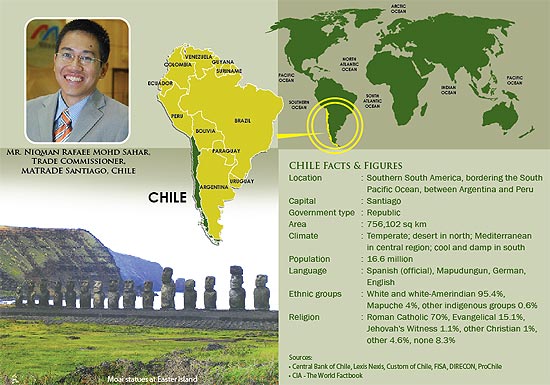

Chile: Business Opportunities From The Southern Tip Of The World

Overview

A key market in South America, Chile is also the gateway to markets like Argentina, Bolivia and Peru. Santiago is the country’s capital city. With a population of 7 million, Santiago is the most important region for business. Major companies, foreign investors, hotels and banks are all based in this city.

Chile’s two largest ports are located nearby Santiago, namely the Port of San Antonio and Port of Valparaiso. They facilitate strong transportation links and better movement of goods within cities and providing good market access. Chile’s largest port and the busiest port on South America’s west coast, the Port of San Antonio transfers over 12.6 million tons of cargo annually. It has excellent access to roads and rail to Santiago, Southern Chile, and Argentina. The Port of Valparaiso is one of Chile’s most important urban centres. The city is a centre for education and important industries are culture, transport, and tourism. In 2003, its historic quarter was designated a UNESCO World Heritage Site.

Chile also has two important Free Trade Zones located north and south of the country. The Iquique Free Trade Zone (known as Zofri), is located north of Chile. Companies based in Zofri enjoy special tax benefits and exemptions. The other is the Punta Arenas Free Trade Zone at the southern part of Chile.

Economy

Chile’s economic growth decreased 2.5% in 2009 from an estimate of 3.5% last year. The deceleration is mainly due to the global slowdown and deteriorating international financial conditions. In the coming year, Chile’s performance is expected to be driven by public spending, domestic investment and private consumption. The GDP is reported to have an outlook growth of about 4% in 2010.

Thanks to its open economy, Chile’s total trade in 2008 grew 16.2% to US$126.1 billion from US$108.5 billion one year ago. Exports rose by 5.6% to US$69.6 billion while imports increased 32.3% to US$56.5 billion. The Chilean trade balance finalised with a surplus of US$13.1 billion for the year 2008.

The United States remained Chile’s major trading partner – accounting for 14.8% of trade, valued at US$18.7 billion. This was followed closely by China with US$16.7 or 13.2% of the market share. Three of the Top 5 Chilean Global Trading Partners are from Asia (China, Japan and ROK), collectively accounting for 26.7% of the market share. Among ASEAN countries, Thailand heads the list with a total trade of US$0.6 billion, followed by Indonesia and Malaysia.

Bilateral Trade with Malaysia

In 2008, bilateral trade between Malaysia and Chile totaled US$336 million – an increase of 38.25% from the previous year. The trade balance remains in favour of Malaysia with a surplus trade value of US$38 million. Malaysia’s exports to Chile were valued at US$186.8 million, of which 52.65% is attributed to the export of automatic data processing machines into Chile. Besides the electrical and electronic sectors, Malaysia’s other exports are from the apparel and clothing, furniture and palm oil sectors.

Investment Opportunities

Taking into account its strategic location in the Southern Cone and blessed with a stable political and economic environment, Chile remains an important investment attraction among foreign investors. There is tremendous potential in the Information, Communication & Technology (ICT), construction, infrastructure, mining and property sectors. Already established as a launching hub for ICT in the region, Chile is also actively promoting the tourism, health and alternative energy sectors.

2009 was a great year for Malaysia’s exposure in Chile. Our home-based wireless provider, P1 Network Sdn Bhd, was awarded a multimillion dollar project to supply wireless internet service to rural areas across Chile. Another company, My Copter Aviation Sdn Bhd was also awarded a contract to service and refurbish helicopters owned by the Chilean Navy. These achievements complement other notable Malaysian investments in Chile, including Masscorp Chile and Safcol Chile SA (owned by Tropical Canning Sdn Bhd).

Potential areas for Malaysian Exporters

Malaysia is well known in Chile as a provider of quality products. We are currently the number one supplier of examination and surgical gloves in the Chilean market. There is also demand for Malaysian made furniture like outdoor rattan furniture, sofas, wooden chairs and office furniture.

Opportunities can be found in areas such as disposable medical products, pharmaceuticals, building materials, cosmetics, auto parts and accessories, fashion apparel, education materials, toys and gifts, construction machinery, packaging materials, canned food, beverages and so much more. In the services sector, emphasis should be given to the promotion of IT services, construction and engineering, power generation, oil and gas exploration as well as biotech.

Doing business in Chile

South American buyers are becoming aggressive and demanding. Retailers, distributors and importers are seeking the best sourcing options to expand throughout the region and earn better profit margins. Chinese products are thriving in this market due to their low-cost and a high volume strategy. The competitive landscape will require Malaysian exporters to demonstrate flexibility and reliability. Knowledge in the Spanish language will be an added advantage. Forming an alliance with a local representative or distributor who is familiar with the local business scenario and operations is a good way to market Malaysian products here successfully.

Free Trade Agreements

Negotiations of bilateral trade have been used as an important marketing tool by Chile. To date, Chile has signed 20 trade agreements with 57 countries giving market access to more than 2 billion people. The current business trend is on doing business with Asia, in particular with Malaysia, Vietnam and Thailand. This provides the impetus for Malaysian companies to start venturing and establish partnerships here. Currently, Malaysia is at the final stage of trade negotiation with Chile. Once concluded, this will further expand opportunities between both countries, taking advantage of the tariff reduction under the preferential agreements offered from the general 6% import tariff.

Contact Details:

Contact Details:

Mr. Niqman Rafaee Mohd Sahar,

Trade Commissioner, MATRADE Santiago,

Oficina Comercial De Malasia, Embajada De Malasia,

Avda. Tajamar 183, Oficina 302, Las Condes,

Santiago, Chile.

Telephone : 56-2-234 2647

Fax : 56-2-234 2652

Email : santiago@matrade.gov.my

Website : www.matrade.gov.my

Malaysian Investments in Chile

MASSCORP (CHILE) S.A,

Datuk Juan Claudio, Managing Director,

Av. Tajamar 183, Of. 1001, Santiago, Chile.

Telephone : 56-2-234 2679

Fax : 56-2-234 2678

Email : masscorp@entelchile.net

SAFCOL CHILE S.A,

Mr. Tee Lee Hoe, General Manager,

Camino Chinquihue KM.8, Casilla 49-D,

Puerto Montt, Chile.

Telephone : 56-65-257 160/257 161

Fax : 56-65-257 623

Email : teeleehoe.safcol@surnet.cl