ACCCIM & MASSA Trade & Investment Mission To Yangon, Myanmar, 26 – 30 April 2012

Tan Sri Dato’ Soong Siew Hoong, ACCCIM Executive Adviser and MASSA EXCO member, led a 28-member delegation to Yangon from 26 – 30 April 2012. The objectives of the mission were:

Tan Sri Dato’ Soong Siew Hoong, ACCCIM Executive Adviser and MASSA EXCO member, led a 28-member delegation to Yangon from 26 – 30 April 2012. The objectives of the mission were:

| • | To understand the host country’s policies, laws, rules and regulations, political, social and economic environment, business and work culture, etc |

| • | To promote products and services from Malaysia |

| • | To source for products from Myanmar |

| • | To explore joint-ventures and cooperation with local SMEs and in the manufacturing or services industries |

| • | To seek opportunities in infrastructure, utilities, property development and other investment projects |

| • | To offer advisory and consultancy services |

Myanmar is a rich country in terms of arable land and natural resources, and is predominantly agricultural country where two-thirds of the 55 million population live in rural areas, and depend on agriculture for their livelihood. The Malaysian participants are involved in sectors such as manufacturing, logistics, printing and publishing, air-conditioning installation and maintenance services, trading, lubricants, household products, IT solutions, development and investments.

Meetings were arranged with the Myanmar Industries Association, the Union of Myanmar Federation of Chambers of Commerce and Industry (UMFCCI) and the Malaysian-Myanmar Business Council. The Joint Secretary-General of UMFCCI, Mr Aung Khin Myint, updated the delegation on the Investment Environment in Myanmar. Some highlights of the changes in progress include:

Reorganisation Of The Myanmar Investment Commission (MIC) – the MIC is chaired by the Union Minister of Industry, with other Union Ministers of Rail Transportation, Finance & Revenue, Electric Power No. 1, Attorney General of the Union, National Planning & Economic Development.

| Revision Of The Foreign Investment Law | |

| • | Specific definition on investment |

| • | Specific definition on guarantee of land lease or guarantee of land used |

| • | Mentioned on restricted activities |

| • | Export promotion and import substitution |

| • | Description on rights & obligations of investor |

| • | 5 years tax holiday |

| • | Description on land use |

| • | Market Exchange Rate |

| • | Description on administrative penalty |

| • | Description on dispute settlement |

| Release Of Notifications | |

| 1) | Notification of Concession Rights for Land Used Relating to Foreign Investment Law (39/2011) – Investor has a right of the guarantee of land lease or land used from government owned land, governmental department, organisation owned lands and citizen owned private lands. |

| 2) | Notification Relating to Foreign Currency Relevant with the Foreign Investment Law (40/2011) – Foreign capital brought in can be exchanged with prevailing market price and investor has the right to make account transfer for payment transition. |

NOTE: Myanmar starts new forex regime at 818 kyat per 1 USD (wef 2 April 2012)

| Streamlining Procedure & Simplifying Formality | |

| • | Reduce unnecessary documents in formality |

| • | Enhance coordination with investment related ministries |

| • | Provide technical suggestion to investors |

| • | Promote public private relations |

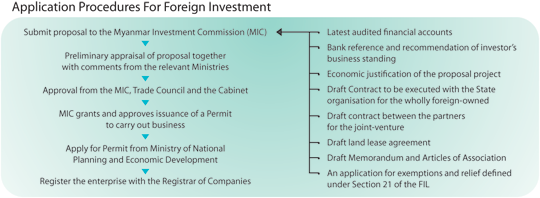

| • | Investors can get investment permit within two weeks if documents are complete |

Setting Up Of One-Stop Service (OSS)

A one-stop service for company registration has been provided since 18 May 2011, and if the documents are complete, the process can be finished within one day. The OSS team was formed in July 2011 to ensure that information is delivered in a clear and transparent manner to Myanmar citizens and foreigners inquiring about investing in Myanmar.

The OSS team comprises senior officials from the Myanmar Investment Commission, Ministry of Finance & Revenue, Ministry of Commerce and Ministry of Construction. The OSS team meets every Friday to answer queries from investors, scrutinise investment proposals and assist in solving difficult investment issues, etc.

| Promoted Fields/Sectors For Investment | |||

| • | Agriculture | • | Construction |

| • | Livestock and fishery | • | Transport and communication |

| • | Forestry | • | Trade |

| • | Mining | • | Economic activities mentioned in section 3 of the State-owned Economic Enterprises Law, provided permission has been obtained under section 4 of the said Law |

| Investment Incentives | ||||

| 1. | Relief from income tax (re-invested profits) | 7. | Right to deduct R&D expenditure | |

| 2. | Exemption or relief from income tax (re-invested) | 8. | Right to carry forward and set off losses | |

| 3. | Accelerated depreciation rates | 9. | Exemption or relief from customs duty or other | |

| 4. | 50% relief from income tax | internal tax (machinery) | ||

| 5. | Right to pay income tax – Right to deduct | 10. | Exemption or relief from customs duty or other | |

| 6. | Right to pay income tax (foreign employees) | internal tax (raw materials) | ||