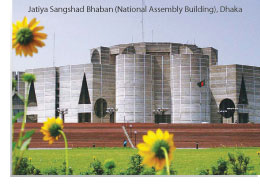

Bangladesh: Your Dream Investment Destination

Overview

Overview

Strategically located next to India, China and the ASEAN markets, Bangladesh is indeed the perfect gateway to South East Asia. It is richly endowed with a variety of natural resources like gas, coal, stones and huge bodies of water.

It has a population of more than 144 million and is a largely homogenous society. Its people live in harmony, irrespective or race and religion. English is widely understood here and commonly used in both the public and private sectors.

Bangladesh’s competitiveness in terms of natural and human resources makes it the destination of choice for investors. Its robust economy and solid financial system provide a foundation for sustainable growth, creating a plethora of investment opportunities and great potential for exceptional returns.

Malaysian companies investing in Bangladesh can look forward to capitalising on the country’s business-friendly environment, political stability, low energy cost, strong local market, investment incentives, proven export competitiveness and investment protection.

Why Bangladesh?

- Industrious Low-cost Workforce: It boasts an educated, skilled and hardworking labour force with the lowest wages and salaries in the region.

- Strong Domestic Demand: A growing middle class with significant purchasing power makes Bangladesh a very attractive investment destination.

- Competitive Incentives: One of the most investment-friendly FDI regimes in South Asia, Bangladesh allows 100% foreign equity and an unrestricted exit policy.

- Low Cost of Energy: Energy prices are among the most competitive. Transportation on green compressed natural gas is less than 20% of the diesel price.

- Proven Competitiveness: Bangladeshi products enjoy tariff-free access to the EU, Canada, Australia and Japan.

- Modern Infrastructure: To ensure a better business environment, the country is focused on developing core infrastructures like roads, highways and port facilities.

Investment Opportunities

Despite the global economic slowdown, Bangladesh is on track to achieve 6% GDP growth this year – once again reinforcing its reputation as one of the most attractive investment destinations in the region.

There are several sectors which offer particularly attractive investment opportunities, from ship-building and ceramics to float glass and tourism. Key opportunities can be found in garment design and production, ICT business services, pharmaceuticals, agro processing and leather products.

Export Processing Zones

There are currently 8 EPZs in Bangladesh, namely Dhaka, Adamjee, Comilla, Mongla, Chittagong, Karnaphuli, Ishwardi and Uttara. These export-oriented industrial enclaves provide infrastructural facilities and support services to foreign investors.

There are currently 8 EPZs in Bangladesh, namely Dhaka, Adamjee, Comilla, Mongla, Chittagong, Karnaphuli, Ishwardi and Uttara. These export-oriented industrial enclaves provide infrastructural facilities and support services to foreign investors.

Special incentives enjoyed by businesses located in the EPZs include:

- 10 years tax holiday

- Concessionary tax for 5 years, after 10 years

- Duty and tax free exports from the EPZ

- Ready-made factory buildings

- Excellent infrastructure logistics

- Duty free import of machinery, raw and construction materials

- Business and administrative support services

The Board Of Investment (BOI) works in tandem with the Bangladesh Export Processing Zone Authority (BEPZA) to assist foreign investors in setting up their business operations.

Public Private Partnership (PPP)

The Government is committed to increase private participation in the country’s infrastructure projects and public sector delivery. PPP opportunities are available in telecommunication and ICT infrastructure, highways and expressways, ports, power and energy, tourism, economic zones, social infrastructures, waste management, water supply and other infrastructure projects. The BOI is responsible for facilitating PPP projects.

Investment Incentives

- Corporate tax holidays from 5 to 7 years for selected sectors

- Accelerated depreciation on cost of machinery for new industries

- Reduced Corporate Tax for 5 to 7 years in lieu of tax holiday and accelerated depreciation

- Avoidance of double taxation under bilateral tax convention

- Tariff concessions

- Bonded warehousing facility

- Cash incentives/export subsidies

…and much, much more.

Contact Information

Board of Investment, Prime Minister’s Office

Jiban Bima Tower (19th Floor), 10 Dilkusha Commercial Area,

Dhaka 1000, Bangladesh.

Tel : +880-2-716 9580 Fax : +880-2-956 2312

Email : service@boi.gov.bd Website : www.boi.gov.bd