2021 April Issue

SPACE

- • Forthcoming Events

- Dubai Expo 2020 (1 October 2021 – 31 March 2022)

- Ethiopia-Malaysia Business Promotion 2021 (Date: TBA)

2020 News

2019-2020 Annual Report

- • President’s Statement

- • Message from The Ministry of International Trade and Industry (MITI) Malaysia

- • Message from The Ministry of Foreign Affairs, Malaysia

- • Message from Malaysia External Trade Development Corporation (MATRADE)

- • Message from Malaysian Investment Development Authority (MIDA)

- • Diary of Events

SPACE

Editorial

Greetings from MASSA !

2020 was a year of unprecedented disruptions and consequently a very challenging time for businesses and governments. We see evidence of global economic recovery from the pandemic in 2021. The fluidity of the Covid19 situation presents a significant and challenging risk factor nevertheless.

In this April newsletter, we report on Malaysia’s Digital Economy Blueprint and MyDIGITAL. This is a comprehensive set of initiatives to transform Malaysia to a digital ecosystem and to be a regional leader in digitalisation. This article presents how the Malaysian government, with support from various private stakeholders, will take on this challenge.

We feature the Federal Democratic Republic of Ethiopia (Ethiopia) in this newsletter edition. The article titled “Ethiopia Investment and Trade Opportunities: Presented to Malaysian Investors” gives us latest information on various economic sectors driving the economy of this strategically located country in the Horn of Africa. Ethiopia’s economy grew at an average of 11% annually from 2010/11 to 2019/20 but slowed down to 6.1% in 2019/20 due to COVID-19. However, Ethiopia is still one of the fastest emerging economies in Africa. This is attributed to its conducive investment climate, large market size with a population of 110,871,031 people (CIA’s World Factbook, https://www.cia.gov/the-world factbook/countries/ethiopia/#people-and-society) and high-level government commitment towards Foreign Direct Investment attraction. Ethiopia’s exports to Asia in 2018/2019 stood at 41.6% while it’s imports from Asia in the same year was 62.3% (International Trade Administration, https://www.trade.gov/country-commercial-guides/ethiopia-market-overview). In 2018, Ethiopia imported 149,435 tonnes of Malaysian palm oil and palm oil-based products worth RM 457.17 million

(https://www.thestar.com.my/business/businessnews/2019/11/08/malaysiaidentifying-new-potential-markets-for-palm-oil-in-africa), making Ethiopia one of the largest importers of Malaysian palm oil. We look forward to more business engagements between Ethiopia with our members in Malaysia and partners in the South-South region.

We also feature the upcoming Expo 2020 Dubai. This event will be held from October 2021 – 31 March 2022, held in the United Arab Emirates, with the theme ‘Connecting Minds, Creating the Future’. There will be six clusters of focus from which MITI and its agencies will be coordinating the trade and IR 4.0 clusters in the Malaysia Pavilion. We hope that this coverage will encourage our MASSA members and readers to participate in programmes held throughout the Expo and gain new knowledge whilst creating new business partnerships.

Finally, as we kickstart 2021, we want to thank our members, contributors, and partners for your support to date. MASSA remains committed to present to members, trade and investment leads from the South-South countries, especially in light of the post-pandemic era that requires heightened cooperation from all levels and on the digital platform.

To that end, several events to keep an eye out for are in the works, which comprise a second joint webinar with PIKOM on Cybersecurity and a joint webinar with the Embassy of Federal Democratic Republic of Ethiopia in Jakarta, Indonesia (accredited to Singapore and Malaysia) on Ethiopia-Malaysia Business Promotion. We look forward to your participation in these business and digital-focused events as 2021 progresses.

We wish all members and readers to stay safe in this ongoing pandemic and to seize the opportunities whilst adapting to the ‘new normal’.

Thank you.

Ng Su Fun

Editorial MASSA

Diary of events

1) PIKOM-MASSA Webinar: Human Capital to Drive Digital Transformation held on 14th April 2021 Via Microsoft Teams

The National Tech Association of Malaysia (PIKOM) and the Malaysia South-South Association (MASSA) jointly organised a webinar titled ‘Human Capital to Drive Digital Transformation’, on 14thApril 2021 over Microsoft Teams. Various business sectors, universities, organisations, and agencies from Malaysia and from the developing countries participated in this webinar.

Digital transformation is imperative for all businesses, from the small to the larger enterprises. This message is repeated at every keynote, panel discussion, article and study relating to how businesses can remain competitive and relevant as the world becomes increasingly digital.

A business may take on digital transformation for several reasons. The on-going pandemic has affirmed that this transformation is imperative for sustainable business continuity and organisational resilience. Companies of all sizes are called to be more cognisant of need to have, maintain and grow their digital tech talent pool to enhance their organisational and productive capacity. This is especially evident as the post-pandemic recovery economy anticipates an improving global demand amid tech upcycle, improving business and consumer sentiment and a gradual return to normalisation.

This webinar, lined-up a list of distinguished industry leaders and role players in the field to raise the awareness that people and talent development is at the heart of enabling this transformation, and its resultant opportunities that can transform society, the business community and the nation towards becoming a technologically-advanced economy.

The programme for this webinar is as follows:

|

Time |

Details |

|

|

2.00 – 2.10 pm

|

Webinar starts. Address by Tan Sri Azman Hashim, President, MASSA. Address by Mr Danny Lee, Chairman, PIKOM.

|

|

|

2.10 – 2.45 pm

|

Session Moderator:

Dr Sumitra Nair, Vice President, Talent Development & Digital Entrepreneurship, Malaysia Digital Economy Corporation (MDEC)

Panelists: 1. Mr Rony Ambrose Gobilee, Chief Programmes Officer, Human Resources Development Fund (HRDF)

2. Encik Muhammad Azmi Zulkifli, Chief Executive Officer, InvestKL

3. Mr Anthony Raja Devadoss, Managing Director & Business Head, PERSOLKELLY Consulting Sdn Bhd

|

|

|

2.45 – 3.30 pm

|

Panel Discussion and Q & A

|

|

| 3.30 pm

|

Closing remarks by Tan Sri Azman Hashim, President, MASSA.

Closing remarks by Mr Justin J Anthony, Executive Director, PIKOM. Webinar adjourns. |

SPACE

The webinar began with welcoming addresses from the leadership of MASSA and PIKOM.

SPACE

Tan Sri Azman Hashim, President, Malaysia South-South Association (MASSA),

delivering his welcome address.

SPACE

Mr Danny Lee, Chairman of The National Tech Association of Malaysia (PIKOM),

giving his welcome address.

SPACE

The discussion on the topic of human capital and its role towards driving digital transformation, was moderated by Dr Sumitra Nair, Vice-President and Head of Digital Skills and Jobs, Malaysia Digital Economy Corporation (MDEC). Joining alongside her was a distinguished panel comprising industry, government and practitioners in the field of Human Resources driving Digital Transformation.

SPACE

Dr Sumitra Nair, Vice-President and Head of Digital Skills and Jobs,

Malaysia Digital Economy Corporation (MDEC),

session moderator.

SPACE

The panelists were as follows:

SPACE

Mr Rony Ambrose Gobilee, Chief Programmes Officer,

Human Resources Development Fund (HRDF)

SPACE

Encik Muhammad Azmi Zulkifli, Chief Executive Officer,

InvestKL

SPACE

Mr Anthony Raja Devadoss, Managing Director & Business Head,

PERSOLKELLY Consulting Sdn Bhd

SPACE

Following the presentations by the speakers, the webinar proceeded into a panel discussion-cum-Q & A session led once more by Dr Sumitra Nair.

SPACE

(Top left) Mr Anthony Raja Devadoss, (Top right) Dr Sumitra Nair,

(Bottom left) Mr Rony Ambrose Gobilee, (Bottom right) Encik Muhammad Azmi Zulkifli

SPACE

(Clockwise, from top left) Mr Anthony Raja Devadoss, Mr Danny Lee, Mr Rony Ambrose Gobilee,Mr Justin J Anthony, Tan Sri Azman Hashim, and Dr Sumitra Nair

The webinar ended with closing remarks by MASSA and PIKOM.

SPACE

Tan Sri Azman Hashim, President, Malaysia South-South Association (MASSA),

giving his closing remarks.

SPACE

Mr Justin J Anthony, Executive Director,

PIKOM giving his closing address.

SPACE

MASSA would like to thank the MASSA Executive Committee and membership, and the participants from the South-South countries for attending this webinar.

President’s Message

Tan Sri Azman Hashim

President

MASSA

2020 saw the global economy contract by 3.5%, whilst trade tapered by 9.6%. The Malaysian economy contracted by 5.6% in 2020, worse than previous projections, and the lowest since 1998 (-7.4%). Overall, Malaysia has adopted a comprehensive and complementary policy response to the crisis brought on by the COVID pandemic. A series of stimulus packages worth RM305 billion (20% of Malaysia’s GDP) was progressively unveiled to support the economy throughout the crisis. Supply-side policies, such as active labour market measures to promote workforce upskilling and reskilling, and initiatives to accelerate digitalisation, were implemented to sustain growth momentum and assist vulnerable segments of the economy. These played a significant role to cushion the economic impact of the COVID pandemic on the domestic economy and to support a growth recovery.

2021 began with an earnest expectation to continue its gradual and uneven journey of recovery following from the second half of 2020. Expectations for growth worldwide continue to be tempered by development surrounding the pandemic, especially the deployment of vaccines, current structural shifts in the economy and the degree of scarring in labour markets. Bank Negara had projected the Malaysian economy will rebound to between 6.0% and 7.5% in 2021. This projection will be dependent on the recovery in global demand and the gradual improvement in domestic economic activity.

Domestic monetary and financial conditions are expected to remain conducive with policy measures remaining in place to support the growth momentum while still assisting the vulnerable segments of the nation and its economy. These include the extension of measures introduced in 2020, the 2021 Budget, as well as the PERMAI and PEMERKASA assistance packages. For businesses, special grants, wage subsidies and the Targeted Relief and Recovery Facility are extended to firms in the services sector, which has been the hardest-hit sector.

The launch of the MyDIGITAL initiative under the Malaysia Digital Economy Blueprint, underpins the Government’s importance of digital transformation, and affirms the Government’s commitment to transforming Malaysia towards a technologically-advanced economy.

To complement this, MASSA will play its role to support our Government on this journey. With the benefits of going digital continuing to be explored by the Association, MASSA has reinvigorated its charge in Bridging the South-South Countries, by exploring alternative avenues of engagement with fellow developing nations which are mutually recovering from the pandemic.

Additionally, MASSA will increase its engagement and collaborative efforts with Government agencies, fellow business associations, both old and new, towards increasing the readily-available virtual knowledge-pool and awareness of incoming trends, changes and events for its membership and stakeholders. I do encourage members to attend these events and to evaluate their opportunities.

I appreciate the continuing support and cooperation of all members, especially my fellow Executive Committee members with your attendance and participation at our regular meetings and your generous contributions.

I also wish to thank all our supporters who have contributed valuable and insightful articles, and our sponsors of our Newsletters for 2020.

I wish everyone a happy, healthy and successful 2021, and a safe Hari Raya 2021.

Tan Sri Azman Hashim

President

MASSA

MALAYSIA: A HAVEN FOR STARTUPS AND TECH INNOVATIONS

A perfect 10 – this was Malaysia’s score in terms of performance and market reach in the Global Startup Ecosystem Report 2020 (GSER 2020)[1]. Kuala Lumpur was ranked 11th in the Top 100 Emerging Ecosystem category, and scored 9 for talent and 8 for funding.

Furthermore, the Global Innovation Index 2020 ranked Malaysia second after China for most innovative country in the upper middle-income group category.

These are not a ‘flash in the pan’ achievements but a testament to the boom the nation is experiencing in the tech industry in recent years. The startup culture and entrepreneurship have gained greater relevance, with players catching up with their global counterparts.

Even more, the growth of tech startups has impacted the Malaysian economy positively, creating many new jobs and contributing to the nation’s Gross Domestic Product (GDP).

But as you know, nothing comes easy. The concept of being an ideal startup hub has been a race, especially among emerging countries and Malaysia is a rising contender.

The Government is fully aware that facilities go a long way towards attracting startups and so we offered speedy processing, improved infrastructure and increased accessibility. It is noteworthy to say that our success so far has been due to multi-ministerial efforts and no one entity can be singled out.

It is also worth noting that Malaysia’s fast-growing Equity Crowdfunding (ECF) and Peer-to-Peer (P2P) Lending spaces, as well as the number of angel investors are a testimony of growing interest in this vibrant ecosystem.

Malaysia, as at June 30, 2020, launched a total of 106 ECF campaigns, raising some RM110.26 million. During the same period, as many as 10,824 P2P campaigns were launched, worth over RM798.32 million raised.

Our homegrown startups are making a name for themselves. Players like Aerodyne, Carsome, EasyParcel, Fave, Grab, iFlix, Kaodim and Pop Meals (previously dahmakan) are some examples of companies riding on the bandwagon and causing disruptions. Recognising the role of startups, the Ministry of Science, Technology and Innovation (MOSTI) is on a mission to groom the country’s startups to propel them to the global arena.

[1] https://startupgenome.com/article/rankings-top-100-emerging

GAME CHANGER IN THE NEW NORM

As in most unexpected turn of events, COVID-19 did not spare Malaysia. The crisis has brought the country’s economy to its knees, impacting many Malaysians and businesses. The one-two punch has proven a major struggle for startups, especially, in terms of capital and demand.

Despite this gloom, many Malaysians rose to the occasion. Product manufacturers and service providers that were previously operating physically, shifted their operations to digital.

According to an online report in November 2020[2], a survey by Malaysian Global Innovation Centre (MaGIC) revealed that about 10% of the 168 startups in the country ceased operation, namely in consulting, services, lifestyle, fashion, events, marketing and advertising industries.

Sixty-one percent of them suffered more than 50% decline in revenue due to the pandemic while 74% have benefitted from various government incentives like wage subsidies and grants. The survey also noted that most of the startups desired financial aid.

These aids were disbursed in three economic packages by the Federal government since the first in March last year. They are the RM250 billion Rakyat Economic Stimulus Package (PRIHATIN), RM35 billion Short-Term Economic Recovery Plan (PENJANA) and RM15 billion Perlindungan Ekonomi dan Rakyat Malaysia (PERMAI). These packages acted as “the kiss of life” for Malaysians in various sectors and categories.

The government came in as a white knight introducing these incentives to assist them to manage their cash flows. However, financial assistance alone is not enough. Startups need to be creative and innovative, foster collaborative partnerships with other players, as well as larger corporations, government agencies and investors.

This drove the Government, through MOSTI, to launch the National Technology and Innovation Sandbox (NTIS) designed to accelerate Malaysia’s goal to become a high-tech and high-income nation. Initiated under the PENJANA, the NTIS helps support and intensify efforts to develop technological fields and accelerate R&D and commercialisation of local technologies.

The advantage is NTIS allows researchers, innovators, startups and high-tech entrepreneurs to test their products, services, business models and delivery mechanisms in a live environment with some relaxation from all or selected regulatory requirements.

[2] https://www.digitalnewsasia.com/entrepreneurial-nation/ntis-helps-startups-power-through-covid-19-collaboration-innovation

CONTRIBUTING TO THE NATION’S WEALTH

Technology development and innovation involves several phases beginning with the ideation phase to product development and pre-commercialisation, before finally reaching the commercialisation phase. The difficult part for every researcher and innovator is to commercialise their R&D products as various challenges need to be addressed, which may involve high costs as well as support from various parties.

Thus, this is where MOSTI plays a role through the Malaysia Commercialisation Year (MCY) initiative, to accelerate the commercialisation of research and development funded by the Malaysian government. From January 2016 to December 2020, 386 products/technologies/services were listed under MCY Special KPIs with sales value of RM402.5 million.

Moving forward with its success, this initiative enters MCY Goes Global stage or MCY 3.0, focusing on global commercialisation of R&D. To enable this to happen, development of the country’s commercialisation ecosystem are being enhanced with the collaboration of the quadruple helix parties: the government, academia, industry players and the public at large.

Synergy among all stakeholders are important to strengthen Malaysia’s position as one of the main producers of R&D products with the appropriate aid or interventions identified.

MOVING FORWARD

As we know, the STI sector is evolving rapidly and we simply cannot rest on our laurels. Like the age-old saying goes, change is the only constant. So, the coming decade will bring about a new phase for the development of STI.

The government has recently launched the National Policy on Science, Technology and Innovation (DSTIN) 2021-2030 aiming to address the issue of innovation inefficiency.

In efforts to make Malaysia a high-tech nation with a Gross Domestic Expenditure on Research and Development (GERD) to GDP of 3.5% by 2030, MOSTI has identified 10 key socio-economic drivers with 10 global leading science and technology sectors to lead and empower Malaysia’s economic growth.

Dubbed the 10-10 Malaysian Science, Technology, Innovation and Economic (MySTIE) Framework, it emphasises strategic collaboration between government, industry, academia, and society, especially in local technology development through research, development, commercialisation and innovation (R&D&C&I) to ensure STI benefits everyone.

Furthermore, towards increasing the GERD to 3.5% from the current 1.08%, the R,D,C&I ecosystem is further strengthened with the launch of the Malaysia Grand Challenge (MGC) early this year. The MGC is supported by five R&D funding schemes amounting to RM220 million.

The schemes are the Strategic Research Fund (SRF), Technology Development Fund 1 (TeD1), Technology Development Fund 2 (Ted2), Bridging Fund (BGF), and the Applied Innovation Fund (AIF), with 114 products expected to be commercialised this year.

EXPO 2020 DUBAI AS A PATHWAY TO GLOBAL MARKETS

To ensure Malaysia rises to the challenge of having top startups globally, we will provide the opportunity for our startups and innovators, together with other industry players, to leverage Expo 2020 Dubai and connect with global players and markets.

The world expo, themed ‘Connecting Minds, Creating the Future’, will take place from 1 Oct 2021 to 31 March 2022 in Dubai, UAE, with 192 participating nations and organisations. Throughout, Malaysia Pavilion will host specially-curated 26 weekly thematic business and trade programmes.

MOSTI and its agencies Technology Park Malaysia and Cradle Fund will debut the programmes with the ‘Commercialisation – From Lab to International’ Week and ‘Creating Tomorrow’s Sustainable Start-ups’ Week respectively. The programmes’ participating companies include those in the ICT, Advanced Engineering, Advanced Material, Biotechnology, Agriculture, Healthcare, Cosmetics and Medical Technologies sectors.

This goes hand-in-hand with MCY 3.0’s intention to bring our industries to global markets and put Malaysian innovators, researchers and startups on the global map. And MOSTI is not the only ministry taking the lead in bringing our startups and SME to the forefront at Expo 2020.

The Ministry of Entrepreneurial Development and Cooperatives (MEDAC) will spearhead 19 startups and SMEs during its ‘Start up Local, End up Global’ Week at Expo 2020. The programme’s objective is in line with Strategic Thrust 4 of the country’s National Entrepreneurship Programme (NEP 2030) to accelerate economic growth through innovation-driven enterprises. MEDAC’s week will focus on Artificial Intelligence (AI), Technology & Innovation, Medical and Health, and drone-related services.

Themed “Energising Sustainability”, Malaysia Pavilion will promote over 10 sustainable industries during its trade and business programmes at Expo 2020 Dubai. They comprise the sectors of Education; Youth & Technopreneurship; Trade, Industry 4.0 & Smart Manufacturing; Science, Technology, Innovation & Environment; Sustainable Agriculture & Agricommodity; Tourism & Culture; E-Commerce and Communication Technology, Halal Industry and Islamic Banking.

Over 200 companies, startups, SMEs, innovators, technoprenuers, social entrepreneurs and GLCs will participate as business delegates. Malaysia’s overall participation at Expo 2020 is led by MOSTI with Malaysian Green Technology and Climate Change Centre as implementing agency.

|

Datuk Ir. Ts. Dr. Siti Hamisah TapsirCommissioner-General for Malaysia at Expo 2020 DubaiSecretary-General, Ministry of Science, Technology and InnovationMalaysia

|

MyDIGITAL

Source: EPU Malaysia Youtube, screenshot via video

space

MyDIGITAL is the Malaysian government’s Initiative to transform Malaysia to a digitally driven and high-income nation and eventually a regional leader in digital economy. (Economic Planning Unit, Prime Minister’s Department, 2021, Malaysia Digital Economy Blueprint)

Digital economy is the combination of economic and social activities that involve the production and the use of digital technology by all levels of society, starting from the government agencies and systems, public and private business sectors, the communities and individual consumers in Malaysia. (Economic Planning Unit, Prime Minister’s Department, 2021, Malaysia Digital Economy Blueprint)

This digital direction is anticipated to increase the strength and competitiveness of the Malaysian business sector and be the catalyst in Malaysia’s trajectory to become a technologically advanced economy through foreign investments from high-profile companies and projects, especially in the manufacturing and services sector (Tan, 2021).

Malaysia’s post-pandemic era is now postured on these three key economic growth areas: sustainability, equal distribution of resources & wealth and inclusivity. In his speech during the virtual launch event of MyDIGITAL on 19 February 2021, YAB Prime Minister Tan Sri Muhyiddin said that the main objectives of this digitalisation project are to empower and improve livelihoods of all levels of Malaysian society across the country by championing digital literacy to create more high-income job opportunities, increased skilled workforce, make banking and finance business more seamless and continue to develop and provide progressive and accessible virtual and physical education as well as medical services to remote areas.

Prime Minister of Malaysia, Tan Sri Dato’ Haji Mahiaddin bin Haji Md. Yasin

Source: EPU Malaysia Youtube, screenshot via video

space

(Prime Minister of Malaysia during his Speech in conjunction with MyDIGITAL and Malaysia Digital Economy Blueprint Launch Ceremony. https://www.pmo.gov.my/2021/02/speech-text-in-conjunction-with-mydigital-and-malaysia-digital-economy-blueprint-launch-ceremony/?highlight=mydigital)

space

Designed to complement Malaysia’s existing development policies such as the 12th Malaysian Plan, Wawasan Kemakmuran 2030 and also the United Nations Sustainable Development Goals (SDGs), MyDIGITAL will encompass 48 national initiatives and 28 sectoral initiatives and is a part of the bigger plan of the Malaysia Digital Economic Blueprint. It is a combination of initiatives and targets across three phases of implementation until 2030 (Sunil, 2021):

– Phase 1: 2021 to 2022, reinforce the foundation of digital adoption.

– Phase 2: 2023 to 2025, drive inclusive digital transformation.

– Phase 3: 2026 to 2030, brand Malaysia a digital and cyber security lead in the regional market.

The information below is an excerpt from YAB Prime Minister Tan Sri Muhyiddin’s speech during the launch of MyDIGITAL regarding its initiatives and targets.

(Prime Minister of Malaysia during his Speech in conjunction with MyDIGITAL and Malaysia Digital Economy Blueprint Launch Ceremony. https://www.pmo.gov.my/2021/02/speech-text-in-conjunction-with-mydigital-and-malaysia-digital-economy-blueprint-launch-ceremony/?highlight=mydigital)

space

YAB Prime Minister Tan Sri Muhyiddin also declared the importance of building Malaysia’s digital infrastructure in order “to accelerate innovation and create an effective digital ecosystem.” (Prime Minister’s Office of Malaysia, 2021, Speech text in Conjunction with MyDIGITAL and Malaysia Digital Economy Blueprint Launch Ceremony (https://www.pmo.gov.my/2021/02/speech-text-in-conjunction-with-mydigital-and-malaysia-digital-economy-blueprint-launch-ceremony/?highlight=mydigital).

(Prime Minister of Malaysia during his Speech in conjunction with MyDIGITAL and Malaysia Digital Economy Blueprint Launch Ceremony. https://www.pmo.gov.my/2021/02/speech-text-in-conjunction-with-mydigital-and-malaysia-digital-economy-blueprint-launch-ceremony/?highlight=mydigital)

space

Source: Technology vector created by starline – www.freepik.com

This digital ecosystem aims to be the main driver of sustainable economic growth in Malaysia. MyDIGITAL is set to bring massive improvements from low-hanging fruits and also long-term goals across all levels of society and through the collaboration of public and private entities in various sectors.

According to Malaysia Digital Economy Corporation (MDEC) Chairman, Datuk Wira Dr Hj. Rais Hussin Mohamed Ariff said, in his statement published as a media release, “MYDIGITAL aims to provide a clear roadmap for the digital transformation of Malaysia in its pursuit of the Shared Prosperity Vision 2030 to achieve social well-being, environmental sustainability and equitable economic development for the country. The blueprint advocates a human-centric approach centred on using technologies responsibly, preserving human values and cultural heritage.” (Malaysia Digital Economy Corporation (MDEC), 2021, MDEC Pledges Unequivocal Support to Ensure Success of MyDIGITAL; the Malaysia Digital Economy Blueprint. MDEC. https://mdec.my/wp-content/uploads/MDEC-Chairman-Statement-Malaysia-Digital-Economy-Blueprint.pdf)

His statement highlighted MDEC’s efforts in expanding the digital capabilities of Malaysians from the digital skills and jobs perspective. MDEC has rolled out initiatives such as ‘Let’s Learn Digital’ which organises free courses on digitalisation and technology. To date, more than 3,800 free courses have been offered to the Malaysian public and have been successfully garnered more than 21,000 applications. (Malaysia Digital Economy Corporation (MDEC), 2021, MDEC Pledges Unequivocal Support to Ensure Success of MyDIGITAL; the Malaysia Digital Economy Blueprint. MDEC. https://mdec.my/wp-content/uploads/MDEC-Chairman-Statement-Malaysia-Digital-Economy-Blueprint.pdf)

Besides that, the Chairman also mentioned initiatives in the education and business sectors such as MyDigitalmaker, 100GoDigital, SME Digital Accelerator, Smart Automation Grant and SME Digital Quickwins, all of which produced commendable numbers and results.

(Malaysia Digital Economy Corporation (MDEC), 2021, MDEC Pledges Unequivocal Support to Ensure Success of MyDIGITAL; the Malaysia Digital Economy Blueprint. MDEC.https://mdec.my/wp-content/uploads/MDEC-Chairman-Statement-Malaysia-Digital-Economy-Blueprint.pdf)

space

In pursuit of a more connected, progressive and economically strong nation, the MYDIGITAL initiative through the Malaysia Digital Economy Blueprint needs to involve levels of society and entities in Malaysia. Although the public and private sectors may play distinctly different roles, it is vital to have absolute cooperation and determination from each level towards achieving the digital vision. Malaysian government agencies and their private partners are set on following through the plan and guidelines of the Malaysia Digital Economy Blueprint to lift the Malaysian economy, improve livelihood by diversifying and innovating ways to generate income as well as promote inclusivity through a digital ecosystem across the country and region.

(Prime Minister of Malaysia during his Speech in conjunction with MyDIGITAL and Malaysia Digital Economy Blueprint Launch Ceremony. https://www.pmo.gov.my/2021/02/speech-text-in-conjunction-with-mydigital-and-malaysia-digital-economy-blueprint-launch-ceremony/?highlight=mydigital)

space

Malaysia has the resources and talents that can be harnessed to contribute greatly towards achieving the aspirations and aim to be a progressive and economically strong nation. Let us all play our respective roles to work towards these goals.

space

space

References

Economic Planning Unit, Prime Minister’s Department. (2021). Malaysia Digital Economy Blueprint. https://www.epu.gov.my/sites/default/files/2021-02/malaysia-digital-economy-blueprint.pdf

Malaysia Digital Economy Corporation (MDEC). (2021). MDEC Pledges Unequivocal Support to Ensure Success of MyDIGITAL; the Malaysia Digital Economy Blueprint. MDEC. https://mdec.my/wp-content/uploads/MDEC-Chairman-Statement-Malaysia-Digital-Economy-Blueprint.pdf

Prime Minister’s Office of Malaysia. (2021). Speech text in Conjunction with MyDIGITAL and Malaysia Digital Economy Blueprint Launch Ceremony. https://www.pmo.gov.my/2021/02/speech-text-in-conjunction-with-mydigital-and-malaysia-digital-economy-blueprint-launch-ceremony/?highlight=mydigital

Sunil, P. (2021, February 22). Key highlights of the new Malaysia digital economy blueprint, a part of the MyDIGITAL initiative. https://www.humanresourcesonline.net/key-highlights-of-the-new-malaysia-digital-economy-blueprint-a-part-of-the-mydigital-initiative

Tan, J. Y. (2021, March 8). MyDigital to transform Malaysia digitally by 2030. Digital News Asia. https://www.digitalnewsasia.com/digital-economy/mydigital-transform-malaysia-digitally-2030

Ethiopia Investment and Trade Opportunities: Presented to Malaysian Investors

space

Ethiopian embassy in Jakarta accredited to Malaysia

March 2021

space

SPACE

Article by:

space

Mr Alemayehu Desta

Second Secretary

Embassy of the FDR Ethiopia in Jakarta, Indonesia

(Accredited to Singapore, and Malaysia)

SPACE

1. Ethiopia at a Glance

Official Name: Federal Democratic Republic of Ethiopia (FDRE)

Political system: Federal State with multi-party system

Capital City: Addis Ababa, seat of the African Union (AU) and United Nations Economic Commission for Africa (ECA)

Area: 1.104 million square kilometers

Population: Appx. 112 million

Language: Multiethnic state with more than 80 languages. Amharic is the working language of the federal government. English is taught in schools and is the main business language.

Location: Strategically located as a jumping off point in the Horn of Africa, close to the Middle East and Europe markets.

Arable land: 513,000 Km2 (45%)

Irrigated land: 34,200 Km2 (3%)

Population density: Appx. 90.5 per Km2

Climate: Temperate in the highlands, ranging from 20°C to 30°C (68°F to 86°F) and hot in the lowlands, often reaching 45°C (113°F). Rainfall ranges from 200 mm to 2000 mm.

GDP per capita: US$ 900 (2019)

Rainy Seasons: Abundant rain in June through August; mild rains in February and March.

Topography: Ethiopia has an elevated central plateau varying in height from 2,000 to 3,000 meters above sea level. In the North and center of the country there are some 25 mountains whose peaks reach over 4,000 meters. The most famous Ethiopian river is the Blue Nile or Abay, which flows a distance of 1,450 kilometers from its source to join the White Nile at Khartoum.

Economy: More than 70% of the population earns a living from agriculture. Agriculture is the backbone of the national economy, and the principal exports from this sector are coffee, oilseeds, pulses, flowers, vegetables, sugar, and foodstuffs for animals. There is also the thriving livestock sector, exporting cattle, hides, and skins.

space

space

2. Ethiopia-Malaysia Relations

The Diplomatic relations between Ethiopia and Malaysia was established in 1965. Both countries have been keen to reinforce their overall relations. In this connection, higher officials and delegations have started making various visits starting from the 1990s.

The commencement of direct flight by Ethiopian Airlines to Kuala Lumpur is playing a major role in promoting trade and investment between the two countries.

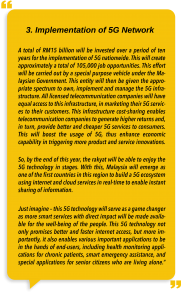

Trade between the two countries is showing a progressive trend in recent years. In 2017 Ethiopia has imported products worth 340,705,770.51 USD and exported items worth 723,616.49 USD. Ethiopia exports leather and leather products, raw meat and vegetable products to Malaysia and imports sugar, cotton, fatty acid, vegetable oil, paper, and paper products, Medical equipment, soap, and Detergent. It imports 95% its demand from edible oil producing countries like Malaysia, Indonesia, and Singapore. The cooking oil demand of the Ethiopian market is 507,191 tonnes annually, of which almost 95% is imported edible oil. Both countries signed Bilateral Investment Treaty (BIT) in 1998.

space

Source: Ministry of International Trade and Industry (MITI), Malaysia

space

space

3. Economic Indicators

– Ethiopia’s economy experienced strong, broad-based growth averaging 11% a year from 2010/11 to 2019/20, Ethiopia’s real gross domestic product (GDP) growth slowed down to 6.1% in 2019/20 due to COVID-19.

– Ethiopia – the second most populous country in Africa is one of the fastest growing states among the 188 IMF member countries. This growth was driven by government investment in infrastructure, as well as sustained progress in the agricultural and service sectors. The GDP in 2019 reached $92.154 billion where the services have surpassed agriculture as the principal source of GDP.

– Fast economic growth, conducive investment climate, large market size, and high-level government commitment towards FDI attraction have contributed to the growth of FDI inflow into Ethiopia-making the country the largest recipient of FDI in East Africa and the 4th largest on the continent.

– East Africa, the fastest-growing region in Africa, received $8.9 billion in FDI in 2018, of which Ethiopia absorbed more than a third and is now the 4th largest recipient of FDI in the continent of Africa and the largest in East Africa. (UNCTAD, World Investment Report 2019 and FDI Intelligence).

– 46% growth in FDI inflow-one of the most dynamic and largest FDI recipients in Africa (UNCTAD World Investment Report, 2017)

– Ethiopia is ranked 57th, better than its regional peers for its conducive macroeconomic environment.

– Recognized by UNCTAD for promoting investment in the Sustainable Development Goals (SDGs)

– Recognized by the World Bank through its “Star Reformer Award” for Ethiopia’s outstanding performance on investment policy reform and promotion

– Ethiopia exports oil seeds like Soyabeans, Sesame, Niger seed, Sunflower seed, Almond seed and pulses like Green mung bean, Red kidney beans, Chick pea, Lentil, red, brown, Field pea, Faba beans, Vetch seed, Lupin seed, Black cumin, and flower like Gypsophila, Veronica, Rose, Hypericum, Chrysanthemums. Coffee and gold are also the top export products.

Economic Growth 2012/13-2016/17

Export of Goods

Source: National Bank of Ethiopia

– Asia, Europe and Africa are the major destinations for Ethiopian merchandise export. Asia accounted for 36.4% of Ethiopia’s total exports. Saudi Arabia was the largest market for Ethiopia’s export with 19.0 % share in total export earnings from Asia, followed by United Arab Emirates (11.5 %), Japan (10.4 %), Israel (9.4 %), China (7.7 %), South Korea (5.9 %), India (5.2 %), Singapore (3.6 %), Yemen (3.5 percent), Indonesia (2.7 %) and Taiwan (2.1 %). These countries altogether accounted for 81.0 % of Ethiopia’s total export revenue from Asia.

– Europe had 33.6 % share in Ethiopia’s total export revenue, with the Netherlands taking 30.8 % share, followed by Switzerland (19.8 %), Germany (16.0 %), Belgium (8.0 %), Italy (4.4 %), Turkey (3.4 %), United Kingdom (3.3 %) and France (2.8 %). On the while, these countries had 88.6 % share in Ethiopia’s total exports earnings from Europe.

– America accounted for 10.6 % of Ethiopia’s total export revenue, of which 67.4 % was from exports to the United States, 4.6 % to Canada and 0.7 % to Mexico. These three countries had 72.7 % share in Ethiopia’s total exports to America.

Source: National Bank of Ethiopia

Import of Goods

– Total merchandise import bill reached USD 13.9 billion depicting 8.1 % year-on-year decline mainly due to lower import bill of fuel, capital goods and consumer goods. Payments for semi-finished goods, raw materials and miscellaneous goods, however, registered annual increment. Hence, import to GDP ratio declined to 12.9 % compared with 15.8 % a year ago.

– In 2019/20, Asia accounted for 60.6 % of the total imports of Ethiopia. The major imports from Asia originated from China (42.9 %), India (12.9 %), Kuwait (12.9 %), U.A.E (6.5 %), Saudi-Arabia (5.4 %), Indonesia (3.4 %), Malaysia (2.45%), Singapore (2.3 %), South Korea (2.2 %) and Japan (2.1 %) whose combined share stood at 90.8 %.

– Europe accounted for 21.8 % share of Ethiopia’s imports with the major trading partners being Turkey (20.2 %), Ukraine (11.2 %), Germany (9.8 %), United Kingdom (9.8 %), Italy (8.7 %), France (8.5 %), Belgium (8.0 %), the Netherlands (5.1 %), Spain (2.7 %), Switzerland (2.4 %) and Russia (2.3 %). These countries jointly constituted 88.7 % of Ethiopia’s total imports from Europe.

– About 9.3 % of Ethiopia’s imports came from America, of which 82.7 % was from the United States, 5.9 % from Canada and 1.3 % from Brazil.

space

space

4. Why Invest in Ethiopia?

– Political and social stability

– Growing Economy

– Excellent climate and fertile soils

– Strong guarantees and protections

– Young and trainable labor force

– Regional hub with access to wider market

– Improved economic infrastructure

– Competitive incentive packages

– High government commitment

space

space

5. Investment Opportunities for Malaysian Companies

5.1 Agriculture

– Ethiopia’s vast land, favorable climate, and water and land resources combine to make it an incredible hub for investment. Located in the horn of Africa, within easy reach of the Horn’s major ports, Ethiopia is close to its traditional markets for export products – the Middle East and Europe. This geographical proximity provides major exporters in the world unparalleled access to the Ethiopian floricultural market.

– The total land area coverage is about 111.5 million ha, of which 74.3 million ha is suitable for agriculture.

Investment Opportunities

– Sugarcane, horticulture, floriculture, forestry (including rubber tree plantation, fiber crops: (cotton, jute) animal husbandry, etc. Eighteen major agro-ecological zones have been identified in the country, and over 3 million ha land has been made available for investment. Ethiopia offers one of the largest and most diverse agricultural investment opportunities on the continent.

space

5.2 Textile and Apparel

– Ethiopia’s textile and garment industry witnessing rapid growth, as a number of domestic and multinational firms are being engaged in the production of textile and apparel for domestic and global markets. In the path to industrialize Ethiopia, the sector is given prominent position in boosting export, creating job opportunities, and as a model to other sectors as well.

– This recent surge in Ethiopia’s textile and apparel production and export to the global markets shows that the country has the potential to become one of the leading textiles and Apparel hubs of Africa, of exporting the equivalent of 30 billion USD with bold vision of transforming the action into compelling new apparel sourcing hub for brand, retails and their suppliers.

– Due to focused strategy and support of the government, in recent years, Ethiopia has grown spectacularly as a sourcing destination for apparel in recent years attracting most of the FDI in the sector.

Investment Opportunities

– Ginning, integrated textile mills, spinning, weaving and/or knitting, dyeing and printing,

– Production of garments; the manufacturing of knitted and crocheted fabrics, carpets, and sportswear, among others

space

5.3 Leather and Leather Products

– Ethiopia has a cattle population of more than 53 million, and sheep and goat population of 25.5 and 24.1 million, respectively. This makes Ethiopia the 1st from Africa and the 9th from the world in its cattle population which enable the country to have a strong raw material base for the leather industry.

– Only 50% of hides and skins potential are being utilized currently.

– Ethiopia has a potential for price competitive and quality supply of skins and hides: The Ethiopia highland sheepskins have got a worldwide reputation in terms of quality, thickness, flexibility, strength, compact structure, and a clean inner surface.

Investment Opportunities

– Tanning of hides and skins up to finished level;

– Manufacturing of luggage (such as handbags), saddle and harness items, footwear, and garments; and

– Integrated tanning and manufacturing activities.

space

5.4 Pharmaceutical

Pharmaceutical manufacturing is a nascent sector in Ethiopia with an annual 15% growth rate; import-dependent with an opportunity to invest and manufacture.

Key Sectors and incentive

– Tailored fiscal incentives to manufacturers including exemption from income tax up to 14 for Active pharmaceutical ingredient manufactures, 8 – 10 years for enterprises engaged in manufacturing of final drugs/ formulation, and up to 6 years for enterprises engaged in pharmaceutical packaging.

– Exemption from duties and other taxes on imports of machinery, equipment, construction materials, spare parts, raw materials, vehicles, loss carryforward, and full export duty exemption for manufactures

– Similar to other sectors, manufactures of pharmaceutical products are allowed duty-free import of capital goods and construction materials to facilitate in the establishment of a plant that adheres to the national General Manufacturing Practices guidelines, and for local manufacturing.

– Government is working towards setting an import tariff on non -Ethiopian Pharmaceutical Supply Agency imports to unify the advantages provided to local manufacturers in serving the domestic market; at the same time, applying the tariff only to non-EPSA imports ensures that EPSA can continue benefiting from the lower prices offered by domestic manufacturers.

space

5.6. Agro-Processing

Key reasons to invest

– Ethiopia’s plentiful agricultural resources including cattle, forests, cropland, suitable climate condition, and labor force are critical inputs for agro-processing industries.

– Ethiopia produces the best Arabica coffee in the world and is known for having a wider genetic variety of coffee than any other coffee producing country.

– Ethiopian coffee is well known for its special aroma and flavor, a uniqueness that makes it preferable for blending with coffee from other countries. Currently, Ethiopia is among the top five coffee exporters in the world.

– Ethiopia produces a variety of different sesame seeds which are highly valued on the international market. Production of sesame in the country has doubled in the past five years.

– Ethiopia ranks first in Africa and tenth in the world by cattle population of 55 million which is a big opportunity for meat processing industry.

– Ethiopia already has well-established partners in the meat trade.

– The size of the livestock population, the natural endowment of favorable climatic condition for improved, high-yielding animal breeds, provides Ethiopia with significant potential to further develop its dairy sector.

– Demand for chicken products is growing quickly in Ethiopia. The Government recently set new targets to bring meat production to 164 tones and egg production to 3.9 billion eggs by 2020 through improved poultry breeds.

– Ethiopia is the tenth largest honey producing country in the world and the largest in Africa. It ranks fourth in the world in terms of bee wax production and export.

– Yields of tomato can reach up to 80 tons per hectare which assures consistent and abundant supply for tomato processing plant.

Investment Opportunities

– Processing of meat and meat product

– Processing of fish and fish product

– Processing of fruit and and/Vegetables

– Manufacturing of edible oil

– Processing of milk and/manufacturing of dairy product

– Manufacturing of starch and starch product

– Processing op pulses, oil seeds or cereals

– Manufacturing of macaroni, pasta and similar products

– Manufacturing of chocolate, candy and biscuits

– Manufacturing of baby foods, roasted and ground coffee and similar products

– Processing of animal feeds

– Processing of alcohol and soft drink

space

5.7 Tourism and Hospitality

– Ethiopia is one of the oldest civilizations, the source of the mighty Nile River, and is endowed with a long-aged heritage and uninterrupted political independence.

– Located in the horn of Africa’s Rift Valley region and known globally as the origin of mankind, Ethiopia offers a variety of tourism attractions such as Natural, Cultural, Historical, Mystical, Athletics, and MICE.

– Ethiopia commands a large and untapped potential for the tourism and hospitality business. The increasing number of tourists and the evolving profile of today’s traveler demand a host of new tourism offerings and infrastructure projects.

– Ethiopia commands a large and untapped potential for the tourism and hospitality business. The increasing number of tourists and the evolving profile of today’s traveller demand a host of new tourism offerings and infrastructure projects.

– MICE Facilities

– Star rated tourist hotels and lodges

– Entertainment and Shopping Centres

– Tourist Information Shops

– Tourist Transport and Travel Services

– Tourism Medical Services

– Food and Beverage Services

– Leisure & Sports

– Education and Training Facilities

– In addition, Addis Ababa’s significance as the political capital of Africa brings a high representation of international and regional organizations, including the seat of the African Union and the United Nations Economic Commission on Africa.

space

5.8. Power

Ethiopia has the second- largest population in Africa (>105 million, ~8.5 % of Africa population), with an expected growth rate of 2.3% per year. Such increase in population size will result in an increase in the number of individuals requiring access to electricity. The government of Ethiopia has set clear power generation and connection targets and sees the private sector as pivotal in meeting intended targets.

Key reasons for investing

– Rapidly growing electricity demand at 30-35% annually mainly as a result of;

– More than 80 GW of exploitable renewable energy reserves;

– Low electricity access provides opportunity for off-grid solutions to thrive because;

– Trainable workforce with competitive wages

– National policy sees Ethiopia as a power supply hub for the East African region through the East African Power Pool

– Investment in on-grid power generation is open to the private sector, mainly targeting foreign direct investment

– Off-grid and mini-grid systems are also a major component of the nation’s plan to increase access to electricity; and engaging the private sector has been championed

– With a dedicated regulator (the Ethiopian Energy Authority) in place, the Ethiopian power sector is semi-unbundled

– The Ethiopian Electric Power (EEP) owns all pubic power generation plants and is a monopoly power transmission provider; EEP also conducts all power purchase contracts with Independent Power Producers

space

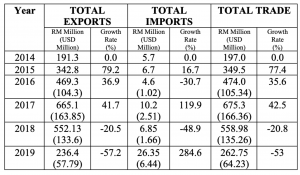

5.9 Mining

Ethiopia’s mining sector has undertaken a major reform programme in recent years. The reform is designed to make it easier than ever to invest in Ethiopia, encourage exploration and mining, and unlock the sectors full potential and value. The reform includes geodata management, transparency and ease of licensing process and the artisanal mining sector among others.

Ethiopia has known occurrences of more than 30 minerals. These include:

– Metallic minerals (gold, platinum, iron, nickel,chromite and base metals);

– Energy minerals (lithium, graphite, tantalum and coal);

– Cement raw minerals (limestone, gypsum, clay, pumice);

– Fertilizer raw minerals (potash and phosphate);

– Ceramics raw minerals (kaolin, feldspar);

– Glass raw minerals (silica sand);

– Dimension stones (marble, granite, limestone, sandstone, diatomite, bentonite, soda ash, salt, graphite and Sulphur);

– Gemstones (opals, emeralds, sapphires)

space

5.10 Information and Communication Technologies (ICT)

– Identified as strategic priorities by the Government of Ethiopia as it will drive and facilitate the transformation of Ethiopia’s predominantly subsistence-agriculture economy to into an information and knowledge-based economy and society, that is effectively integrated into the global economy. Tailored industrial park has been dedicated to the sector.

– Ethiopia’s internet penetration in 2016 was 15.4% while recent statistics show mobile penetration at 63%, with low penetration rates stemming from underdeveloped telecommunications infrastructure. With a population over 100 million and a median age of under 18 years, Ethiopia offers significant opportunities for ICT development.

– In June 2018 Ethiopia’s government announced that it would allow private domestic and foreign investment in a number of sectors including telecoms tentatively opens up one of the last biggest telecoms opportunities in Africa. The government took steps to liberalization this year by issuing an internet service provider license to a local private company.

space

6. Industrial Parks (IP)

– The Government of Ethiopia, with the vision of making Ethiopia a leading manufacturing hub in Africa, placed a high focus on industrial parks development and expansion.

The government has so far constructed and operationalized over 20 state-of-the-art industrial parks which are located along key development corridors – each with a distinct specialty in a priority sector (Textile & Apparel, Leather & Leather Products, Pharmaceutical, Agro-Processing, and Mixed). Industrial parks allow the investors to get all the necessary services easily at a single place.

– Industrial parks are both government and private owned.Facilities in industrial parks include One-Stop Service, dedicated power sub-station, waste treatment facilities, commercial buildings and housing facilities, health stations, fire brigade, and 24/7 security service.

– With the vision to make Ethiopia a leading manufacturing hub in Africa by 2025, the Government of Ethiopia had placed a high focus on industrial park development and expansion. The GoE has so far constructed and operationalized over 20 state-of-the-art industrial parks which are located along key development corridors – each with a distinct specialty in priority sectors.

space

You can download the detailed version of the investment and trade profile of Ethiopia here:

ETHIOPIA INVESTMENT OPPORTUNITIES TO MALAYSIAN COMPANIES

space

space

Contacts

FDR Embassy in Jakarta

Address: Jl. Aditiyawarman No.21, RT.3/RW.2, Selong, Kec. Kby. Baru, Kota Jakarta Selatan, Daerah Khusus Ibukota Jakarta 12110

Phone: +62 21 22776658

Email: ethembjakarta@gmail.com

Website: www.jakarta.mfa.gov.et

space

space

Additional important contact Address

| Ethiopian Investment Commission

P.O. Box 2313 Tel: +251-11-551 0033 Fax: +251-11-551 4396 E-mail: ethioinvest@investethiopia.gov.et Website: http://www.investethiopia.gov.et/ |

Ministry of Trade

P.O. Box 704 Tel: +251-11-551 8025 Fax: + 251-11-551 5411 Website: http://www.mot.gov.et/home

|

|

| Industrial Parks Development

Corporation (IPDC) Tel: +251-11-661 6986 / 661 6674 E-mail: info@ipdc.gov.et Website: http://www.ipdc.gov.et/index.php/en/

|

Ministry of Foreign Affairs

P.O. Box 393 Tel: +251-11-551 7345 Fax: +251-11-551 4300/ 551 1244 E-mail: mfa.addis@telecom.net.et Website: http://www.mfa.gov.et/

|

|

| Ministry of Industry

P.O. Box 6945 Tel: +251-11-550 7542 Fax: + 251-11-575 9871 Website: www.moin.gov.et

|

Ministry of Labour and Social Affairs

P.O. Box 2056 Tel: +251-11-551 7080 Fax: +251-11-551 8396 E-mail: molsa.comt@ethionet.et Website: http://www.molsa.gov.et/

|

|

| Ethiopian Revenue and Customs Authority

Tel: +251-11-667 3970 Fax:+ 251-11-662 9842 Website: http://www.erca.gov.et/

|

Ethiopian Chamber of Commerce

and Sectoral Associations P.O. Box 517 Tel: 251-11-551 8240 Fax: 251-11-551 7699 E-mail: etchamb@ethionet.et Website: http://www.ethiopianchamber.com/

|

|

| National Bank of Ethiopia

P.O. Box 5550 Tel: +251-11-551 7430 Fax: +251-1-551 4588 E-mail: nbe.excd@ethionet.et Website: http://www.nbe.gov.et/

|

Development Bank of Ethiopia

P.O.Box 1900 Tel: 251-11-51 1188/89 Fax: 251-11-511606 E-mail: dbe@telecom.net.et Website: http://www.dbe.com.et/

|

|

| Addis Ababa Chamber of Commerce

and Sectoral Associations P.O. Box 2458 Tel: 251-11-551 8055 Fax: 251-11-551 1479 E-mail: info@addischamber.com Website: http://addischamber.com/

|