Country Feature: Colombia

Country Feature: Colombia

Colombia Flag

Bogota, Capital of Colombia

Colombia is located at the northeastern of the South America continent

Colombia heavily depends on energy and mining exports, making it vulnerable to fluctuations in commodity prices. Colombia is Latin America’s fourth largest oil producer and the world’s fourth largest coal producer, third largest coffee exporter, and second largest cut flowers exporter. Colombia’s economic development is hampered by inadequate infrastructure, poverty, narcotrafficking, and an uncertain security situation, in addition to dependence on primary commodities (goods that have little value-added from processing or labour inputs). (Source: CIA World Factbook, Colombia.) The Republic of Colombia is the third most populous country in Latin America. The nation is considered a middle power in international affairs, being the only NATO Global Partner in its region, and is a member of various major international organisations including the OECD, the UN, the WTO, the OAS, the Pacific Alliance and others. |

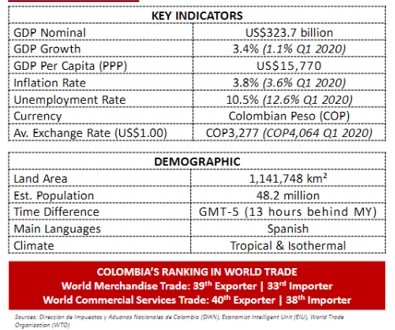

(Source: MATRADE Webinar, Bilateral Trade between Malaysia & Colombia on 13 July 2020)

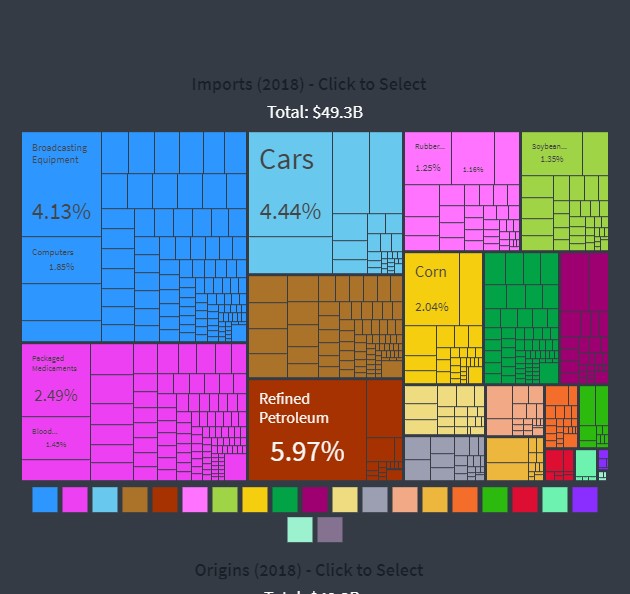

(Source: The Observatory of Economic Complexity (OEC)

(Source: The Observatory of Economic Complexity (OEC)

(Source: The Observatory of Economic Complexity (OEC)

(Source: MATRADE Webinar, Bilateral Trade between Malaysia & Colombia on 13 July 2020)

| Top Export | (%) | Top Import | (%) |

| Coffee, Tea Mate, and Spices | 67 | Others | 27 |

| Others | 11 | Electrical Machinery and Equipment and Parts | 22 |

| Copper and Articles Thereof | 7 | Rubber and Articles Thereof | 15 |

| Aluminium and Articles Thereof | Iron and Steel | ||

| Miscellaneous Edible Preparations | 5 | Optical, Photographic, Cinematographic, Measuring, Checking, Precision, Medical or Surgical Instruments and Apparatus; Parts and Accessories Thereof | 11 |

| Plastics and Articles Thereof | 3 | Nuclear Reactors, Boilers, Machinery and Mech Appliances | 10 |

(Source: MATRADE Webinar, Bilateral Trade between Malaysia & Colombia on 13 July 2020)

Outlook

(1) Colombia has a track record of prudent macroeconomic and fiscal management, and despite economic downturns has maintained its investment grade rating since 2013. Growth was on track to accelerate further in 2020, but the COVID-19 pandemic is expected to significantly affect private consumption and investment (Source: The World Bank, April 2020, Colombia Overview).

(2) Colombia’s government has implemented early emergency response measures – declared a State of Emergency, closed the country’s borders, and imposed a mandatory quarantine. The Government also announced a sizable fiscal stimulus package (COP 14.8 trillion or 1.4% of GDP, with potential to increase to up to 48 trillion) that would provide additional resources for the health system, special lines of credit for businesses in certain sectors, and increased transfers for vulnerable groups. The central bank reduced its intervention rate by 50 basis points on March 27 and introduced a broad range of measures to increase liquidity (Source: The World Bank, April 2020, Colombia Overview).

(3) Colombia continues to maintain a solid macroeconomic framework. Key components of Colombia’s macroeconomic framework include the adoption of a full-fledged inflation-targeting regime, a flexible exchange rate, a Fiscal Rule (2011) for the central government, and a Medium-Term Fiscal Framework (Source: The World Bank, April 2020, Colombia Overview).

(4) Findings (Source: MATRADE Webinar, Bilateral Trade between Malaysia & Colombia 13 July 2020; MATRADE Webinar, Market Update – Colombia Business Scenario During Covid-19 and the Way Forward.):

a. Colombia is sourcing for alternative imports, instead of relying on traditional markets i.e. America and China.

b. Colombia is offering import flexibilities:

i. duty-free tariffs for health products, medicines, medical equipment, non-textile gloves, and protective clothing etc.

ii. no health registration (INVIMA) required for antibacterial gel and disinfecting topical solution.

c. Increase in e-Commerce business activities.

d. Surge in Digitization: online messaging and digital home services increased by 28%.

(Source: MATRADE Webinar, Bilateral Trade between Malaysia & Colombia on 13 July 2020)

(Source: MATRADE Webinar, Bilateral Trade between Malaysia & Colombia on 13 July 2020)

(Source: MATRADE Webinar, Market Update – Colombia Business Scenario During Covid-19 and the Way Forward)

(Source: MATRADE Webinar, Bilateral Trade between Malaysia & Colombia on 13 July 2020)

Sources

1. CIA World Factbook, South America: Colombia, retrieved from https://www.cia.gov/library/publications/the-world-factbook/geos/co.html.

2. MATRADE Webinar, Bilateral Trade between Malaysia & Colombia on 13 July 2020.

3. MATRADE Webinar, Market Update – Colombia Business Scenario During Covid-19 and the Way Forward.

4. Observatory of Economic Complexity (OEC), Colombia, retrieved from https://oec.world/en/profile/country/col/.

5. The Colombian Government Trade Bureau, retrieved from https://coltrade.org/contact/aboutthebureau.asp.

6. The World Bank, April 2020, Colombia Overview, retrieved from https://www.worldbank.org/en/country/colombia.

7. The World Bank, Colombia At-A-Glance, retrieved from https://www.worldbank.org/en/country/colombia.

Embassy of the Republic Colombia in Malaysia

H.E. Mauricio Gonzalez Lopez

Ambassador Extraordinary and Plenipotentiary

Business Suite 19A-27-3A

Level 27, UOA Centre

No. 19, Jalan Pinang

50450 Kuala Lumpur

Tel: +603-2164 5488 / 5489

Fax: +603-2164 5487

Email: ekualalumpur@cancilleria.gov.co

Website: http://malasia.embajada.gov.co/