (AFTA) and ASEAN Economic Community (AEC) which will materialise in 2015.

In terms of investment, the country enacted the Union of Myanmar Foreign Investment Law (FIL) in 1988, with the Myanmar Investment Commission being formed simultaneously. The law provided incentives to attract foreign investors such as exemption or relief from income tax on reinvested profits within one year, accelerated depreciation rates, 50% relief from income tax on profits accrued from exports, the right to pay income tax on behalf of foreign experts and technicians employed in the business and the right to deduct such payment from the assessable income, right to pay income tax on the income of foreign employees at the rates applicable to Myanmar nationals, the right to carry forward and set off losses up to three consecutive years from the year the loss is sustained, and the exemption or relief on customs duty or other internal taxes or both on imported raw materials for the first three years of commercial operation after completion of construction.

Inflow of FDI in 2010/11 was remarkable, with USD 20 billion being approved which pushed the total approved amount up to USD 36 billion. These approved investments mainly came from Asian countries such as Mainland China, Hong Kong, South Korea and Thailand, and were concentrated in extractive sectors such as oil & gas, hydropower and mining. In terms of FDI, Malaysia stands 7th with 47 projects and USD 2.9 billion investment. The Myanmar foreign direct investment policy is also being reviewed as part of the overall restructuring and development policy of the new government, which described as priorities, the realisation of a full-fledged market oriented system for better allocation of resources, encouragement of private investment and entrepreneurial activity, and the opening of the economy to foreign trade and investment. The majority of recent investment proposals have been approved smoothly by the new administration and its investment authority – the Myanmar Investment Commission.

INVESTMENT OPPORTUNITIES BY SECTORS

Foreign investors will be interested in various sectors in Myanmar such as agriculture, livestock and breeding, forestry, energy, mining, industry and service sectors. In the agriculture sector, foreigners, citizens or joint ventures are allowed to invest according to regulations set by the Central Committee for the Management of Cultivable Land, Fallow Land and Waste Land and allowed contract farming only in the forms of joint ventures with citizens. Foreign investment in the agricultural sector is still limited at USD 173.10 million – 0.48% of the total foreign investment. Investments in perennial crops such as rubber, oil palm and coffee are being encouraged however.

In the livestock and fisheries sector, foreigners, nationals or joint ventures can operate on fallow lands with permission from the Central Committee for the Management of Cultivable Land, Fallow Land and Waste Land. Foreigners are allowed to cultivate, capture and produce aquatic animals and to invest in value-added processing. 130 fish processing and cold storage factories exist across the country, and are located in Yangon, Tanintharyi Region and Rakhine State, i.e. areas that have potential for the development of the fisheries sector. There is good potential in the breeding of cows and oxen. Investments in this sector and distribution of good breeds are encouraged. Proper investment, production and export of cows and beef can be promoted. According to the Notification Regarding Land Use for Foreign Investments, Republic of the Union of Myanmar in September 2011, land can now be rented out to foreigners with the advanced agreement of the Union Government through a 30-year land lease.

In the forestry sector, foreigners are allowed to invest only in joint ventures with citizens for teak-based products but foreigners are allowed to invest in the production of hard wood products. 90 wood -based factories out of 281 across the country are located in the Yangon Region, which has good potential for timber-based investments as this is where the main port facilities are located.

For the energy sector, 4 foreign-funded hydropower projects help this sub-sector occupy top place among FDI with USD 14.5 billion, followed by oil & gas with USD 13.8 billion in 104 projects. The development of these sectors is expected to contribute to the development of various regions across the country, sufficient supply of energy and the earning of foreign exchange. In the oil & gas sector, there are 47 blocks of onshore oil and natural gas fields, 26 blocks of offshore oil fields in Myanmar territorial waters along the Mottama, Tanitharyi and Rakhine coasts, and 18 blocks of offshore deep sea oil fields. Exploration is being carried out in cooperation with foreign companies under joint ventures.

The mining sector also has potential for FDI, standing in third place with USD 2.7 billion in 64 projects. The mining sector is operated through foreign or joint venture investments under the management of the Ministry of Mines in order to produce copper, tin and other minerals.

For the industrial sector, businesses are encouraged to establish processing and manufacturing industries for foodstuff, textiles, consumer goods, household goods, leather products, transportation equipment, construction materials, pulp and paper, chemicals, chemical products and pharmaceuticals, iron and steel, machinery, etc. There are plants in 18 industrial zones and 24 sub-industrial zones across the country as well as upcoming plants in newly established Special Economic Zones such as Dawei, Thilawa and Kyauk Phyu. Foreign investors can participate in the SEZs through various forms of investment.

In the financial sector, the provision of domestic banking services is permitted only to private citizen banks. Foreign banks are permitted to open representative offices and in the future their branch offices will also be in a position to perform operations. There are 15 foreign bank representative offices in Myanmar but foreign banking services are not allowed yet. Currently, only two government banks provide foreign banking services, but some local private banks will soon be offering foreign banking services as well. In October 2011, the Central Bank has allowed six local private banks to carry out foreign currency trading. The Central Bank also issued Authorised Dealer Licenses to 11 private banks on 25 November 2011 which allowed them to provide foreign banking services including opening LCs and other payment transaction means for foreign trade.

Investment in the hotel and tourism sector has huge potential in Myanmar. Hotel and tourism services are allowed to be provided by foreign, national and joint ventures. In Myanmar, there are only 691 hotels with 27,000 rooms throughout the country. Tourist arrivals in Myanmar were 800,000 in 2010 – 2011 and it is estimated to reach 1.3 million in 2011 – 2012. The Ministry of Hotels and Tourism plans to meet the target of 2.5 million tourists in 2014 – 2015. Bagan, Mandalay, Inle Lake, and Ngapali and Ngwe Saung beaches are popular with international tourists.

YBHG TAN SRI AZMAN HASHIM, CHAIRMAN OF MASSCORP BERHAD VISITED MICASA HOTEL APARTMENTS IN YANGON, MYANMAR ON 3RD NOVEMBER 2011

(2nd from left to right) Ms Khin Khin Htay (Communications Manager), Ms Khin Kaythi San (Director of Sales & Marketing), Mr Michael @ Min Lwin Oo (Resident Manager/Director of Finance), Tan Sri Azman Hashim (Chairman of Masscorp Berhad), Ms Ng Su Fun (General Manager of Masscorp Berhad), Mr Lee Yai Sin (General Director Of MASSDA Land Company Limited) and Mr Steven Twang (Executive Chef/F & B Operations Manager)

(2nd from left to right) Ms Khin Khin Htay (Communications Manager), Ms Khin Kaythi San (Director of Sales & Marketing), Mr Michael @ Min Lwin Oo (Resident Manager/Director of Finance), Tan Sri Azman Hashim (Chairman of Masscorp Berhad), Ms Ng Su Fun (General Manager of Masscorp Berhad), Mr Lee Yai Sin (General Director Of MASSDA Land Company Limited) and Mr Steven Twang (Executive Chef/F & B Operations Manager)