A Brief on Trade and Investment Opportunities in Bangladesh

A Brief on Trade and Investment Opportunities in Bangladesh

Article by:

Md Rajibul Ahsan,

Counsellor (Commercial),

Bangladesh High Commission, Kuala Lumpur

E-mail: commwing.kl@gmail.com

– The full version of the report can be accessed HERE –

1. Bangladesh: An Emerging Economy

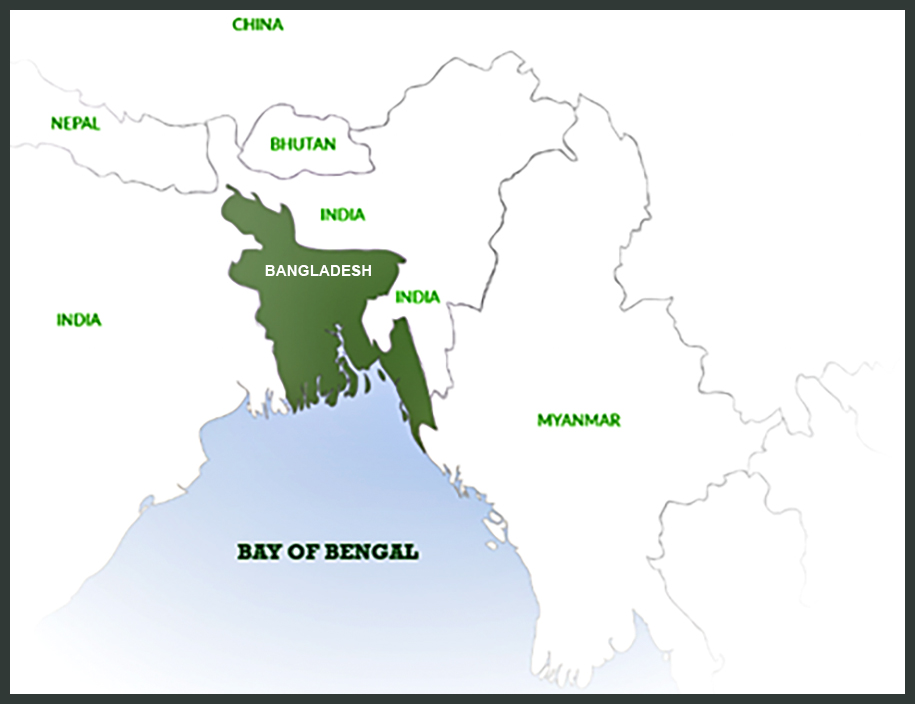

Bangladesh is in the north-eastern part of South Asia. Bangladesh belongs to the largest river delta in the world with a total area of 1,47,570 sq. km. The country is ethnically homogeneous where over 98 percent of the people speak in Bangla. English is widely spoken as well. The country is covered with network of rivers and canals forming a maze of interconnecting channels and rich waterways.

Bangladesh has demonstrated rapid progress since independence; continues to show its resilience through the Asian Financial crisis in the ‘90s, the global financial crisis in 2008, and even COVID-19 pandemic. It has been among the fastest growing economies in the world over the past decade, thanks to demographic dividend, strong ready-made garment (RMG) industry, and stable macroeconomic conditions.

2021 is a special year for Bangladesh. We are celebrating the birth centenary of our Father of the Nation Bangabandhu Sheikh Mujibur Rahman. This is the year we celebrate the golden jubilee of our independence, built on our innate strength and resilience. The 50th year of independence also marks the year where Bangladesh has been nominated to graduate from LDC status, a testament to the sustainable growth potential of the country.

2. Bangladesh-Fast Facts

Official Name

People’s Republic of Bangladesh

Capital City

Dhaka

Geographical Location

Latitude between 20°34′ and 26°38′ North

Longitude between 88°01′ and 92°41′ East

Boundaries

North- India (West Bengal and Meghalaya)

West- India (West Bengal)

East- India (Tripura and Assam) and Myanmar

South- Bay of Bengal

Demography

Population: 152 million (Census 2011); 166 million (Estimated 2019)

Life Expectancy (yrs), 2019

72.6

Literacy Rate, 2019

74.4%

Religion

Muslims- 86.6%

Hindus- 12.1%

Others-1.3%

Gross Domestic Product (GDP)

(at current market price, 2020)

BDT 27963.8 Billion

USD 330.54 Billion

GDP growth

5.24 (2020)

8.15 (2019)

GDP per capita

USD 1,970 (2020)

Gross Investment

(at current market price, 2020)

BDT 8879.9 Billion

Private: 6608.4 Billion, Public: 2271.5 Billion

Export

USD 33.7 Billion (2020)

Import

USD 54.8 Billion (2020)

Remittance

USD 18.2 Billion (2020)

Foreign Exchange Reserve

USD 36.04 Billion (2020)

Inflation

5.65% (2020)

Exchange rate (BDT/USD)

84.60 (2020)

Principal Crops

Rice, Jute, Tea, Wheat, Sugarcane, Pulses, Mustard, Potato, Vegetables.

Principal Industries

Garments & Textiles (2nd largest in the world), Tea, Ceramics, Pharmaceuticals, Cement, Leather, Jute (largest producer in the world), Chemical, Fertilizer, Electrical and Electronics, Agriculture, Fishing, etc.

Principal Exports

Garments, Knitwear, Frozen Shrimps, Tea, Leather and Leather products, Jute and Jute products, Ceramics, Pharmaceuticals, IT Services, etc.

Principal Imports

Wheat, Fertilizer, Electrical and Electronics, Petroleum goods, Cotton, Edible Oil, etc.

Export Processing Zones (EPZs)

Total- 8, Chittagong EPZ, Dhaka EPZ, Mongla EPZ, Ishwardi EPZ, Comilla EPZ, Uttara EPZ, Adamjee EPZ, Karnaphuli EPZ

Economic Zones (approved)

Total: 98

Public: 69

Private: 29

3. Global Ranks of Bangladesh

- – Bangladesh is 2nd largest garments exporter in the world.

- – 8th largest country in the world in terms of population.

- – 4th largest Muslim country in the world in terms of population.

- – Bangladesh is the world’s fourth biggest rice producer.

- – Bangladesh ranks 3rd in inland fish production.

- – Bangladesh ranks 3rd in global vegetable production.

- – Cox’s Bazaar is the longest natural sea beach in the world.

- – Largest producer of Jute fibre in the world.

- – Sundarbans (hosted by both Bangladesh and India) is the largest mangrove forest in the world.

4. Making strides in growth and development

Despite the pandemic, the government of Bangladesh has been able to maintain the growth pace by achieving the real GDP growth of 5.2 percent which is the highest in Asia. In the last 12 years, the average growth of GDP was 6.6 percent which was above 7 percent in FY2017-2018, 2017-2018 and 2018-2019 and exceeded 8 percent in FY2018-2019.

Figure 1: Growth in South Asian Countries in FY19 (Source: IMF)

Figure 2: Growth in South Asian Countries in FY20 (Source: IMF)

Like elsewhere, the global COVID-19 pandemic has adversely affected the economy of Bangladesh. Growth in export and import in FY2019-20 experienced negative. However, remittance inflows grew by 10.87 percent that contributed to reduce the current account deficit. Foreign exchange reserves have increased significantly. As of June 30, 2020 the foreign exchange reserve stood at US$ 36.04 billion, the highest ever. To keep the country’s economy afloat in the face of the ongoing COVID-19 pandemic, the government has already announced a financial package of abut Tk. 1.2 lakh crore for economic recovery.

5. Bangladesh- Malaysia Bilateral relations

Both Malaysia and Bangladesh have come a long way to consolidate their bilateral relation since the establishment of diplomatic ties between the two countries after Malaysia recognized Bangladesh on 31 January 1972. Besides, location of Bangladesh and Malaysia in the South and the Southeast Asia respectively have brought these two countries closer. Mutual respect, fraternity and co-operation particularly on development activities are increasing with the passage of time.

Malaysia and Bangladesh share common views on a wide range of international issues, as both are being the members of organizations like D-8, G-77, OIC, and Commonwealth. More importantly, Malaysia has stood by Bangladesh as a tested friend throughout the outbreak of the Rohingya crisis particularly in setting up a field hospital in Cox’s Bazar.

As a testament of strong bilateral relations both Bangladesh and Malaysia have agreed to sign a bilateral Free Trade Agreement (FTA) that would encourage trade and cross border investment between the two friendly nations. At the moment, both sides are ready to start FTA negotiation at a mutually convenient time. Besides, a recent Memorandum of Understanding (MoU) signed between Bangladesh and Malaysia on 13 July 2021 to supply Liquefied Natural Gas (LNG) to Bangladesh will pave the way for further economic engagement between Bangladesh and Malaysia.

6. Bilateral Trade between Bangladesh and Malaysia

In South Asia Bangladesh is the second largest trading partner for Malaysia, after India. Although the balance of trade is heavily tilted towards Malaysia, the total trade between Bangladesh and Malaysia has increased to a significant level and our export to Malaysia is also increasing in recent years.

Bilateral Trade between Bangladesh and Malaysia (in million USD)

(Source: Bangladesh Bank)

| Financial Year | Export | Import | Balance |

| 2011-12 | 56.11 | 1406.70 | (-) 1350.59 |

| 2012-13 | 100.11 | 1903.10 | (-) 1802.99 |

| 2013-14 | 135.64 | 2084.10 | (-) 1948.46 |

| 2014-15 | 140.09 | 1287.50 | (-) 1147.41 |

| 2015-16 | 191.05 | 952.30 | (-) 761.25 |

| 2016-17 | 211.52 | 1017.50 | (-) 805.98 |

| 2017-18 | 232.42 | 1410.40 | (-) 1177.98 |

| 2018-19 | 277.23 | 1496.21 | (-) 1218.98 |

| 2019-20 | 236.37 | 1671.30 | (-) 1434.93 |

Malaysian market for Bangladeshi products is not widely diversified. Readymade Garments (knit wear and woven garments) is the main export item that account for more than 70 percent of our total export earnings. The other exportable items are vegetables, potato, food and beverage, footwear, spices etc.

In 2018-19, just before the COVID-19 pandemic, goods exports to Malaysia reached to USD 277 million with a growth of 19 percent. But when the pandemic began in early 2020 the Malaysian economy faced significant challenges coupled with the collapse of the global oil prices and US-China trade war. This impacted Bangladesh’s exports to Malaysia by declining it to USD 236 million in 2019-20. Again, in FY 2020-21 exports picked up and reached an all-time high of USD 306.57 million.

Major import items from Malaysia are mineral fuels and oils, vegetable fats and oils, machinery and mechanical appliances, plastics, chemicals, cotton, rubber, electrical and electronics etc.

7. Malaysian Investment in Bangladesh

Malaysia is the 9th largest investor for Bangladesh. Total FDI stock of Malaysia in Bangladesh is 825.14 million USD as on end of June 2020. Telecommunication sector (508.69 million) dominates the FDI inflow followed by computer software and IT (244.11 million), construction sector, and textile and wearing sector etc. Too many Malaysian companies have shown their interest to invest in the newly-built Special Economic Zones (SEZs) of Bangladesh. Sector-wise investment statistics are stated below:

Malaysian Investment in Bangladesh, June 2020

(Source: Bangladesh Bank)

| Major Sectors | Investment (in million USD) |

| Telecommunication | 508.69 |

| Computer Software and IT | 244.11 |

| Construction | 23.7 |

| Textile and Wearing | 15.3 |

| NBFI | 4.1 |

| Power | 3.38 |

| Chemicals and Pharmaceuticals | 2.54 |

| Others | 23.32 |

| Total | 825.14 |

To date, a total of 123 Malaysian companies are registered under the Bangladesh Investment Development Authority (BIDA). Some of them are as follows:

| Telecommunications | Computer Software and IT |

|

|

| Power | Textile and Wearing |

|

|

| Food and Allied | Engineering |

|

|

| Others | |

|

|

8. Investment Opportunities in Bangladesh

Currently the FDI stock of the country is growing very rapidly because of its large population and impressive economic growth over the recent years that is matched by liberal investment policies. Bangladesh is potentially a significant market, especially with access to South Asia and South-East Asia. It presents a rare opportunity for investment. Initiatives to establish 100 Special Economic Zones (SEZs) by 2030 also gave FDI a great boost. Besides, in line with this the government is also implementing some mega infra-structure projects like Padma Bridge, Rooppur Nuclear Power Plant, Dhaka Metro-rail Project, etc.

Investment Areas: Foreign investment is welcome in all areas of the economy with the exception of the four reserved sectors (arms and ammunition, forest plantations, nuclear energy, and security printing). Such investments can be made either independently or through venture on mutually beneficial terms and conditions.

Legal Protection for FDI: In Bangladesh the policy framework for foreign investment is based on ‘The Foreign Private Investment (Promotion & Protection) Act. 1980,’ which ensures legal protection to foreign investment in Bangladesh against nationalization and expropriation. It also guarantees non-discriminatory treatment between foreign and local investment and repatriation of proceeds from sales of shares and profit.

Bilateral Agreements: To invest in Bangladesh Malaysian investors enjoy two existing bilateral agreements, one is for the avoidance of double taxation (April 1983) and the other one is the investment treaty for promotion and protection of investment (October 1994).

Tax Holiday and Tax Exemption:

– 5 to 10 years of Tax Holiday and reduced tax.

– 100% tax exemption on income and capital gain for certain projects under Public Private Partnership (PPP) for 10 years.

– 100% tax exemption from software development, telecommunication and information technology enabled services.

– 50% of income derived from export is exempted from tax.

– Tax exemption on royalties, technical knowhow and technical assistance fees and facilities for their repatriation.

– Tax exemption on interest paid on foreign loan.

Accelerated Depreciation: Industrial undertakings not enjoying tax holiday will enjoy accelerated depreciation allowance. Such allowance is available at the rate of 100 per cent of the cost of the machinery or plant if the industrial undertaking is set up in the areas falling within the cities of Dhaka, Narayangonj, Chittagong and Khulna and areas within a radius of 10 miles from the municipal limits of those cities. If the industrial undertaking is set up elsewhere in the country, accelerated depreciation is allowed at the rate of 80 per cent in the first year and 20 per cent in the second year.

Exemption on Import Duties: Exemption of customs duties on capital machineries and exemption of import duties on raw materials used for producing goods for export.

Bonded warehousing Facilities: For export-oriented industries.

Ownership: 100% ownership is allowed with unrestricted exit policy.

Work Permit: Multiple entry visa will be issued to prospective foreign investors for 3 years. In case of experts, multiple entry visa will be issued for the whole tenure of their assignments.

Repatriation of invested capital and dividend: Full repatriation of capital invested is allowed. Similarly, profits and dividend accruing can be transferred in full. If foreign investors reinvest their dividends and/or retained earnings, those will be treated as new investment.

Others

– No restrictions on issuance of work permits to project related foreign nationals and employees.

– Provision of transfer of shares held by foreign shareholders to local investors.

– 100% FDI, Joint Ventures, Partnerships, PPPs, Non-equity mode (technology transfer, licensing franchising, contracting etc.), and Foreign Lending are allowed.

– 100% FDI or Joint Venture FDIs are allowed to participate in the primary and secondary stock markets.

– Foreign Investors are allowed to have access to local banks for working capital requirements.

– Citizenship by investing a minimum of USD 500,000/- or by transferring USD 1,000,000/- to any recognized financial institution and permanent residency by investing a minimum of USD 75,000/-.

– Special facilities and venture capital support are provided to export-oriented industries under “Thrust sectors”. Thrust Sectors include agro-based industries, artificial flower-making, computer software and information technology, electronics, frozen food, floriculture, gift items, jute goods, jewelry, leather, sericulture and silk industry, stuffed toys, etc.

– Intellectual Property right is protected by law.

– Duty free market access to EU & most developed countries.

9. Reasons of recent surge in Foreign Direct Investment in Bangladesh

Bangladesh is now one of the most promising emerging markets in the world and foreign investors are recognizing it as a potential market to keep an eye on. Bangladesh has been hailed by The Economist as the ‘New Asian Tiger’. And foreign investors’ focus in recent times reflects this. A few of reasons of why foreign investors consider investing in Bangladesh are stated below:

Strategic Location: The geographic location of the country is ideal for global trade with its strategic location, regional connectivity, and worldwide access.

Greater Integration: Greater integration with regional and sub-regional blocs such as the South Asian Association for Regional Cooperation (SAARC), the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC), the Association of South-East Asian Nations (ASEAN) is facilitating regional cooperation on a new level.

Big Consumer Market: With a population of just over 166 million, the country has a strong consumer demand and the consumer goods market, ranging from white goods and clothes to fintech, is growing fast. In Bangladesh, the Middle & Affluent Class (MAC) represents 19 million population in 2020 and will reach to 33 million in 2025.

One-Stop Service (OSS): The One-Stop Service (OSS) puts all investment facilitation mechanisms under a single window. Currently, 21 services of 7 agencies are delivered from OSS. 150 services of 34 agencies will be offered through OSS soon.

Young Workforce: Highly adaptive and industrious workforce with the competitive wages and salaries are available in Bangladesh. About 57.3% of the population is under 25, providing a youthful group for engagement to meet global standards.

Fast Scaling Infrastructure: World-class Facilities are available in Bangladesh Export Processing Zones, Bangladesh Economic Zones and High-tech Parks.

Significant Cost Arbitrage: Bangladesh provides 10-60 lower cost compared to its peers in terms of utility cost as well as labour wage.

Figure 3: Competitive Factor Cost (Water and Electricity) among the Peer Cities

(Source: 27th Investment Cost Survey, JETRO 2017)

Figure 4: Competitive Factor Cost (Wages and Salaries) among the Peer Cities

(Source: 27th Investment Cost Survey, JETRO 2017)

At present, Bangladesh is the 41st largest economy in the world. According to the Center for Economic and Business Research (CEBR), a British economic research organisation, Bangladesh will become the 25th largest economy in the world by 2035. The extraordinary pace of development of Bangladesh has stunned the world today. The Wall Street Journal has published an article on 3rd March 2021 titled “Bangladesh is Becoming South Asia’s Economic Bull Case”. The New York Times published an op-ed article on 10th March 2021 titled “What Can Biden’s Plan do for Poverty? Look at Bangladesh”. Thus, Bangladesh is now a wonder of the wonders.

– The full version of the report can be accessed HERE –